To view the message as a file click here

- The Exchange Rate

Strengthening of the shekel alongside weakening of the US dollar worldwide.

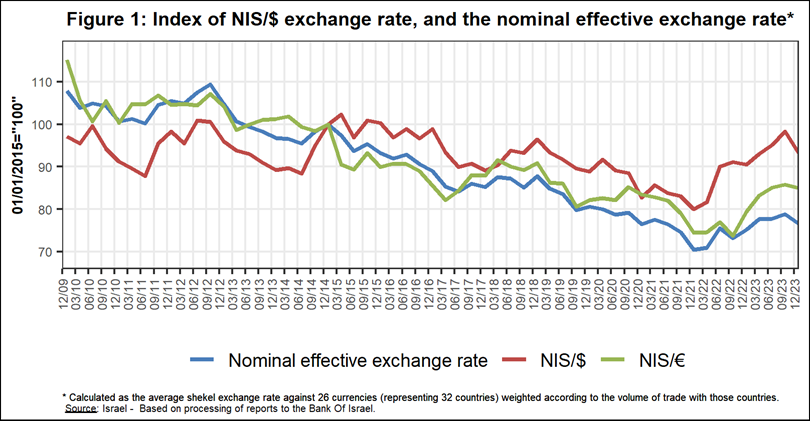

During the course of the fourth quarter, the shekel strengthened by 5.2 percent against the US dollar and by 1 percent against the euro. This came after the shekel weakened significantly against most currencies at the beginning of the quarter, with the outbreak of the Swords of Iron war.

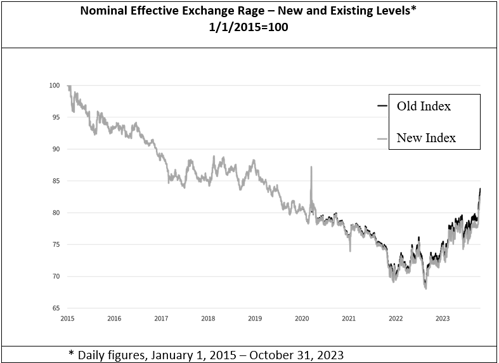

In addition, the shekel strengthened by about 2.8 percent against the currencies of Israel's main trading partners, in terms of the nominal effective exchange rate (i.e., the trade-weighted average shekel exchange rate against those currencies).[1]

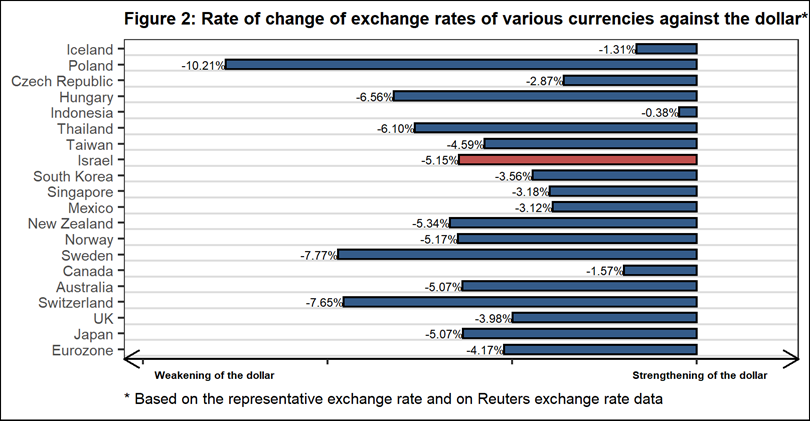

The US dollar weakened against most major currencies (Figure 2) during the quarter. It weakened by approximately 4.2 percent against the euro, by about 5.1 percent against the Japanese yen, and by about 4 percent against the British pound.

[1] The Bank of Israel is revising the weights for calculating the nominal effective exchange rate – for details see the end of this notice.

