To the Fiscal Survey in Word Document

To the Recent Developments in Word Document

![]() To Graph as an Excel spreadsheet

To Graph as an Excel spreadsheet

v During the reviewed period (April–September 2014) the moderation in the pace of growth that began a year ago continued. Fourth quarter data show that the economy recovered from the shock caused by Operation Protective Edge, but it is not clear whether activity accelerated beyond that.

v The picture of the fiscal situation that is being published in this survey shows that following the fiscal consolidation program enacted by the government at the time the budget for 2013-14 was approved, the deficit in 2014 totaled 2.8 percent of GDP, slightly below the ceiling of 3.0 percent.

v Expenditures in 2014 were slightly lower than the original budget, despite the NIS 7 billion supplement to the defense budget due to the direct costs of Operation Protective Edge.

v Operation based on an interim budget, until the 2015 budget is approved, is expected to lower the government’s civilian expenditures as compared to the level derived from the expenditure ceiling, and make it possible to meet the ceiling while providing the NIS 4.3 billion supplement to the defense budget that was decided upon by the outgoing government.

v Due to the decline in the likelihood that the “zero VAT” program for the purchase of a new home will be implemented, and assuming that the expenditure ceiling will be adhered to, the expected deficit for 2015 is similar to the deficit ceiling set out in the law—2.5 percent of GDP. Uncertainty remains regarding the actualization of some of the outgoing government’s decisions concerning a moderation of the growth of expenditures and increased revenues.

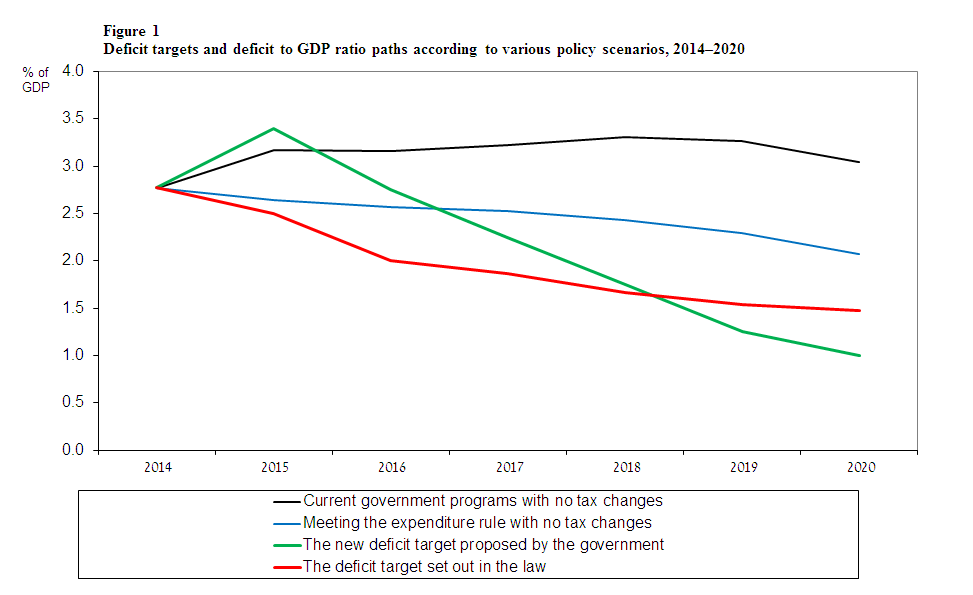

v In order to meet the lower deficit targets later in the decade, the government will need to make adjustments on the revenue side and on the expenditure side totaling about 1.5 percent of GDP. Meeting these targets will reduce the debt to GDP ratio in 2020 to 60 percent. Without making these adjustments, the deficit is expected to grow to more than 3 percent of GDP, and the debt to GDP ratio is expected to reach about 70 percent of GDP.

v It is important that the budgetary adjustments made by the government be based on measures the effect of which can be estimated at a reasonable level of precision, and on items the inclusion of which in the budget does not weaken the connection between the recorded deficit and the development of public debt and the financial state of the government.

v In addition to the review of current developments and the fiscal survey, Recent Economic Developments includes four issue analyses that were published recently.

Recent Economic Developments, April–September 2014, published today by the Bank of Israel, deals with a period in which the moderation in the growth rate that began about a year ago continued. In the second quarter of 2014, growth was 1.9 percent, and in the third quarter—as a result of Operation Protective Edge—growth was near zero (0.2 percent), and the negative output gap widened. Data for the fourth quarter of 2014 show that the economy—including the labor market—recovered from the shock caused by Operation Protective Edge, but it too early to tell whether activity accelerated beyond that. One of the main causes for the moderate growth rate has to do with the moderate growth of global demand, led by moderate growth in the eurozone—the destination of about one-third of Israeli exports. In addition to the global slowdown, other contributing factors to the moderation included Operation Protective Edge, the effect of which on GDP is estimated at about 0.3 percent, mainly as a result of a negative impact on tourism; the constrictive 2013 budget, since it also affects activity at a lag; and uncertainty regarding government measures in the area of housing.

