1. The Exchange Rate

The shekel weakened against the dollar, as the dollar weakened against global currencies

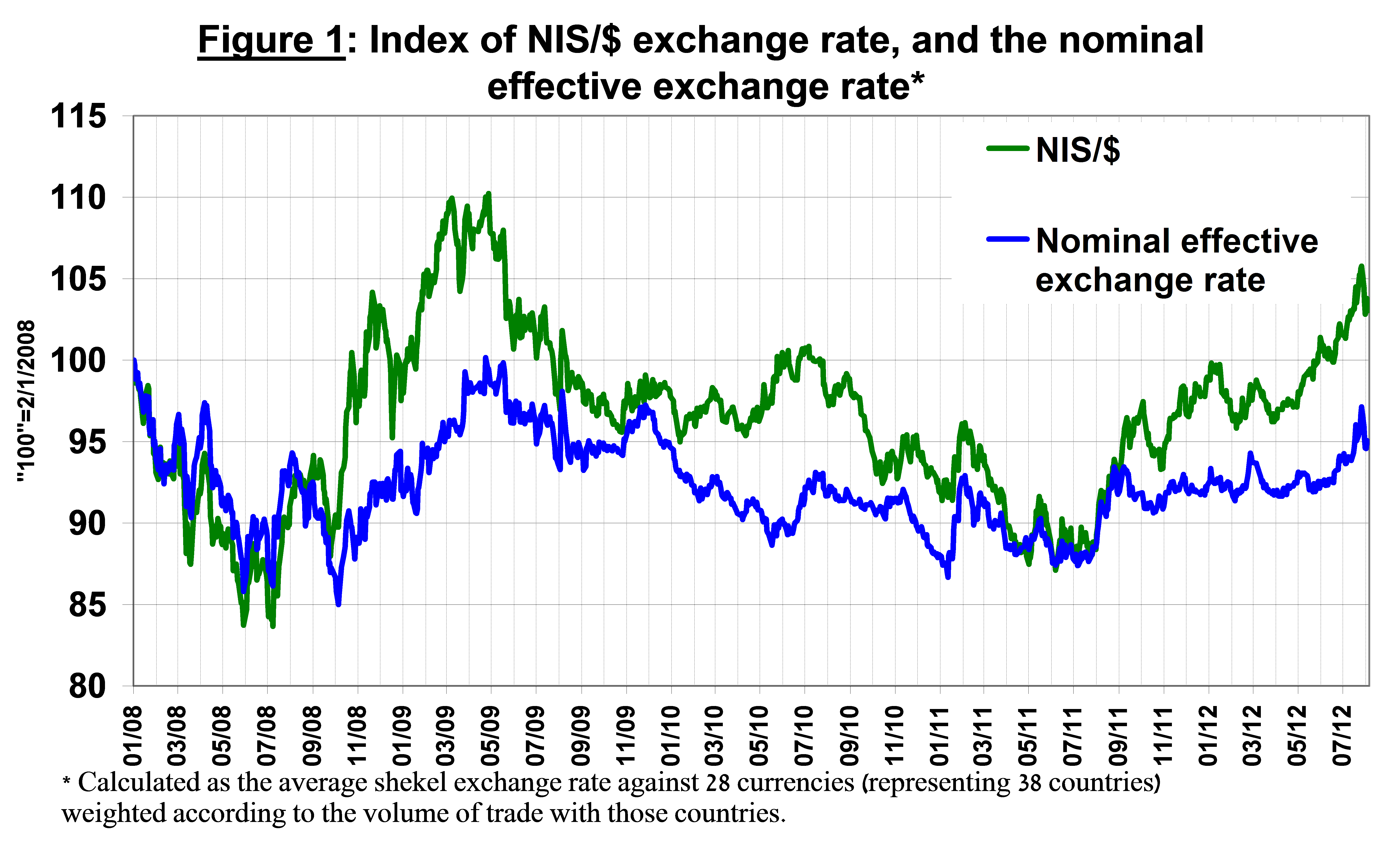

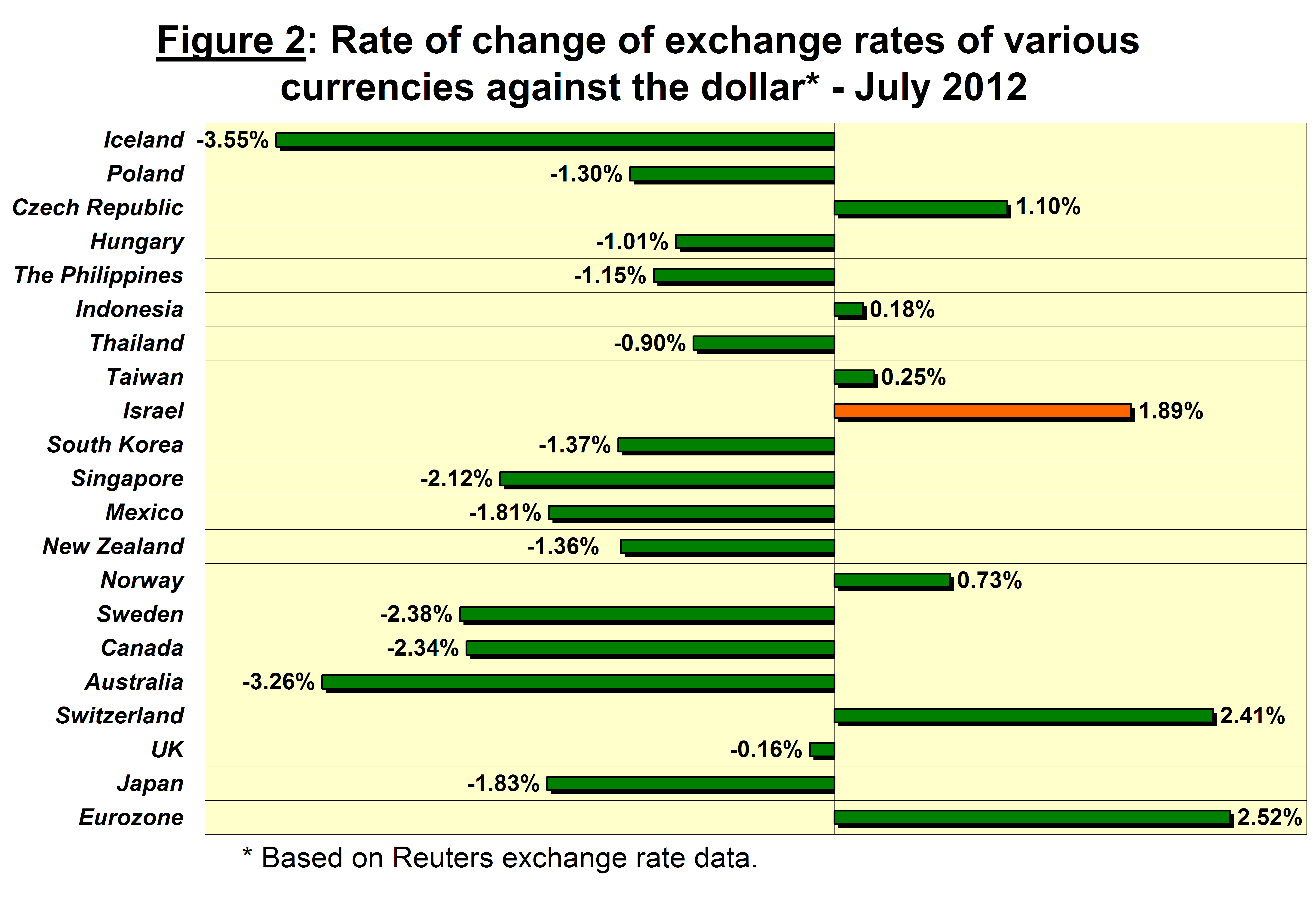

The shekel depreciated by about 1.9 percent against the dollar during July, and strengthened by about 0.5 percent against the euro. Against the currencies of Israel's main trading partners, in terms of the nominal effective exchange rate of the shekel (i.e., the trade-weighted average shekel exchange rate against those currencies), the shekel weakened by about 1.5 percent.

In July, the dollar strengthened by 2.5 percent against the euro and by 2.4 percent against the Swiss franc, but weakened against most other currencies in the world, weakening by about 1.8 percent against the Japanese yen, by 3.2 percent against the Australian dollar, and by 0.2 percent against the pound sterling.

The shekel's depreciation against the dollar, which began in August of last year, totaled about 17 percent in the past 12 months. The depreciation trend was in line with the trend of the dollar's strengthening worldwide, as the weighted exchange rate index for advanced economies indicated depreciation of 12 percent against the dollar, and the weighted exchange rate index for emerging economies indicated depreciation of 17 percent against the dollar. In terms of the nominal effective exchange rate the shekel weakened during this period by about 8% only.

2. Exchange Rate Volatility

Actual and implied volatility of the exchange rate increased

The standard deviation of changes in the shekel-dollar exchange rate, which represents its actual volatility, increased in July to 9.2 percent, compared with 6.8 percent in June.

