![]() To view this press release as a word document

To view this press release as a word document

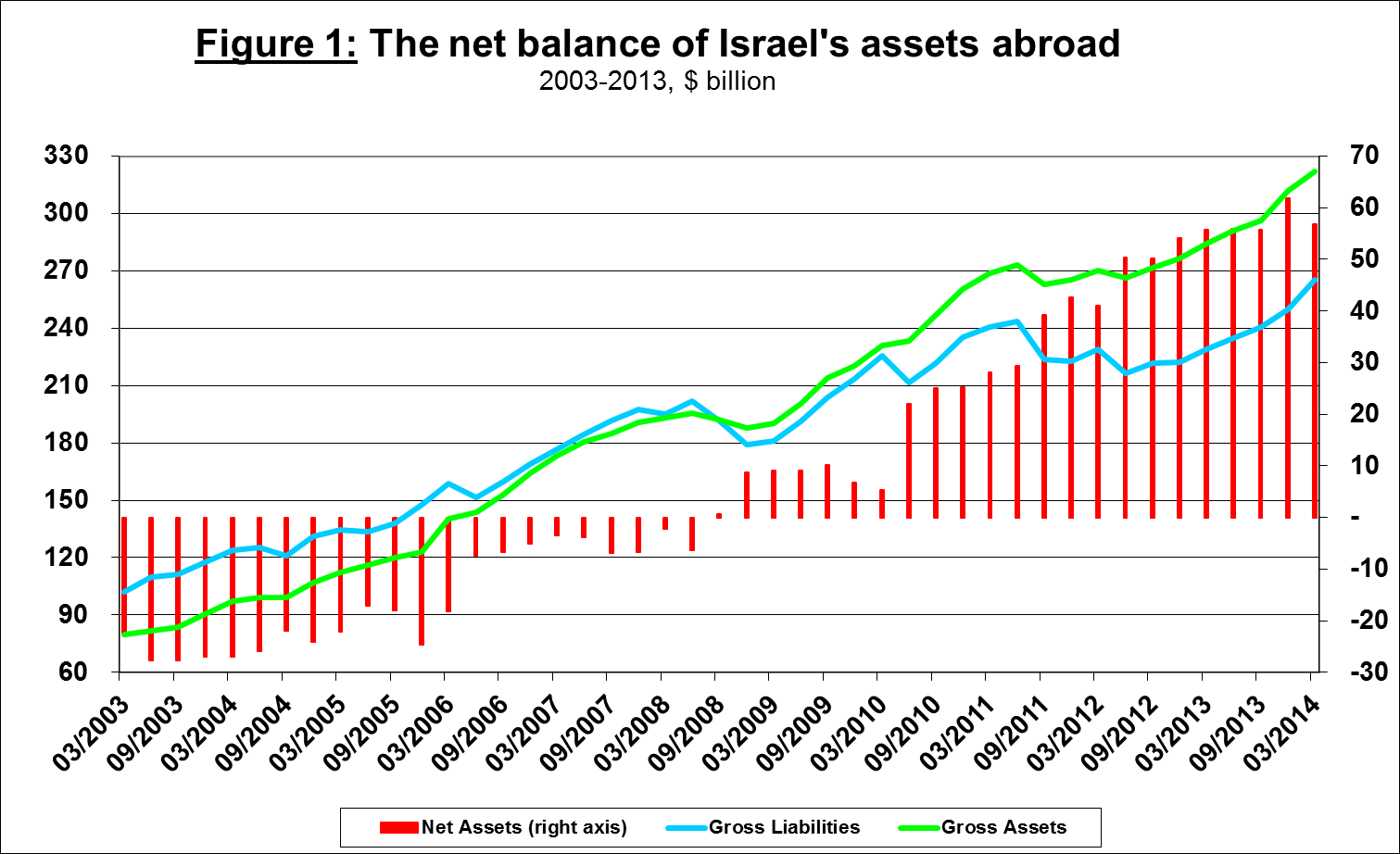

- In the first quarter of 2014, Israel’s surplus of assets over liabilities vis-à-vis abroad declined by about 8 percent (about $5 billion), to about $57 billion at the end of March. An increase of about $15.1 billion (6.1 percent) in the value of liabilities held abroad by Israelis was partly offset by an increase of about $10.2 billion (3.3 percent) in the value of Israelis’ assets abroad.

