Construction and Housing Ministry Director General Shlomo Ben-Eliyahu: “The option of refinancing a mortgage is a further step intended to make it easier for home purchasers and home owners. The fruitful cooperation with the Bank of Israel will make it possible for tens of thousands of eligible homeowners to realize significant savings in their day-to-day expenses. This is a further step in our struggle to lower the cost of living and the cost of housing, and I am pleased and thankful for the banks’ worthy cooperation.”

Supervisor of Banks David Zaken: “I am pleased that the banks have acceded to our request and will make it possible for eligible homeowners to refinance the mortgages given to them by the State, and to obtain mortgages with easier interest payments (interest that will not exceed the average interest rate on housing loans), through a short process with minimal fees.

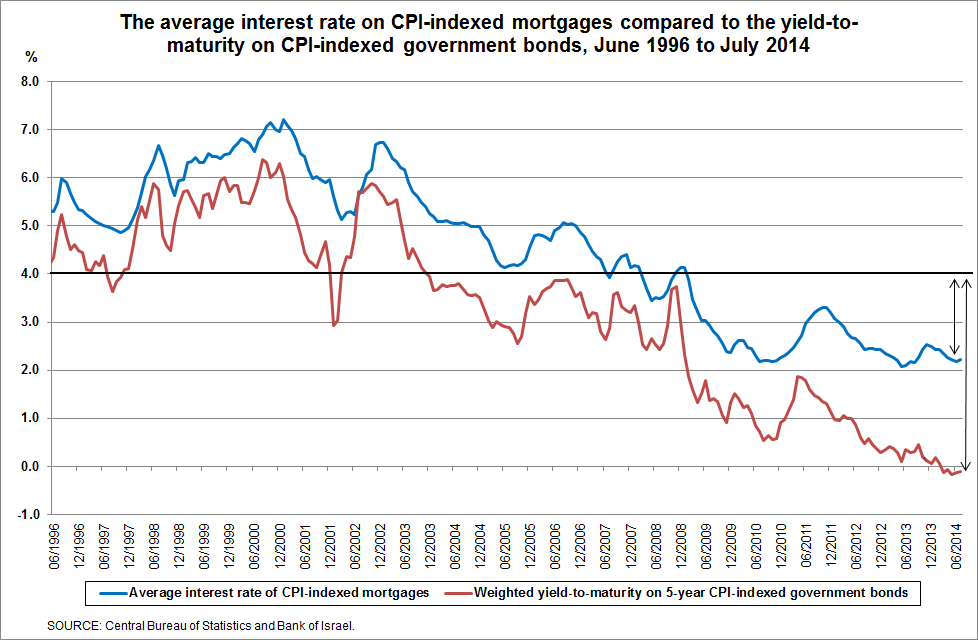

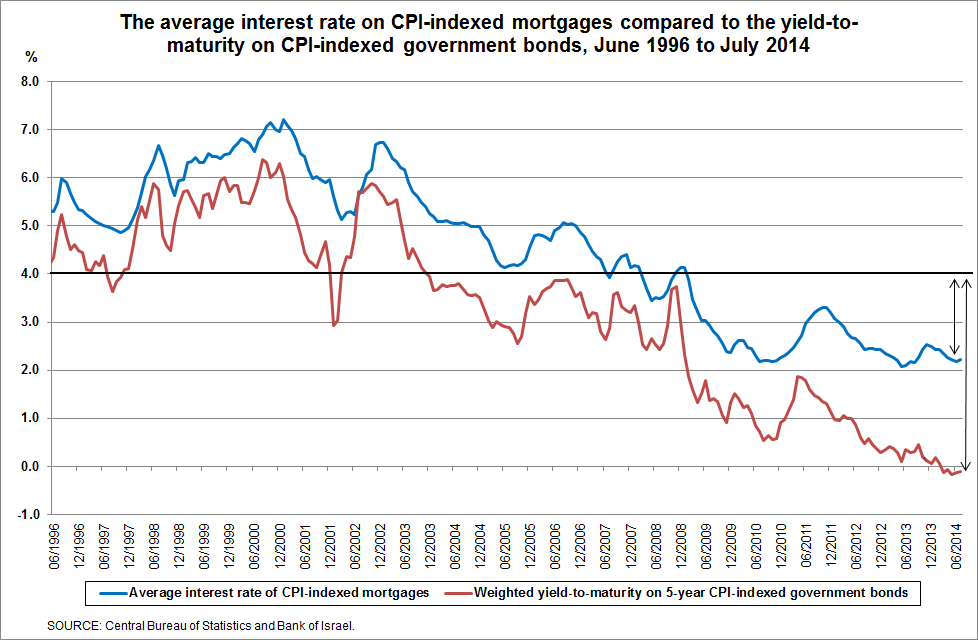

The Ministry of Construction and Housing and the Bank of Israel Banking Supervision Department are promoting a measure to encourage the early repayment, or refinancing, of State mortgage loans to eligible homeowners. Until 2012, the interest rate on State loans to eligible homeowners was 4 percent indexed to the CPI. Since there has been a significant drop in the average interest rate on CPI-indexed housing loans over the years, and since the early repayment of State loans does not involve the payment of capitalization differentials, it has become markedly more worthwhile to repay those mortgages early. It is economically worthwhile whether the early repayment is from the borrower’s equity (compared to risk-free alternative investments with a real yield of 4 percent), or through the refinancing of the loan and taking out a new loan at the currently prevailing interest rates.

Over the years, the State of Israel has made grants and directed loans available to those purchasing their first home as part of its housing assistance policy. As of the end of June 2014, the balance of directed loans (excluding pending loans) totaled about NIS 18 billion. A rough estimate shows that, assuming that about half of borrowers will respond to the measure and refinance their loans, the savings to borrowers will be around NIS 250 million.

The objectives of the measure led by the Ministry of Construction and Housing in conjunction with the Bank of Israel are:

- To increase public awareness of the economic worthwhileness of early repayment of mortgage loans to eligible homeowners, which carry a real interest rate of 4 percent or more, whether through self-financing or through the refinancing of the loan with a new loan (hereinafter: refinancing loan) issued by the banking corporation.

- To make it easier for borrowers who wish and are able to refinance the loan, so that they can do so through a quick process at market prices.

