To view this message as a file click here

- An increase in the Bank of Israel interest rate is reflected in a change in the composition of the public's asset portfolio, reducing the share of risky assets. Investors redeem investments from equity and bond funds and invest more in money market funds.

- The rise in the interest rate also causes a decrease in liquidity in the equity and bond markets, but the change in investment composition in these funds explains only a small part of the liquidity reduction.

- While mutual funds sell government bonds, corporate bonds, and stocks in response to interest rate hikes due to redemptions by fund holders, institutional investors act in the opposite direction and buy these assets in response to the rate increase.

The study, conducted by Noam Ben Ze'ev, Dr. Sigal Ribon, and Dr. Roy Stein from the Bank of Israel Research Department, explores the response of mutual fund investors to changes in the Bank of Israel interest rate and the effects of this response on liquidity in the financial asset markets. Mutual funds are described in economic literature as financial intermediaries that can amplify negative trends. This is because, in cases where mutual fund investors redeem their investments on a large scale and quickly, a liquidity shortage may arise in asset markets (e.g., stocks and bonds). Such a phenomenon was observed at the beginning of the COVID-19 pandemic. The study examines whether interest rate changes may cause redemptions on a scale that could significantly impact market liquidity. Using daily data on mutual fund inflows and outflows, the researchers found that an interest rate hike leads mutual fund investors, who are primarily households, to shift from funds specializing in government and corporate bonds and stocks to money market funds. They also found that the interest rate hike is reflected in a decrease in liquidity in these asset markets, which is partly reflected in an increase in the bid-ask spread. However, the contribution of mutual fund movements to the liquidity decline following an interest rate change is not significant.

Mutual funds allow their investors to redeem their money on any given day, distinguishing them from other financial intermediaries such as banks, pension funds, or insurance companies. When many investors redeem their money from mutual funds simultaneously, fund managers are forced to sell the financial assets they hold to obtain cash to distribute to investors. Such sales may create pressure in these asset markets, in terms of both price and liquidity—the ability to buy and sell assets at a certain volume without significantly affecting the price.

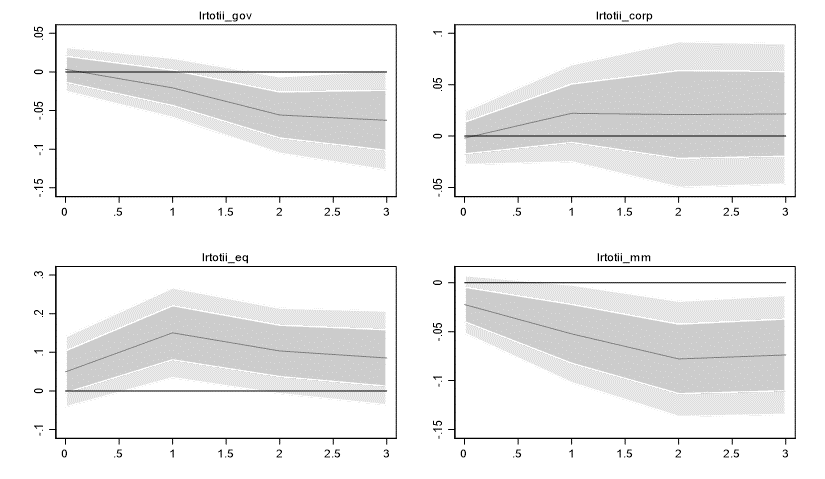

The study found that following an unexpected interest rate hike by the Bank of Israel, daily redemptions of about 0.2–0.4 percent of the assets of bond and equity funds can be identified, accumulating to about 6–10 percent of their total assets, and there are daily inflows to money market funds amounting to about 1 percent of their assets, accumulating to about 30 percent in total, which are larger in shekel terms than the outflows from bond and equity funds. This means that the source of the funds flowing into money market funds also comes from other assets beyond those in specialized funds (Figure 1).

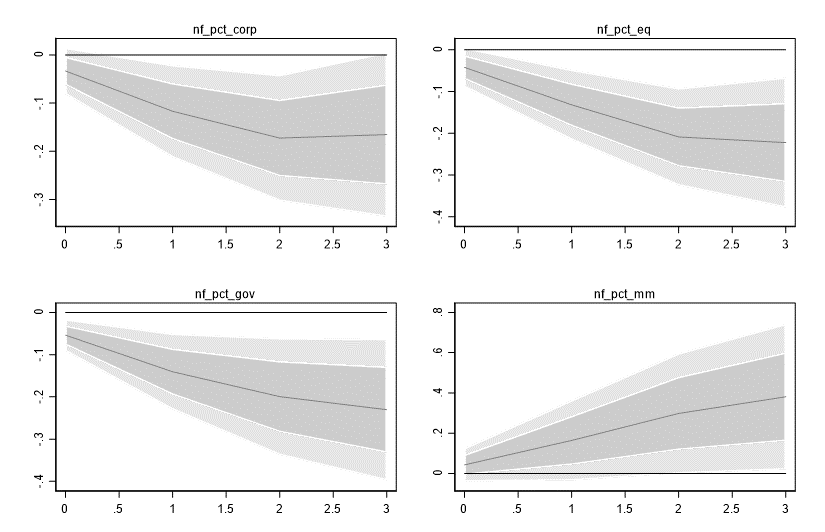

To complete the picture of the response of different financial intermediaries, the researchers compared the response of mutual fund investors to that of institutional investors (pension funds, provident funds, and insurance companies) to an interest rate hike. For this analysis, the researchers used monthly data on the holdings of institutional investors. The cumulative response of these entities is shown in Figure 2. As this figure shows, institutional investors act in the opposite direction to mutual funds in response to an interest rate hike. While mutual funds sell bonds and stocks and purchase short-term government bonds (Makam) to adjust their assets to fund redemptions, institutional investors sell Makam (and to a less statistically significant extent, also government bonds) and purchase stocks and corporate bonds. This finding aligns with the common approach in economic literature discussing the differences between different types of financial intermediaries, and is mainly due to the longer investment horizon of institutional investors.

Figure 1: The cumulative response of various categories of mutual fund investors to an increase in the interest rate

Figure 2: The cumulative response of institutional investors to an increase in the interest rate