![]() To post as Word doc

To post as Word doc![]() To data file

To data file

1. The Exchange Rate

The dollar weakened against the shekel, in contrast to the dollar's strength against global currencies

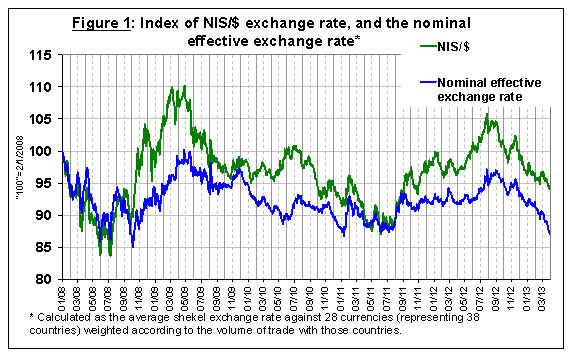

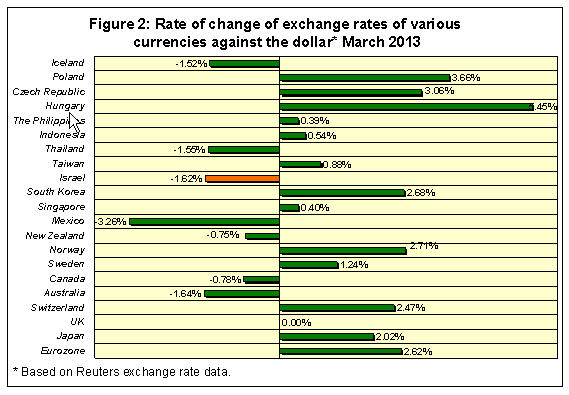

The shekel appreciated by about 1.6 percent against the dollar during March, and appreciated by about 4.1 percent against the euro. Against the currencies of Israel's main trading partners, in terms of the nominal effective exchange rate of the shekel (i.e., the trade-weighted average shekel exchange rate against those currencies), the shekel strengthened by about 2.8 percent. For the year to date, the shekel has appreciated against the currencies of Israel's main trading partners by about 4.4 percent.

In March, the dollar strengthened against global currencies—the dollar appreciated by about 2.5 percent against the Swiss franc, by about 2.6 percent against the euro, and by about 2 percent against the Japanese yen.

2. Exchange Rate Volatility

Actual and implied volatility of the exchange rate declined

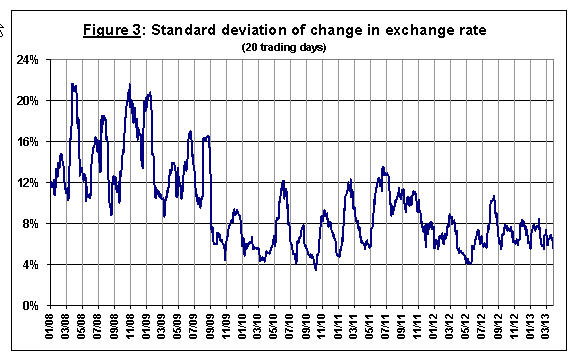

The standard deviation of changes in the shekel-dollar exchange rate, which represents its actual volatility, declined in March to 5.6 percent, compared with 7.4 percent in February.

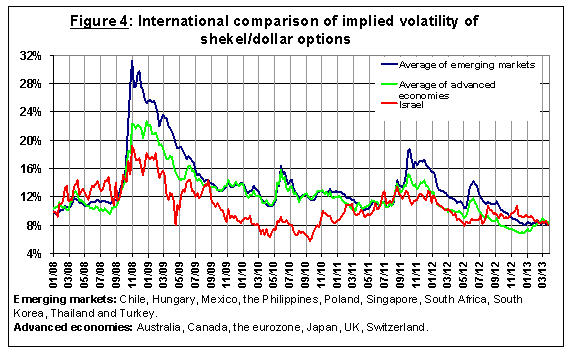

The average level of implied volatility in over the counter shekel-dollar options––an indication of expected exchange rate volatility––declined moderately. In March, the implied volatility of foreign exchange options was 8.4 percent in emerging markets, and 8.5 percent in advanced economies, similar to their levels in February.

3. The Volume of Trade in the Foreign Currency Market

There was a decline in average daily trading volume and an increase in nonresidents' share of trading volume

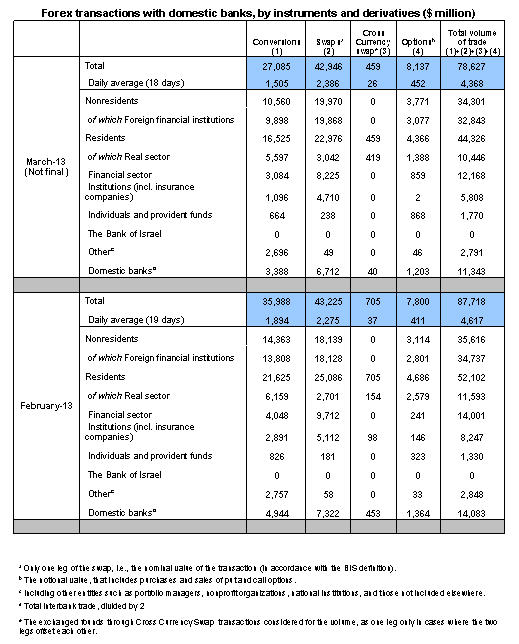

The total volume of trade in foreign currency in March was about $79 billion, compared with about $88 billion in February. Average daily trading volume declined by about 5 percent in March, and reached about $4.4 billion.

The volume of trade in spot and forward transactions (conversions) was about $27 billion in March, compared with $35 billion in February. The average daily trading volume in those transactions declined in March by about 20 percent, compared with February.

The volume of trade in over the counter foreign currency options (which are not traded on the stock exchange) totaled about $8.1 billion in March. The average daily trading volume in those options in March was $452 million, an increase of 10 percent from February.

The trading volume of swap transactions was about $43 billion in March. Average daily turnover increased by around 5 percent.

Nonresidents' share of total trade (spot and forward transactions, options and swaps) increased in March to 44 percent, compared with 41 percent in February.