![]() To view this press release as a Word document

To view this press release as a Word document

Abstract

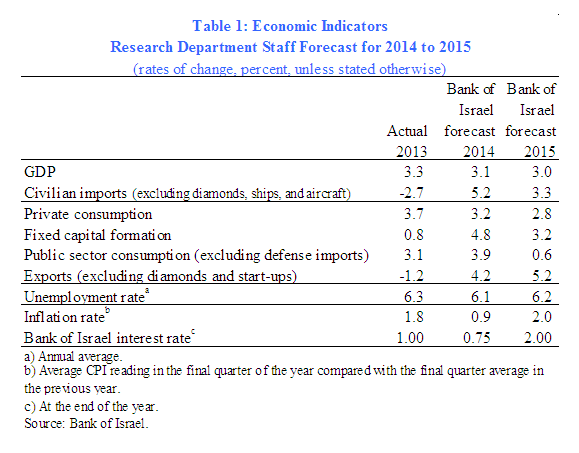

This document presents the forecast of macroeconomic developments compiled by the Bank of Israel Research Department in March 2014. The forecast was presented to the Monetary Committee on March 23, 2014 during its meeting prior to the decision on the Bank of Israel interest rate for April 2014. According to the staff forecast, gross domestic product (GDP) is projected to increase by 3.1 percent in 2014, and by 3.0 percent in 2015. Excluding the estimated effect of natural gas production from the "Tamar" site, the GDP growth rate is expected to improve from 2.5 percent in 2013 to 2.8 percent in 2014 and to 3.0 percent in 2015, in view of an improvement in the global environment and forecasts of a continued trend of improvement in 2014 and 2015. The rate of inflation over the next year (ending in the first quarter of 2015) is expected to be 1.6 percent. The Bank of Israel is expected to leave the monetary interest rate at 0.75 percent—its level when the forecast was compiled—until the end of 2014, and to start raising it at the beginning of 2015, such that the interest rate is expected to reach 1 percent in the first quarter of 2015.

Forecast

The Bank of Israel Research Department compiles a staff forecast of macroeconomic developments on a quarterly basis. The staff forecast is based on several models, various data sources, and assessments based on economists' judgment.[1] The Bank's medium scale Dynamic Stochastic General Equilibrium (DSGE) model developed in the Research Department—a structural model based on microeconomic foundations—plays a primary role in formulating the macroeconomic forecast.[2] The model provides a framework for analyzing the forces which have an effect on the economy, and allows the integrating of information from various sources into a macroeconomic forecast for real and nominal variables, with an internally consistent "economic story". In addition to formulating the base forecast, the DSGE model is also used to assess the effects on the economy of changes in the interest rate, to assess alternative scenarios and to evaluate risks.

A. The global environment

The assumptions about the global economy are primarily based on forecasts by international financial institutions (such as the IMF and OECD) and foreign investment houses. This quarter as well, the forecasts reflect the assessment that in 2014 and 2015, the global economy will continue its gradual recovery from the economic crisis. The current assessments of economic growth and trade in the advanced economies in 2014 have increased slightly compared with our assessments when compiling the previous forecast (in December), while assessments concerning 2015 have declined slightly—a result of budgetary changes in the US that are expected to be reflected in more accommodative fiscal policy in 2014 and more restrictive fiscal policy in 2015.[3] On March 19, the Federal Open Market Committee (FOMC) announced that, in view of the improvement (albeit moderate) in the American economy, and particularly in the labor market, it would continue reducing the pace of asset purchases made by the Federal Reserve as part of its quantitative easing program.[4] Together with the announcement of tapering in the quantitative easing program, the Federal Reserve noted that it estimates that even after the complete end of the asset purchase program, the short-term interest rate will remain at its low level for an extended period of time, and that the timing and pace of increasing it will be determined in accordance with the pace of the economic recovery (as will be reflected in various economic indicators, including indicators from the labor market, the financial markets, and inflation data). Most members of the FOMC believe that the short-term interest rate will begin rising in 2015.