The average level of the implied volatility in over the counter shekel-dollar options––an indication of expected exchange rate volatility––increased in July to 9.2 percent, compared with 8.8 percent in June.

For comparison, the implied volatility of foreign exchange options in emerging markets in July was 11.7 percent, down from 13.8 percent in June, and that in advanced economies was 9.5 percent, down from 11.3 percent in June.

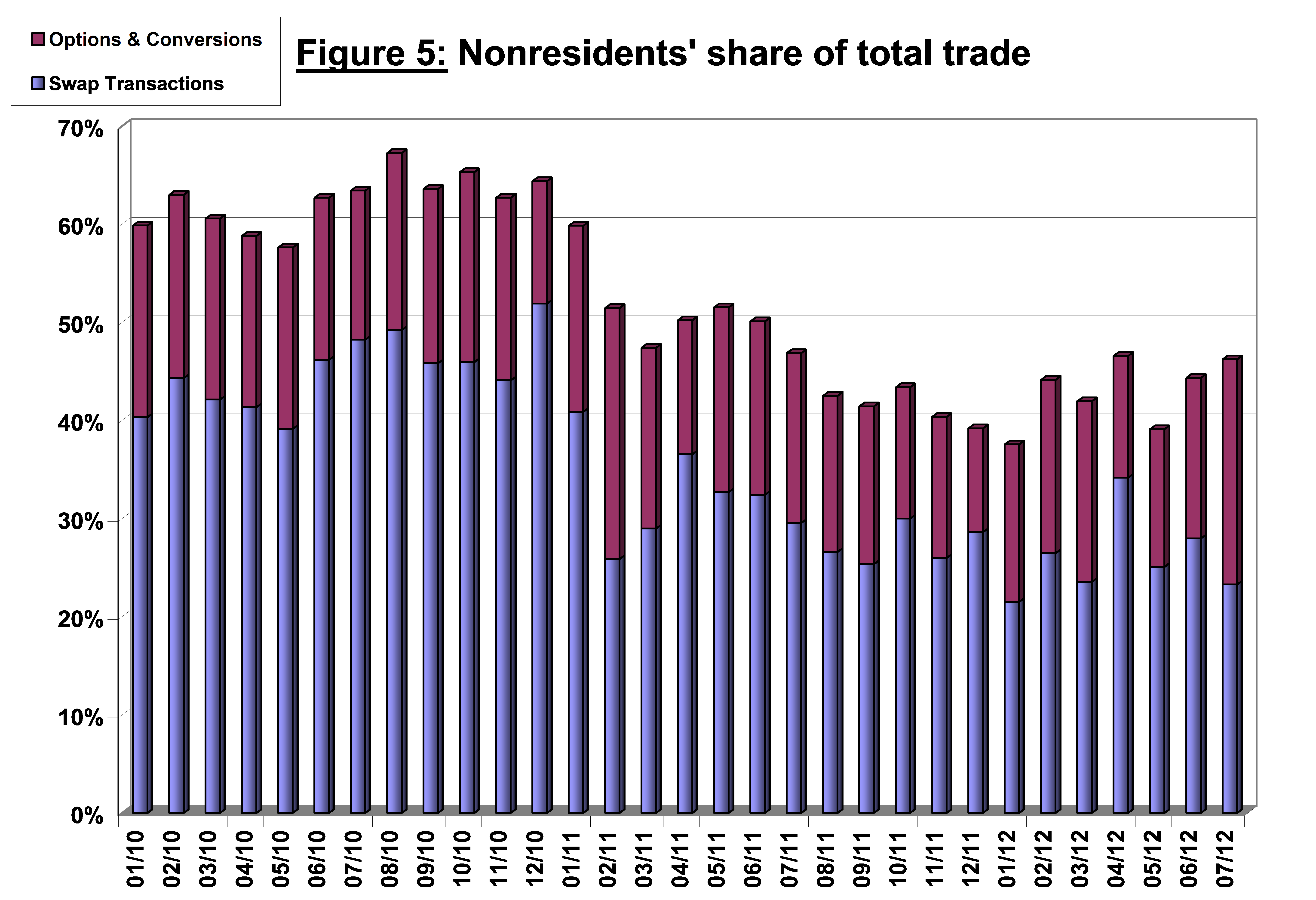

a Only one leg of the swap, i.e., the nominal value of the transaction (in accordance with the BIS definition).

b The notional value, that includes purchases and sales of put and call options.

c Including other entities such as portfolio managers, nonprofit organizations, national institutions, and those not included elsewhere.

d Total interbank trade, divided by 22