The Digital Shekel challenge

The Digital Shekel Challenge has been completed

The Digital Shekel Challenge’s closing conference was held on October 31, 2024. The Bank of Israel appreciates the participation and interest that it received, as well as the development and presentation of innovative and original use cases in the field of payments.

Fourteen creative and ground-breaking ideas for the use of a digital shekel were presented at the conference:

- IDEMIA: Offline payments solution

- SHVA: Conversion between Cash and a Digital Shekel using ATM Machines

- QEDIT: Trust for Digital Transactions using Advanced Cryptography

- Energy: Transparent, Scalable Contract Automation for Construction and Every Industry

- Siara: Platform for Putting Debtors Back on an Economic Growth Track Using a Digital Shekel

- Kima: Securities Trading Using a Digital Shekel

- Credics Technologies: Family Allowance Management Using Digital Shekel Wallets

- PayPal: Automation for Smart Wage Payments Using a Digital Shekel

- Brinks, Committed: Converting Cash to a Digital Shekel at Thousands of Merchants

- Bits of Gold: Secure Crypto-to-Cash Exchange with Digital Shekel

- 0xPay: Managing IoT/nonhuman Device with Digital Shekel Wallets

- COTI: Decentralized Market for Event Tickets

- Fireblocks: AI-Powered Digital Shekel Travel Payments

- Open Finance: Travel Insurance Abroad Using a Digital Shekel

The winners were chosen according to the rankings issued by the judging committee and the conference audience:

In first place, the team from Siara

In second place, the team from PayPal

In third place, the team from Idemia

The team from QEDIT won the audience prize

A recording of the conference will be available for viewing shortly

What is the digital shekel challenge?

Like many other central banks, the Bank of Israel has in recent years been examining the possibility of issuing a central bank digital currency (CBDC), or digital shekel. Just like physical cash issued by the Bank of Israel, a digital shekel – if issued – would be a central bank liability toward its holder. As opposed to cash, though, such a currency would enable digital transactions.

As part of the process to examine and evaluate the necessary functionalities of a digital shekel, the Bank of Israel has decided to issue a “Digital Shekel Challenge” – an experiment inspired by the “Rosalind Project” that was carried out by the BIS Innovation Hub (London Centre) – one of the leading institutions studying CBDCs.

The invitation to submit a request to join the challenge is open to anyone interested in studying or experimenting with the use of a digital shekel. It should be emphasized that participating in the challenge involves technological development, and requires appropriate capabilities, as detailed in the accompaying document to the public call. The competing teams may include commercial banks, financial service providers, payment service providers, fintech firms, academic innovation labs, the public sector, nonprofits, or any other field. Registration is open to entities from Israel and abroad. Preference will be given to use cases that are relevant for the Israeli payments array and ecosystem.

-

Objectives of the Challenge

The objectives of the Challenge are to involve the payments ecosystem in Israel and abroad in the thought process with regard to the necessary characteristics of a digital shekel system in order for the system to support innovative and diverse use cases in the payments world, analyze and sample the digital shekel’s potential to offer such use cases in the Israeli economy, and enable the Bank of Israel’s Steering Committee, for the Potential Issuance of a Digital Shekel, to receive feedback regarding certain elements of the emerging design of the digital shekel.

The Challenge relates to a proposed two-tier model for issuing a CBDC at the Bank of Israel. At the center of this model, there is an API layer that provides a set of functionalities that enable payment service providers and other service providers to connect to the digital shekel system and offer end users among the public a wide and innovative range of services, while maintaining end users’ privacy and the security and reliability of the payment system.

-

What is required to do in the challenge?

Contestants in the Challenge will be asked to technologically develop various use cases for the digital shekel, by using the API layer. Preference will be given to uses with innovative characteristics in the payments market, whether they are improvements to existing applications, or completely new applications. The uses can offer solutions to existing or future problems in the market, be adapted to the unique needs of certain population groups, or provide a response to potential consumer areas and capabilities that may be enabled through the digital shekel and developing or future technology to help in the field. While some of the use cases may be universal by nature, it is important that they be specified and presented in the context of use cases relevant to the Israeli economy.

-

Use cases examples

The system can support payments between a variety of end user types (individuals, businesses, government and the public sector, nonprofits, and so forth) on a variety of access technologies (smartphone, Internet application, featurephone, POS proximity (NFC), smart cards, QR codes, etc.) in a variety of payment scenarios that already exist (large and small amounts, wage payments, rental payments, in-store or online shopping, bill payments, benefit payments, travel on public transit, transfer between individuals, donations, and so forth). The APIs also support RequestToPay transactions and applications derived from this capability. In addition, the APIs can enable advanced and innovative use cases such as split payments, micropayments, conditional payments, subwallet management, advanced information-based services, and etc.

-

Who can join the challenge?

The invitation to submit a request to compete in the Challenge is open to anyone interested in studying or experimenting with the use of a digital shekel. We emphasize that competing in the Challenge includes technological development, and requires the appropriate capabilities, as detailed in the document accompanying the Public Call. The competing teams may include commercial banks, financial service providers, payment service providers, fintech firms, academic innovation labs, the public sector, nonprofits, or any other field. Registration is open to entities from Israel and abroad. Preference will be given to uses that are relevant for the Israeli payments array and ecosystem.