For this purpose, a special track has been created which the six major banks—Leumi, Hapoalim, Mizrachi-Tefahot, Discount, First International and Union Bank—have joined, and the banks have agreed to offer borrowers who meet the benchmark conditions detailed below refinancing loans with terms detailed in this document. In this context, it is important to emphasize that this process does not derogate from the borrower’s right to repay the directed loan in any other way he chooses: self-financing; refinancing through the bank that administers the loan, under various conditions; or refinancing through another bank. Furthermore, this process does not harm the rights of a borrower who has taken out additional loans beyond the directed loan to refinancing the other parts of the loan taken from the bank, and it is recommended at this time to assess the feasibility of refinancing the entire loan. It is emphasized that regarding these other parts of the loan, it is not necessarily worthwhile to refinance, particularly because some refinancing transactions involve early repayment fees, which make it necessary to assess the feasibility for each case on its own.

The following graph illustrates the drop in the real interest rates that has taken place over the past few years, and the gap that currently exists between the average interest rate on housing loans (the price of the refinancing loan) and the 4 percent interest rate (the price of the benefit loan), as well as the gap between the yield to maturity on CPI-indexed government bonds (the price of alternative investment).

Details of the process

A calculator will be placed on the Ministry of Construction and Housing website, which is intended to assist borrowers in assessing the feasibility of refinancing. At the same time, the banks that have joined the process take upon themselves a commitment to make refinancing loans available to borrowers who meet the conditions detailed in this document, until May 31, 2015.

A. Benchmark conditions for refinancing a loan on the fast track

- The original directed loan provided to the borrower carries a real interest rate of 4 percent or higher;

- The loan was repaid on schedule until the date of refinancing;

- The balance of the loan on the date of refinancing (excluding early repayment fees) does not exceed 75 percent of the value of the attached property. A borrower who wishes may provide the bank with an assessor’s report to determine the value of the property at the time of the refinancing.

- There are no extenuating circumstances that justify the withholding of refinancing under these terms.

It is understood that this will not prevent the banking corporations from also acceding to requests from borrowers who do not meet one or more of these benchmark conditions.

B. Terms of the refinancing loan

In order to motivate borrowers to act of their own volition to improve the terms of their loans at the banking corporation that provided the loan, it has been agreed that the following will be put into practice:

- Since this is a process of changing the terms of the loan, the fee that will be collected is the fee for changing the terms of the loan and shall not exceed NIS 120. No other fee will be collected.

- The refinancing loan shall be for an amount that does not exceed the balance of the directed loan for repayment and its duration shall not exceed the remaining duration of the directed loan until repayment.

- The refinancing loan shall be issued at a fixed interest rate indexed to the CPI.

- The interest rate on the refinancing loan shall not exceed the average interest rate on CPI-indexed housing loans known on the date the loan is taken out, in accordance with the period remaining to repayment, as calculated for the purpose of the Banking (Early Repayment Fees) Order, 5762–2002. The interest is calculated in accordance with the remaining period to repayment of the loan.

