Full research

Full research- The fact that in Israel the eligibility for the Earned Income Tax Credit (EITC) and its amount are not dependent on a spouse’s eligibility, greatly reduces the negative impact of the EITC on the employment of the spouse, an impact found among married women in the US and UK.

- The eligibility for the EITC is correlated, on average, with a decline in the exit from employment by 1–1.5 percent of total eligible workers; about 20–25 percent of the exit rate among the relevant populations.

- The largest positive impact of the EITC is on the employment of ultra-Orthodox men—a population group characterized by a low employment rate—and of women above the age of 55.

- The findings of the study regarding a lack of interdependence between a spouse’s eligibility for the EITC and employment highlight the importance of designing EITC programs in a manner that balances between encouraging employment and the precise focusing of the transfer on reducing poverty.

The Earned Income Tax Credit (EITC) program in Israel is based on an individual’s income, in contrast to similar programs in the US and UK that are based on family income. The design of the program in the US and UK focuses the grants on working families with the lowest income. However, it creates a negative incentive for labor market participation by the secondary wage earner, due to the reduction of the family grant when the combined labor income exceeds a certain threshold. This result has been documented in the empirical literature for those two countries.

The current study is based on a large panel of administrative data, the source of which is the Israel Tax Authority. It facilitates the tracking of individuals who work over a prolonged period, but occasionally stop to work. The examination is focused on the exits from employment, and takes into account the relevant factors impacting on the individuals’ decision to stop working. The administrative data include income from salary and income tax payments, the EITC payments, and some allowances. The study uses a natural experiment created by the gradual implementation of the plan, beginning in October 2007. In the first stage, the plan was only implemented for employed people in pilot areas; a year later it was expanded to self-employed individuals as well, and in 2011 it went into effect nationwide.

The study found that the eligibility for the EITC being unrelated to the eligibility of the spouse - the connection between an individual’s eligibility and a spouse’s income affected only about a quarter of married workers whose salary is in the range that is eligible for the EITC - markedly reduces the plan’s negative impact on employment, an effect found among married women in the US and UK. A negative impact of the spouse’s eligibility for the EITC on the employment of an individual was not found—whether the actual individual was eligible for the grant or not. Alongside this, it was found that an increase of NIS 100 per month in the EITC to which a woman is eligible is correlated with a decline of 0.4 percentage points in the probability that she will stop working, and a similar increase in the EITC paid to a man reduces the probability of his stopping to work by 0.8 percentage points. In examining only the eligibility for the grant, without accounting for its amount, it is found that the eligibility is correlated, on average, with a decline in stopping to work by 1.0–1.5 percent of the total eligible people; between a quarter and a fifth of the exit rate among the relevant population, which is 6–6.5 percent.

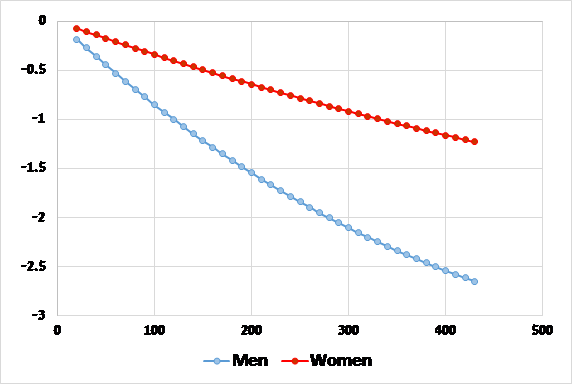

The figure presents the effect of changes in the EITC on the probability of stopping to work for men and women. The figure indicates the product of the marginal effect of the grant on stopping to work, as estimated in this study (all other variables held constant) and the amount of the EITC. It can be seen that increasing the EITC for which an individual is eligible markedly reduces the probability that he or she will stop to work, for both women and men.

The Effect of Increasing the Monthly EITC Amount (in NIS) on the Probability of Stopping to Work (in percentage points)

In addition, it was found that the plan’s effect on reducing exits from employment is statistically significant among all population groups, both among women and men. Among men, the largest positive impact is on ultra-Orthodox men—a population group characterized by a low employment rate. Among women, the smallest impact is on exits from employment by ultra-Orthodox women, and the largest impact is on women above age 55.

The study's findings regarding the lack of a negative impact between a spouse’s eligibility for the grant and an individual’s employment emphasize the importance of designing EITC plans in a manner that balances between encouraging employment and precise focusing of the transfer on reducing poverty among low-income working families. Plans like those in the US and UK, which focus on reducing poverty among workers—and therefore focus on both wage-earners’ income—have a negative impact on the employment of the secondary wage-earner, while plans based on an individual’s income, like in Israel, do not have such an impact, but are less accurate in targeting the working poor.