- During the third quarter of 2014 the value of the public's financial assets portfolio increased by about NIS 81 billion, an increase of about 3 percent in real terms, and reached about NIS 3.13 trillion at the end of September.

- The growth during the quarter derived mainly from an increase in the tradable portfolio abroad (about NIS 35 billion, 8.7 percent) and in current account balances and foreign exchange indexed deposits (about NIS 23 billion, 2.4 percent). Some of the increase in these components was affected by the significant depreciation of the shekel vis-à-vis the dollar (7.5 percent). There was actually a decline in the pace of increase of the net outflow of investments during the past two quarters.

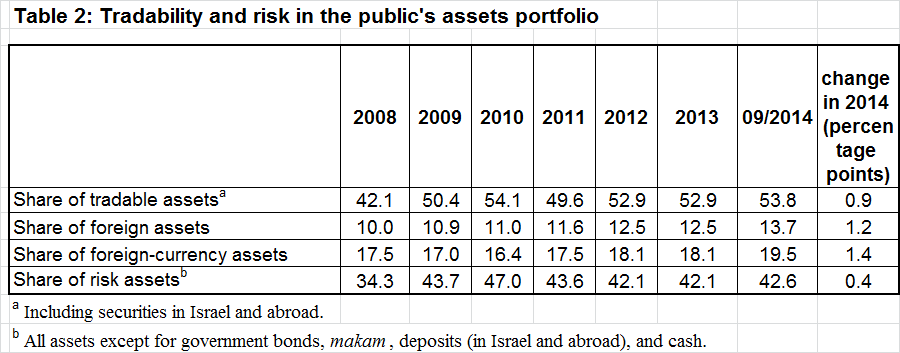

- As a result of the increase in the value of the public’s securities portfolio abroad, the share of foreign exchange assets in the portfolio increased by about 0.8 percentage points during the third quarter (to 19.5 percent), and the share of foreign assets increased by 0.5 percentage points (to 13.7 percent).