- The increase in the gross balance of liabilities to abroad derived from an increase in the value of nonresidents’ tradable securities portfolio ($13.2 billion), mainly an increase in the value of shares.

- The increase in the value of the asset portfolio derived mainly from an increase in the balance of financial investments by Israelis in tradable assets, stocks and bonds ($5.7 billion). Increases were also recorded in the other areas: the Bank of Israel’s foreign exchange reserves—$3.8 billion; direct investment abroad—$0.9 billion.

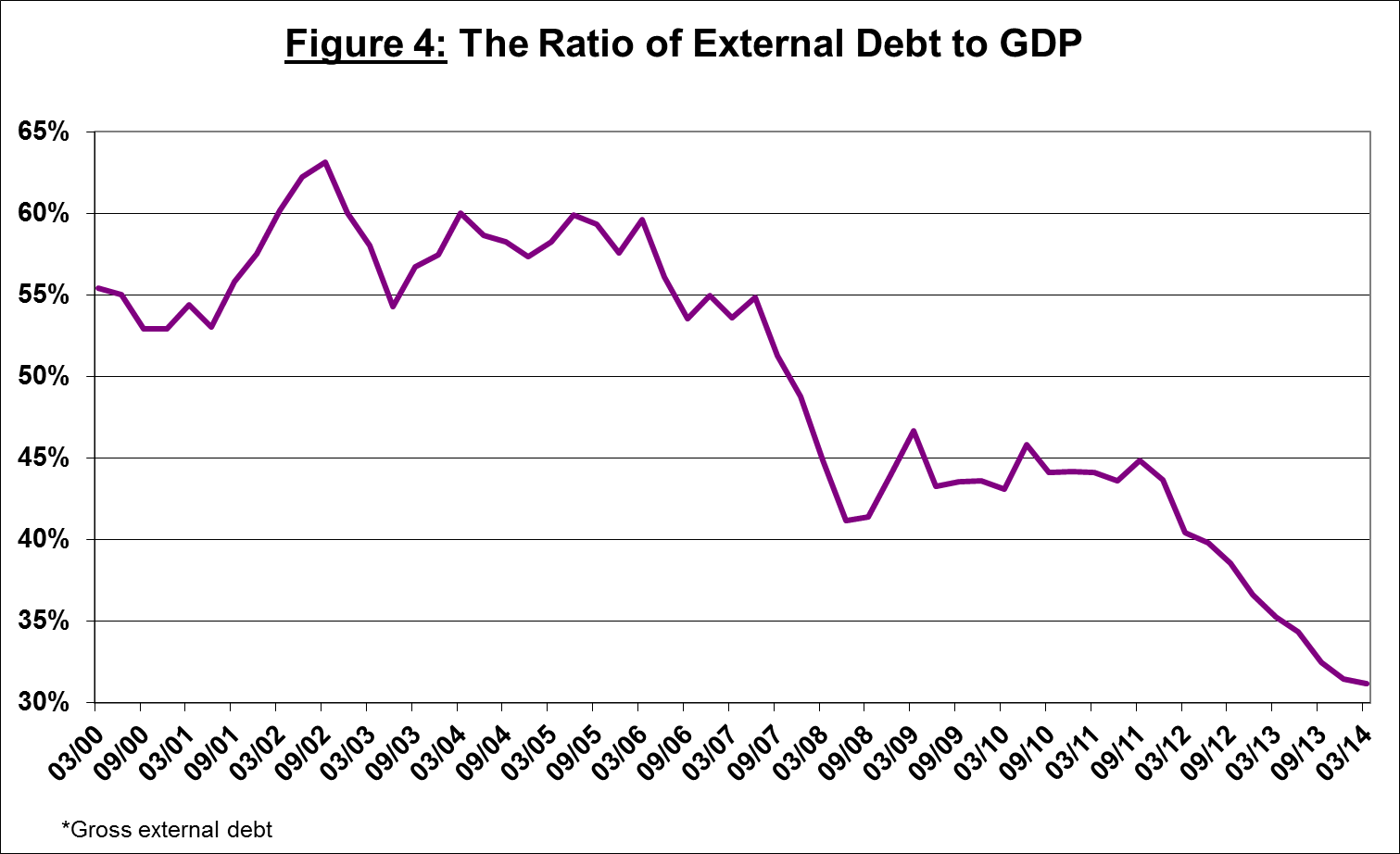

- The gross external debt to GDP ratio continued to decline in the first quarter as well, by another 0.3 percentage points, to only about 31.2 percent at the end of March.

