The guidelines encourage the banks to carry out significant processes to increase efficiency by defining regulatory easings. This, against the background of the low level of efficiency that characterizes most banks in Israel’s banking system, compared with the rest of the world.

Dr. Hedva Ber, the Supervisor of Banks, said, “The goal is for the banks to carry out significant processes to increase efficiency. The steps to increase efficiency will enable the banks to lower the costs of banking services, particularly for households and small businesses. The increased efficiency, alongside a range of steps taken to increase competition, will ensure a more stable and competitive banking system, for the benefit of customers.” The Supervisor added, “We are aware of the difficulties inherent in increasing efficiency in the system and therefore defined new guidelines that will make it easier to carry out voluntary retirement and cost reduction programs, which will lead to the required significant increase in efficiency.”

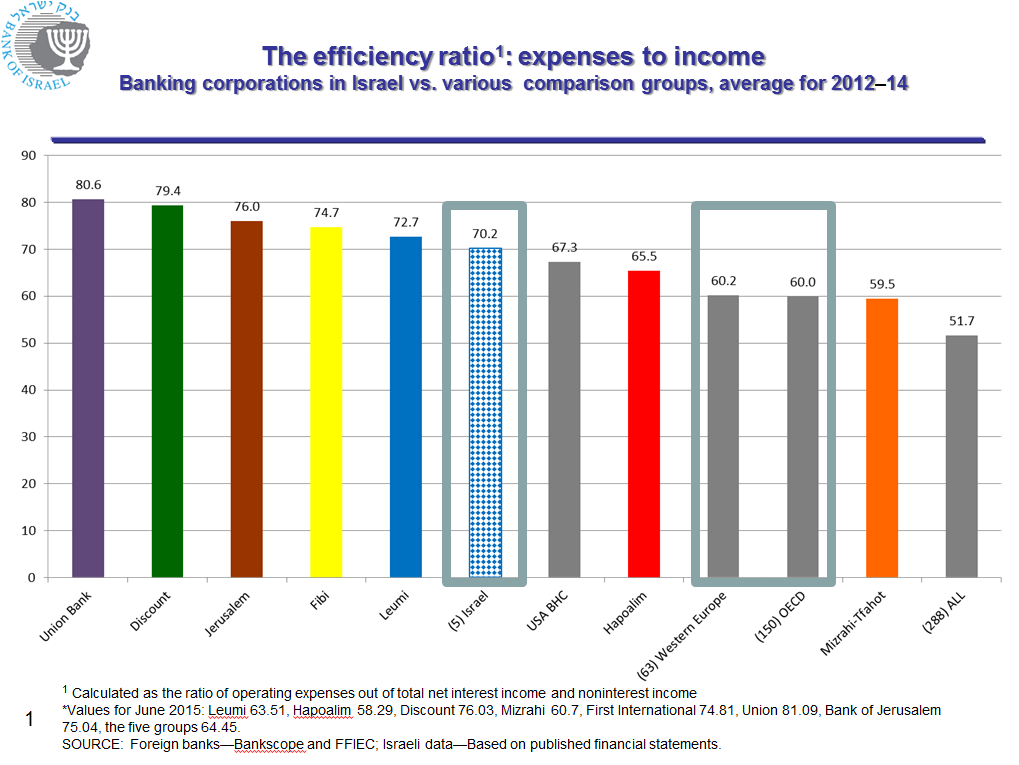

The environment of economic, regulatory, and technological activity in which the banking system operates in Israel, as worldwide, is undergoing many changes that are expected to continue in the coming years. The technological changes in the financial sector are changing the “production function” of banking services, as customers worldwide and in Israel are moving to increasingly consume banking services directly—via the Internet, mobile, and automated banking devices. In addition, the availability of the technology considerably increases, and will increase, the transparency of the information to customers, the ease of receiving competitive offers from a number of entities, and thus the competitiveness in the banking system as well competition from nonbank entities. In view of these trends, and the fact that various banking system performance indices show a markedly low level of efficiency for banks in Israel, compared with the rest of the world, the Banking Supervision Department intends to emphasize processes to increase efficiency in the coming years. These processes can be carried out through setting a voluntary retirement program for employees, and other cost reductions.

The Banking Supervision Department’s policy in this regard is intended to support the lowering of costs of banking services and to ensure the long term stability of banks. Banks that will carry out significant plans to increase efficiency, in line with the framework in the guideline, are expected to see an improvement in their efficiency ratios in the coming years and will be able to increase their capital adequacy ratios. The improvement in efficiency ratios, alongside the increased competition that will be created through the processes being promoted today in the economy and by the Bank of Israel, are expected to contribute to a reduction of the price of banking services for households and small businesses.

Based on the draft guidelines:

v Banks are to establish and present to the Banking Supervision Department a multiyear plan to increase efficiency, which will include well-defined intermediate goals, and to monitor and supervise the implementation of the plan by the banking corporation’s board of directors. In addition, a mechanism for reporting to the Banking Supervision Department on the issue will be defined.

v The Banking Supervision Department will take steps to support the plans to increase efficiency, including leniencies in capital adequacy requirements for banks that will define significant long-term plans to increase efficiency, and clarifications regarding the accounting treatment of said plans.