Abstract

This document presents the forecast of macroeconomic developments compiled by the Bank of Israel Research Department in April 2018.[1] In terms of the main macroeconomic variables—GDP, inflation and the interest rate—the forecast remains unchanged relative to the forecast published in January. According to the staff forecast, gross domestic product (GDP) is projected to increase by 3.4 percent in 2018 and by 3.5 percent in 2019. The rate of inflation over the next year[2] is expected to be 1.1 percent. The Bank of Israel interest rate is expected to remain at its current level of 0.1 percent over the first three quarters of the year, and to increase to 0.25 percent in the fourth quarter of the year.

Forecast

The Bank of Israel Research Department compiles a staff forecast of macroeconomic developments on a quarterly basis. The staff forecast is based on several models, various data sources, and assessments based on economists’ judgment.[3] The Bank’s DSGE (Dynamic Stochastic General Equilibrium) model developed in the Research Department—a structural model based on microeconomic foundations—plays a primary role in formulating the macroeconomic forecast.[4] The model provides a framework for analyzing the forces that have an effect on the economy, and allows information from various sources to be combined into a macroeconomic forecast of real and nominal variables, with an internally consistent “economic story”.

a. The global environment

Our assessments of expected developments in the global economy are based mainly on projections by international institutions (the International Monetary Fund and the OECD) and by foreign investment houses. These institutions revised their forecasts for growth and inflation in advanced economies and for world trade upward compared to their previous forecasts. Accordingly, our assessments are that growth in the advanced economies will be about 2.5 percent in 2018 and 2.2 percent 2019, and that imports to the advanced economies will increase by 5.0 percent in 2018 and by 4.9 percent in 2019. According to the assessments of investment houses, the US federal funds rate is expected to increase to 2.4 percent at the end of 2018 and 3.0 percent at the end of 2019. The declared interest rate in the eurozone is expected to be 0.0 percent at the end of 2018, and 0.3 percent at the end of 2019. Additionally, our assessment is that inflation in the advanced economies will reach about 1.9 percent in 2018 and in 2019. Oil prices continued to increase in recent months, with the average price of Brent crude oil reaching about $67 per barrel in the first quarter, compared with an average of $61 in the fourth quarter of 2017.

b. Real activity in Israel

GDP is expected to grow by 3.4 percent in 2018 and by 3.5 percent in 2019 (Table 1). Our assessments of forecast real developments in 2018 and 2019 are essentially unchanged from the previous forecast. Fixed capital formation is expected to increase by 3.0 percent in 2018, in view of the slowdown in investment in residential construction, as can be derived from the relatively low level of building starts in 2017. Investments are expected to increase in 2019 due to a number of large investments (import-oriented) in various industries. Exports are expected to continue increasing, inter alia because world trade is expected to continue its recovery, and in view of the maturation of a number of investments in various industries. Changes in vehicle taxation are expected in January 2019[5], and our assessment is that they will lead to vehicle purchases being brought forward, which will be reflected in growth figures for 2018 (similar to the development that was observed in previous years).

c. Inflation and interest rate estimates

According to the staff forecast, the inflation rate[6] in 2018 will be 1.1 percent and at the end of 2019 it will be 1.4 percent. This forecast reflects the assessment that inflation will increase moderately toward the center of the target range. The main contribution to inflation is expected to be from the tight labor market, which will be reflected in wage increases. In contrast, the continued increase in competition and measures taken by the government to lower the cost of living are expected to continue to moderate inflation. In our assessment, the prices of nontradable goods and services are expected to continue making a positive contribution to inflation, and in particular we expect that the rents item will be prominent despite moderation in its rate of increase in recent months. The pace of increase in the prices of tradable goods is expected to rise due to the increase in inflation globally, particularly the increase in energy prices, assuming that the shekel’s exchange rate remains relatively stable. However, long-term price trends of tradable goods and structural processes (such as the development of Internet commerce), as well as expected additional government measures will moderate the increase.

