![]() To view this press release as a Word document

To view this press release as a Word document

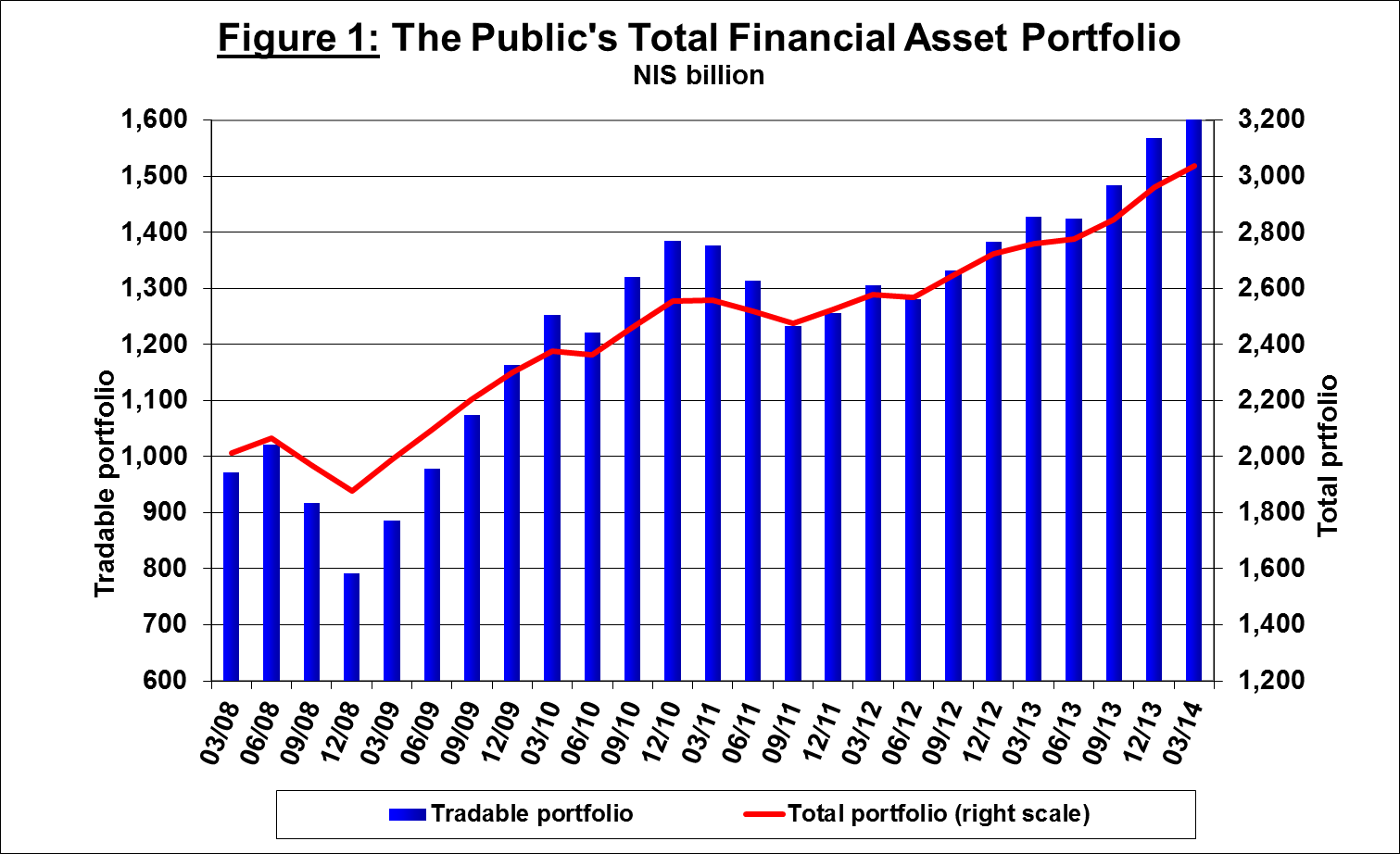

- During the first quarter of 2014 the value of the public's financial assets portfolio increased by about NIS 74 billion, an increase of about 3 percent in real terms, and reached NIS 3.04 trillion at the end of March.

