To view this message as a file click here

To view the data as an excel file click here

The following is a summary of developments in nonfinancial private sector debt[1] in the fourth quarter of 2023:

- In the fourth quarter of 2023, in view of the Swords of Iron War, the balance of nonfinancial private sector debt declined moderately, by approximately 0.3 percent. This marked the first decline since the second half of 2020. This followed a slowdown in the growth rate of this balance, which began in the second half of 2022, continued, both with regard to the business sector and with regard to the household sector.

- The balance of business sector debt declined by about 0.4 percent (about NIS 5 billion) during the quarter, to about NIS 1.3 trillion. This was mainly due to the appreciation of the shekel against the US dollar and net payments of debt raised abroad (loans and bonds).

- The balance of household debt also declined during the quarter, by about 0.2 percent (about NIS 2 billion), to about NIS 792 billion: a combination of an increase in the balance of housing debt, which was fully offset by a decline in the balance of nonhousing debt. The increase in the balance of housing debt moderated, due to a slowdown in new mortgage borrowing from banks, which continued this year in view of the increase in the Bank of Israel interest rate, and intensified following the outbreak of the war. The decline in the balance of nonhousing debt was due to a decline in the outstanding debt owed to the major lenders—banks, credit card companies, and institutional investors.

- The slowdown in the annual rate of change of outstanding debt, both housing and nonhousing, which began in the second half of 2022, continued. At the end of 2023, the rate of change in housing debt was 5 percent, and the rate of change in nonhousing debt was -4 percent.

The nonfinancial business sector’s[2] outstanding debt

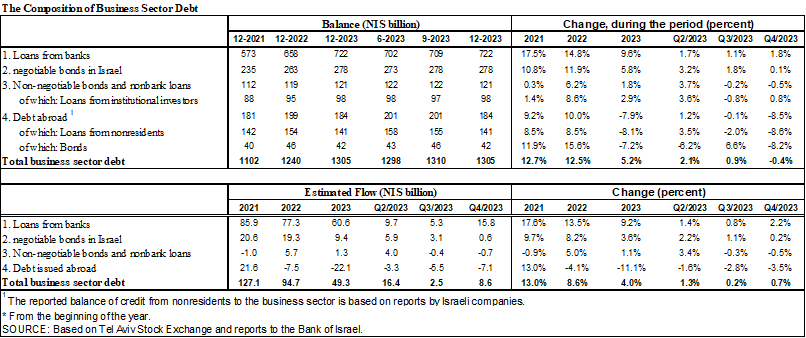

- In the fourth quarter of 2023, in view of the Swords of Iron War, the balance of business sector debt declined moderately, by approximately NIS 5 billion (0.4 percent), to a level of about NIS 1.3 trillion. This was the first decline since the second half of 2020, and continued the slowdown in the balance’s year-over-year growth rate, which began in the second half of 2022 and reached about 5 percent.

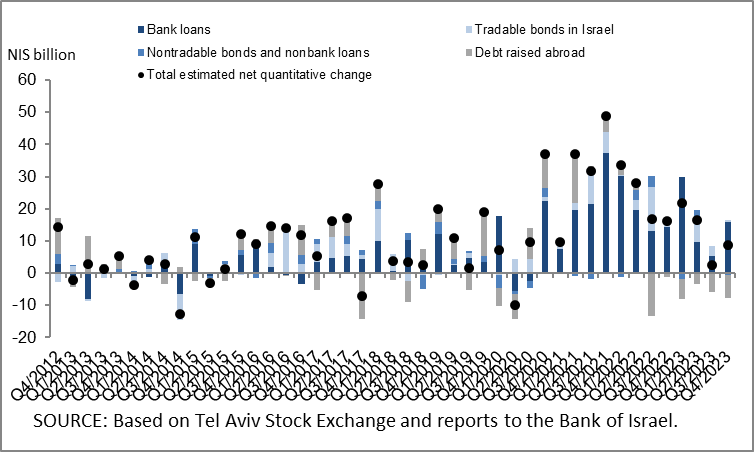

- The decline in the debt balance in the quarter derived mostly from an appreciation of the shekel by about 5.2 percent vis-à-vis the US dollar, which lowered the value of debt that is foreign currency-denominated or foreign currency-indexed, as well as net repayments of debt raised abroad (loans and bonds), which were partly offset by net debt raised through bank loans and tradable bonds in Israel. These all led to total net debt raised in the quarter of about NIS 9 billion, which is lower than the quarterly average of the past three years. (Figures 1, 2).

