- The Banking Supervision Department is initiating the monthly publication of main data on credit (excluding housing loans) and deposits, arranged by the banking system’s various activity segments, going back to January 2016. These data and others indicate:

- Half the portfolio of credit to the public is business credit. Forty-four percent of the business credit balance is directed to micro and small businesses, and 38 percent of it is provided to large companies.

- Part of the credit that is provided, and in particular to medium and large businesses, includes revolving credit that is paid off and reinstated several times during the course of the year.

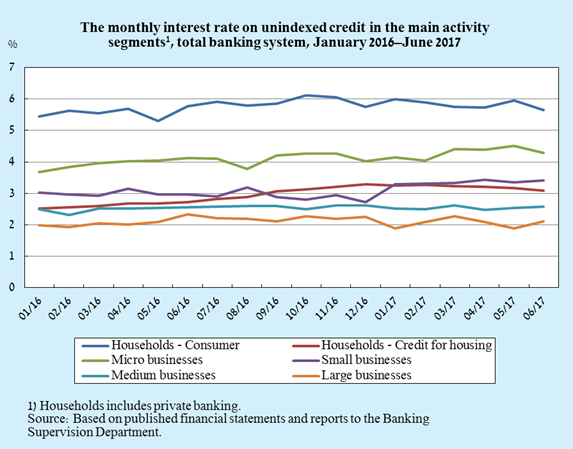

- Over the past 18 months, there weren’t any sharp changes in the interest rate on credit in the various segments, against the background of the stability in the Bank of Israel interest rate, which is one of the main parameters impacting on the interest rate. The average interest rate in the unindexed consumer (excluding housing) credit segment was 5.8 percent, and the average interest rate on business credit was 2.7 percent. There is considerable variance in the interest rate on business credit, ranging from 4.1 percent, on average, in the micro business segment to 2.1 percent, on average, in the large business segment.

- The gaps in interest rates on credit among the various segments derive from, among other things, structural differences related to operating costs and the extent of competition in each segment. Thus, for example, the operating cost of credit provision and loan management in the household segment and the micro and small business segment is markedly higher than that in the large business segment, as numerous branches and employees are needed for them. In addition, the average term to final repayment in the unindexed consumer credit segment is 4.5 years while in the medium and large business segment it is only less than half a year. The longer the term for which credit is provided, the greater risk entailed, and therefore the interest rate on it is higher. In view of these characteristics and against the background of the low monetary interest rate in the economy, banks’ profitability is lowest in the households segment.

The report to the public is attached to the press release, and will be published at a monthly frequency on the Bank of Israel website at:

http://www.boi.org.il/en/BankingSupervision/Data/Pages/Tables.aspx?ChapterId=6.

Figure 1

Micro business—a business with annual turnover of less than NIS 10 million

Small business—a business with annual turnover of equal to or greater than NIS 10 million but less than NIS 50 million

Medium business—a business with annual turnover of equal to or greater than NIS 50 million but less than NIS 250 million

Large business—a business with annual turnover of equal to or greater than NIS 250 million

Annual turnover—annual sales or revenue

To the report

To the report