This document presents the forecast of macroeconomic developments compiled by the Bank of Israel Research Department in October 2018[1] regarding the main macroeconomic variables—GDP, inflation and the interest rate. According to the staff forecast, gross domestic product (GDP) is projected to increase by 3.7 percent in 2018, similar to the previous forecast, and by 3.6 percent in 2019, slightly higher than the previous forecast. The inflation rate over the next year is expected to be 1.4 percent, similar to the previous forecast. The Bank of Israel interest rate is expected to increase to 0.25 percent in the first quarter of 2019, and to increase again, to 0.5 percent, in the third quarter of 2019.

Forecast

The Bank of Israel Research Department compiles a staff forecast of macroeconomic developments on a quarterly basis. The staff forecast is based on several models, various data sources, and assessments based on economists’ judgment.[2] The Bank’s DSGE (Dynamic Stochastic General Equilibrium) model developed in the Research Department—a structural model based on microeconomic foundations—plays a primary role in formulating the macroeconomic forecast.[3] The model provides a framework for analyzing the forces that have an effect on the economy, and allows information from various sources to be combined into a macroeconomic forecast of real and nominal variables, with an internally consistent “economic story”.

a. The global environment

Our assessments of expected developments in the global economy are based mainly on projections by international institutions (the International Monetary Fund and the OECD) and by foreign investment houses. These institutions’ forecasts for growth and inflation in advanced economies were revised only slightly since the previous forecast, but their projections for world trade declined markedly. We assume that growth in advanced economies will be about 2.4 percent in 2018 and 2.0 percent in 2019, and that the advanced economies’ imports will increase by 4.3 percent in 2018 and by 4.0 percent in 2019, compared with the previous forecast of 5.0 percent in 2018 and 4.7 percent in 2019. According to the assessments of investment houses, the US federal funds rate is expected to be 2.5 percent at the end of 2018 and 3.1 percent at the end of 2019. The declared interest rate in the eurozone is expected to be 0.0 percent at the end of 2018, and 0.2 percent at the end of 2019. Additionally, our assumption is that inflation in the advanced economies will be 2.1 percent in 2018 and 2.0 percent in 2019. The average price of Brent crude oil was about $76 per barrel in the third quarter of 2018, essentially unchanged from its second quarter average, though there was an upward trend toward the end of the quarter.

b. Real activity in Israel

GDP is expected to grow by 3.7 percent in 2018 and by 3.6 percent in 2019 (Table 1). The expected growth rate for 2018 is similar to the previous forecast, while the expected growth rate for 2019 is 0.1 percentage points higher. Although National Accounts data that became available since the publication of the previous forecast (in July) indicated notable moderation in the second quarter growth rate, our assessment regarding the full-year growth rate did not change, due to two reasons. First, the moderation was already reflected in the previous forecast, as we had mostly expected it. Second, current indicators strengthen our assessment that this moderation reflects volatility of the quarterly data and that in the third quarter the growth rate is expected to return to higher levels. The forecast for 2019 was revised slightly upward, due to an upward revision in the expected growth rates of public consumption and of exports.

Regarding the uses, in 2018 exports are expected to grow at a slightly slower pace than assessed in the previous forecast, due to the downward revision in the world trade forecast, while in 2019 they are expected to grow at a slightly faster pace, with the culmination of several investments in various industries. The growth rate of public consumption was revised slightly upward, among other things due to the development of actual public consumption to date, which was higher than our previous assessment. The forecast for private consumption and for investments remained unchanged.

Table 1 Economic Indicators Research Department Staff Forecast for 2018–2019 (rates of change, percent, unless stated otherwise) |

|||||

|

2017 |

Bank of Israel forecast for 2018 |

Change from the previous forecast |

Bank of Israel forecast for 2019 |

Change from the previous forecast |

GDP |

3.5 |

3.7 |

- |

3.6 |

0.1 |

Private consumption |

3.4 |

4.0 |

- |

3.5 |

- |

Fixed capital formation (excluding ships and aircraft) |

3.2 |

3.0 |

- |

3.5 |

- |

Public sector consumption (excluding defense imports) |

4.4 |

3.0 |

0.5 |

3.0 |

1.0 |

Exports (excluding diamonds and start-ups) |

7.3 |

5.0 |

-0.5 |

5.5 |

0.5 |

Civilian imports (excluding diamonds, ships, and aircraft) |

6.4 |

6.0 |

- |

4.5 |

- |

Unemployment ratea |

3.7 |

3.4 |

0.1 |

3.4 |

- |

Inflation rateb |

0.3 |

0.8 |

-0.4 |

1.5 |

- |

Bank of Israel interest ratec |

0.1 |

0.1 |

-0.15 |

0.5 |

- |

a) Annual average of unemployment in the primary working ages (25–64). b) Average CPI reading in the final quarter of the year compared with the final-quarter average in the previous year. c) End of the year. |

|||||

c. Inflation and interest rate estimates

According to the staff forecast, the inflation rate in the four quarters ending in the third quarter of 2019 will be 1.4 percent. Inflation at the end of 2018 will be 0.8 percent, and at the end of 2019 it will be 1.5 percent. The Consumer Price Index readings published since the publication of the previous forecast indicated a lower inflation rate than we had assessed, and the inflation rate in the third quarter is expected to be lower than preceding quarters. This development, as well as the appreciated level of the effective exchange rate relative to our assessment in the previous forecast, led to a downward revision in the forecast for annual inflation (previous four quarters) for the coming quarters. In contrast, the increase in oil prices from the middle of August is expected to make a positive contribution to inflation. Overall, we assess that the moderate inflation in recent months is a transitory phenomenon, and our baseline assessment remains in place—inflation is expected to continue rising gradually toward the midpoint of the target range, and the inflation rate over the coming four quarters will be 1.4 percent, similar to our assessment in the forecast published in July. The main contribution to this process is expected to derive from the tight labor market, which in our assessment will support a continued increase in wages, and as a result in an increase in manufacturing costs. The inflation in prices of imported goods is expected to rise gradually, after being low in recent years due to the appreciation of the shekel and the moderate inflation worldwide. This is in light of the rise in inflation worldwide, and assuming relative stability in the representative exchange rate.