Estimates of inflation rates expected in the next year in advanced economies declined slightly compared to those that were in place when the last forecast was prepared in December, following lower-than-expected inflation (mainly in the eurozone and the UK) in the last quarter of 2013. Inflation expectations in the advanced economies are near 1.7 percent, on average.

The price of oil (Brent crude) was about $108 per barrel in the first quarter of 2014, close to its level when the previous forecast was prepared. The global food index increased sharply in January–March, following a trend of decline in the past year. This increase comes in view of harsh weather conditions in Europe and the US, and it may be partially connected with the crisis in Ukraine.

Alongside the general assessment of continued improvement in the global economy, there are many risks, the realization of which may negatively impact global growth. One main concern is in relation to the growth rates of emerging markets, both in view of various domestic factors and in view of the outflow of capital from these markets with the increase of yields in the US that began with the expectation of tapering in quantitative easing. Risks to growth exist in the advanced economies as well. In its recent review in January, the IMF noted the low inflation rate as a risk factor to the European economy, since low inflation expectations act to increase expected real interest rates, which may lead to moderation of economic activity.

B. Real activity in Israel

GDP growth is expected to be 3.1 percent in 2014. Excluding the effect of natural gas production from the "Tamar" site, GDP in 2014 is projected to increase by 2.8 percent.

The GDP growth forecast for 2014 is slightly lower than the estimate in the previous forecast (at the end of December), when it was 3.3 percent. This follows the publication of National Accounts data for 2013, which indicate lower growth in the second half of 2013 than our previous estimate. These data have a negative base effect on expected growth rates in 2014. In contrast, growth rates of exports and of private consumption in the second half of 2013 were higher than our previous estimate. As a result of this positive base effect, and following the slightly more rapid growth projected globally, the expected growth rate of these components was revised upward for 2014. The GDP growth rate excluding the effect of natural gas production is expected to increase in 2014 compared to 2013, led by an increase in the growth rates of exports and of investments, with the expected improvement in the global economy.

GDP in 2015 is expected to grow by 3.0 percent. The improvement in growth in 2015 compared to 2014 (excluding the effect of natural gas production) is led by exports, which are expected to grow with the improvement in the growth rate of global trade. With that, an increase in the global interest rate environment (and consequently in the domestic economy as well) is expected to have a moderating impact on growth rates of private consumption and investments.

C. Inflation and interest rate estimates

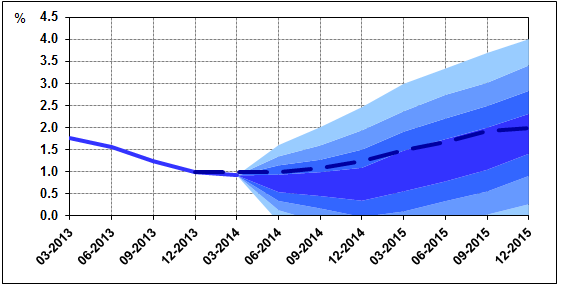

In our assessment, the rate of inflation during the four quarters ending in the first quarter of 2015 will be 1.6 percent, slightly below the midpoint of the inflation target range of 1–3 percent. Inflation as measured over the previous four quarters is expected to be slightly below the lower bound of the target range in the second half of 2014 (Figure 1).

Most of the relevant factors are expected to be moderating or neutral in relation to inflation. First, there are no signs of inflationary pressure from domestic demand (through the cost of the factors of production), and in view of the moderate growth, it seems that this situation will remain in place in the coming year. Second, further to the trend that has become apparent this year, the housing component of the Consumer Price Index (based on rents) which, in recent years has been a contributing factor to inflation, is expected to be neutral from the standpoint of its effect on inflation in the coming year, due to the consistency in the high level of building starts and the high level of building completions that continue to increase the supply of homes. Third, the shekel appreciated markedly in 2013, and some part of its effect may not yet have been fully realized.[5] Fourth, the absence of inflationary pressure globally against the background of surplus manufacturing capacity is also contributing to restraining inflation.