-

The registration process

In the first stage: entities interested in competing in the challenge will send a request to join the Challenge via the registration form, providing a brief description of the idea they would like to implement in the Challenge. For this purpose, we recommend that you read the accompanying document, which includes a description of the super-architecture of the experimental digital shekel system that will be implemented in the Challenge, and a functional description of the APIs.

The Bank of Israel will select a small number of applicants, who will be invited to compete in the second stage, at its sole discretion, partly based on a number of criteria:

- Innovation in the proposed use case;

- The suitability of the proposed use case for the needs of the Israeli economy;

- The ability of the proposed use case to support the motivations presented by the

- Bank of Israel for potentially issuing a digital shekel (competition, innovation, redundancy and resilience of the payment system, cross-border payments, privacy, reducing the use of cash by making the digital shekel accessible to population groups that commonly use cash);

- How the APIs’ functionality is used to implement the solution;

- An effort will be made so that the project’s participants come from a wide range of entities (banks, payment service providers, fintech and bigtech firms, academia, government, civil society).

In the second stage: the contestants chosen from among all applicants will receive the necessary technological details and access to the API layer that will be used in the trials to examine the applicability of the proposed ideas. The development itself will be done in each participant’s independent technological environment, and participants will need to present the full application of the proposed use, including the front end interface used by end users, while operating the core of the digital shekel system through the API layer.

* A necessary condition for being selected for the second stage is agreement to the terms of participation in the challenge and compliance with all the requirements, including submitting the documents on time and signing an agreement, as much as may be required, as determined by the Bank of Israel from time to time, in accordance with the Bank of Israel's sole opinion and to the complete satisfaction of the Bank of Israel.

** It will be clarified that the Bank of Israel may limit the number of participants in the second stage or terminate the participation of a participant in the second stage, or decide not to hold the second stage or change it, at any time, in accordance with its sole discretion.

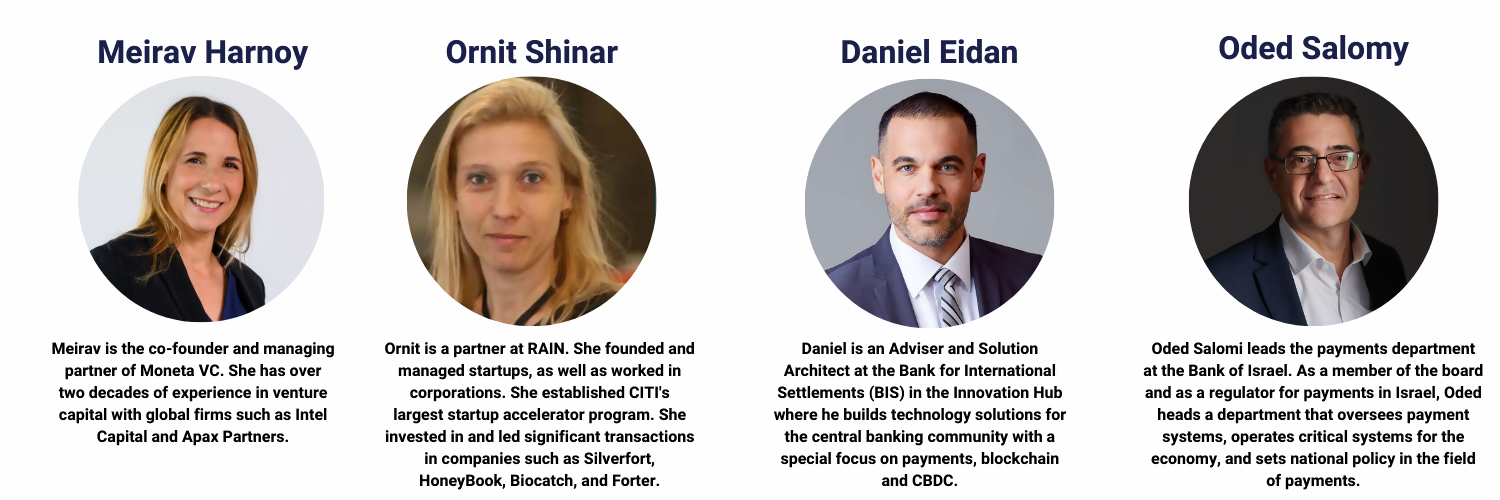

The judging team

At an event that will be held at the end of the Challenge, a team of experts will judge and rank the top projects, according to the following criteria:

• The originality of the proposed solution, in general and in reference to the existing payment solutions in Israel and abroad.

• The innovation of the proposed solution.

• The use of the APIs’ functionality in implementation of the solution.

• How the solution supports one or more of the motivations that the Bank of Israel has published for the potential issuance of a digital shekel.

• The quality of presentation and demonstration of the solution.

How to apply for participation in the challenge

Teams interested in participating in the Challenge are asked to fill out a registration form, including a presentation of the team members, a brief description of the idea for use in the challenge, and more. The registration form should be sent by email to digitalshekelchallenge@boi.org.il before 11/07/24.