- The growth during the quarter derived mainly from an increase in the value of the shares portfolio in Israel (about NIS 42 billion, 8.3 percent) and abroad (NIS 16.3 billion, 7.1 percent)—a combination of share price increases and a net inflow of investments.

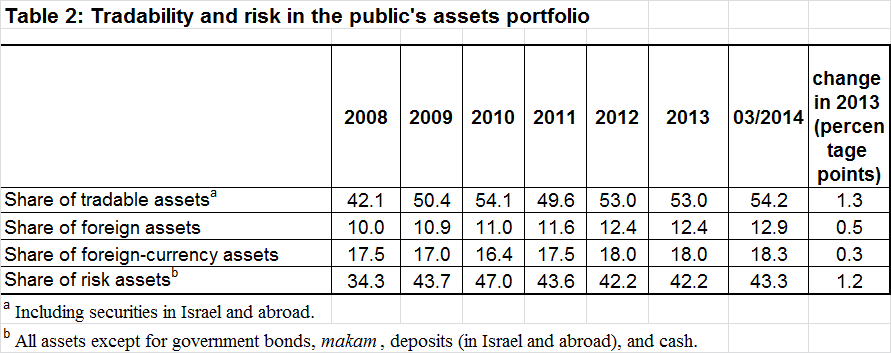

- As a result of the above developments, the share of tradable assets in the portfolio increased by 1.3 percentage points during the first quarter, in parallel with a similar increase in the share of risk assets in Israel and abroad.