- Exchange Rate Volatility

A rise in actual volatility and a decline in implied volatility

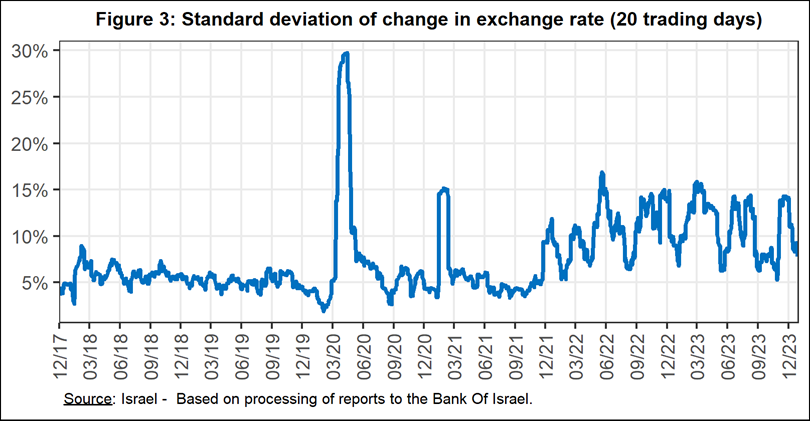

The standard deviation of changes in the shekel/dollar exchange rate, which represents its actual volatility, declined during the quarter, to an average level of 10.1 percent.

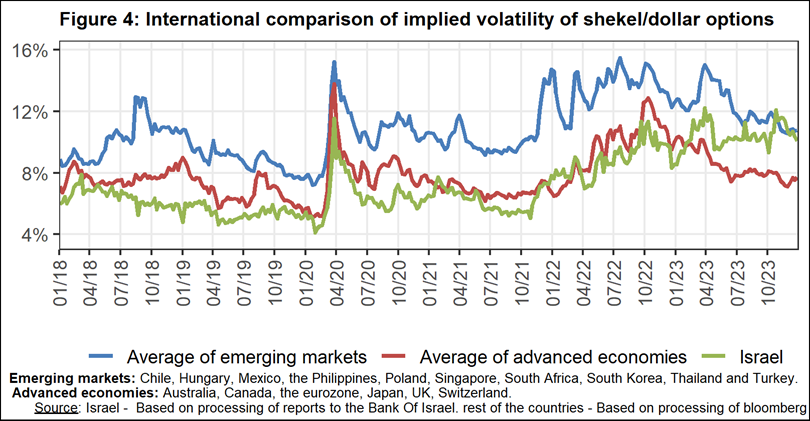

The average implied volatility in over-the-counter shekel/dollar options, an indication of expected exchange rate volatility, rise, to about 10.8 percent by the end of the quarter.

During the quarter, with the outbreak of the Swords of Iron war, the implied volatility hit a record high, and for the first time since 2008, it passed the level of implied volatility in emerging markets. Toward the end of the quarter, volatility returned to its average level of the previous quarter.

For comparison, the average level of implied volatility in foreign exchange options in emerging markets was 11.1 percent at the end of the quarter, a decline of 0.4 percentage points from its level at the end of the previous quarter. The average level of implied volatility in advanced-economy markets was 7.7 percent at during the quarter, a decline of about 0.3 percentage points from the previous quarter (Figure 4).

- The Activity of the Main Segments in the Foreign Exchange Market[2]

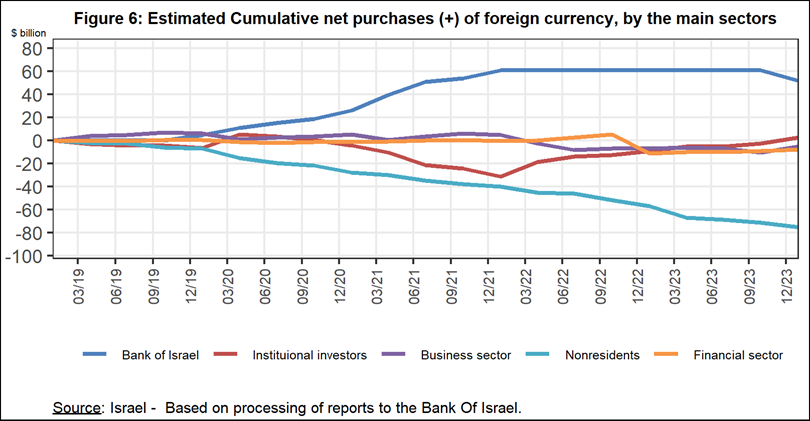

An estimate of the activity of the main segments in the foreign exchange market indicates that during the course of the fourth quarter, institutional investors (pension funds, provident funds, and insurance companies) made net purchases totaling about $5.3 billion, and the business sector made net purchases totaling about $5.2 billion. In contrast, nonresidents made net sales of foreign currency totaling about $3.8 billion. Due to the Swords of Iron war, the Bank of Israel made net sales of foreign currency for the first time, totaling about $8.5 billion.

