![]() To view this press release as a Word document

To view this press release as a Word document

1. The Exchange Rate

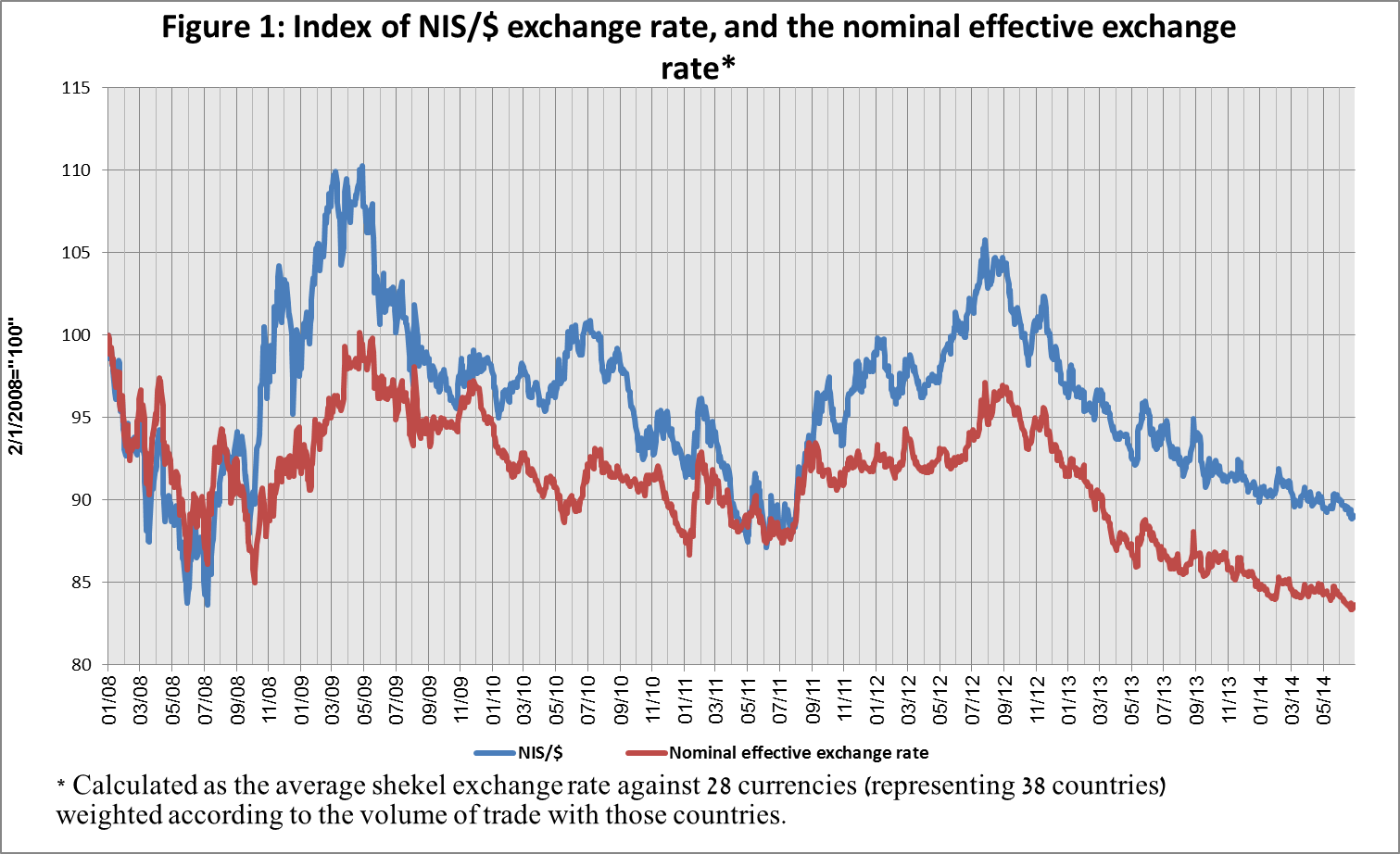

The shekel strengthened against the dollar, as the dollar weakened worldwide.

In June, the shekel strengthened by about 1 percent against the dollar and by about 0.7 percent against the euro. Against the currencies of Israel's main trading partners, in terms of the nominal effective exchange rate of the shekel (i.e., the trade-weighted average shekel exchange rate against those currencies), the shekel strengthened by about 0.8 percent.