According to the Research Department’s assessment, the Bank of Israel interest rate is expected to start increasing in the fourth quarter of 2018, following the increase of the annual inflation rate to within the target range, and as the inflation expectations at that time will also be within the inflation range.

|

Table 1 Economic Indicators Research Department Staff Forecast for 2018 to 2019 (rates of change, percent, unless stated otherwise) |

|||||

|

|

2017 |

Bank of Israel forecast for 2018 |

Change from the previous forecast |

Bank of Israel forecast for 2019 |

Change from the previous forecast |

|

GDP |

3.3 |

3.4 |

- |

3.5 |

- |

|

Private consumption |

3.3 |

4.0 |

- |

3.0 |

- |

|

Fixed capital formation (excluding ships and aircraft) |

3.1 |

3.0 |

- |

4.5 |

-2.5 |

|

Public sector consumption (excluding defense imports) |

4.3 |

1.5 |

-0.5 |

2.0 |

-1.0 |

|

Exports (excluding diamonds and start-ups) |

5.7 |

4.0 |

0.5 |

6.0 |

- |

|

Civilian imports (excluding diamonds, ships, and aircraft) |

6.9 |

5.5 |

1.5 |

5.5 |

-2.0 |

|

Unemployment ratea |

3.7 |

3.1 |

-0.5 |

3.1 |

-0.5 |

|

Inflation rateb |

0.3 |

1.1 |

- |

1.4 |

- |

|

Bank of Israel interest ratec |

0.10 |

0.25 |

- |

0.50 |

- |

|

b) Annual average of unemployment in the primary working ages (25–64). c) Average CPI reading in the final quarter of the year compared with the final-quarter average in the previous year. d) End of the year. |

|||||

Table 2 indicates that the forecasts compiled by the Research Department regarding inflation and the interest rate in the coming year are higher than the projections of private forecasters and expectations derived from the capital markets. However, according to the forecasters and market expectations, there is some likelihood of an increase in the interest rate during the coming year.

Table 2 |

|||

|

Inflation and interest rate forecasts for the coming year |

|||

|

(percent) |

|||

|

|

Bank of Israel Research Department |

Capital markets |

Private forecasters |

|

Inflation ratea |

1.1 |

0.6 |

0.7 |

|

(range of forecasts) |

|

|

(0.3–1.8) |

|

Interest rateb |

0.25 |

0.16 |

0.13 |

|

(range of forecasts) |

|

|

(-0.10–0.25) |

|

a) Research Department: average CPI reading in the first quarter of 2019 compared with the average in the first quarter of 2018. Forecasters: Average forecast of inflation in 2018 published following the publication of the CPI for February 2018. |

|||

|

b) Research Department: in the first quarter of 2019. Expectations from the capital market are based on the monthly average forward Telbor rates for 9–12 months. Forecasters: As published following the publication of the CPI for February 2018. |

|||

d. Risks in the forecast

Several factors may lead to the domestic economy developing differently than in the baseline forecast. These include uncertainty concerning the future development of the exchange rate, as well as uncertainty concerning the extent to which government measures to reduce the cost of living will roll over to prices and regarding the strength of further measures of this kind that the government may take. In addition, even though the forecast takes into account the continued increase in competition in the economy, there is uncertainty from a quantitative standpoint regarding the strength of the increase and its continued effect. Regarding the global environment, while the growth forecast and world trade forecast have been revised upward, recent developments in world trade may worsen to the point of a trade war that may have a significant impact on the Israeli economy, which is small and open.