The rise in inflation is expected to be gradual, as various factors are expected to moderate the process—continued growth in competition in the economy, steps that the government is taking to reduce the cost of living, and the development of e-commerce.

According to the Research Department’s assessment, the Bank of Israel interest rate will begin rising in the first quarter of 2019, to a level of 0.25 percent. As inflation was more moderate than we assessed in July, we slightly deferred the timing of the expected interest rate increase. The deferral is slight because we assess that the moderate inflation of recent months is only transitory, and that the inflation rate will continue to increase at a pace similar to our assessment in July. In accordance with our assessment of the continued increase in inflation, the interest rate is expected to be raised another time, to 0.5 percent, in the third quarter of 2019.

Table 2 |

|||

|

Inflation and interest rate forecasts for the coming year |

|||

|

(percent) |

|||

|

|

Bank of Israel Research Department |

Capital marketsa |

Private forecastersb |

|

Inflation ratec |

1.4 |

1.3 |

1.1 |

|

(range of forecasts) |

|

|

(0.6–2.2) |

|

Interest rated |

0.5 |

0.5 |

0.35 |

|

(range of forecasts) |

|

|

(0.10–0.75) |

|

a) Average following publication of the Consumer Price Index for August. Inflation expectations are seasonally adjusted. b) The forecasts published following the publication of the Consumer Price Index for August. c) Inflation rate in the coming year. Research Department: average CPI reading in the third quarter of 2019 compared with the average in the third quarter of 2018. |

|||

|

d) The interest rate one year from now. (Research Department: in the third quarter of 2019.) Expectations from the capital market are based on the Telbor market. SOURCE: Bank of Israel. |

|||

Table 2 indicates that the forecast compiled by the Research Department regarding inflation is slightly higher than the average of private forecasters’ projections, and close to expectations derived from the capital market. The Research Department’s forecast regarding the interest rate in one year is similar to the projections derived from the capital market and slightly higher than the average of the private forecasters.

d. Main risks to the forecast

Several factors may lead to economic developments that differ from those in the forecast. These include uncertainty concerning the future development of the shekel exchange rate; uncertainty concerning the extent to which government measures to reduce the cost of living will roll over to prices and regarding the strength of further measures of this kind that the government may take in the future; uncertainty regarding the magnitude of the impact of the increase in competition in the economy; and uncertainty regarding the future development of the housing market.

Regarding the global environment, the recent developments in the world trade environment are liable to worsen to the point of a broad trade war, which could impact on the Israeli economy, though there is also uncertainty regarding the extent of such impact. There is also marked uncertainty regarding the future development of oil prices.

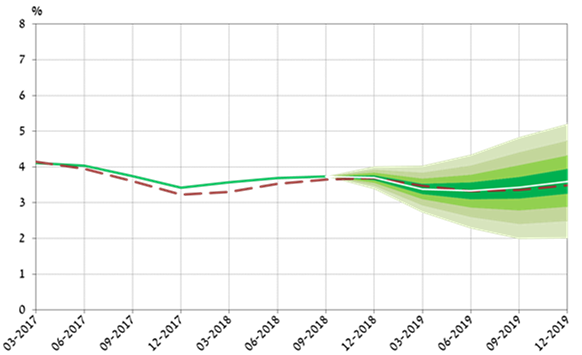

Figures 1 to 3 present fan charts around the inflation rate, interest rate and GDP growth forecasts. The center of the fan (the white line) reflects the Research Department’s staff forecast. The broken line represents the baseline forecast from the previous quarter. The width of the fan does not reflect a judgmental assessment of the risks to the forecast or their distribution, but is derived from the estimated distribution of the shocks in the Research Department's DSGE model. The fan encompasses 66 percent of the expected distribution.

Figure 1

Actual Inflation and Fan Chart of Expected Inflation

(Cumulative increase in prices in the previous four quarters)

Figure 2

Actual Bank of Israel Interest Rate and Fan Chart of Expected Interest Rate

Figure 3

Actual GDP Growth Rate in the Past Four Quarters and Fan Chart of Expected Growth Rate

(Total GDP over the past four quarters relative to GDP in the preceding four quarters)

Regarding GDP growth (Figure 3), until June 2018, the broken line reflects the data and estimates that were known at the time when the previous forecast was formulated, while the solid line reflects the updated data and estimates (the difference between them derives from new data and revisions to the data by the Central Bureau of Statistics).

[1] The forecast was presented to the Monetary Committee on October 7, 2018 during its meeting prior to the decision on the Bank of Israel interest rate reached on October 8, 2018.

[2] An explanation of the macroeconomic staff forecasts compiled by the Research Department, as well as a review of the models on which they are based, appear in Inflation Report number 31 (for the second quarter of 2010), Section 3c.

[3] A Discussion Paper on the DSGE model is available on the Bank of Israel website, under the title: “MOISE: A DSGE Model for the Israeli Economy,” Discussion Paper No. 2012.06.