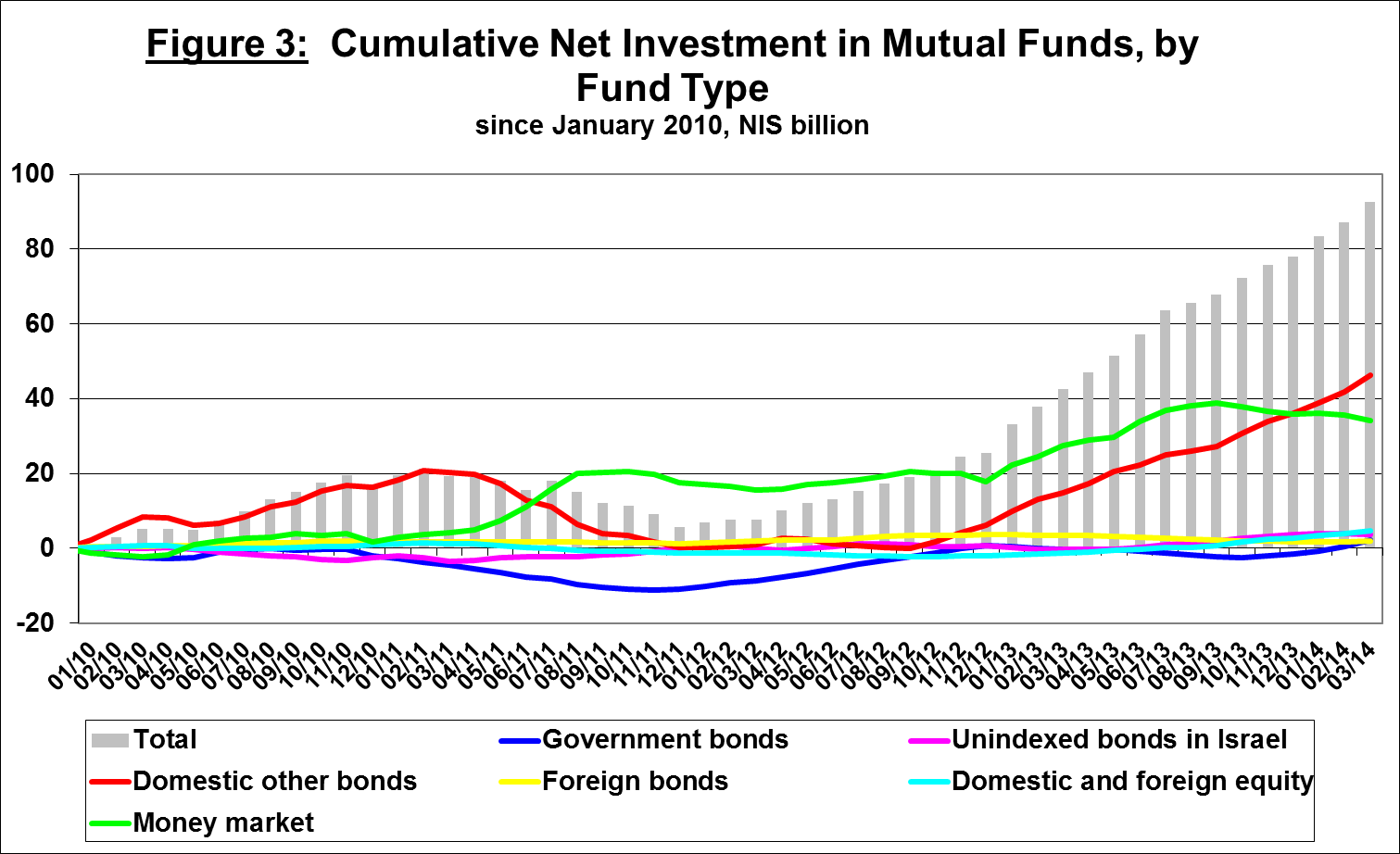

- There was a net increase of about NIS 14.5 billion (6.3 percent) in the section of the portfolio managed through mutual funds during the first quarter, mainly in mutual funds specializing in CPI-indexed corporate and government bonds. Money market funds registered net redemptions.

1. The total assets portfolio

During the first quarter of 2014, the value of the public’s financial assets portfolio increased by about NIS 74 billion, an increase of about 3 percent in real terms, and reached NIS 3.04 trillion at the end of March.

The increase in the first quarter was due primarily to an increase in the value of the securities portfolio on the Tel Aviv Stock Exchange—an increase of about NIS 42 billion (8.3 percent)—due primarily to an increase in share prices. In parallel, there was an increase of about NIS 24 billion (6.6 percent) in the value of the tradable assets portfolio abroad—a combination of an increase in investments and price increases.

During the first quarter of 2014, there was an increase of about 1.3 percentage points in the share of tradable assets in Israel and abroad, and in the share of risk assets, as a result of the growth in the public's securities portfolio abroad.