In June, the dollar weakened against most currencies—including by about 0.8 percent against the Swiss franc, by about 0.3 percent against the euro, by about 1.8 percent against the British pound, and by about 0.3 percent against the Japanese yen.

2. Exchange Rate Volatility

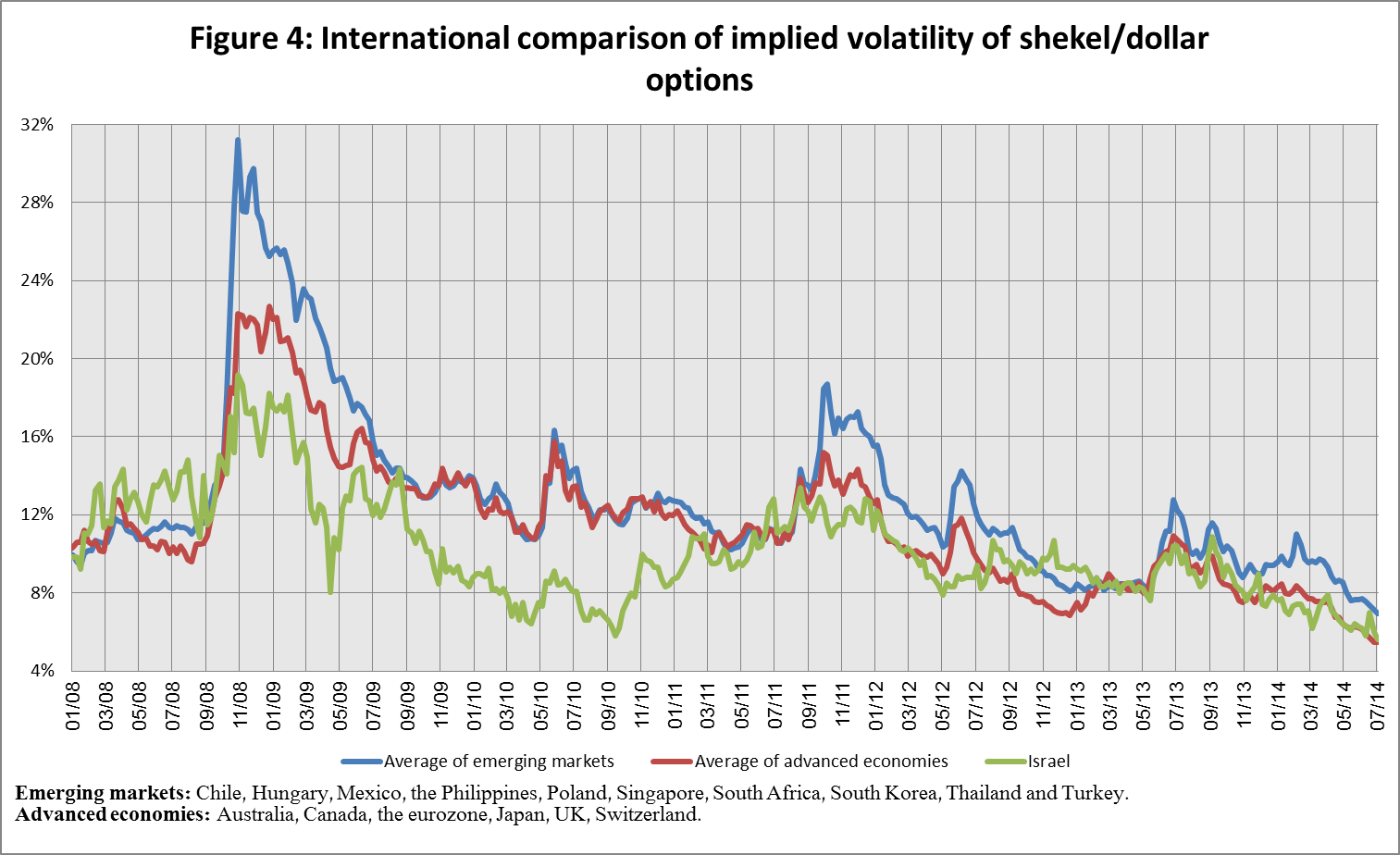

Actual volatility of the exchange rate declined along with a decline in the implied volatility of the exchange rate.

The standard deviation of changes in the shekel-dollar exchange rate, which represents its actual volatility, declined in June by about 0.4 percentage points to 3.4 percent.