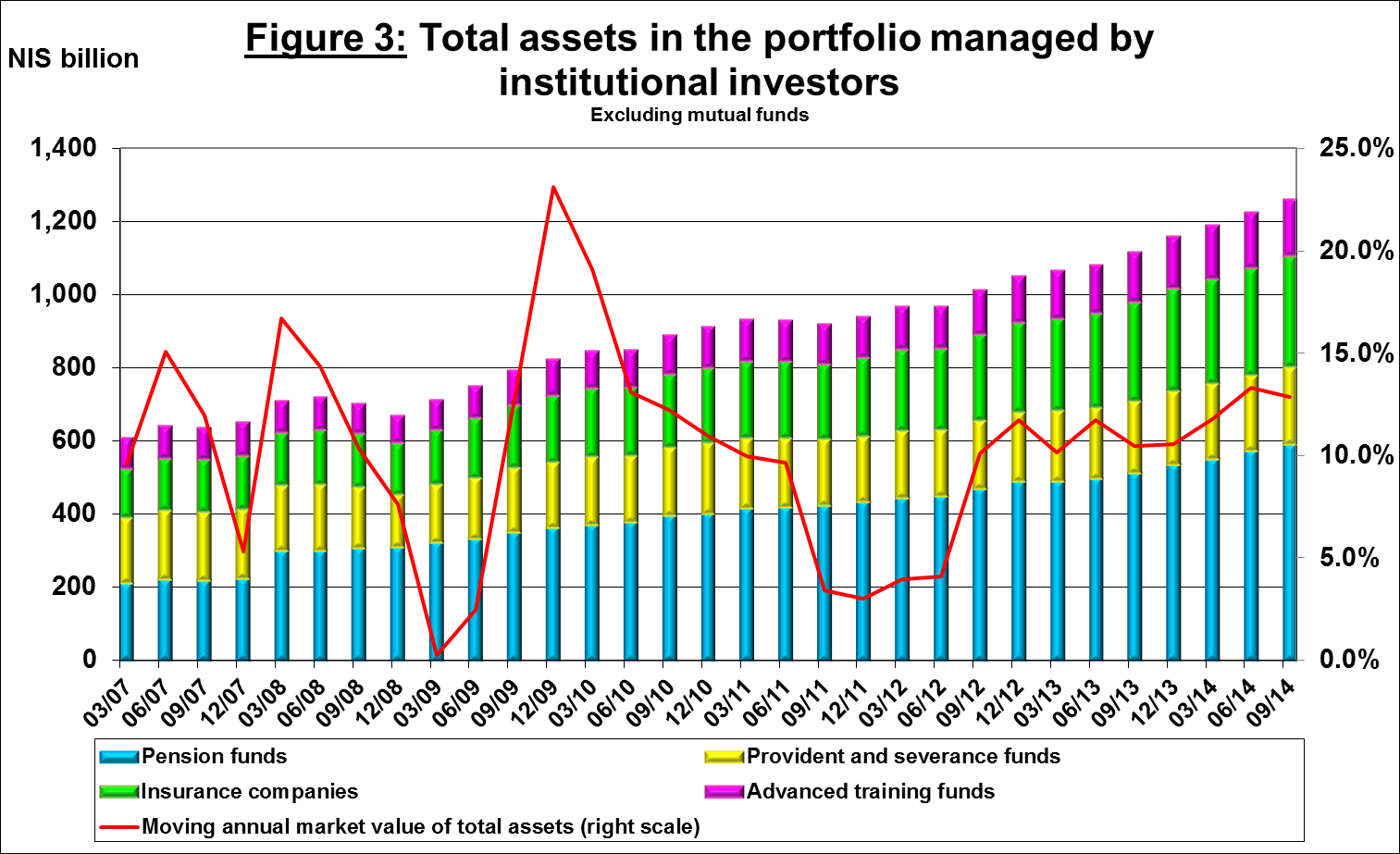

- The value of the asset portfolio managed by institutional investors (excluding mutual funds) increased by about NIS 36 billion (3 percent) in the third quarter, to about NIS 1.3 trillion at the end of September. Most of the increase was the result of an increase in the value of the portfolio traded abroad, and an increase in the makam and government bonds portfolio. The share of the portfolio managed by institutional investors remained at 40.2 percent.

1. The total assets portfolio

During the third quarter of 2014, the value of the public’s financial assets portfolio increased by about NIS 81 billion, an increase of about 3 percent in real terms, and reached about NIS 3.13 trillion at the end of September.

The increase in the third quarter was primarily due to an increase in the value of the tradable assets portfolio abroad by about NIS 35 billion (8.7 percent), mainly due to the weakening of the shekel vis-à-vis the dollar by about 7.5 percent. In addition, there was an increase of about NIS 23 billion (2.4 percent) in the current accounts and foreign exchange indexed deposits components.

As a result of the growth in the value of the public’s securities portfolio abroad, in the third quarter of 2014 there was an increase of about 0.8 percentage points in the share of foreign exchange assets, and 0.5 percentage points in the share of foreign assets.

2. The securities portfolio, by main components

Shares in Israel

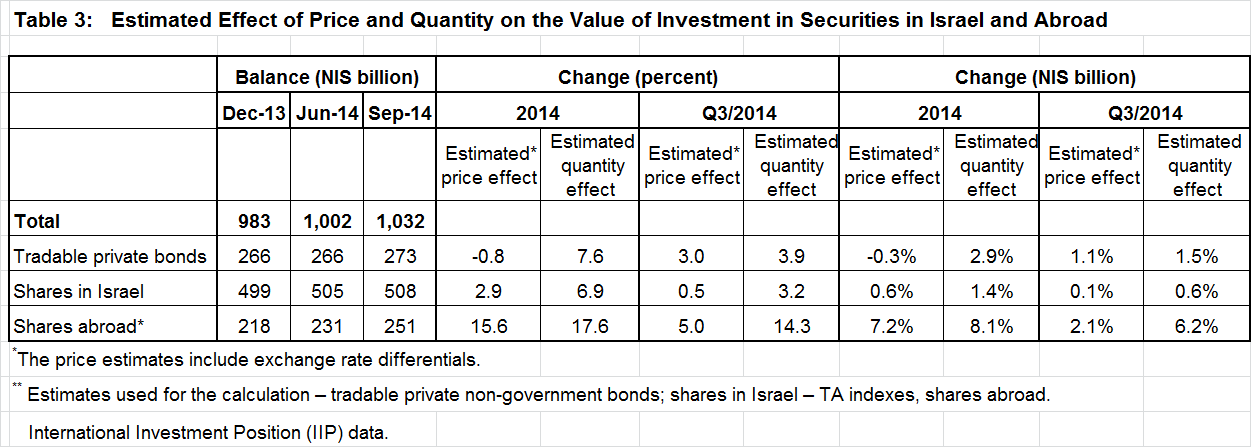

During the third quarter of 2014, the balance of shares held in Tel Aviv by the public increased by about NIS 3.7 billion (0.7 percent), to about NIS 508 billion at the end of September. This decline was due mainly to the effect of price changes of Tel Aviv Stock Exchange-traded shares. In the first three quarters of the year, there was an increase of about NIS 10 billion in the value of the shares portfolio in Israel, of which about NIS 7 billion was due to share price increases.

