- In the third quarter of 2014, Israel’s surplus of assets over liabilities vis-à-vis abroad declined by about $3.5 billion (about 6.4 percent), to about $51.4 billion at the end of September. An increase of about $4.1 billion (about 1.5 percent) in the value of Israelis’ liabilities to abroad was partly offset by an increase of about $0.6 billion (0.2 percent) in the value of assets held abroad by Israelis.

- The increase in the balance of gross liabilities to abroad derived from a combination of the flow of investments in the economy ($3.3 billion) and an increase in share prices ($3.6 billion), which were offset by the effect of the depreciation of the shekel, which decreased the dollar value of the portfolio.

- The increase in the value of the assets portfolio derived mainly from an increase in the value of the balance of financial investments abroad ($2 billion) and net new deposits by Israeli banks abroad ($1.5 billion).

- The gross external debt to GDP ratio increased in the third quarter by about 1.9 percentage points, to about 34.4 percent at the end of September, further to an increase of about 1.2 percentage points in the previous quarter.

- The surplus of assets over liabilities vis-à-vis abroad in debt instruments alone (negative net external debt) increased in the third quarter by about $1.5 billion (1.7 percent), and reached about $90 billion at the end of September.

Israel's net assets abroad (the surplus of assets over liabilities) declined during the third quarter of 2014 by about $3.5 billion (about 6.4 percent), to around $51.4 billion at the end of September. An increase of about $4.1 billion (about 1.5 percent) in the value of Israelis’ liabilities to abroad was partly offset by an increase of about $0.6 billion (0.2 percent) in the value of Israelis’ assets abroad (Figure 1).

The decline in surplus assets in the economy began at the beginning of 2014, and represents a change in trend compared to the prolonged increase in surplus assets in recent years: In the first nine months of 2014, surplus assets in the economy declined by $10.3 billion: An increase of about 427 billion dollars in the value of the economy's liabilities to abroad was partly offset by an increase of about $17 billion in the value of its assets abroad.

The increase in the value of the economy's gross liabilities has, since the beginning of the year, mainly reflect an increase in the prices of shares held by nonresidents, which was higher than the increase in the value of assets that derived mainly from the flow of the non-banking private sector's investments abroad. It is noted that nonresidents hold shares in a small number of large Israeli companies, for which the year-to-date return was higher than on most indices.

The balance of Israelis’ assets abroad increased by about $0.6 billion (0.2 percent), to about $328 billion, at the end of September—comprised mostly of an increase in the value of financial investments abroad ($2 billion) and of net new deposits by Israeli banks abroad ($1.5 billion).

The value of the financial shares portfolio declined in the third quarter, by about $0.6 billion (1 percent): there was net flow of investments by Israelis of about $680 million, which was offset by price declines on foreign stock markets totaling about $1 billion, and the effect of the strengthening dollar totaling about $700 million.

The balance of investments in tradable bonds abroad increased by about $840 million in the third quarter. The flow of net investments in foreign bonds by institutional investors, households and the banking system, totaling about $2 billion, was partly offset by net sales by the business sector.

The value of other investments abroad increased by about $0.9 billion (1.6 percent) in the third quarter. Of this, there was an increase of about $1.5 billion in deposits abroad by Israeli banks. This increase was partly offset by a decline of about $580 million in loans to abroad. In addition, there were withdrawals of about $420 million by Israelis from banks abroad.

The value of foreign exchange reserves declined by about $600 million in the third quarter. Purchases totaling $1.9 billion were partly offset by the effect of the strengthening dollar against the main currencies, which decreased the value of the reserves, in USD terms, by about $2.4 billion.