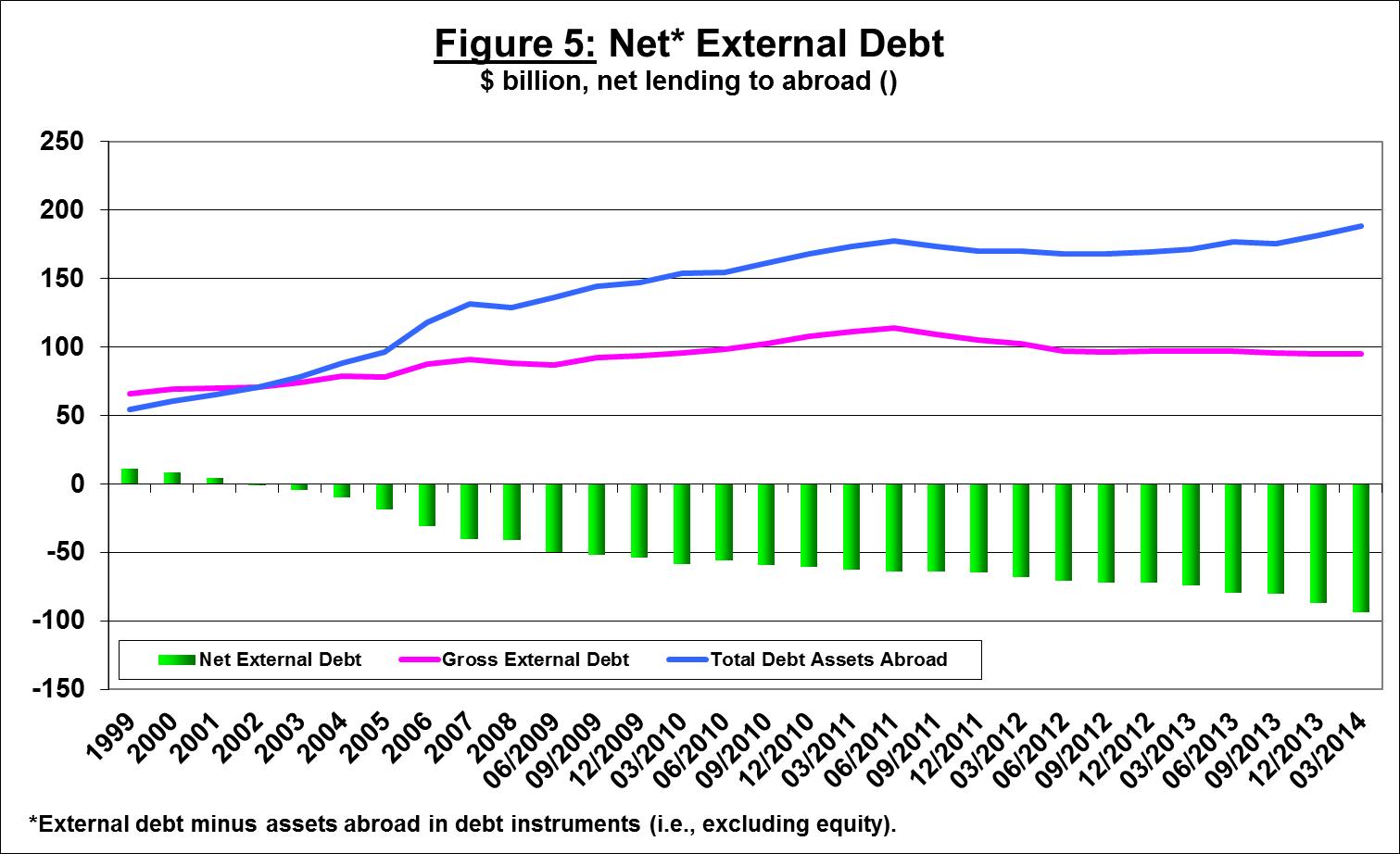

- The surplus of assets over liabilities vis-à-vis abroad in debt instruments alone (negative net external debt) increased in the quarter by about an additional $6.8 billion (7.8 percent), and reached about $93.3 billion at the end of March.