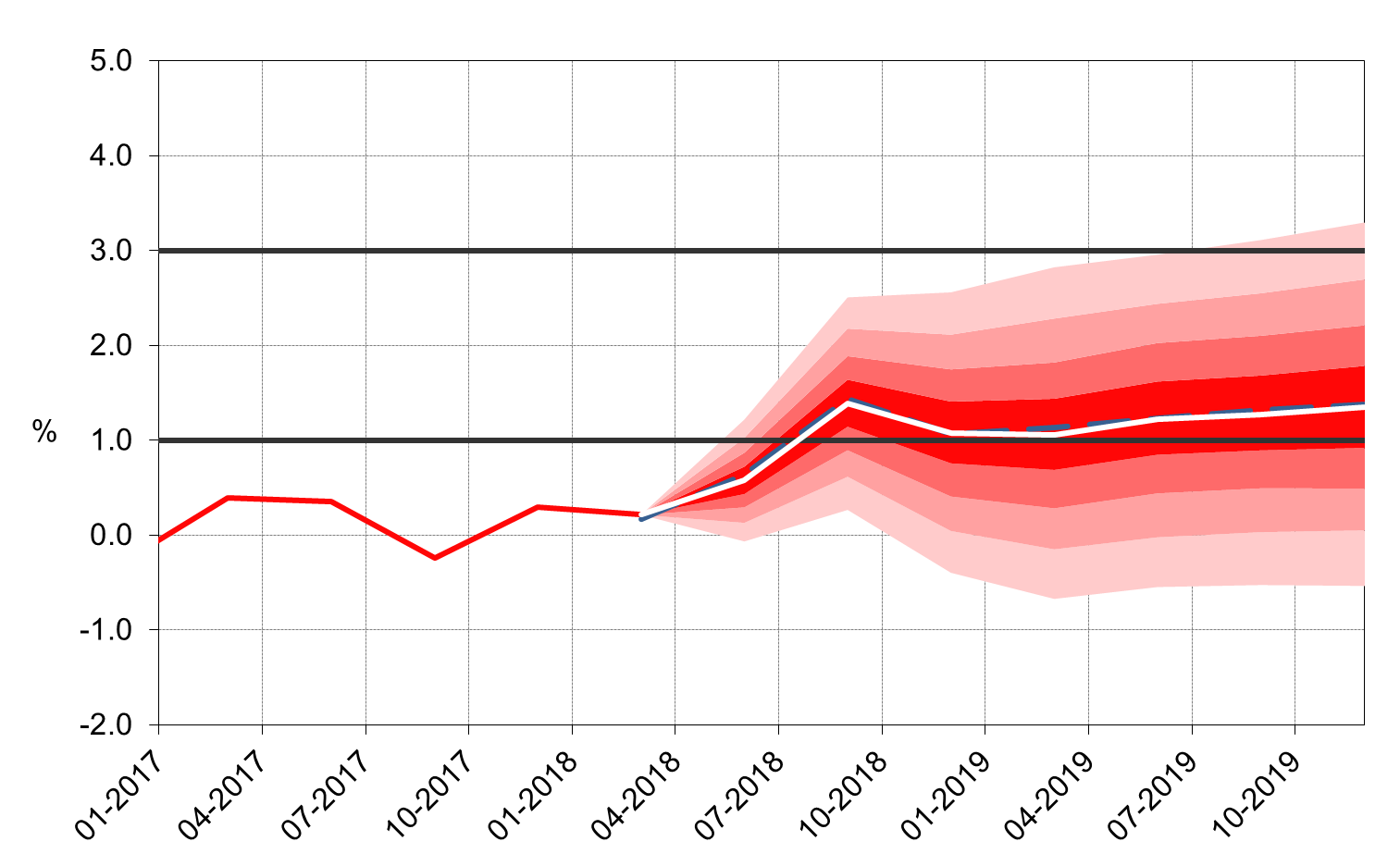

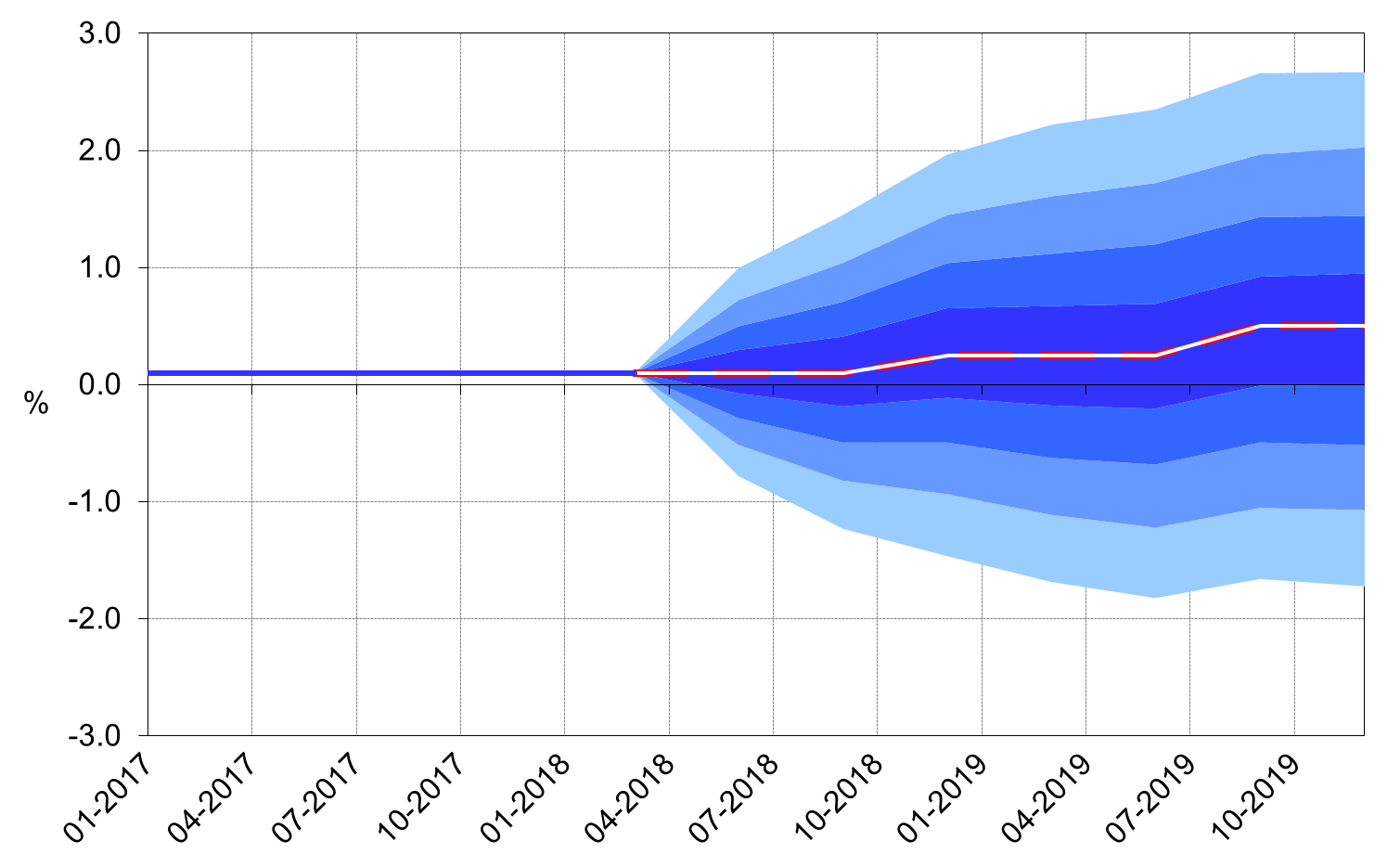

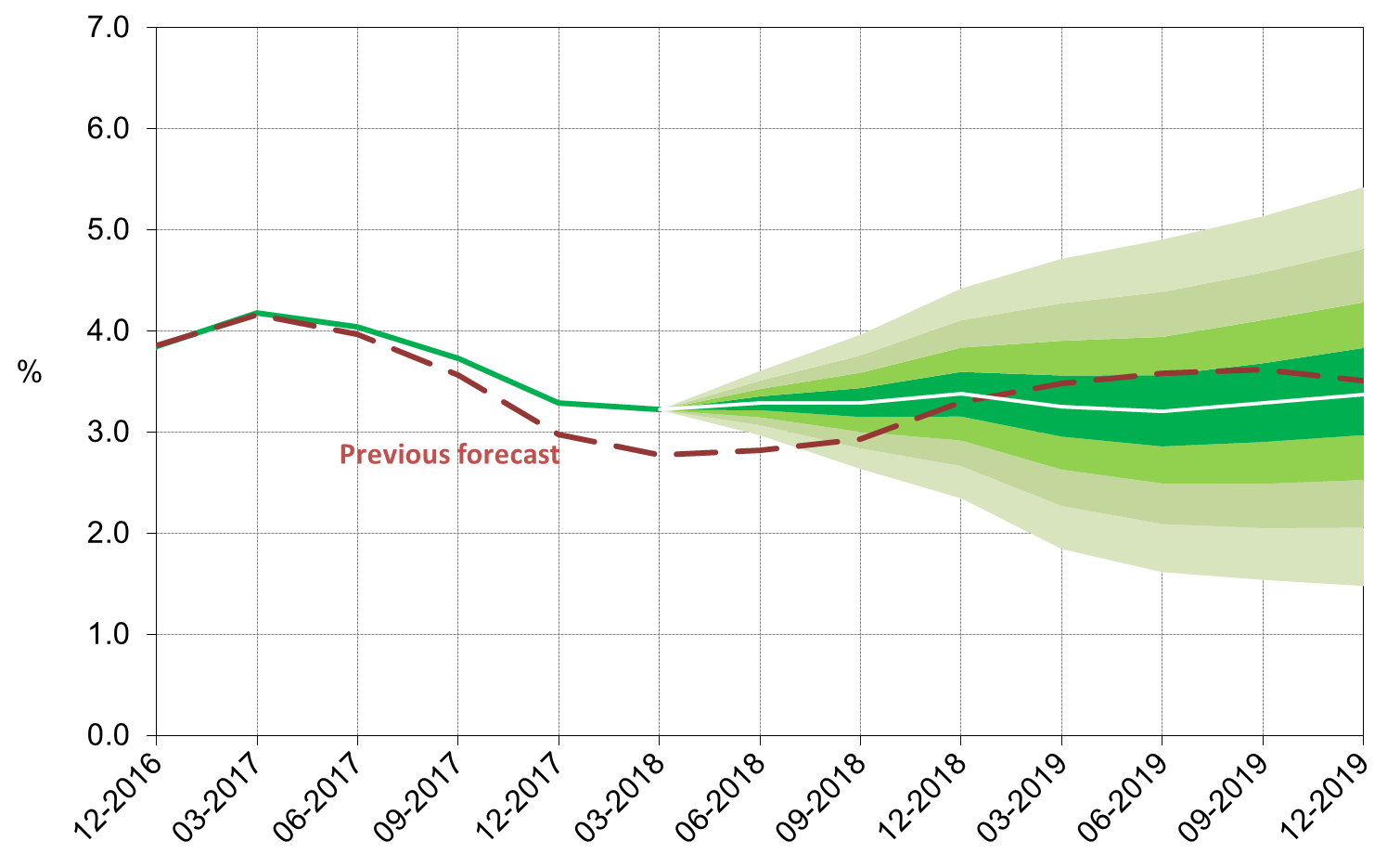

Figures 1 to 3 present fan charts around the inflation rate, interest rate and GDP growth forecasts. The center of the fan (the white line) reflects the Research Department’s staff forecast. The broken line represents the baseline forecast from the previous quarter. The width of the fan is derived from the estimated distribution of the shocks in the Research Department's DSGE model, and the fan encompasses 66 percent of the expected distribution.

Figure 1

Actual Inflation and Fan Chart of Expected Inflation

(Cumulative increase in prices in the previous four quarters)

Figure 2

Actual Bank of Israel Interest Rate and Fan Chart of Expected Interest Rate

Figure 3

Actual GDP Growth Rate in the Past Four Quarters and Fan Chart of Expected Growth Rate

(Total GDP over the past four quarters relative to GDP in the preceding four quarters)