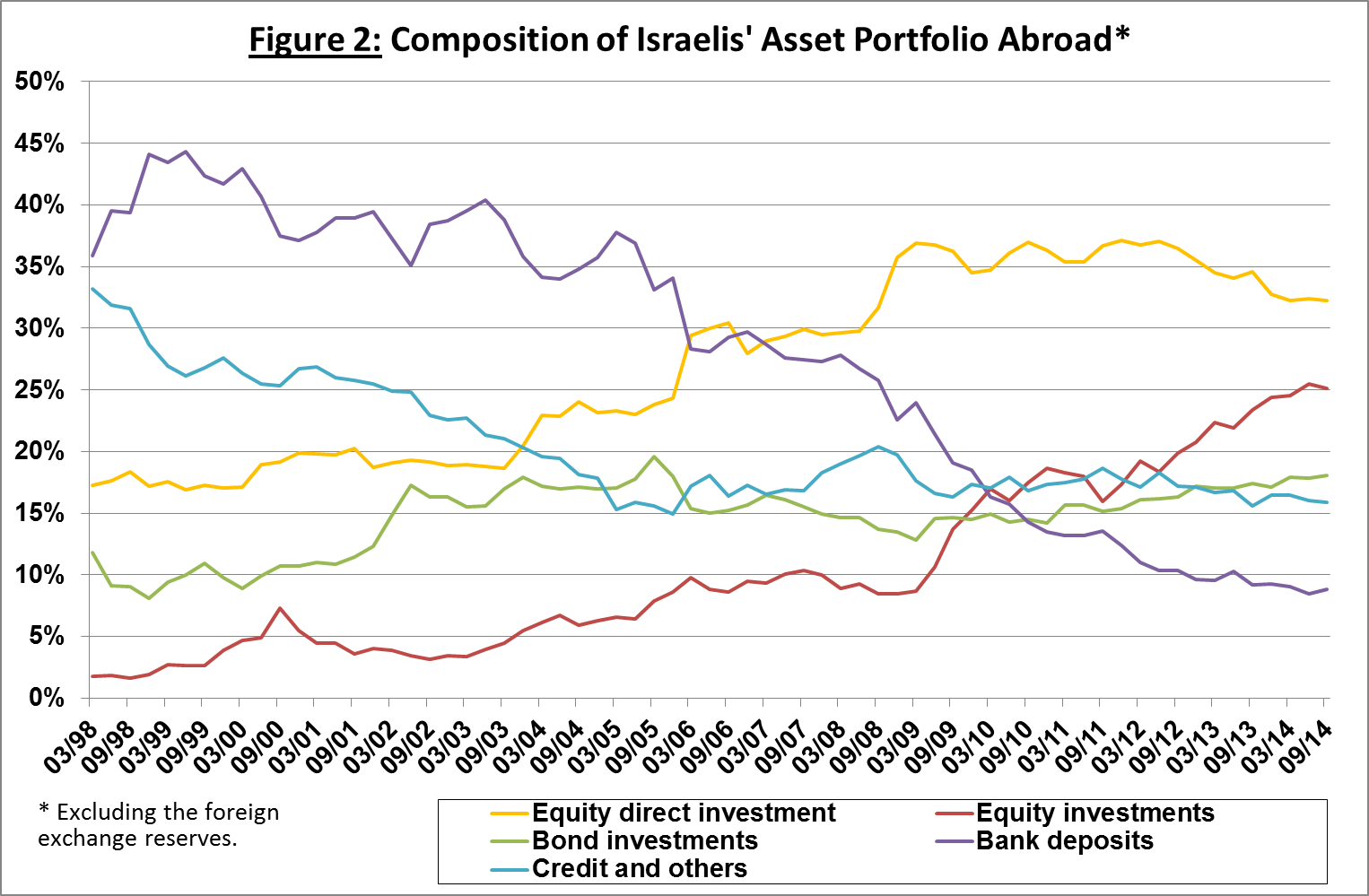

In the composition of residents' securities portfolio abroad, there was no significant change during the third quarter of 2014 (Figure 2).

During 2014, the increase in the weight of stocks in the portfolio, and the decline in the weight of deposits abroad, moderated. These trends were accelerated greatly due to the recovery from the global financial crisis.

The balance of Israel's liabilities to abroad increased during the third quarter of 2014 by about $4.1 billion (1.5 percent), derived mainly from an increase in the prices of shares held in Israel by nonresidents (2.6 percent), and from the flow of investments totaling about $2.1 billion in financial investments, and of about $1.1billion in direct investment into the economy.

The value of nonresidents' financial portfolio on the Tel Aviv Stock Exchange increased in the third quarter by around $1.2 billion (3.6 percent), to about $34 billion at the end of the quarter. Nonresidents invested about $2.3 billion in the tradable portfolio in Israel (stocks and bonds), which was partly offset by the effect of the depreciation of the shekel (Figure 3).

The gross external debt

Israel's gross external debt declined, by about $1 billion (1 percent) during the third quarter of 2014, mainly as a result of withdrawals by nonresidents from deposits in Israeli banks, a decline in the balance of owners loans, and the effect of the strengthening dollar. These were partly offset by an increase in the value of outstanding shekel-denominated bonds on the Tel Aviv Stock Exchange, and an increase in deposits in Israel by foreign banks.

The ratio of gross external debt to GDP increased in the third quarter, by about 1.9 percentage points, to about 34.4 percent at the end of September, following on an increase of about 1.2 percentage points in the previous quarter (Figure 4).

The net external debt

The surplus of assets over liabilities abroad in debt instruments alone (negative net external debt) increased by about $1.5 billion (1.7 percent) in the third quarter, and reached $90 billion at the end of September (Figure 5).

The balance of short-term debt assets was about $135 billion at the end of September, mostly reserves at the Bank of Israel, reflecting a coverage ratio of 3.3 of short-term debt, a slight increase from the end of 2013.

Further information and details on this subject are available at the following link:

http://www.boi.org.il/en/DataAndStatistics/Pages/MainPage.aspx?Level=2&Sid=27&SubjectType=2