To view this message as a file click here

The Bank of Israel is expanding the comparative information among the banks regarding the interest rates on deposits and loans, in order to allow access, and comparison that will strengthen consumers’ ability and enhance competition among the banks.

Supervisor of Banks Mr. Yair Avidan said, “The broad additional information that we are publishing today about interest rates on deposit and credit products for households, divided among the various banks, is another important step in enhancing transparency. I believe that this is another stage in strengthening the customer and providing the ability to make an informed decision, after examining a range of data in a simple, accessible, and convenient manner.”

In October 2022, the Bank of Israel launched the interest rate transparency reform, through the Bank’s website. The information published included data reported to the Banking Supervision Department on an ongoing basis about the average interest rate levels for each bank, which were granted in actuality on deposits (fixed and variable interest rates), and credit (at a variable interest rate) in Israeli currency, that is not CPI-indexed.

Today the Banking Supervision Department announces the expansion of the information published, in the interest of making complete and more detailed information accessible to the public, which will help the public to make a better comparison of interest rates on the various deposit and credit products.

Later, the website will make additional comparison details accessible, which will assist the customer in making a decision when depositing money or receiving loans that are not just from the banking system, such as Makam.

Following is a listing of the additional information that will be published starting today:

Interest on deposits

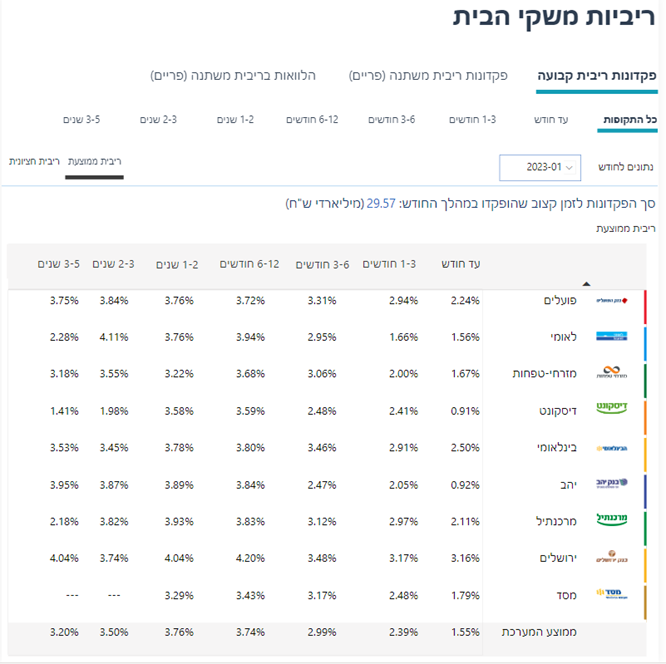

- Deposits with a fixed interest rate—segmentation of the interest rates offered by the banks for additional time periods and additional information on the median interest rates.[1]

- Deposits with a variable interest rate— segmentation of the interest rates offered by the banks based on time periods, as well as additional information on the median interest rates.

The segmentation by time period enables the consumer to compare and to receive more focused information on the interest rates on deposits for the various periods, and to make better comparisons according to the customer’s needs.

Household interest rates

Interest rates on consumer credit (household loans)

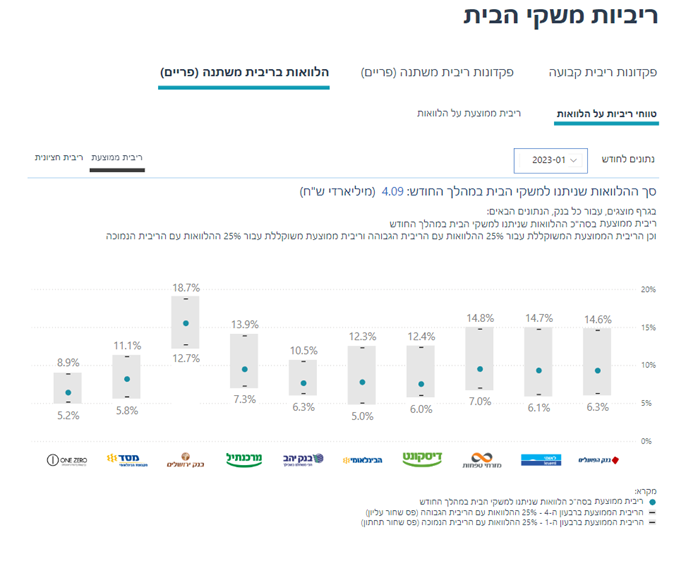

In addition to a simple comparison of the average interest rates charged by the various banks on total loans, there is also a comparison of the median interest rates. The median interest rate will enable consumers to understand better their placement relative to the other interest rates offered on loans to other consumers. The difference between the median interest rate and the average interest rate is that the average is impacted by amounts (because it is weighted), while the median interest rate is not impacted by the amount. We note that the interest rate on credit does not change significantly between the various loan periods.

- Information on interest rates by percentiles: Alongside the average or median interest rates, from now on the average interest rate in the bottom quartile (the 25 percent of loans with the lowest interest rate) and the average interest rate in the highest quartile (the 25 percent of loans with the highest interest rate)

- Due to consumer loans having considerable variance in the interest rates paid by the customers, the publication was expanded, so that it reflects information not only on the average interest rate but also presents the range of interest rates.[2] The interest rates offered to consumers are impacted by a number of parameters, among others the borrower’s risk level, the loan amount and its terms.

Household interest rates

The information is made accessible by a designated accessible page on the Bank’s website, which was developed by the IT Department and the Communication Department, and is updated on a monthly frequency.

[1] The median interest rate is the interest rate for which half the loans (or deposits) were extended (or received) at an interest rate that is equal or higher than it, and half the loans (or deposits) are at an interest rate that is equal or lower than it. The information on the median interest rate neutralizes the impact of the amount on the prices.

[2] To do so, the loans at each bank were arranged by the interest rate, and the weighted average interest rate was calculated for the loans in the first quartile (the 25 percent of loans with the lowest interest rate) and the weighted average interest rate was calculated for the loans in the fourth quartile (the 25 percent of the loans with the highest interest rate).