The average level of implied volatility in over the counter shekel-dollar options––an indication of expected exchange rate volatility––declined to 6.1 percent at the end of June, compared with 6.3 percent in May.

At the same time, in June, the implied volatility in foreign exchange options in emerging markets also declined, to 7.3 percent on average. The implied volatility in foreign exchange options in advanced economies declined as well in June, to 5.7 percent at the end of the month.

3. The Volume of Trade in the Foreign Currency Market

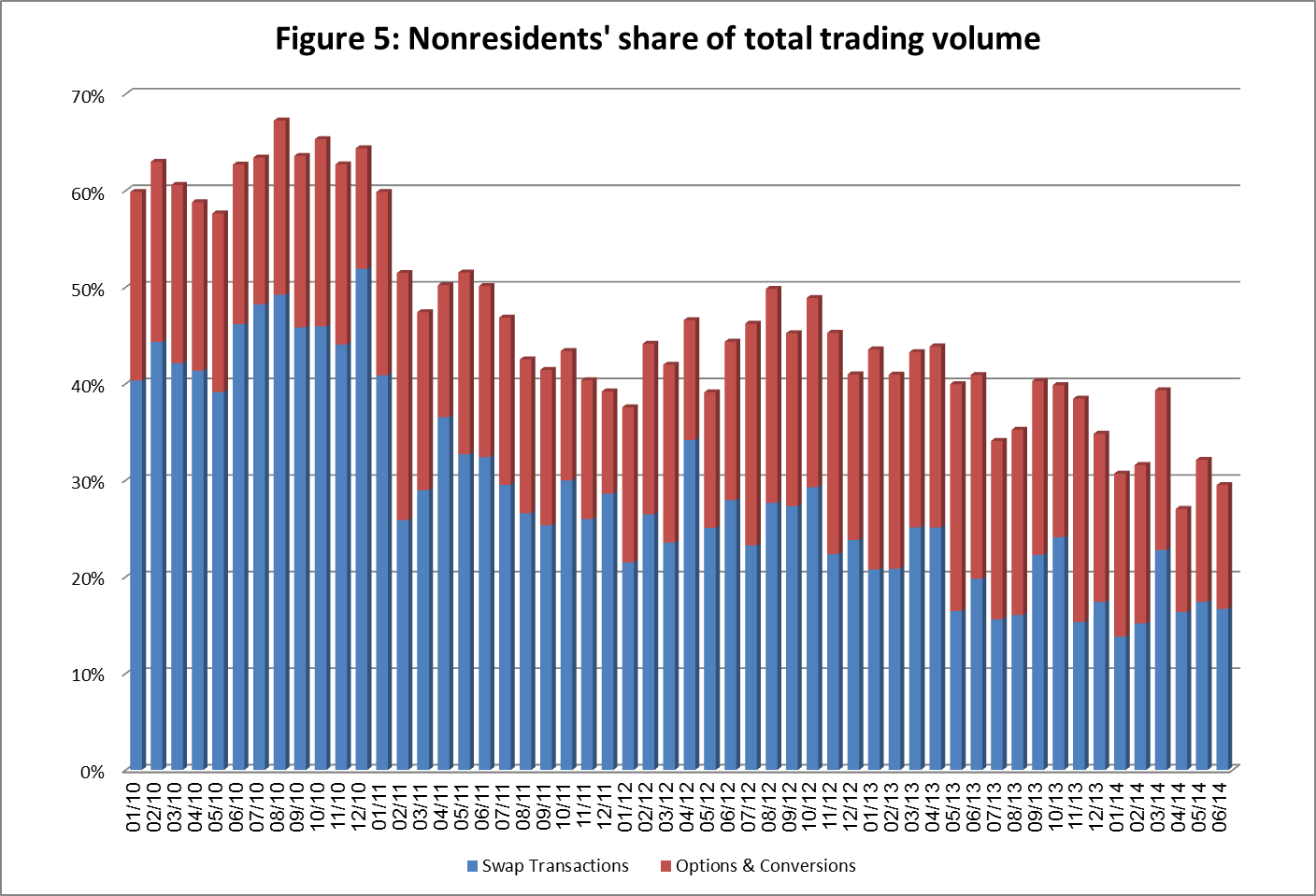

Total trading volume increased as a result of an increase in swap transaction volume.

The total volume of trade in foreign currency in June was about $127 billion, compared with about $107 billion in May. Average daily trading volume increased by about 18 percent in June, and reached about $6.3 billion.

