· About half of the sales by the large Israeli public nonfinancial companies in recent years has been directed to foreign markets.

· The global stock index has an effect on the share prices of public companies on the Tel Aviv 100 index. The effect on the shares of a company that directs all of its sales to exports is 40 percent greater than the effect on a company that sells only to the domestic market.

· When indirect exposure is added to the direct equity exposure to abroad, it increases total equity exposure to abroad in the public’s financial asset portfolio by about 40 percent, and the exposure of the institutional investors’ portfolio by about 15 percent.

Capital market investors can gain international exposure inter alia by investing in companies with exposure to abroad that are traded on the local market. Snir Afek and Nadav Steinberg, researchers in the Bank of Israel Research Department, examined the international exposure of companies traded on the Tel Aviv Stock Exchange, and its effect on the public’s and of institutional investors’ total exposure to the global capital markets.

Finance theory holds that if the global capital markets are not totally integrated with each other, and particularly given barriers to the flow of financial investments, a firm can provide its investors with added value through international diversification. According to this concept, investment in multinational corporations serves investors as an alternative to investment in international markets—markets that are imperfect due to various limitations on investment and due to the direct and indirect costs involved in investment through them. From the standpoint of the companies that direct most of their sales to foreign countries, the fact that they choose to be traded on the local stock exchange may show that the local exchange enables them to lower the costs inherent in trading on foreign markets, and particularly to raise capital at a lower cost.

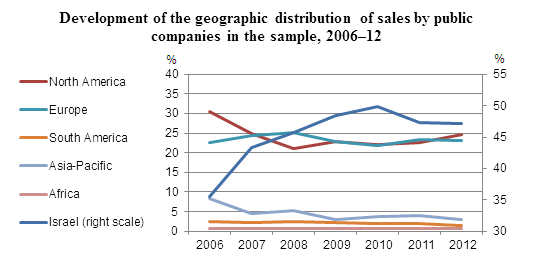

This study for the first time examines the ramifications of multinational companies’ activity on Israeli investors’ financial exposure to the world. The researchers gathered data on public nonfinancial Israeli companies included on the Tel Aviv 100 during at least part of the sample period, and show that these companies conduct significant activity abroad. For instance, in 2012, they directed about 53 percent of their sales to abroad. Most of the companies’ activity focuses on advanced economies, and there is relatively low exposure to the developing economies, Asia, and the Pacific rim (Figure). In addition, it was found that companies from the manufacturing, technology and biomed industries sell to abroad more than companies from the other industries in the Stock Exchange.

The question arises as to whether the real exposure of the companies to foreign markets is also reflected in significant financial exposure to the global stock indices. In order to examine this question, the researchers estimate an international asset pricing model, through which they explain a stock’s yield by use of a domestic factor and a global factor. Even though the Israeli market is small and open, it was found that the global factor has less of an effect than the domestic factor.

The study then examines whether there is a connection between the geographic distribution of the companies’ sales and the sensitivity of their shares to the global stock indices. The study shows that the percentage of sales directed by the public companies to abroad has a positive and significant effect on the sensitivity of their shares to the global factor in the model. It was found that the effect on the stock of a company that directs all of its sales to abroad is 40 percent higher than the effect on a company that sells only to the domestic market. The results are robust to various estimation models, and do not significantly change even when using the geographic distribution of the companies’ long-term assets (instead of the geographic distribution of their sales) as a measure of their international activity. The results are even stronger in the case of dual-listed companies.

The findings of the study show that Israeli investors, including institutional investors, are not only directly exposed to the global capital markets, through their investments in foreign assets, but are also indirectly exposed through their investments in public companies traded on the domestic stock exchange. The examination presented in the study shows that when Israeli investors’ indirect exposure is added to their direct equity exposure to abroad, it increases the total equity exposure to abroad in the public’s financial asset portfolio by about 40 percent.[1] Moreover, the institutional investors rapidly increased their direct exposure to abroad in recent years by rapidly increasing their investments in foreign assets traded abroad. The examination presented in the study shows that when indirect exposure is added to the institutional investors’ direct equity exposure to abroad, it increases their total equity exposure to abroad by about 15 percent.[2]

The results of the study may be relevant to a large group of small and open economies with public companies that tend to be domestic in nature but that direct a significant portion of their sales to abroad. These small, open economies are very exposed to global economic developments, partly through the effect of these developments on the pricing of public companies traded on the local stock exchange. A decline in demand for goods and services in a certain area of the world where companies traded on the local stock exchange operate may be reflected not only in a negative impact to the level of business activity of those companies, but also to the price of their shares and to their ability to repay their debts. Such developments negatively impact the value of the public’s asset portfolio. Therefore, an analysis of public companies’ exposure to abroad, particularly leveraged companies and companies in industries with the potential for the realization of systemic risks, is important to maintaining financial stability.

[1] Direct investment in equity abroad by the Israeli public totaled almost NIS 270 billion at the end of 2015. The exposure to abroad resulting from the public’s investment in stocks traded on the Tel Aviv Stock Exchange adds about NIS 106 billion to this total according to the study’s estimate.

[2] Direct investment in equity abroad by institutional investors totaled about NIS 141 billion at the end of 2015. The exposure to abroad resulting from institutional investors’ investments in stocks traded on the Tel Aviv Stock Exchange adds about NIS 21 billion to this total according to the study’s estimate.