This press release as a Word document

This press release as a Word document

§ In the second quarter of 2012 the value of the public's financial assets portfolio declined by about 0.4 percent in real terms, and reached NIS 2.6 trillion at the end of June.

§ The domestic bonds and shares portfolio declined by about NIS 24 billion, due mainly to the decline in prices on the Tel Aviv Stock Exchange (TASE); however, the net flows into short term deposits and government bonds increased.

§ The value of the public’s assets portfolio abroad increased by some NIS 4 billion, mainly due to investments in foreign bonds and shares.

§ As a result of the above developments, the share of risk assets in the portfolio decreased by one percentage point in the second quarter, while the share of deposits and government bonds increased.

§ There was a net increase in the section of the portfolio managed through mutual funds, primarily through net new investments in government bond funds and money market funds.

1. The total assets portfolio

In the second quarter of 2012 the value of the public's financial assets portfolio decreased by about 0.4 percent in real terms, and reached NIS 2.6 trillion at the end of June.

There was no significant change in the nominal value of the balance of the assets portfolio in the quarter, but the composition of the portfolio did change: there was a decline in the share of stocks and corporate bonds (primarily due to price declines), while there was an increase in the net flows into local currency deposits and government bonds.

In the second quarter, there was a decline of about 1 percentage point in the share of risk assets in the portfolio, and a decline of about 0.5 percent in the share of tradable assets. At the same time, there was an increase in less risky assets in the portfolio—an increase of about NIS 25 billion in deposits, cash, and government bonds.

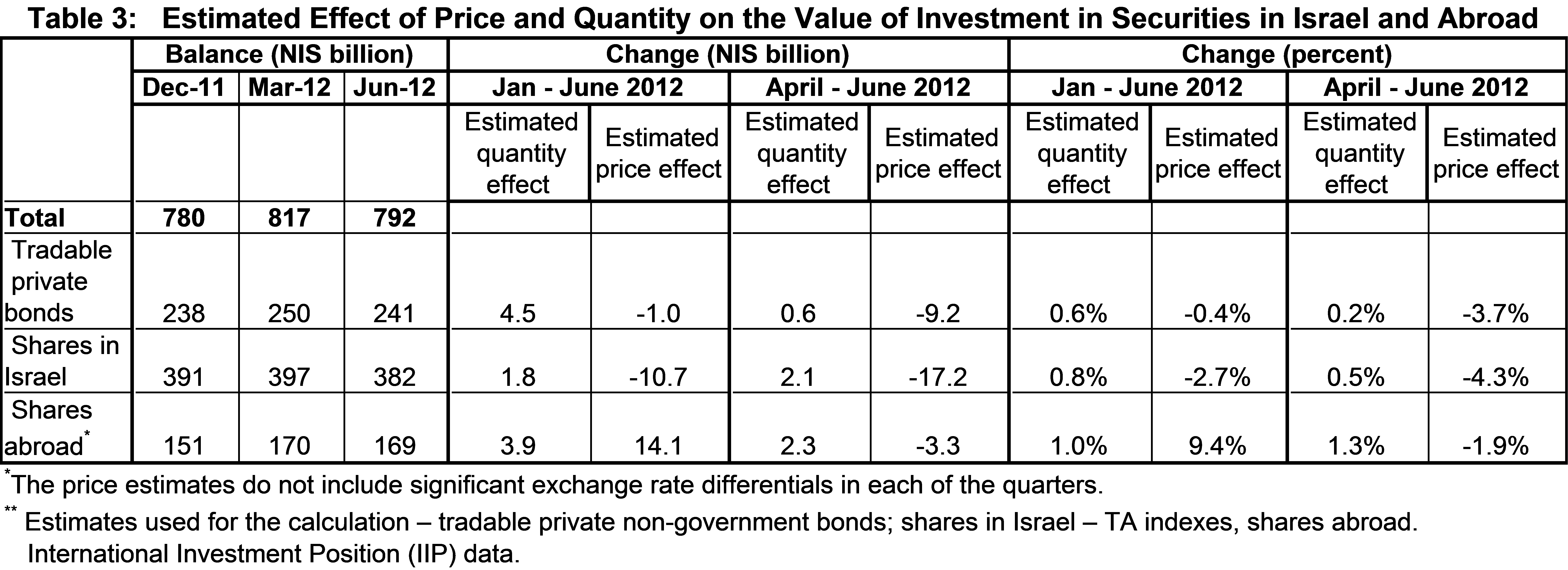

2. The securities portfolio, by main components

Shares in Israel

In the second quarter of 2012 the balance of shares held by the public decreased by some NIS 15 billion (3.8 percent), to NIS 382 billion. The decline was due primarily to the decline in share prices on the TASE, which was slightly offset by net investments of about NIS 2 billion. This was in contrast to an increase in the value of the shares component in the previous quarter due to increased prices on the local stock market.

