- The research described below examines, using a unique database, the factors impacting on an insurer’s decision to sell credit insurance.

- The research finds that the factors with the greatest impact on the decision are the size of the insured company, the diversification of the insurer’s activities in various countries, and the risk of the insured company’s clients.

- In addition to understanding these factors, the research presents descriptive statistics on a major source of credit—suppliers’ credit—and connects difficulties in this credit with economic activity.

In a paper by Meital Graham-Rozen and Noam Michelson from the Bank of Israel’s Research Department, the writers study credit insurance in Israel between 2010 and 2017, using a unique database provided for the Bank’s use by ICIC—The Israeli Credit Insurance Company, one of the largest credit insurers in Israel.

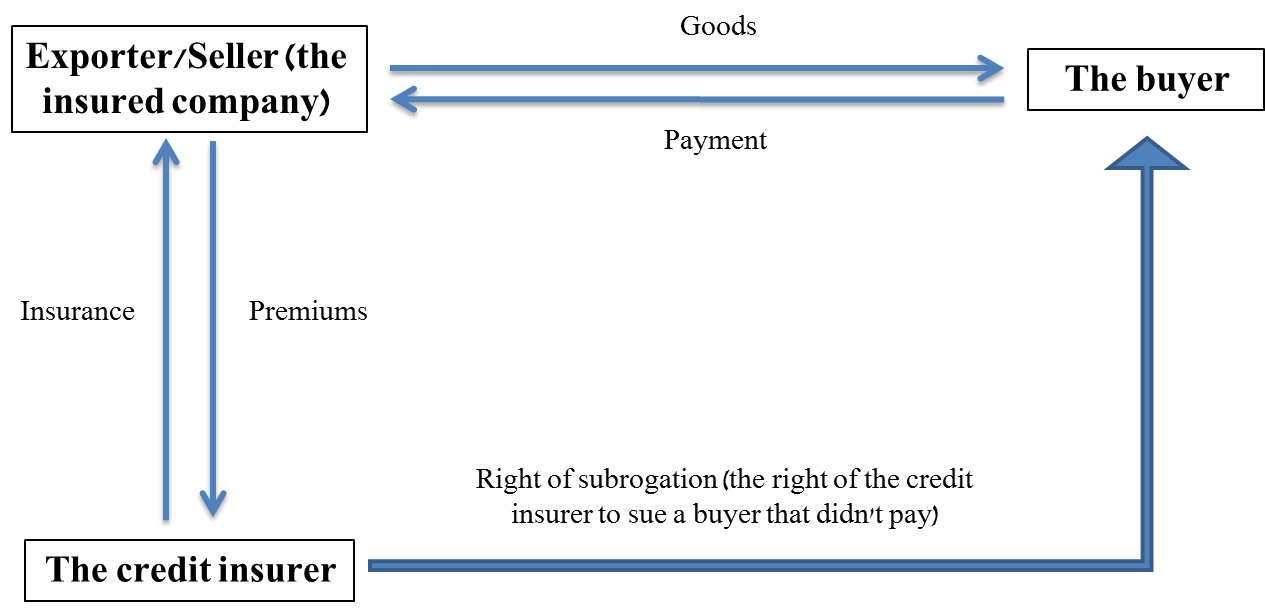

Credit insurance is intended to insure companies against a situation in which their customers receive certain credit terms, and ultimately do not pay. Credit insurers are approached by exporters as well as by domestic suppliers, and they can insure all of them against commercial risks, and for exporters, against political risk as well. When an exporter or domestic supplier requests to purchase an insurance policy, they contact a credit insurer and request a certain amount as insurance coverage for any transaction vis-à-vis any customer. After an underwriting process, the credit insurer responds with whether it has decided to insure the transaction and what the amount of coverage it is providing is. The amount that it is willing to cover divided by the amount requested is termed the “acceptance rate”, and this is how the credit insurer views the risk inherent in the insured company’s customers. Following is a diagram that summarizes the activities in credit insurance.

FIGURE 1: Illustration of credit insurance activity

The research aims to determine what factors impact the acceptance rate. This is the main parameter set by the credit insurer, and it reflects the pricing of the risks in each transaction. In addition, within the framework of the research, we examine the scope of exports insured by credit insurance and characterize it by geographical distribution and by risk levels. Finally, the paper examines—for the first time in Israel—suppliers’ credit in a detailed manner.

The research’s findings indicate a strong link between the risk in suppliers’ credit risk (that is, the difficulties of buyers to pay) and real activity, and it is likely that an increase in the former is a leading indicator for weakness in real economic activity. Likewise, it is found that the acceptance rate is affected mainly by the extent of the insurer’s exposure to the buyer’s country, but also by the size of the insured party, the risk of the buyer with whom the company is transacting, and by the global real economic situation.

Understanding the factors impacting on the acceptance rate contributes markedly to understanding the process of granting credit insurance. An understanding of the risk approach in the insuring company could contribute to the development of a policy tool to encourage exports: if the government chooses to encourage exports by assisting with credit insurance (research shows that this is in fact a tool to encourage exports[1]), then if it knows what factors impact on the acceptance rate, it will be able to allocate resources to channels that will increase it and thus encourage potential exporters.

[1] See, for example:

Review of World Economics, 150(4), 715-743.

van der Veer, K. J. (2015). The private export credit insurance effect on trade. Journal of Risk and Insurance, 82(3), 601-624.