Home purchasing patterns by domestic investors, 2003–12

Excerpt from the "Recent Economic Developments" to be published soon: Home purchasing patterns by domestic investors, 2003–12.

To view this press release as a Word document

To view this press release as a Word document

To Research

To Research

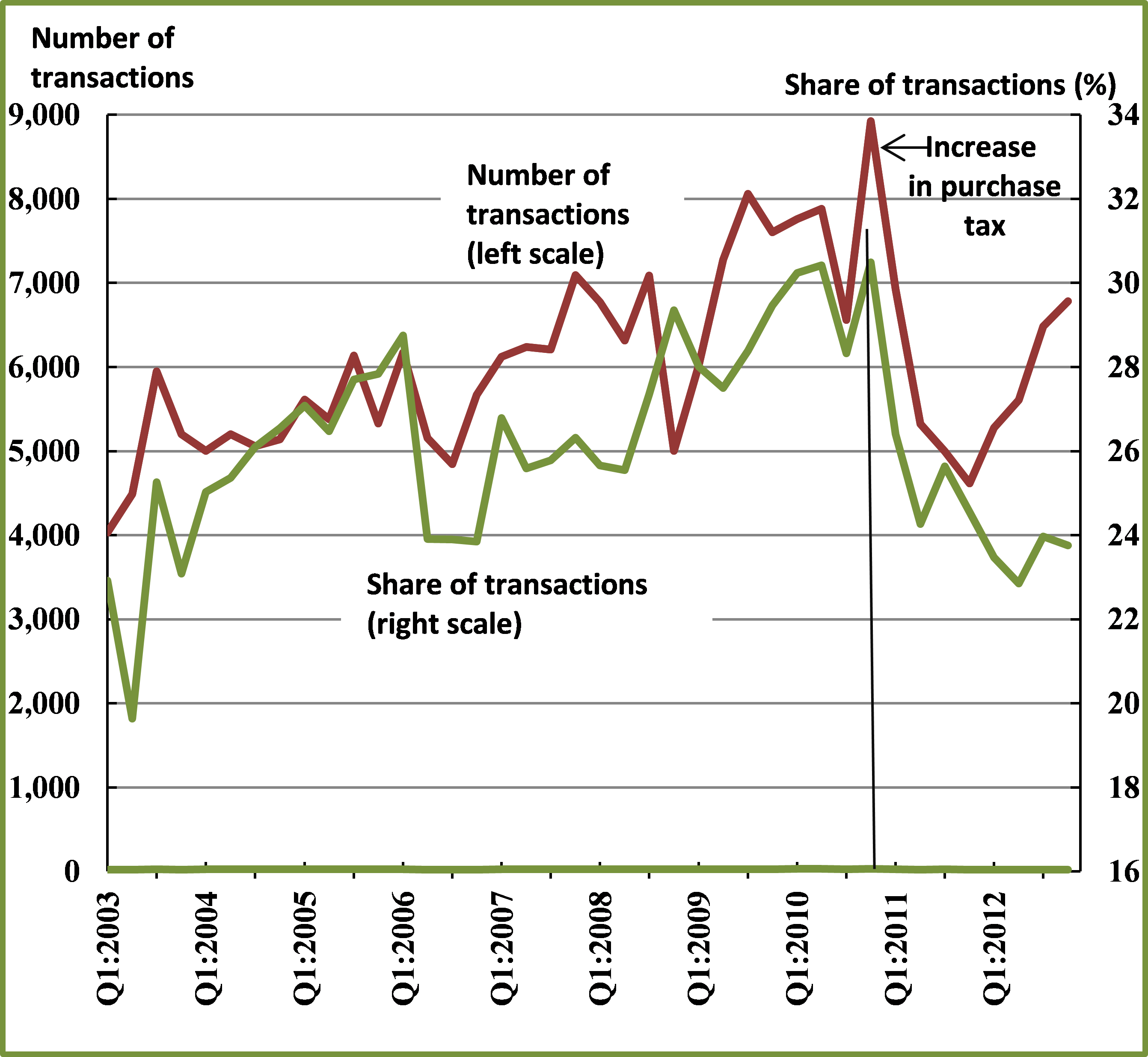

- Between 2007 and 2009, there was a marked increase both in the share of domestic investors’ transactions out of total residential purchase transactions, and in their absolute number. The increase began even earlier in the center of the country, and moved gradually into the periphery.

