- The public debt to GDP ratio has a statistically significant effect on real yields of government bonds in Israel. The effect is greater the longer the bond’s term to maturity is.

- Monetary policy has a marked effect on shorter yields, but also a statistically significant, if small, effect on long term yields.

- The global financial environment, reflected by yields on US government bonds, has an effect on domestic real yields for all horizons; this effect has strengthened in the past decade.

- The effect of government debt on yields in Israel has also strengthened in the past decade: since the breaking out of the global crisis, a 1 percentage point increase in the ratio of government debt to potential GDP acts to increase the 10-year yield by about 10 basis points.

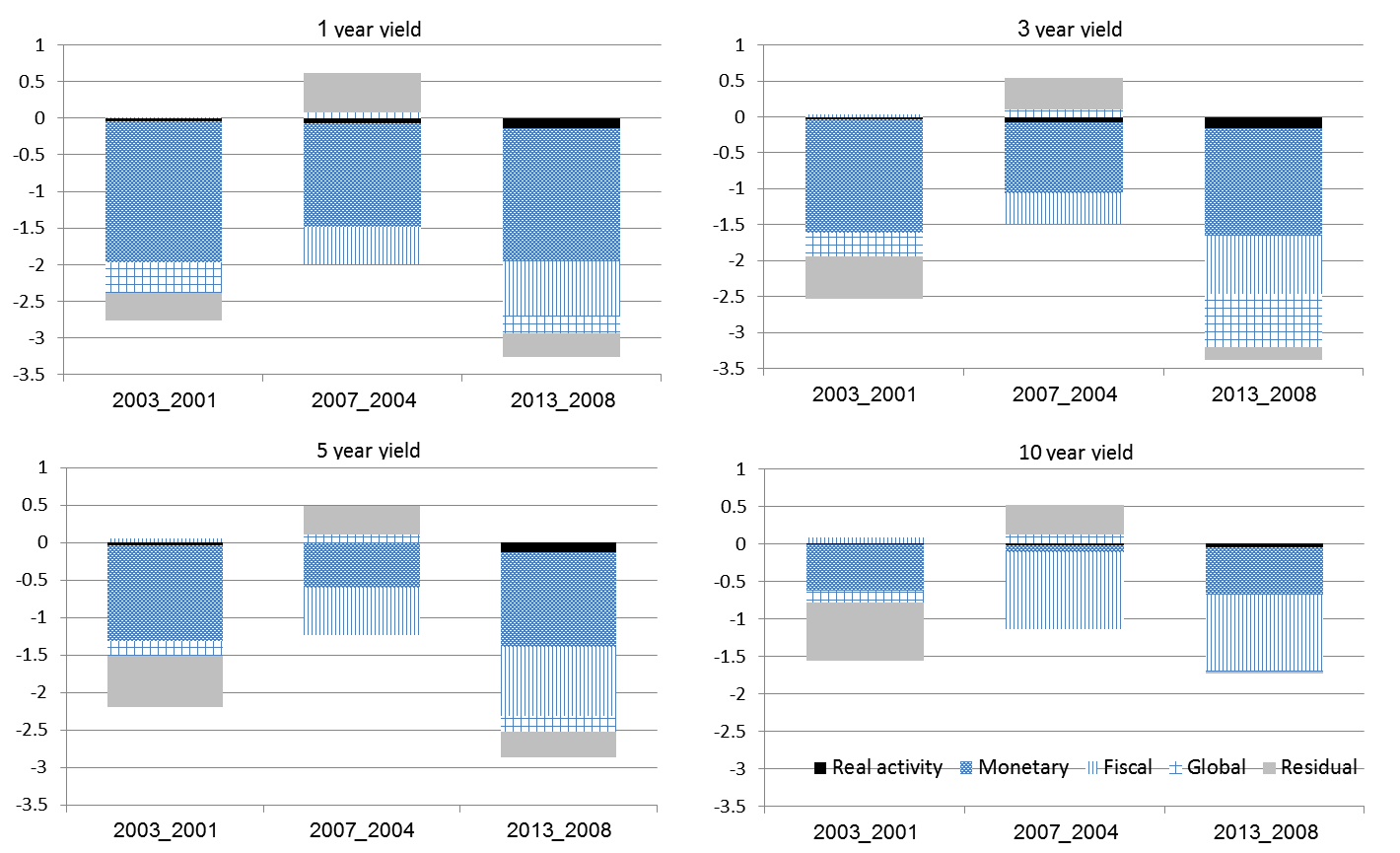

- The decline in the Bank of Israel interest rate explains a notable part of the decline in short term and medium term yields that occurred in the middle of the previous decade, while the decline in government debt explains a large part of the decline in longer term yields.

Fiscal policy, monetary policy, and the global economic environment affect government bond yields in Israel. Monetary policy is the dominant factor affecting short term yields, fiscal policy especially impacts on longer term yields, while the global economic environment—as reflected by US government bond yields and by the VIX index of equity market volatility—impacts on domestic real yields for all horizons. These are among the findings of a new research paper by Dr. Adi Brender and Dr. Sigal Ribon of the Bank of Israel’s Research Department. Their research also examined the changes over time in the factors impacting on the yields, and found that the effects of government debt and US yields strengthened over the past decade.

An examination of the effect of fiscal policy variables on yields indicates that the dominant variable is the public debt to GDP ratio—an increase of 1 percentage point acted, over the course of the sample period (2001 through September 2013), to increase the 1-year yield by 4 basis points (0.04 percentage points) on average, and to increase the 10-year yield by 7 basis points. This effect has strengthened over the past decade, and in the period since the global economic crisis broke out, it has reached about 10 basis points for the 10-year yield. The current research did not find a statistically significant effect of the forecast deficit or the deficit target on yields, in contrast to the study authors’ previous research, which examined data for an earlier period and found such an effect. The implication is that the effect of fiscal policy on yields is expressed through an extended deficit which is reflected in accumulated debt that leads to an increased burden of interest payments, due to both the increase in the debt itself and the increase in yields, and not through short term fluctuations in the deficit.

The paper finds that unexpected changes in the Bank of Israel interest rate have a greater impact on bond yields than changes that could be forecast by an econometric equation. It was found that monetary policy has a dominant effect on interest rates for the short term, but that it also a statistically significant effect on the long term yield—including the effect of (unexpected) interest rate changes on the 5–10 year forward yields.

The effect of the global economy on yields was measured in the paper by two variables that were found to contribute to the explanation: the real yield on US government bonds and the VIX volatility index of US equities. These two variables are positively correlated with yields in Israel, and the effect of the US yield has also intensified to a statistically significant extent during the past decade. In addition to the direct channel, the US interest rate also has an indirect effect on yields in Israel, via the effect on the Bank of Israel interest rate.

An analysis of the factors that affected the development of yields in Israel in the past decade indicates that the decline in the monetary interest rate explains most of the decline in short term yields, while fiscal policy explains most of the decline in long term yields (Figure 1). The breakdown of the factors impacting on the interest rate, between domestic and global elements, shows that global factors had a marked effect on the decline in yields for all maturities, and that the effect intensified in the second half of the decade (Figure 2).