- The grants, subsidies and tax benefits intended to assist young working families in Israel are lower than in the other advanced economies, particularly regarding low- or middle-income families.

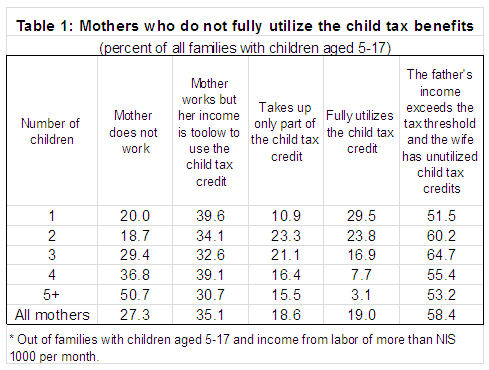

- Child tax benefits in Israel are focused on mothers, but about half of working mothers do not utilize these tax benefits at all, due to low salaries, and a further one-quarter take up only part of the benefits. In 58 percent of families, the father exceeds the tax threshold and the mother has unused tax benefits left over.

- The prices of goods and services consumed by young families have not increased more than those consumed by other families in the past decade.

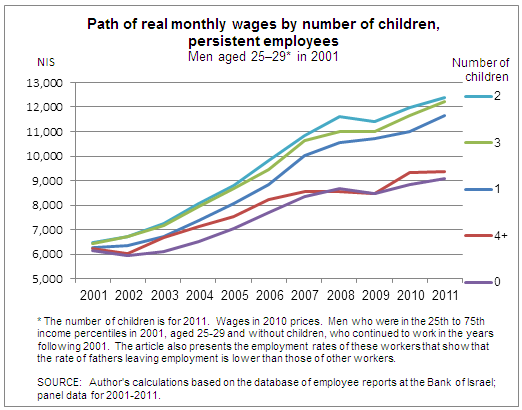

- Young working families in Israel maintain full-time or close to full-time employment for both parents, even during the initial parenting years, which is reflected in a steady increase in the parents’ wages.

- During years in which the household contains young children, the parents’ wages are lower than in later life, and their expenses are higher. The additional expenses in respect of the children are particularly high for children up to age 3 and between the ages of 15 and 17.

- The liquidity constraints of young families are reflected in the housing market. During periods of home price increases, the rate of young families renting a home increases significantly, while there is no similar phenomenon observed among other families.

The incomes of young working families with children are lower than their average incomes during their lives, and their expense levels are higher. For this reason, it is common practice in most advanced economies to assist such families by way of tax benefits, child allowance grants, subsidized services, and other benefits. In Israel, the assistance to young working families is significantly lower than in other advanced economies, according to a study by Dr. Adi Brender of the Bank of Israel Research Department and Prof. Michel Strawczynski of the Hebrew University. The study found that the cash benefits provided in Israel, for instance in the form of tax credits or child allowance payments, are markedly lower than their level in almost all other OECD countries, particularly for working families in the lower part of the income distribution. In parallel, the services to families with children, and other benefits such as tax deductions in respect of child expenses, are also no higher in Israel than in the other countries. The three main characteristics of the tax and grants system in Israel that lead to the low level of assistance are the focusing of tax credits in respect of children on mothers (Table 1), the limited scope of the Earned Income Tax Credit program, and the relatively low level of child allowances.

An assessment of the size and composition of the expenses of young working families (couples married up to 10 years with children up to age 9, where at least one of the parents works a significant part of the time) showed, as expected, that these families have higher expenses than other families, particularly for education and housing. An assessment of all families found that the additional expenses are particularly high in respect of children aged 0–3 and 15–17. It was also found that the prices of the goods and services consumed by the young families did not increase more than the prices of the products and services consumed by the rest of the public in the past two decades.

Young fathers have a high level of commitment to the labor market, which is reflected in high rates of employment, a high and rising wage path (Figure 1), and few interruptions of employment. Most of the young fathers are at wage levels where they pay income tax at significant amounts. While the progress of young working mothers up the wage scale is slightly slower than that of other women, over the years of their work, the young mothers close the gap, and in the 40–55 age range, their wages exceed those of women who have not become mothers. These findings show that young parents are a population group with a steady presence in the labor market, and therefore, if policy makers so choose, the benefits given to this group during the period in which there are children in the household can be based on tax revenues from this population group when the children grow older. As stated, this is similar to the common practice in other advanced economies, and is in order to ease the liquidity difficulties of these families during the period in which the children are in the household. The study indicates that in order to implement such a policy while maintaining a budget balance, it will be necessary in the initial stage to also raise taxes on the older population that will not enjoy these benefits (but that did to a large extent enjoy similar benefits in the not-too-distant past).

One of the indicators of the liquidity constraint that affects young families is their position in the housing market during periods of price increases. During such periods, the rate of young families living in rented accommodations instead of purchasing a home increases markedly, while among other families, this phenomenon is almost completely absent. This happened, for instance, in the 1990s against the background of the wave of immigration from the former Soviet Union. In the last decade, this was reflected in an increase of 15 percentage points in the rate of young families renting homes (about 20 percentage points among the non-ultra-Orthodox Jewish population), while the rate of those renting homes among the other families remained almost unchanged. This phenomenon took place in most regions of the country, and in all socioeconomic clusters of municipalities.