Regarding GDP growth (Figure 3), until December 2017, the dotted line reflects the data and estimates that were known at the time when the previous forecast was formulated, while the solid line reflects the updated data and estimates (the difference between them derives from new data and revisions to the data by the Central Bureau of Statistics).

[1] The forecast was presented to the Monetary Committee on April 15, 2018 during its meeting prior to the decision on the Bank of Israel interest rate reached on April 16, 2018. Around the time of publication of this forecast, it was announced that the Israel Tax Authority intends to delay the revision of the tax formula for vehicles to the middle of 2019. The current forecast does not take this new information into account.

[2] The average CPI in the first quarter of 2019 compared with the average in the first quarter of 2018.

[3] An explanation of the macroeconomic staff forecasts compiled by the Research Department, as well as a review of the models on which they are based, appear in Inflation Report number 31 (for the second quarter of 2010), Section 3c.

[4] A Discussion Paper on the DSGE model is available on the Bank of Israel website, under the title: “MOISE: A DSGE Model for the Israeli Economy,” Discussion Paper No. 2012.06.

[5] According to the National Accounts recording rules, taxation on imported vehicles is included in GDP. These imports also contribute to GDP through their effect on importers’ added value. Around the time of publication of this forecast, it was announced that the Israel Tax Authority intends to delay the revision of the tax formula for vehicles to the middle of 2019. The current forecast does not take this new information into account.

[6] Average CPI reading in the final quarter of the year compared with the final-quarter average in the previous year.