Bonds

During the third quarter of 2014, the value of negotiable corporate bonds in the portfolio increased by about NIS 6.9 billion (2.6 percent), and reached about NIS 273 billion at the end of September. At the same time, there was an increase of about NIS 13 billion in the balance of the government bonds and makam portfolio, mainly by institutional investors, and increased government commitments to the older pension funds.

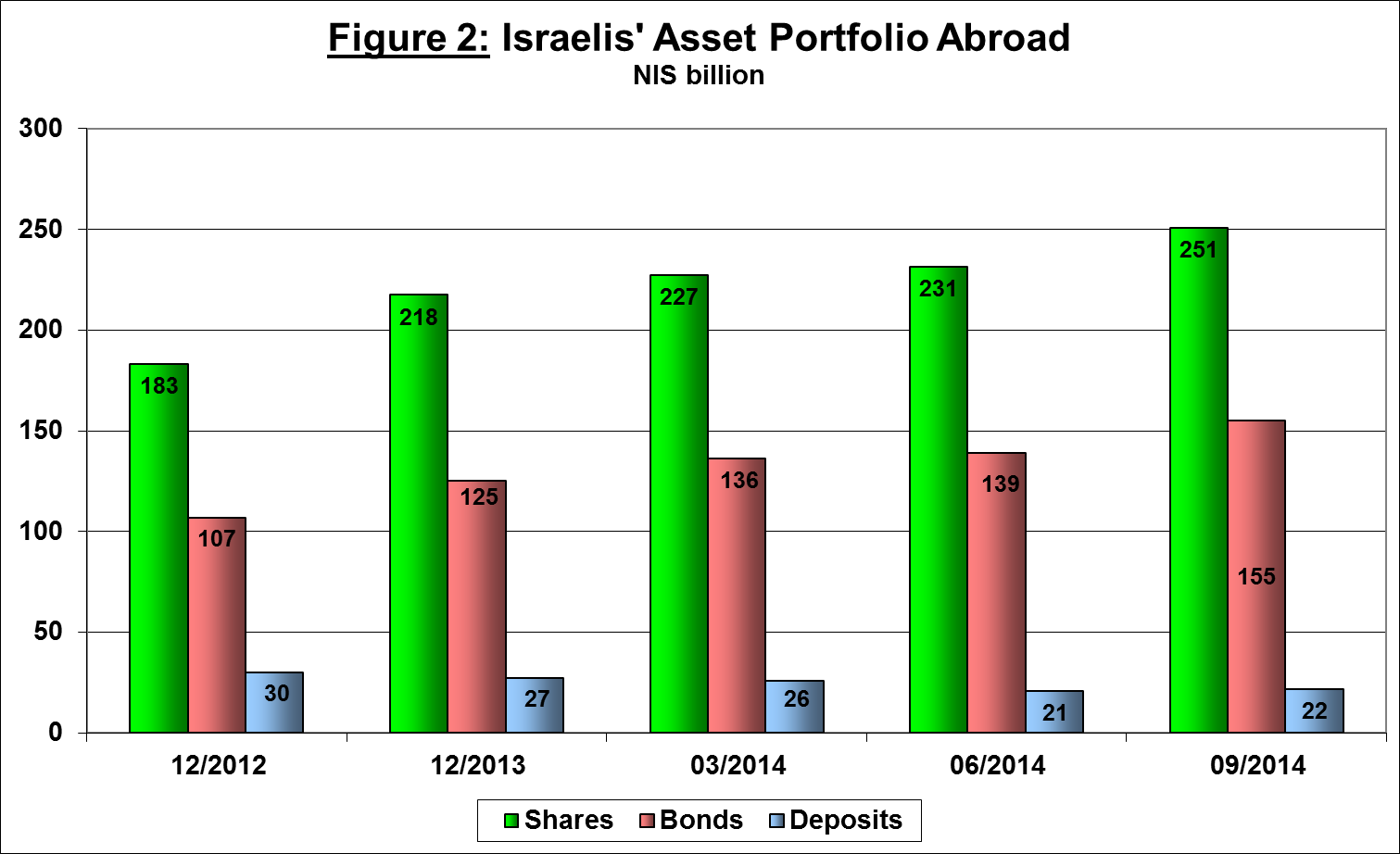

The assets portfolio abroad

During the third quarter of 2014, the value of the portfolio held abroad by Israelis increased by about NIS 36.6 billion (9.4 percent), and reached about NIS 428 billion at the end of September, which accounts for about 14 percent of the total asset portfolio. The increase in the value of the portfolio was affected by the depreciation of the shekel vis-à-vis the dollar (7.5 percent) and price increases abroad. There was a marked decline in the pace of growth of the net outflow of investments during the last two quarters.