Corporate bonds

In the second quarter of 2012 the value of negotiable corporate bonds in the portfolio declined by about NIS 9 billion, and at the end of June reached NIS 241 billion. The decrease was due mostly to a decline amounting to NIS 9.2 billion in bond prices, which were partially offset by net bond issues. These were in contrast to price increases and bond issues in the previous quarter, which contributed to an increase in the portfolio balance.

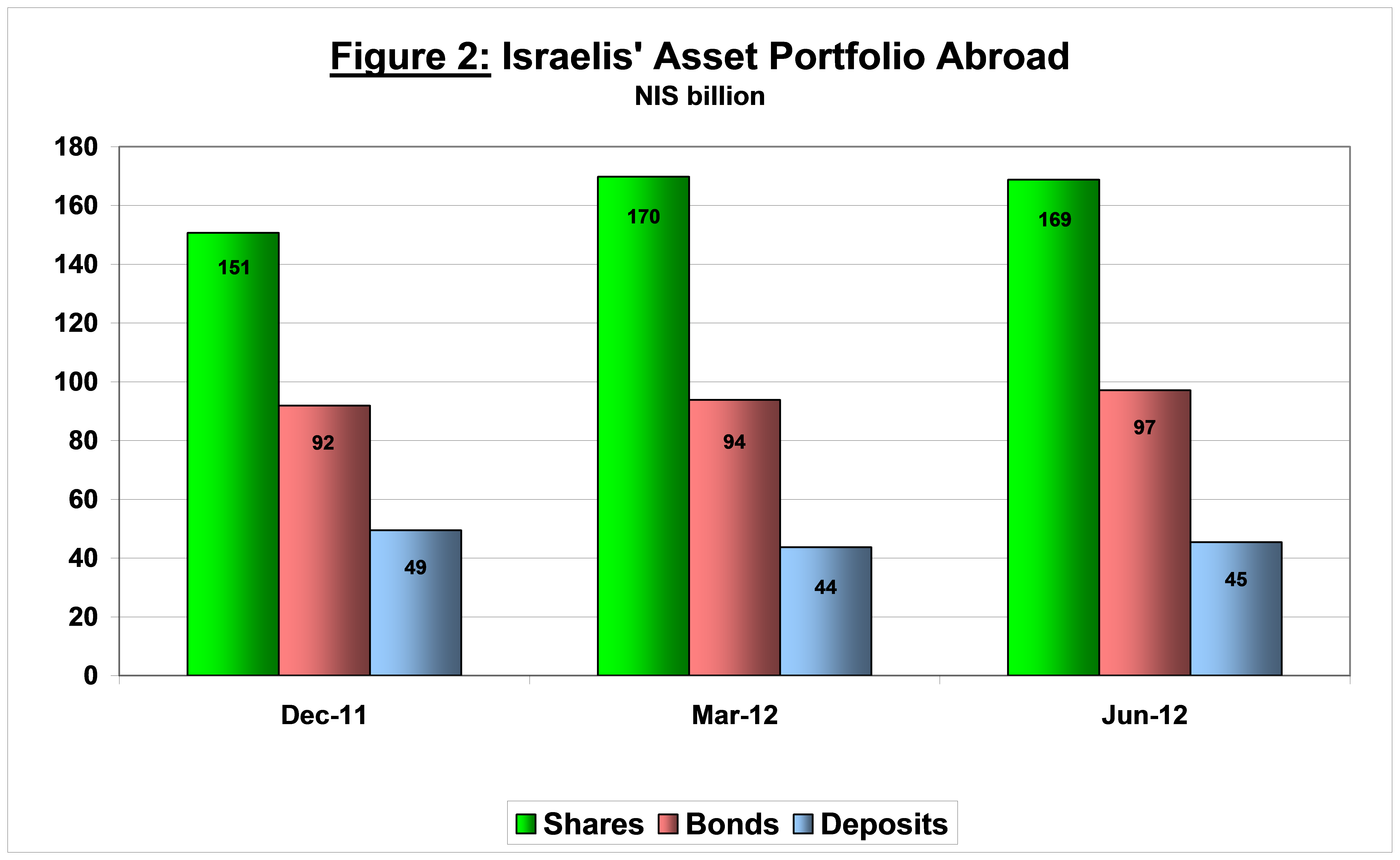

The assets portfolio abroad

In the second quarter of 2012 the value of the public's assets portfolio abroad increased by about NIS 4 billion (1.3 percent), to NIS 311 billion. The shares component declined by about NIS 1 billion (0.6 percent) and reached NIS 169 billion––due to declines in share prices in stock markets abroad (NIS 3.3 billion) which were partially offset by net investment abroad by Israelis (NIS 2.3 billion). In addition, there were increases in the value of holdings of foreign bonds (NIS 3.2 billion), and net deposits abroad (NIS 1.7 billion). The increase in the value of the portfolio in shekel terms was also affected by the 5.6 percent depreciation of the shekel against the dollar in the second quarter.