The fiscal survey presents the situation prior to the preparation of the 2015 State budget, and the budgetary trends expected later in the decade. The fiscal adjustment made by the government at the time it approved the 2013–14 budget succeeded in halting the increase in the deficit, and even lowered it back to a level that enables the stabilization of the debt to GDP ratio. Moreover, control of government expenditures made it possible to absorb the costs of Operation Protective Edge totaling about NIS 7 billion—and its impact on the economy and on tax revenues—without exceeding the original budget or the deficit ceiling, although at the price of reducing planned civilian expenditures. These achievements contributed to a narrowing of the yield spread between Israel and other advanced economies, and since a significant portion of the measures taken were structural, they provide the next government with the ability to continue moving forward along the fiscal outline set out in the law, such that the deficit will decline to levels that enable a declining path for the debt to GDP ratio.

Alongside progress in the deficit reduction outline, the government will also need to decide whether this progress will be based on a continued decline of public expenditure as a share of GDP, the level of which is currently lower than in most of the advanced economies, or on increased revenue through an increase in tax receipts, the level of which are also lower than in most advanced economies. The determination of the future outline of the defense budget will have great importance in reaching this decision. According to current estimates, adhering to the expenditure ceiling will mean that decisions to reduce government expenditures—compared to existing programs—totaling about one percent of GDP will be necessary until the end of the decade. In other words, not only will the governments serving during that period not be able to make decisions to increase their expenditures without parallel reductions in other expenditures, they will also be required to reduce or cancel some of the increases that have already been decided upon. Reducing the defense expenditure may according to this outline make it possible to increase civilian expenditure to a certain extent, and vice versa.

Tax revenues in 2014 were slightly higher than the original projection. An analysis according to the Research Department’s tax model shows that the main factors for this were the increase in consumer goods imports (in shekel terms), and positive developments in the capital market—particularly capital gains on stocks and bonds. In contrast, nontax revenue was lower than the original projection. The debt to GDP ratio did not change in 2014, inter alia due to the financing of about NIS 9 billion of the deficit by lowering government balances at the Bank of Israel and by net repayment of credit provided to the public by the government in the past (mainly mortgages).

Since the beginning of 2015, the government has been operating based on an interim budget. Based on past experience, expenditures during such a period are somewhat lower than the overall ceiling, and it is therefore highly likely that until the budget is approved, the level of government expenditures will be lower than the seasonal path that is consistent with meeting the expenditure ceiling set out in the law, and that this gap will not be closed by the end of the year. As a result, some government services, particularly those based on new decisions made in the past year, and investments in infrastructure will also be negatively impacted. The low level of expenditures may make it possible for the government to absorb the planned supplement to the defense budget without breaching the expenditure ceiling set out in the law. Taking into account that the “Zero VAT” plan for the purchase of new homes will apparently not be approved this year, and taking into account the revised tax projection, it therefore seems that the government will be able to come close to the deficit ceiling of 2.5 percent of GDP for 2015.

The deficit path set out in the law sets out a continued reduction of the deficit from 2.5 percent of GDP in 2015 to 1.5 percent in 2019. Meeting this path is expected to reduce the public debt to GDP ratio to about 60 percent in 2020. However, an analysis of the expected deficit path later in the decade (Figure 1) shows that if the government meets the expenditure ceiling but does not make revenue-enhancing statutory changes to the tax system, the deficit will be higher than the targets set out in the existing law in all years. The additional taxes required to meet the deficit targets in such a case amount to about NIS 8 billion, mostly in 2016. A further analysis shows that if the government operates according to the individual expenditure programs it approved and does not adjust its expenditures to the expenditure ceiling, the expected deficit will be higher than 3 percent of GDP and will not decline until the end of the decade. In such a case, the debt to GDP ratio will not decline, and expected to reach about 70 percent in 2020. As a result, the annual interest payments in 2020 on this path will be about NIS 3.5 billion higher than those required if the government meets the deficit path set out in the law.

As a principle, it is important for there to be congruence between the government's approved expenditure programs and the expenditure ceiling set out by the government. It is also important that there be congruence between expenditures according to the expenditure rule and the sources available to the government. A gap created between the cost of the various programs adopted by the government and the expenditure allowed by the fiscal rule—and the desire to sometimes delay the required adjustments on the taxation side—may create pressure to include items in the budget framework that may not be able to be brought to fruition, or the inclusion of which weakens the connection between the recorded deficit and the development of public debt and the government’s financial situation. On the revenue side, items of the first type include, for instance, additional revenue as a result of “enhanced collection”, an item that it is difficult to predict if and when it will materialize. Items of the second type include, for instance, withdrawals from public sector entities and from government companies, the transfer of government activities to the business sector in return for government commitments to pay for them over time, and changes in the spread of government payments in exchange for interest payments to outside entities. In order for the budget path set out by the government to continue maintaining its reliability over time, it is important that the government continue to avoid the use of such items as much as possible.

In addition to the review of current developments and the fiscal survey, Recent Economic Developments includes four issue analyses that were published recently: 1. Development of real wages in Israel in the past two decades; 2. A discussion of the monetary tool known as forward guidance; 3. A description of the changes in purchasing patterns of first homes in the past decade; and 4. An analysis of fixed capital formation in the healthcare system. The survey also includes statistical tables.