The value of shares held abroad increased by about NIS 19.3 billion (8.3 percent), and reached about NIS 251 billion at the end of September. This was mainly comprised of net investments abroad by households and the business sector. In addition, the value of the tradable bonds portfolio abroad increased by about NIS 16 billion (11.5 percent), and reached about NIS 155 billion at the end of September. In parallel, there was also an increase in the accumulation of deposits at banks abroad (6.6 percent).

3. The portfolio managed by institutional investors

The value of the assets portfolio managed[1] by the institutional investors (excluding mutual funds) increased by about NIS 36 billion (3 percent) in the third quarter, to about NIS 1.3 trillion at the end of September. Most of the increase was in the value of assets managed by the new pension funds (4.9 percent) and the old pension funds (2.6 percent).

The share of the portfolio managed by the institutional investors out of the public’s total assets portfolio remained virtually unchanged during the third quarter, at about 40.2 percent. Since the beginning of the year, this share of the managed portfolio increased by 1 percent.

Exposure[2] of the portfolio managed by the institutional investors to foreign assets and foreign exchange

The rate of exposure to foreign assets increased by about 0.8 percentage points in the third quarter, to about 22.8 percent of the portfolio in September. Since the beginning of 2014, the rate of investment in foreign assets increased by about 2 percentage points. The increase in the rate of exposure to foreign assets was common to all types of institutional investors.

The rate of exposure to foreign exchange, which is measured by the weight of assets denominated and indexed to foreign exchange (including derivatives) increased slightly in the third quarter, to 12.8 percent of total assets at the end of September. The changes in the rates of exposure to foreign exchange are also affected by changes in the value of the assets and in the exchange rates.

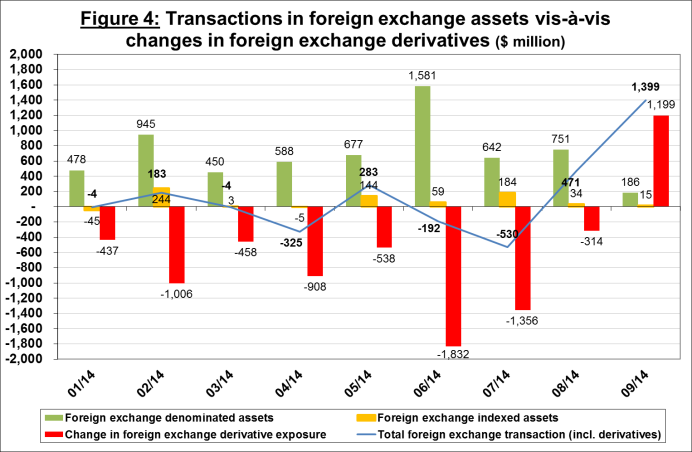

An analysis of net transactions in institutional investors’ foreign exchange assets shows that in August and September there was a change in the pattern of the institutional investors’ activity in the market: The institutional investors transitioned to net purchases of foreign exchange in derivative instruments, compared with significant amounts of net sales in recent years.

4. Mutual funds

The value of the portfolio managed by Israeli mutual funds was NIS 270 billion at the end of September, about 8.6 percent of the public's total asset portfolio and about 16 percent of the tradable portfolio.