- Trading Volume in the Foreign Currency Market—Tables and Figures

Trading volume vis-à-vis the domestic banking system[3]

The average daily trading volume declined by about 3.4 percent during the quarter to $10.4 billion, mainly due to a decline in the daily trading volume in spot and forward transactions.

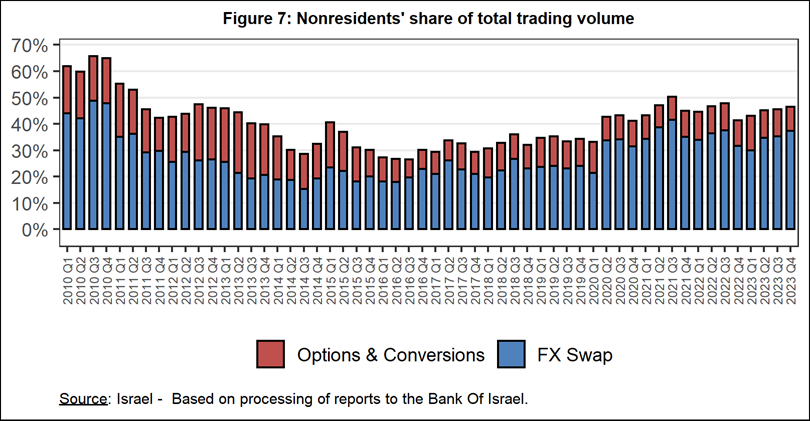

Nonresidents' share of total trading volume vis-à-vis the domestic banking system (spot and forward transactions, options, and swaps) increased by about 1.1 percentage points to about 46.6 percent at the end of the first quarter.

Estimated total trading volume[4]—domestic banking system and foreign reporting entities

The estimated total activity in transactions against the shekel reflected in reports from the domestic banking system and foreign reporting entities indicates that nonresidents’ relative share of trading volume in spot and forward transactions (excluding swaps and options) was 82.4 percent in the fourth quarter. Trade between nonresidents constituted 70.6 percent of the volume, which had a daily average of about $9.4 billion.

The Bank of Israel Revises the Weights in the Nominal Effective Exchange Rate

The Bank of Israel calculates and publishes a nominal effective exchange rate index on a daily basis, similar to other central banks. This index is comprised of the weighted average of a number of exchange rates, reflecting the relative importance of each currency in Israel’s foreign trade.

The Bank of Israel examines a revision of the weights in the index every three years so that it represents the nominal effective exchange rate in the most precise and up-to-date manner. The weights in the existing index were last revised in 2020. Since that time, there have been changes in the composition of Israel’s foreign trade.

The weights in the new index are calculated on the basis of data on the flow of bilateral goods and services trade, correcting for third-party competition. This reflects the fact that Israeli exports compete against manufacturers from a large number of countries in each market to which they are exported, and not just against local manufacturers from that country. The new index includes 29 countries and 21 currencies (9 European countries included in the index use the same currency—the euro), compared with the previous index that included 31 countries and 24 currencies.

The revision of the weights led to an increase of 3.3 percentage points in the weight of the Chinese yuan and a decline of 1.8 percentage points in the weight of the US dollar. There was also a decline in the weight of the eurozone countries. In total, the effect of the changes on the index itself is not large, and the new index paints a picture that is similar to that shown by the development of the old index. As of the end of October 2023, the shekel has cumulatively appreciated by about one percentage point more according to the new index since the beginning of 2020.

|

Revision of the weights of the main currencies in the nominal effective exchange rate (percent) |

||

|

Currency |

Old Weight |

New Weight |

|

Euro |

24.4 |

23.5 |

|

US dollar |

28.7 |

26.9 |

|

Chinese yuan |

11.5 |

14.8 |

|

British pound |

6.4 |

5.7 |

|

Turkish lira |

3.7 |

5.0 |

|

Other currencies[5] |

25.3 |

24.1 |

[1] The Bank of Israel is revising the weights for calculating the nominal effective exchange rate – for details see the end of this notice.

[2] The main segments presented do not make up the entire market—for additional information, see the section on “The Database of Foreign Exchange Market Activity” in the Bank of Israel's "Statistical Bulletin" for 2018:

https://boi.org.il/en/communication-and-publications/regular-publications/statistical-publications/statistical-bulletin-2018/

[3] From the beginning of 2020, the data do not include branches of foreign banks in Israel.

[4] Total trading volume is an estimate of total activity in transactions against the shekel, based on reports by the domestic banking system and by foreign reporting entities.