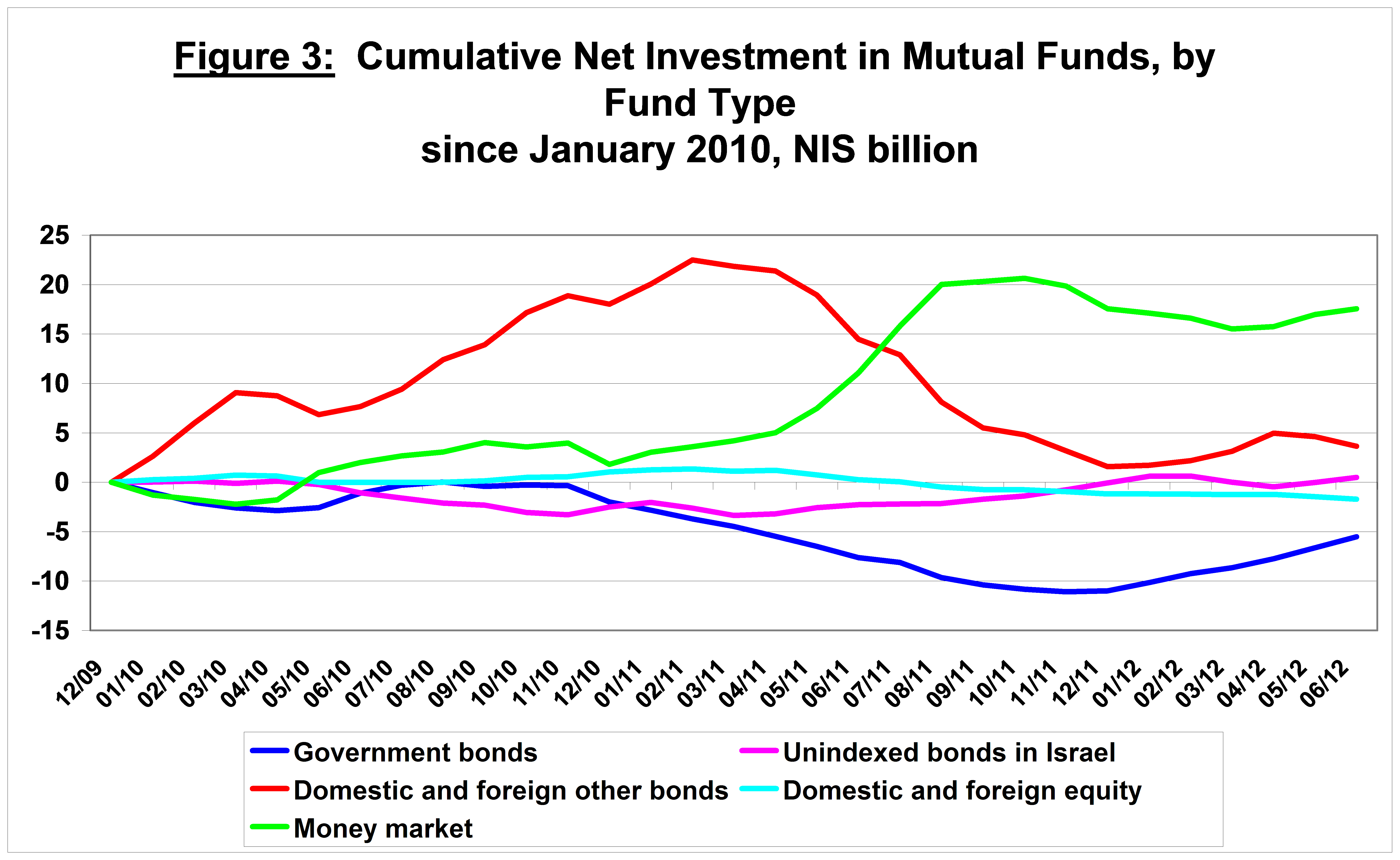

3. Mutual funds

The value of the portfolio managed by Israeli mutual funds was NIS 152 billion in June 2012, about 6 percent of the public's total asset portfolio, and about 12 percent of the tradable assets portfolio in Israel. (Mutual fund assets are included in the portfolio analysis in the previous sections.) In the second quarter of 2012, mutual fund assets increased by about NIS 4 billion (3 percent)—the combination of a NIS 5.5 billion surplus of new investments over redemptions, and price declines in the markets.

Most of the new investments (about NIS 5.7 billion) were in funds specializing in government bonds and in money market funds. In the second quarter, there was a change in trend among money market funds: there were net inflows of about NIS 2 billion, compared with net redemptions of NIS 5 billion between the end of the fourth quarter of 2011 and March 2012.

* Further information on the public's assets portfolio can be seen on the Bank of Israel's website www.bankisrael.gov.il .