Israel's net assets abroad (the surplus of assets over liabilities) declined during the first quarter of 2014 by about $5 billion (8 percent), to around $57 billion at the end of March. An increase of about $15 billion (6.1 percent) in the value of Israelis’ liabilities to abroad was partly offset by an increase of about $10 billion (3.3 percent) in the value of Israelis’ assets abroad (Figure 1).

The balance of Israelis’ assets abroad increased by about $10.2 billion (3.3 percent), to about $322 billion, at the end of March—comprised mostly of an increase in the balance of financial investments in tradable assets (shares and bonds) ($5.7 billion) and in the foreign exchange reserves.

The value of the shares portfolio increased in the first quarter, by about $2.5 billion (4.5 percent): there was net flow of investments by Israelis of $2 billion, mainly by institutional investors and households, and about $0.7 billion was in respect of price increases on stock markets abroad.

The balance of investments in tradable bonds abroad increased by about $3.2 billion (8 percent) in the first quarter, primarily through net investment flow of $2.7 billion.

Other investments : withdrawals of about $670 million by Israeli banks from their deposits abroad were mostly offset by investment of $370 million in other assets abroad and by deposits of $140 million by Israeli residents in banks abroad.

The value of foreign exchange reserves increased by about $3.8 billion in the first quarter, mainly due to the Bank of Israel’s intervention in foreign exchange trading.