The volume of trade in spot and forward transactions (conversions) was about $34 billion in June, compared with about $32 billion in May. The average daily trading volume in those transactions increased in June by about 6 percent compared with May. During June, the Bank of Israel bought $1,380 million through conversion transactions[1], of which $580 million was part of the purchase program intended to offset the effect of natural gas production on the exchange rate.

The volume of trade in over the counter foreign currency options (which are not traded on the stock exchange) totaled about $8.4 billion in June. The average daily trading volume in those options in June was about $420 million, a decline of about 6 percent from its level in May.

The trading volume of swap transactions was about $84 billion in June, compared with $65 billion in May. Average daily turnover increased by about 28 percent from the previous month, to around $4.1 billion.

Nonresidents' share of total trade (spot and forward transactions, options and swaps) declined in June, to about 29 percent, compared with about 32 percent in May.

Forex transactions with domestic banks, by instruments and sectors

($ million)

Conversions (1) |

Swaps[1] (2) |

Cross Currency swap[2] (3) |

Options[3] (4) |

Total volume of trade (1)+(2)+(3)+(4) | ||

June

2014

(Not final) |

Total |

34,578 |

83,849 |

309 |

8,382 |

127,118 |

Daily average (20 days) |

1,729 |

4,192 |

15 |

419 |

6,356 | |

Nonresidents |

12,528 |

21,143 |

0 |

3,724 |

37,395 | |

of which Foreign financial institutions |

11,890 |

21,121 |

0 |

3,681 |

36,692 | |

Residents |

22,050 |

62,706 |

309 |

4,658 |

89,723 | |

of which Real sector |

6,145 |

7,087 |

0 |

1,858 |

15,090 | |

Financial sector |

3,598 |

35,867 |

121 |

1,539 |

41,125 | |

Institutions (incl. insurance companies) |

3,401 |

9,096 |

38 |

12 |

12,547 | |

Individuals and provident funds |

728 |

2,944 |

0 |

208 |

3,880 | |

The Bank of Israel |

1,380 |

0 |

0 |

0 |

1,380 | |

of which within the program to offset the gas effect |

580 |

0 |

0 |

0 |

580 | |

Other[4] |

3,596 |

38 |

0 |

250 |

3,884 | |

Domestic banks[5] |

3,202 |

7,674 |

150 |

791 |

11,817 | |

May

2014 |

Total |

32,326 |

65,312 |

577 |

8,876 |

107,091 |

Daily average (20 days) |

1,616 |

3,266 |

29 |

444 |

5,355 | |

Nonresidents |

12,675 |

18,545 |

0 |

2,986 |

34,206 | |

of which Foreign financial institutions |

12,027 |

18,516 |

0 |

2,864 |

33,407 | |

Residents |

19,651 |

46,767 |

577 |

5,890 |

72,885 | |

of which Real sector |

6,413 |

5,488 |

59 |

2,248 |

14,208 | |

Financial sector |

3,171 |

26,233 |

204 |

1,959 |

31,567 | |

Institutions (incl. insurance companies) |

2,666 |

6,099 |

0 |

1 |

8,766 | |

Individuals and provident funds |

803 |

900 |

0 |

493 |

2,196 | |

The Bank of Israel |

295 |

0 |

0 |

0 |

295 | |

of which within the program to offset the gas effect |

295 |

0 |

0 |

0 |

295 | |

Other4 |

3,111 |

35 |

0 |

518 |

3,664 | |

Domestic banks5 |

3,192 |

8,012 |

314 |

671 |

12,189 |

[1] Only one leg of the swap, i.e., the nominal value of the transaction (in accordance with the BIS definition)

[2] The exchanged founds through Cross Currency Swap transactions considered for the volume, as one leg only in cases where the two legs offset each other.

[4] Including other entities such as portfolio managers, nonprofit organizations, national institutions, and those not include elsewhere.

[1] This figure reflects transactions by trade date, not settlement date. Therefore, it is not necessarily identical to the data published in the foreign exchange reserves notice, which reflects transactions by settlement date.

[2] Only one leg of the swap, i.e., the nominal value of the transaction (in accordance with the BIS definition)

[3] The exchanged founds through Cross Currency Swap transactions considered for the volume, as one leg only in cases where the two legs offset each other.

[5] Including other entities such as portfolio managers, nonprofit organizations, national institutions, and those not include elsewhere.