- In recent years, the Bank of Israel has used foreign exchange market intervention as an additional monetary instrument aimed at moderating the trend of shekel appreciation.

- Research conducted at the Bank of Israel finds that the discretionary foreign exchange purchases by the Bank of Israel beginning in 2009 led to an immediate depreciation in the shekel vis-à-vis the dollar in more than 90 percent of the cases.

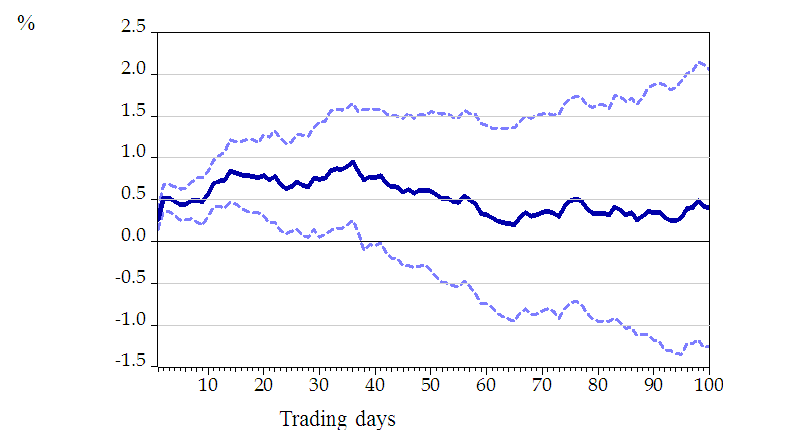

- The research finds a statistically significant effect of the purchases on the nominal effective exchange rate that persists for a period of 40–60 trading days.

- Based on these findings, it can be assessed that the level of the effective exchange rate in 2013–17 was depreciated by 2–3 percent, on average, due to the purchases. In periods that were characterized by intensive purchases, the impact reached 4–6 percent.

- The estimates above reflect the impact solely of the purchases, not the effect of the existence of a purchasing regime: the fact that the Bank of Israel intervenes from time to time in the foreign exchange market can, in and of itself, have an impact on the exchange rate level over time. However, as noted, the research does not identify this effect.

In recent years, the Bank of Israel, like some other central banks, has used foreign exchange market intervention as an additional monetary instrument aimed at moderating the trend of exchange rate appreciation. This policy was implemented at a time when monetary policy worldwide was characterized by unprecedented accommodation, reflected in quantitative easing and/or negative interest rates at major central banks.

Beginning from August 2009, the Bank of Israel has purchased foreign exchange occasionally, without advance notice, in accordance with its discretion, as published in a press release dated August 10, 2009.[1] In addition, beginning from May 2013, there are foreign exchange purchases within the framework of the natural gas plan, the annual quantity of which are announced in advance.

New research by Itamar Caspi and Sigal Ribon of the Bank of Israel Research Department, and Amit Friedman of the Bank’s Market Operations Department, utilizes a high frequency dataset to estimate the impact of the Bank of Israel’s foreign exchange purchases on the exchange rate.

As a marked share of the foreign exchange purchases takes place in periods of appreciation, it is difficult to estimate the immediate and persistent impact of the purchases, and to what extent those purchases moderated the trend of appreciation, because even if there was an appreciation on the day of the purchase, it is difficult offhand to know if the appreciation would have been larger without the purchase. In order to deal with this difficulty, the researchers used data at high frequencies, and a research method that allowed the cleaner identification of the impact of the intervention and its persistence over time. The results of the estimation indicate that in 90 percent of the cases, the intervention caused an immediate depreciation of the shekel, and that the impact lasted for a period of 40–60 trading days. These results allow the assessment of the impact of the actual foreign exchange purchases carried out on the level of the exchange rate over the period studied, from 2009 to 2017. In particular, it may be assessed that in years in which the Bank actually intervened between 2009–11 and between 2013–17, the purchases weakened the shekel by approximately 2–3 percent. In periods characterized by intensive purchases, particularly 2013–17, the effect reached 4–6 percent. It is important to emphasize that the impact that was measured is only of purchases that were unexpected (in their timing), and not due to the actual existence of a purchasing regime: the fact that the Bank of Israel intervenes from time to time in the foreign exchange market can, in and of itself, have an impact on the exchange rate level over time. As noted, the research does not identify this effect, but checks the effect of the purchases on the exchange rate as they occur.

Based on the research’s main finding, presented in Figure 1, as a result of an unexpected foreign exchange purchase that led to an immediate depreciation of 1 percent in the exchange rate, a significantly positive depreciation is maintained after a day, and subsequently for about 40 days (the range between the dashed lines that notes a confidence internal of 90 percent is greater than zero). The change measured on the day of intervention presented in the figure is smaller than one percent because a marked share of the interventions occurs after the representative exchange rate is set. In such as case, the impact of the intervention on the nominal effective exchange rate will only be expressed the following day.

FIGURE 1

Response of the nominal effective exchange rate to an unexpected purchase that leads to an immediate depreciation of 1 percent

|

Notes: This figure presents the response of the representative nominal effective exchange rate to a unitary unexpected purchases shock, meaning a shock that depreciates the shekel-dollar exchange rate by 1 percent at “Time 0”. The dark blue line notes the response as a function of the number of trading days after the actual intervention. The dashed lines signify a confidence interval of 90 percent.

[1] The Bank of Israel purchased foreign exchange from March 2008 until August 2009 under a commitment that was fixed and known in advance. The research discussed here does not deal with that period of purchases.

To the full study

To the full study