- In 2011 and 2012, measures were taken to lower the worthwhileness of such purchases for investors. As a result, their activity declined markedly—at the end of 2012, the likelihood that an apartment was purchased by an investor was only about 90 percent of what it was before the measures were enacted.

- Investors purchase relatively small homes, and this pattern has strengthened over time. They do not prefer homes in neighborhoods with a particular socioeconomic background, and the prices they pay are similar to the prices paid by other purchasers for similar homes.

- When the yield on renting an apartment increases by one percentage point, the likelihood that a given home will be bought by a domestic investor rather than by another purchaser increases by about 22 percent. When the interest rate rises by one percentage point, the likelihood declines by about 8 percent.

Between the years 2003 and 2012 the share of households owning two or more homes increased from 3.2 percent to 7.9 percent. Monitoring home purchasing patterns by domestic investors (hereinafter, “investors”) yields the following findings.

During 2003, their share in total purchases increased, possibly due to the imposition of capital gains tax in the capital market (Figure 1); toward the end of 2007, the share of purchases began to climb because the global crisis led to a prolonged decline in the value of financial assets and in interest rates, as well as a strengthening of the assessment that investment in real estate was worthwhile compared to other channels. At the height of the crisis, the absolute number of transactions declined for a short period. In 2011 and 2012, tax and credit policy measures, which were intended to reduce demand for investment homes, came into effect. In the period following the coming into effect of those measures, the number of transactions by investors, as well as their share in total transactions, contracted. At the end of the period reviewed their number and share had not returned to their levels of just before the policy measures were adopted.

