The production and supply of electricity are usually concentrated at a small number of companies, since significant economies of scale exist in this sector, particularly in the segment of transmission. This concentration, and the fact that advanced economies are dependent on the reliable supply of electricity, requires regulation and supervision of the sector, which if carried out efficiently, can reduce production costs (which are primarily determined by the capital invested in the building of power stations and by the cost of fuel).

Accordingly, many countries regulate the supply of electricity, even in markets that transitioned to a competitive structure. This control requires the accurate prediction of future electricity consumption, since it is desirable to avoid both undercapacity, which may disrupt the supply of electricity to consumers, and overcapacity, which imposes unnecessary capital costs on the economy. Forecasting future demand makes it possible to optimally plan the number and types of additional power plants that will be required and to sign long-term contracts for the supply of fuels.

This survey presents several of the main characteristics of the supply and demand of electricity in Israel, which may be expected to influence the planning of the electricity system in coming years.

1. The demand for electricity in Israel during the coming decades

Long term planning for the electricity sector necessitates forecasting the demand for electricity. It is generally assumed that the rate of growth in electricity demand parallels the rate of growth in GDP.[1] However, a closer examination reveals a different picture. Thus, although changes in the level of economic activity have a considerable impact on changes in the demand for electricity, there are also additional factors, primarily the relative price of electricity, the composition of GDP, the availability of electricity substitutes, consumption habits of households and technology, which also play a part. These factors affect the intensity of electricity use, which is defined as the amount of electricity used per unit of output.

The rate of growth in economic activity (GDP): This is the most important factor in the determination of the demand for electricity. A high level of economic activity, accompanied as well by a rise in the standard of living, increases demand and vice versa. According to forecasts, GDP in coming years will grow at a slower rate than it did in recent decades (due to, among other things, the lower rate of growth in the working-age population) and therefore it is expected that the consumption of electricity will also grow at a slower pace than in the past.[2]

The price of electricity: An analysis conducted by the Bank of Israel shows that the price of electricity directly influences the consumption of electricity by households—an increase in price reduces consumption of electricity by about 25–30 percent of the change in price, and vice versa. The price of electricity has an indirect effect on the manufacturing and service industries: an increase in price reduces the elasticity of electricity consumption with respect to growth in GDP. That is, a decline in the price of electricity leads to greater marginal investment in electricity-intensive technology. This may reflect the gradual relative expansion of electricity-intensive industries at the expense of other industries and/or an increase in the intensity of electricity use in all industries.

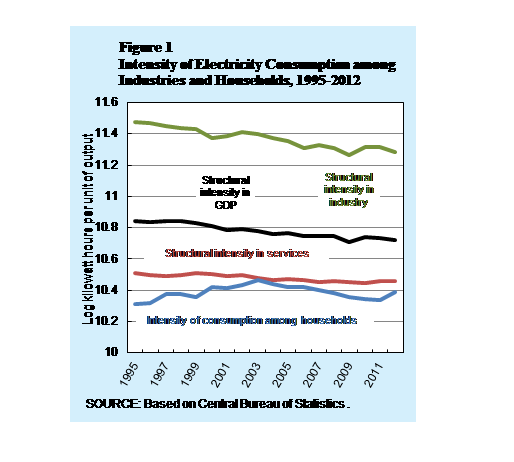

The composition of GDP: The structural changes in Israel’s economy have also influenced the demand for electricity by way of the elasticity of electricity consumption with respect to growth in GDP. In recent decades, the share of service industries within Israeli GDP has increased, and since the intensity of electricity use in services is less than that in manufacturing, the result has been a drop in the intensity of electricity use in the Israeli economy. Furthermore, within both the service and manufacturing sectors, the share of industries with relatively low electricity usage has grown. In manufacturing, the share of high-technology industries (pharmaceuticals and electronic components) has grown, as has the share of financial and other business services within the service sector. These trends can be seen in Figure 1, which shows that the structural intensity of electricity use in the various industries of the economy, i.e. the intensity resulting from structure,[3] has been characterized by a prolonged decline over the last two decades. If these trends continue, they are expected to lead to a continuation of the decline in the intensity of electricity use and a reduction in the rate of increase in demand for electricity relative to GDP.