- Due diligence—The banking corporations will send borrowers who meet the benchmark conditions detailed above a letter in which the price of refinancing and its implications are detailed (including the fee involved in refinancing, the fact that the refinancing loans are not subject to the Housing Loans Law, 5752–1992 and particularly Section 5a of that law, and that the borrower’s right to a discussion before a special committee in a case of arrears is therefore forfeit, and the fact that in case of additional early repayment, an early repayment fee may apply on the amount currently being repaid).

- Following the borrower’s confirmation that he is interested in refinancing, through any of the means of communication (letter, recorded conversation, the bank’s website, and so forth), the banking corporation shall produce a document amending the loan contract, without it being necessary for the borrower to come to the banking corporation’s branch. The amendment to the contract shall be sent to the borrower by way of the communications method he chooses, and he shall return the signed document to the bank, through any of those methods.

- Upon completion of the process, the bank shall send the borrower confirmation of the refinancing.

- If, following the refinancing, the borrower decides to also repay the complementary loan that he had, the reduction in the capitalization differentials set in the Banking (Early Repayment Fees) Order, 5762–2002 shall be kept in place.

- Should a borrower wish to refinance an additional loan (complementary loan), in addition to the directed loan, through bank financing, that stated in this document shall not apply to the complementary loan.

Assessing the feasibility of the process for the borrower

The following are a number of examples (based on actual cases) that illustrate the economic feasibility of early repayment of directed loans bearing a real interest rate of 4 percent, in a number of ways: reducing the monthly payment, reducing the number of payments, and calculating the financial profit in terms of current value.

In example 2 in the table below: As of August 2014, the monthly repayment for a customer who took out a loan for NIS 90,000 in July 2005 at an annual interest rate of 4 percent indexed to the CPI for 25 years is NIS 586. Following refinancing of the loan, the monthly payment for that same borrower will be just NIS 533, meaning a savings of NIS 53 in the monthly payment, which translates to a cumulative saving of NIS 8,224, which is about 10 percent of the balance of the directed loan.

For later loan issue dates, the cumulative savings for a borrower are expected to be even higher, since the period remaining to final repayment is longer, during which the borrower will benefit from a lower interest rate.

The following are a number of additional examples that illustrate the economic feasibility of refinancing as part of this process:

|

Example 1 |

Example 2 |

Example 3 |

Current figures: |

|

|

|

Date the loan was issued |

June 30, 2000 |

June 30, 2005 |

June 30, 2010 |

Original loan amount |

NIS 90,000 |

NIS 90,000 |

NIS 90,000 |

Original annual interest |

4% |

4% |

4% |

Original loan period |

25 years |

25 years |

25 years |

Remaining period until loan repayment |

10.8 years |

15.8 years |

20.8 years |

Current value of outstanding loan (including indexation) as of August 31, 2014 |

NIS 66,421 |

NIS 82,429 |

NIS 87,113 |

Current monthly payment |

NIS 631 |

NIS 586 |

NIS 514 |

After refinancing of the loan: |

|

|

|

New annual interest, according to the average interest rate on CPI-indexed housing loans, by remaining period until loan repayment. |

2.22% |

2.69% |

2.92% |

New monthly payment |

NIS 576 |

NIS 533 |

NIS 466 |

Savings: |

|

|

|

Savings on monthly payment |

NIS 55 |

NIS 53 |

NIS 49 |

Cumulative savings = savings in monthly payment * the number of payments remaining to full repayment |

NIS 7,172 |

NIS 10,106 |

NIS 12,140 |

Current value of cumulative savings |

NIS 6,371 |

NIS 8,224 |

NIS 9,086 |

Alternatively: Shortening the loan period by months, should the monthly payment remain unchanged. |

16 monthly payments |

27 monthly payments |

37 monthly payments |

The Banking Supervision Department is available to the public for any questions concerning the process to encourage the refinancing of mortgage loans for eligible homeowners. To obtain information in this matter, please contact the Public Enquiries Unit at

michzur@boi.org.il.

The estimate of economic feasibility relates to the savings derived only from refinancing the loan, and does not take into account additional costs, should there be any (such as the fee for changing the terms of the loan, or collection fees). Annual nominal interest rate based on the average effective interest rate on CPI-indexed housing loans (yearly basis) published monthly by the Bank of Israel, which serves in the calculation of the early repayment fee. The interest rate is taken in accordance with the remaining loan period until final repayment. The calculation is based on the interest rate adjusted to the shortened repayment period.