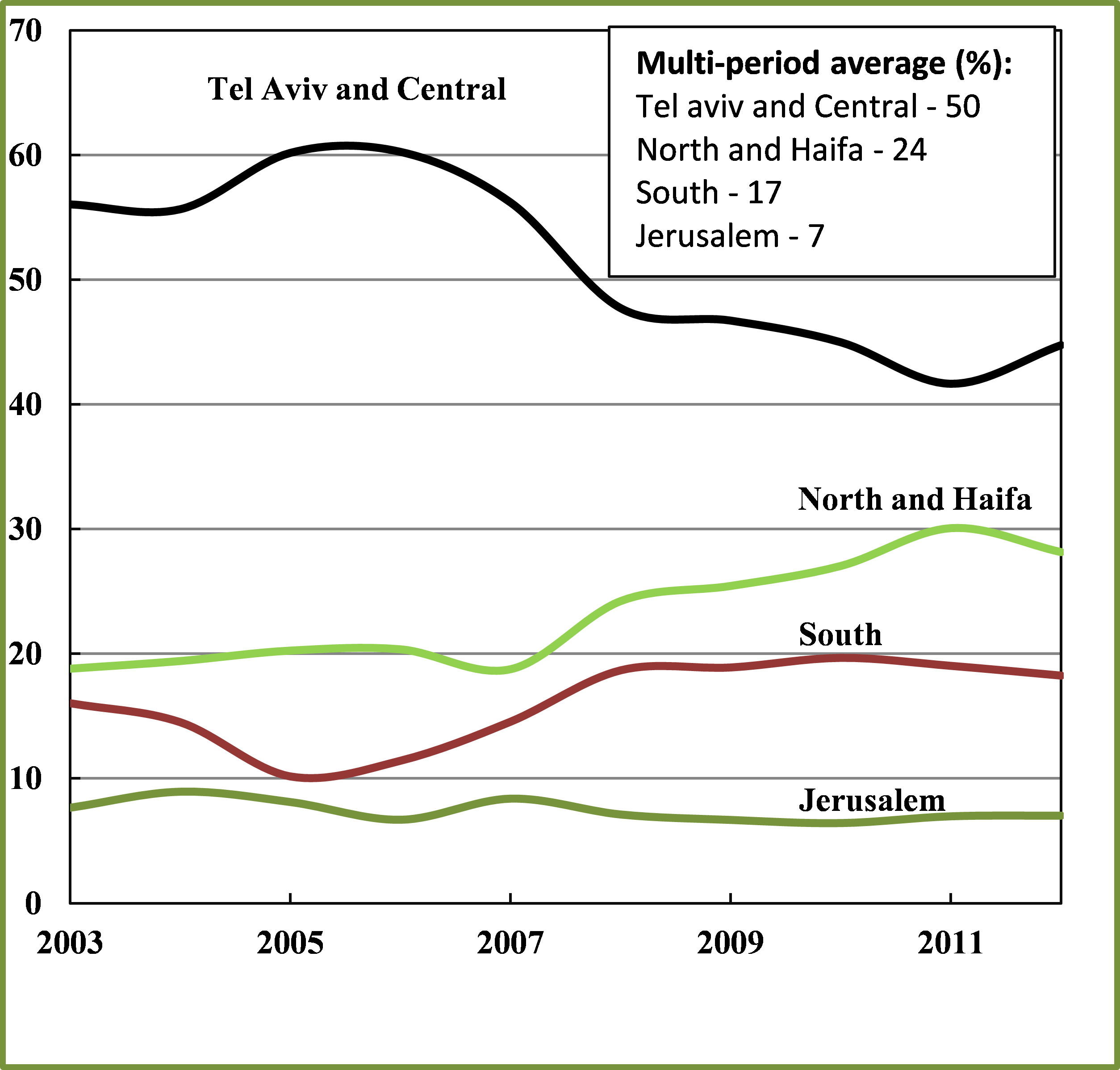

The share of purchases in the center of the country (Tel Aviv and Central district) out of total purchases by investors expanded greatly in the middle of the previous decade, and afterward in the periphery (Figure 2). A possible explanation for this is that the relative prices of homes in the center of the country increased greatly in the beginning of the period and accumulated capital gains, with a similar phenomenon taking place in the periphery in the rest of the period. Furthermore, yields on renting out homes declined throughout the country, although they remained relatively high in the north even during the second half of the last decade.

Throughout the entire reviewed period, the share of investors’ purchases in the Tel Aviv district out of total purchases in the district (about 29 percent) was much higher than the shares in the rest of the country, apparently due to strong demand for residential rentals.

An econometric examination of the factors affecting the likelihood that an investor—rather than another purchaser—has purchased a given home, indicates that investors tend to purchase homes that are relatively small. The explanation is that the return on renting out smaller homes is relatively higher, and declined by a more moderate rate than the return on renting out a typical home. Investors have no preference regarding the age of the home, and they also do not prefer a first-hand home over a second-hand home. Investors have a strong tendency to purchase homes in the Haifa and Tel Aviv districts, a less-strong tendency to purchase in the periphery, and a relatively weak tendency to purchase in the central and Jerusalem districts. They tend to purchase homes in large Jewish communities.

With regard to the socioeconomic background of the neighborhood in which the home is located, it was found that investors’ preference is similar to that of other purchasers. Given the characteristics of the home and the environment, investors purchase homes at prices similar to those paid by other players in the market, a finding which may show a competitive market.

The more the surplus yield from renting out an home—meaning the spread between the yield on renting out a home (by area and home size) and the yield on an alternative investment track such as the interest on CPI-indexed deposits for ten years or more—increases, the more the likelihood that an investor (rather than another purchaser) has purchased a given apartment will increase. Every increase of one percentage point in the surplus yield increases the probability by 22 percent. Short term interest rates also have an effect on investors’ behavior, and every 1 percentage point increase in the interest rate reduces the likelihood ratio by about 8 percent. It seems that investors respond more strongly than others to changes in the expected interest rate since they are more motivated by economic considerations. In the period following the coming into effect of the measures, the interest rate effect declined by a third.

In 2011 and 2012 the relative likelihood that an investor, rather than another purchaser, purchased a home was about 90 percent of the probability before the adoption of tax and credit policy measures, similar to the average likelihood in 2003–07.

Figure 1

Home purchases by investors, 2003—12 (Quarterly) |

SOURCE: Ministry of Finance

Figure 2

The distribution of investors' home purchases by district,

2003—12 (percent)

SOURCE: Israel Tax Authority and Bank of Israel Calculations.

Owners of a second or additional home, who are not nonresidents. The group does not include those who are moving to different accommodations but have not yet sold their first home. Furthermore, since the beginning of 2003, the State of Israel has imposed a tax on Israelis’ income from rentals abroad, and it is possible that this diverted investments to homes in Israel. In April 2003, there was a sharp decline in the share of investors’ transactions, which is connected with the outbreak of the Second Gulf War.

![]() To view this press release as a Word document

To view this press release as a Word document