In contrast with these moderating factors, the sharp increase in food prices globally that has taken place in January–March may be a contributing factor to inflation. On the assumption that the increase in food prices is just temporary, it should not have a major impact. However, if food prices remain at their current level, it may have an inflationary effect later in the year.

The Bank of Israel interest rate, is expected to remain at its current level of 0.75 percent during 2014, and then to begin increasing in the first quarter of 2015, and to reach 2 percent at the end of 2015. This increase is expected against the background of the improvement in global economic conditions that will be accompanied by an increase in the global interest rate environment. While long-term interest rates are expected to increase during 2014, supported by the tapering of quantitative easing in the US, our assessment is that, in view of the fragility of the global economic recovery, the Bank of Israel interest rate will only start increasing again in 2015 with the expected entrenchment of the global recovery and supported by interest rate increases at major central banks worldwide.

Table 2 indicates that, with regard to the coming year, the Research Department's forecast of the inflation rate is similar to that of private forecasters and expectations derived from capital markets. Regarding the interest rate forecast for one year from now, expectations derived from capital markets are lower than the Research Department’s forecast and the average of the private forecasters' forecasts.

Table 2 | |||

Forecasts for inflation rate and interest rate for the coming year | |||

(percent) | |||

Bank of Israel Research Department |

Capital marketsa |

Private forecastersb | |

Inflation ratec |

1.6 |

1.6 |

1.6 |

(range of forecasts) |

(1.4-1.9) | ||

Interest rated |

1.00 |

0.6 |

0.9 |

(range of forecasts) |

(0.5-1.25) | ||

a) Average for the month of March (through March 19). Seasonally adjusted inflation expectations. | |||

b) Inflation and interest rate forecasts are after the publication of the CPI reading for February. | |||

c) Inflation rate over the next 12 months (Research Department: in the next four quarters). | |||

d) Capital markets forecast derived from Telbor rates. Forecasters and market: the interest rate one year from now. Research Department: Interest rate in the first quarter of 2015. | |||

Source: Bank of Israel. | |||

D. Balance of risks in the forecast

There are many factors, domestic and global, which can lead to developments that are different than those in the baseline forecast. Globally, the estimates of major international institutions are that the risks to growth forecasts still tend to the downside. A major risk is disappointing developments in real activity in various countries worldwide, such that the improvement may be slower than expected in the baseline forecast. In particular, there is concern regarding the recovery in major emerging markets and in Europe. On the domestic level, we note the uncertainty regarding the effect of the planned tapering of quantitative easing in the US, particularly on capital flows and, through them, on the exchange rate of the shekel, as well as the geopolitical uncertainty in our region.

The center of the fan chart is based on the Bank of Israel Research Department assessment. The width of the fan is based on the Department’s medium-scale DSGE (dynamic stochastic general equilibrium) model. The full fan covers 66 percent of the distribution of expected inflation.

The dotted line corresponds to the previous staff forecast (published in December 2013).

Source: Bank of Israel.

The center of the fan chart is based on the Bank of Israel Research Department assessment. The width of the fan is based on the Department’s medium-scale DSGE (dynamic stochastic general equilibrium) model. The full fan covers 66 percent of the distribution of expected interest rate.

The dotted line corresponds to the previous staff forecast (published in December 2013).

Source: Bank of Israel.

[1] An explanation of the staff macroeconomic forecast, and an overview of the models on which it is based, can be found in Inflation Report 31 for the second quarter of 2010, section 3-C.

[2] A Discussion Paper on the model is available on the Bank of Israel website, under the title: “MOISE: A DSGE Model for the Israeli Economy,” Discussion Paper No. 2012.06.

[3] According to the IMF’s most recent forecast, from January 2014, global trade is expected to grow by 4.5 percent in 2014, and by 5.2 percent in 2015. GDP in the advanced economies is expected to grow by 2.2 percent in2 014 and by 2.3 percent in 2015.

[4] A reduction of the pace of asset purchases to the equivalent of $55 billion per month instead of $65 billion per month.

[5] The shekel appreciated during the first half of 2013, and was relatively stable during the second half of the year. Over the entire year (quarter over quarter), the effective exchange rate appreciated by about 8 percent.