Availability of electricity substitutes: The reform in the fuel sector in the early 1990s led to a significant drop in the intensity of electricity consumption. Among other things, the reform permitted fuel products to be freely imported and these products (primarily fuel oil) serve as a substitute for electricity in production processes in some industries. A similar process may take place in Israel during the coming decade when natural gas, which is a close substitute for electricity, becomes more available to energy-intensive factories and perhaps also to households for heating. Thus, the greater use of natural gas will moderate the growth in demand for electricity in Israel.

Consumption habits of households: Households account for about 30 percent of the economy’s total consumption of electricity. This share has been quite stable since the beginning of the 1990s and reflects a lower rate of growth than that of GDP. Household consumption has grown at a moderate rate even though there has been a massive increase in the installation of residential air conditioners during the last two decades. Since the proportion of households owning an air conditioner is expected to reach close to 100 percent by the beginning of the next decade, it can be expected that there will be a subsequent drop in the rate of growth in the consumption of electricity by households.

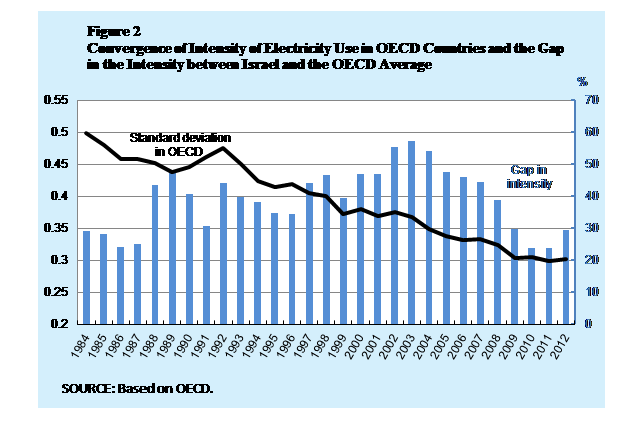

These findings, i.e., the past decline in the intensity of electricity use and the forecast that this trend will continue in coming decades, are consistent with the significant downward trend in OECD countries since the 1970s, which was accompanied by a narrowing of differences between the various countries. This is reflected in Figure 2 which indicates that, during the last decade, the intensity of electricity use by the Israeli economy declined toward the OECD average and that the variation between countries is gradually disappearing as intensity declines.

2. The supply of electricity in Israel during the coming decades

Electricity production in Israel is expected to become less concentrated in the coming decades, which is due in large part to the increased availability of natural gas and the transition to the use of renewable energy. These trends have a major impact on the planning of the supply of electricity in Israel since they lead to greater flexibility in planning, while at the same time they require building greater reserve production capacity, which will exceed the expected rate of growth in total demand. This reserve capacity will become necessary since the production of electricity from renewable sources (such as solar energy) varies during the course of the day, by season, and from year to year.

Until 2013, the Israel Electric Corporation (IEC) produced almost all of the electricity in Israel, apart from a small amount produced by factories. Since 2013, a significant amount of privately owned production capacity has been added and already in 2016 private producers are expected to account for about 30 percent of the electricity in Israel. This change is the result of the government’s decision to halt the construction of any additional power plants by the IEC, as well as technological innovations. Most of the electricity produced in the new private power plants is sold in bilateral deals to private consumers and the rest is sold to the IEC. In coming years, additional producers are expected to enter the market and the share of private production is expected to reach about 40 percent. The integration of private producers into the system will require the development of mechanisms for coordination between the private producers and the national electricity grid. This is because the national electricity grid is obligated to purchase the surplus production of the private producers, while producers’ first obligation is to their private customers. Therefore, the private producers cannot commit themselves to the timing or quantity of delivery to the national system.