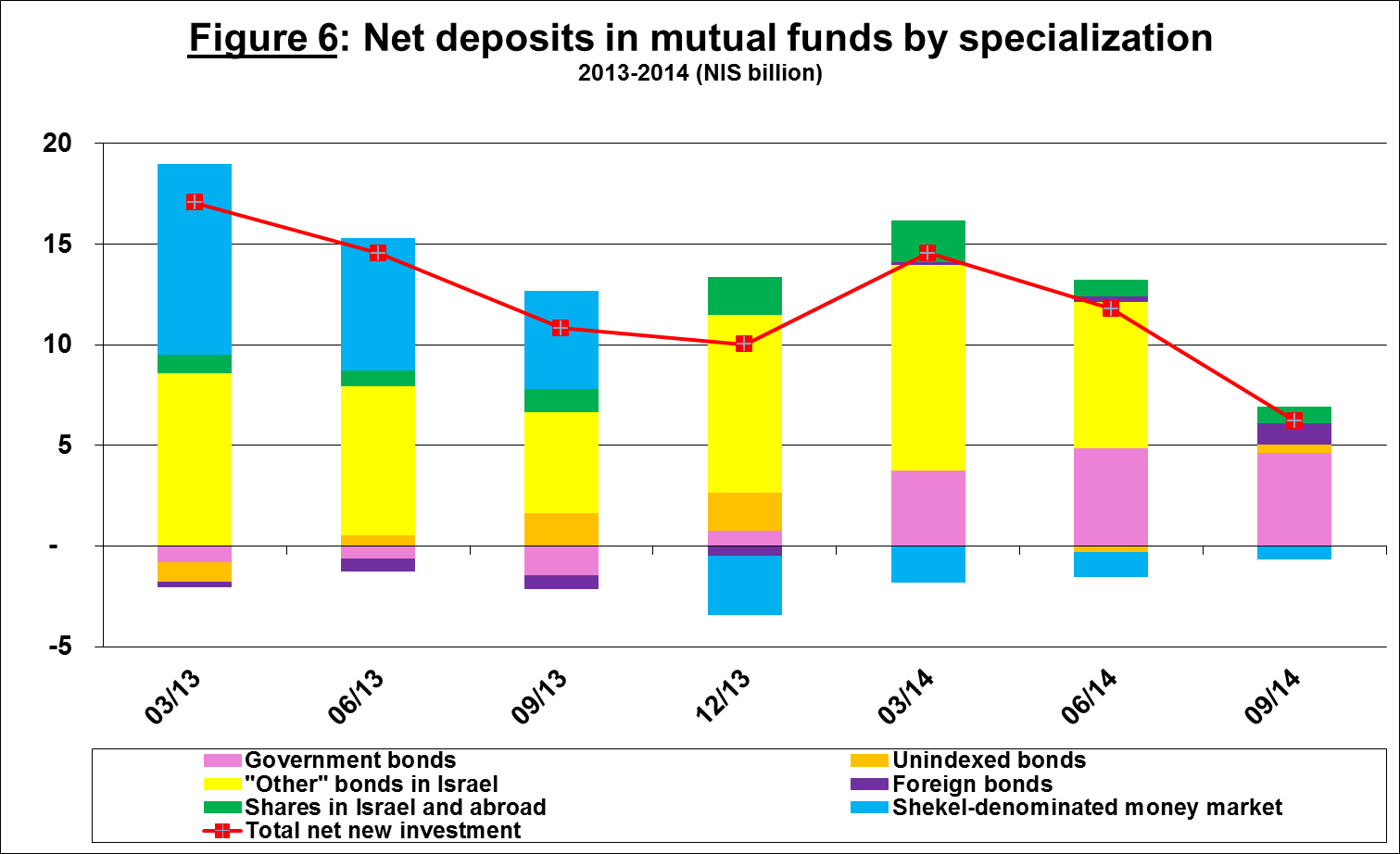

In the third quarter of 2014, the value of mutual fund assets increased by about NIS 9.1 billion (3.5 percent)—of which about NIS 6.3 billion was due to net accumulations (surplus of issues over redemptions, minus dividends), and the rest was due to price increases in the markets—a decline compared to previous quarters.

A breakdown of mutual funds by specialization shows that net accumulations in the third quarter were concentrated in State bonds (about NIS 4.7 billion or 11.1 percent), and in shares and foreign bonds (about NIS 2.3 billion). In contrast, there were net redemptions in money market funds and in shares traded in Israel (about NIS 1.2 billion). There was a small net accumulation in “other” bonds during the third quarter. Net accumulations in general bonds were mostly offset by net deposits in mutual funds specializing corporate bonds.

Further information and details on this subject are available at the following link: http://www.boi.org.il/en/DataAndStatistics/Pages/MainPage.aspx?Level=2&Sid=15&SubjectType=1

[1] The managed portfolio—provident and severance pay funds, pension funds and advanced training funds, life insurance plans (guaranteed yield and profit sharing), excluding nostro investments. The managed portfolio does not include mutual fund assets.

[2] Estimates of members’ exposure (rather than exposure of the institutional investors themselves) to various risks in the portfolio managed for them by the institutional investors (excluding insurance policies with a guaranteed yield, where the risk is taken on by the institutional investors).