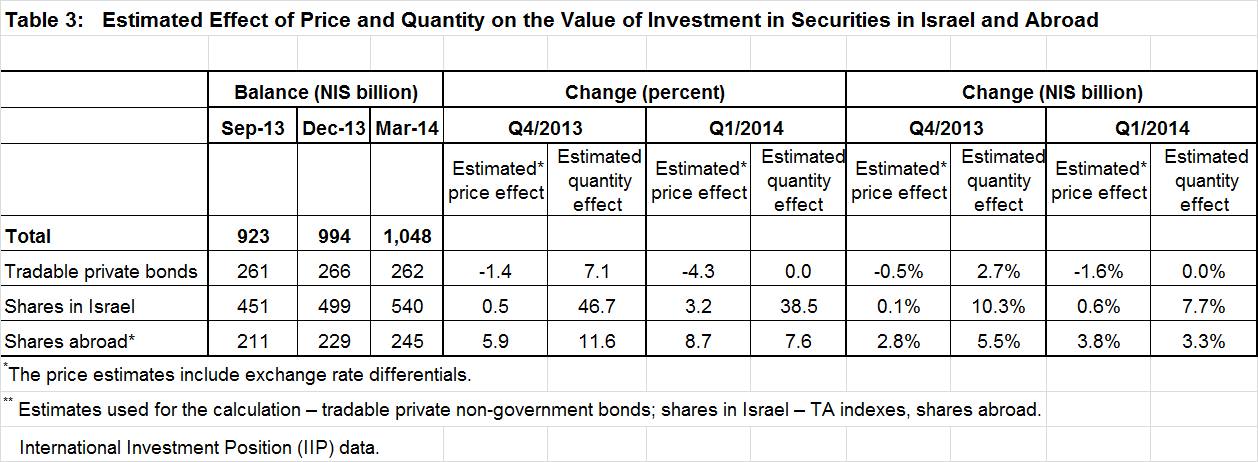

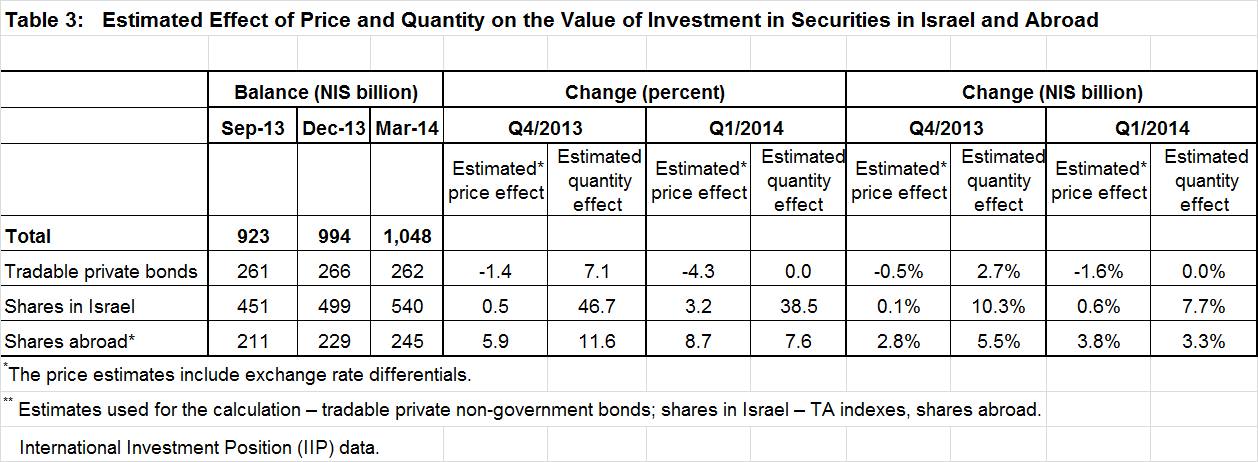

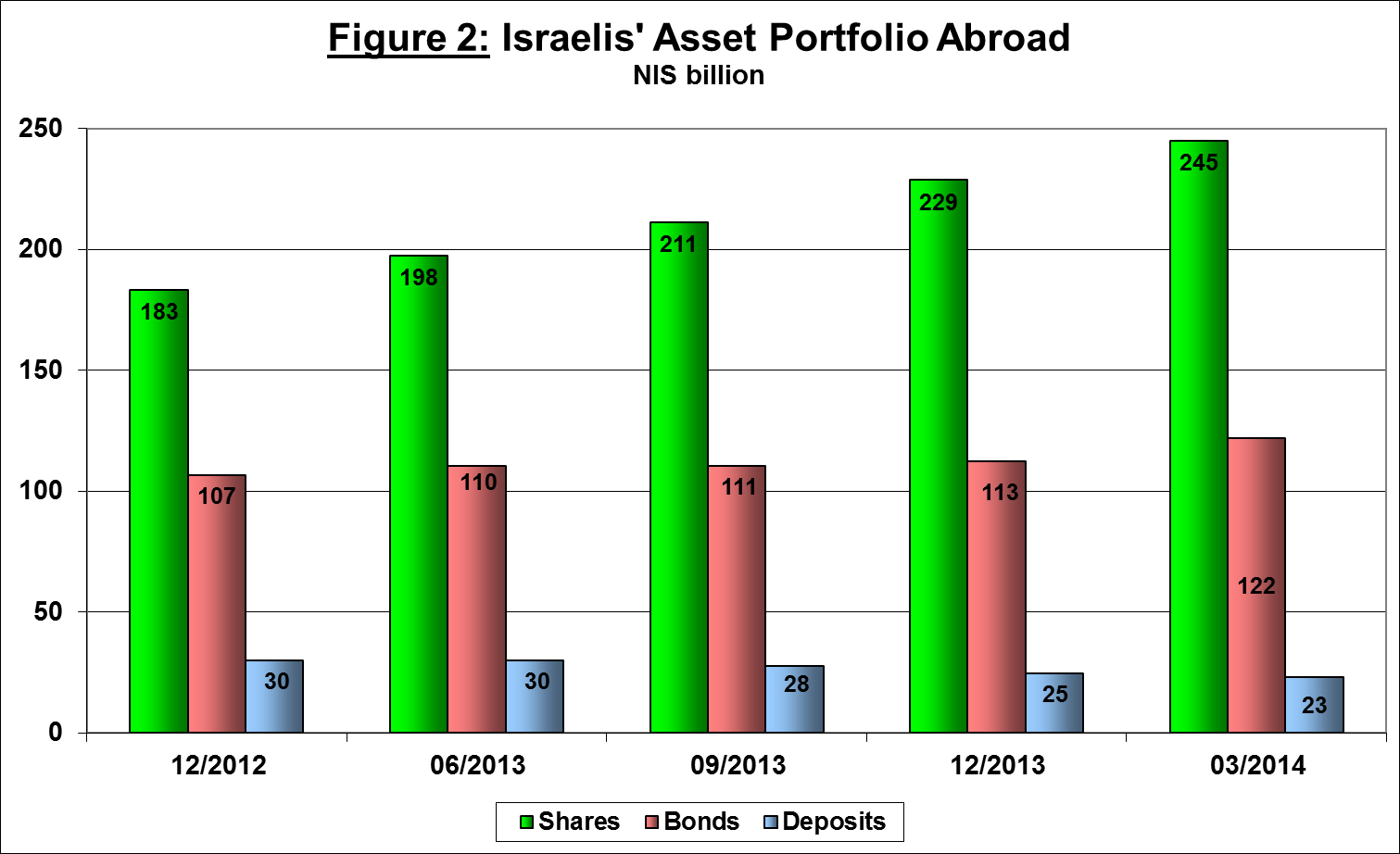

2. The securities portfolio, by main components Shares in Israel During the first quarter of 2014, the balance of shares held by the public increased by about NIS 42 billion, to about NIS 540 billion at the end of March, an increase of 8.4 percent. This increase was due mainly to the effect of price changes of Tel Aviv Stock Exchange-traded shares (7.7 percent). The net inflow of investments by the public was NIS 3.2 billion—net investments by mutual funds and by institutional investors, following the NIS 47 billion increase in the value of the shares portfolio in Israel during the fourth quarter of 2013. During the first quarter of 2014, the value of negotiable corporate bonds in the portfolio declined by about NIS 4.3 billion (1.6 percent), and reached about NIS 262 billion at the end of March, mainly net repayments following net repayments of about NIS 1.4 billion in the fourth quarter of 2013. The assets portfolio abroad During the first quarter of 2014, the value of the portfolio held by the public increased by about NIS 24 billion (6.6 percent), and reached about NIS 390 billion at the end of March. Most of the increase was in the balance of shares abroad, which increased by about NIS 16.3 billion (7.1 percent)—a combination of a net flow of investments (about NIS 8.7 billion) by institutional investors, the business sector and households, and of price increases in stock indices abroad. In parallel, there was an increase of about NIS 9.5 billion (8.4 percent) in the tradable bonds portfolio abroad, which was partially offset by a decline in the balance of deposits in banks abroad (7 percent). In addition, the depreciation of the shekel against the dollar (0.5 percent) in the first quarter increased the shekel value of the portfolio. * Further information on the public's assets portfolio can be seen on the Bank of Israel's website:

Corporate bonds

3. Mutual funds