The size of the gas reserves off the coast of Israel enables Israel to expand the use of natural gas in the economy over the course of the next few decades. The expanded availability of natural gas will make it possible to establish relatively small power plants, which will produce electricity for self-consumption and will sell the surplus to the electricity system. This change is likely to be beneficial for large consumers (such as kibbutzim, shopping malls, hospitals and factories). However, the exit of these consumers from the national electricity grid will not necessarily make it possible to reduce, in parallel, the production capacity of the system, since they will continue to rely on the national system for backup.

Another process that is expected to have an impact on the structure of the electricity sector in Israel is the transition to renewable energy. This process is driven by increased undertaking of international standards regarding environmental issues, as reflected in the Climate Change Conference in Paris in 2015. However, this process is dependent on overcoming fairly significant engineering and statutory barriers.[1] Up until now, the proportion of electricity produced from renewable energy in Israel stood at less than 2 percent. However, following decisions by the government leading up to the conference, this proportion is to grow to at least 13 percent within a decade and to at least 17 percent by 2030.

In addition to the pressure originating from international norms, another important development is the decline in the cost of renewable energy from solar panels as a result of technological innovation. The cost of solar energy is expected to eventually equal the cost of producing energy from conventional sources, such as natural gas. However, the large-scale introduction of renewable energy will require the expansion of the capacity of the electricity network. Furthermore, there are still major technical barriers in the field of solar energy, primarily the development of the ability to store electricity at low cost (since solar energy can be produced only during the daytime and is also affected by weather conditions). The existence of these barriers means that the system will require reserves of production capacity in order to meet demand during the nighttime and on cloudy days.[2] Therefore, the technological changes will at the same time require the judicious management of the electricity supply system.

3. Conclusion

The rate of growth in demand for electricity is expected to slow during the coming decades, among other reasons due to the growth in the share of industries that are not electricity-intensive. On the supply side, it is expected that there will be greater dispersion of electricity production among various producers (accompanied by greater potential for the activity of small producers who will produce electricity from natural gas and renewable energy) and greater use of renewable energy.

While the more moderate growth in demand will make it possible to expand production capacity at a relatively moderate rate, the increasing number of producers, which is partly due to the potential for private production in relatively small facilities, and the use of renewable energy will require significant reserve capacity in the central system, with its accompanying cost. In order to reduce this cost, it is important to develop tools for regulating demand. To this end, it is possible to exploit the proven effect of changes in the price of electricity on the demand for electricity and to make use of existing technologies, such as electronic consumption meters, in order to enable the pricing of electricity according to the variation in demand during the day. At the same time, it is possible to use existing technologies to develop a mechanism that will shift the costs of backup onto the entities that choose to establish independent production facilities, in order for the burden not to be borne by consumers in general.

The trends on the production side are increasing the complexity of the system, but at the same time are reducing the risks involved in forecasting demand, and they will apparently make it possible to maintain smaller safety margins in the planning of production capacity. This is because in coming years it will be easier and cheaper to adjust production capacity to unforeseen changes in demand. This flexibility will be made possible by the production of electricity using natural gas and solar energy in small, and even micro, facilities, in contrast to production using coal or oil (the dominant sources of energy in the past) which requires huge facilities (with all that it implies for construction time, allocation of land, and use of engineering, financial, administrative and statutory resources).

The systemic significance of these various trends is that the electricity sector in Israel will become increasingly complex in coming years, and in turn it will become even more important to have a professional planning and regulatory capability to deal with these challenges.

[1] See “Recommendations of the Steering Committee for the Reform of the Israel Electric Corporation and the Electricity Sector”, March 2014. (Hebrew)

[2] Changes in the growth rate of the working-age population, due to, for example, a wave of immigration, are likely to accelerate the rate of increase in GDP. Other changes, such as an increase in the growth rate of segments of the population that are characterized by low employment rates and levels of productivity, are liable to moderate it. The planning of the electricity sector should take this uncertainty into account.

[3] In order to calculate the structural intensity of each sector, we took the proportion of each industry in the sector’s output and multiplied by its electricity consumption per unit of output (according to the input-output tables for 2006). The intensity of electricity consumption among households is calculated as the expenditure on electricity consumption divided by total private consumption.