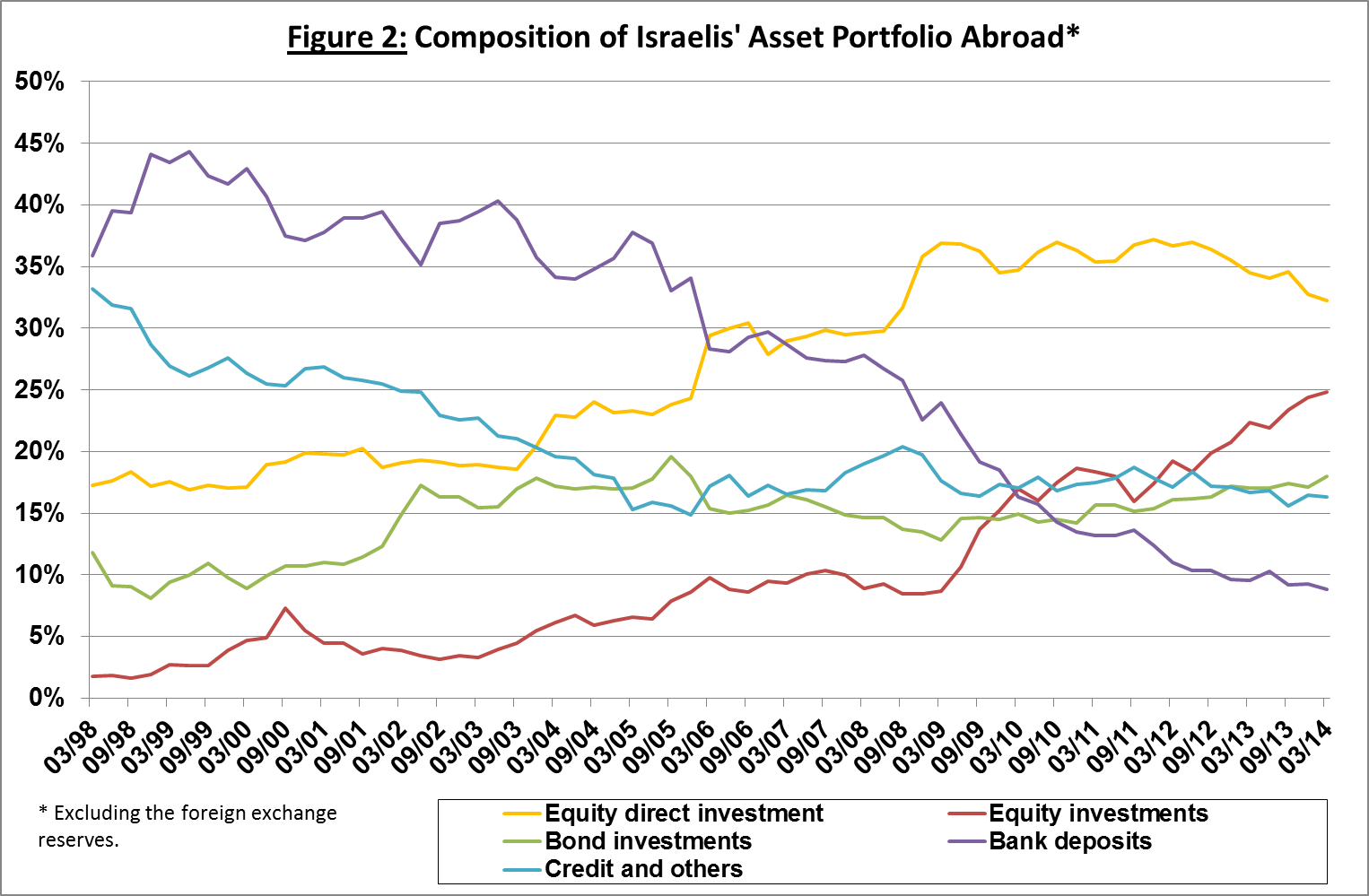

In the composition of residents' securities portfolio abroad, there was an increase in the first quarter of 2014 in the share of investment in foreign tradable securities, at the expense of the other components. These trends have accelerated since the financial crisis in 2008–09, the combination of a sharp decline in the share of Israeli residents’ deposits in foreign banks and increases in the flow of investment into shares abroad and their market value (Figure 2).

From a longer term perspective of the composition of residents' securities portfolio abroad (excluding the reserves), it can be seen that there has been a marked change in the makeup of assets held abroad since 1998: there has been a gradual and consistent decline of about 40 percentage points in the share of debt assets (deposits, bonds, and other credit), to a share of 43 percent at the end of the first quarter of 2014. In contrast, during the same period, the weight of investments in shares and direct investment has similarly increased, to about 57 percent at the end of March 2014.

The balance of Israel's liabilities to abroad increased during the first quarter of 2014 by about $15.1 billion, derived from an increase in the value of nonresidents’ shares portfolio, deriving from an increase in value of the shares ($11 billion, of which $9 billion was in the pharmaceuticals industry), and from a $2.6 billion flow of direct investment into the economy. This increase was partly offset by the withdrawal from deposits in Israel of nonresidents (about $1 billion).

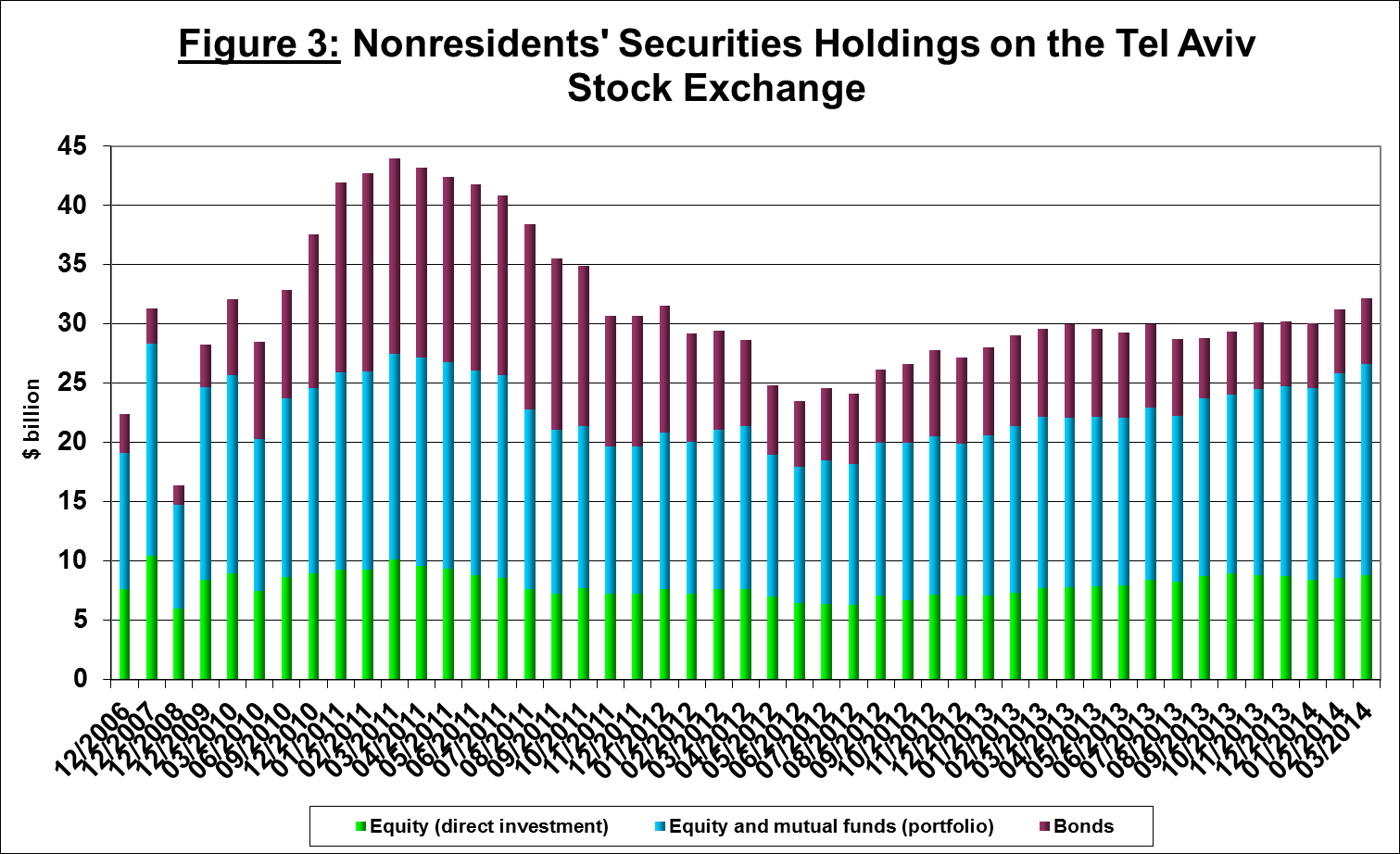

The value of nonresidents' financial portfolio on the Tel Aviv Stock Exchange increased in the first quarter by around $1.9 billion (6.3 percent), to about $32.1 billion at the end of the quarter. Nonresidents invested only about $180 million, net, in shares traded on the Tel Aviv Stock Exchange during the quarter. The share of holdings of shekel-denominated bonds traded in Tel Aviv remained virtually unchanged (Figure 3).

The gross external debt

Israel's gross external debt declined by $0.3 billion (0.4 percent) during the first quarter of 2014, mainly as a result of withdrawals by nonresidents from deposits in Israeli banks, and a decline in loans and suppliers’ credit. This decline was partly offset by nonresidents’ investment in shekel-denominated bonds on the Tel Aviv Stock Exchange and an increase of deposits in Israel by foreign banks.

The ratio of gross external debt to GDP declined in the first quarter, by about 0.3 percentage points, following on a decline of 12.2 percentage points in 2012–13, to only 31.2 percent at the end of March (Figure 4).

The net external debt

The surplus of assets over liabilities abroad in debt instruments alone (negative net external debt) increased by about $6.8 billion (7.8 percent) in the first quarter, and reached $93 billion at the end of March (Figure 5).

The balance of short-term debt assets was about $135 billion at the end of March 2014, mostly reserves at the Bank of Israel, reflecting a coverage ratio of 3.3 of short-term debt, a slight increase from the end of 2013.