- As a result of these effects, the slowdown in the year-over-year growth rate of the balance of debt, mainly to nonbank lenders, that began in the second half of 2022 continued in the fourth quarter. However, the annual growth rate of debt owed to banks remains high (about 10 percent), and the growth rate of debt to nonbank lenders was near-zero, compared to 4 percent in the previous quarter. It should be noted that in the past two-and-a-half years, the annual growth rate in the balance of debt to banks has been higher than the annual growth rate of debt to nonbank lenders.

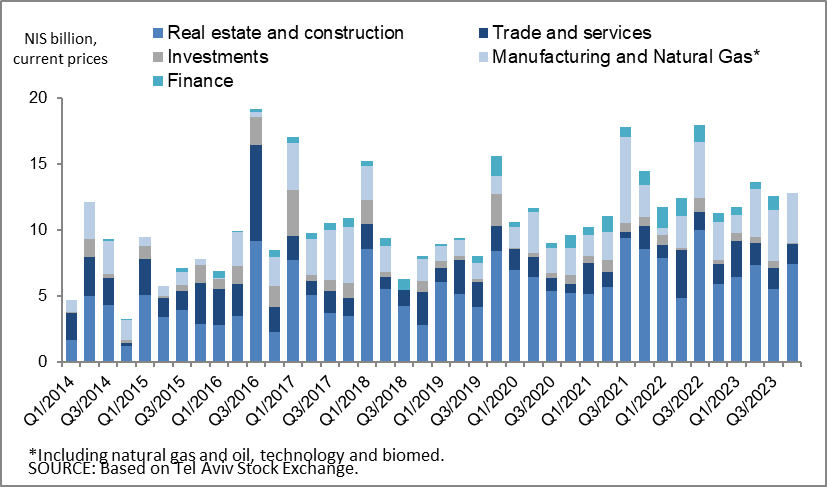

- In the fourth quarter, the business sector issued about NIS 13 billion in bonds, with about two-thirds of them issued in December, slightly higher than the average quarterly issuance of the past 4 quarters (about NIS 12 billion per quarter). About 58 percent the issuances in this quarter were carried out by companies in the real estate and construction industry, which continues to lead in bond issuances, similar to previous years (Figure 3).

- In January 2024, the business sector issued bonds worth about NIS 10 billion, significantly higher than the monthly average in the fourth quarter (about NIS 4 billion). Companies from the real estate and construction industry accounted for about 46 percent of the bond issuances in January.

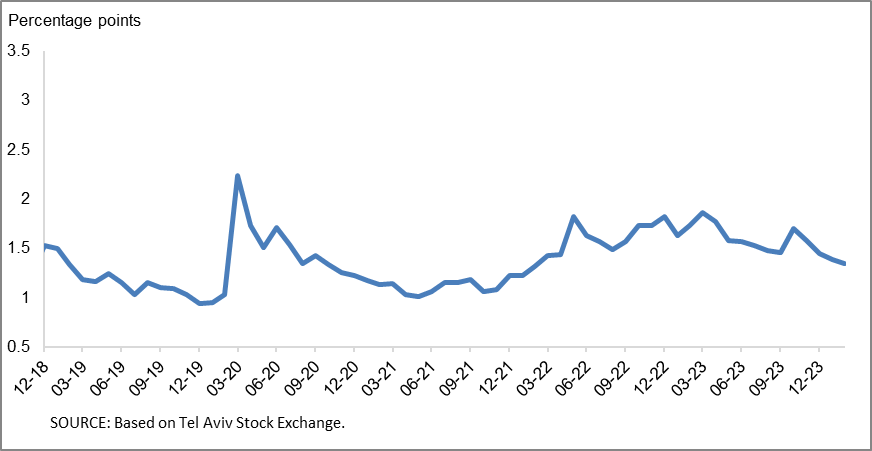

- In October 2023, in view of the war, the spread[3] between yields on corporate bonds that are included in the Tel Bond 60 Index and the yields on CPI-indexed government bonds widened to about 1.7 percentage points, and then narrowed again in the final months of the year by about 0.3 percentage points, to about 1.44 percentage points. In January and February 2024, the spread continued to narrow, to about 1.35 percentage points, reaching a level even lower than the prewar level (Figure 4).

Table 1: The Composition of Business Sector Debt

Figure 1: Estimated Net Quarterly Quantitative Change in Business Sector Debt

Figure 2: Rate of Change (Year on Year) in the Business Sector's Bank and Nonbank Debt

Figure 3: Nonfinancial Business Sector Bond Issuance during the quarter, by Industry

Figure 4 : Spread between Indexed Corporate Bonds (Tel-Bond 60) and Indexed Government Bonds (monthly average)

Household debt

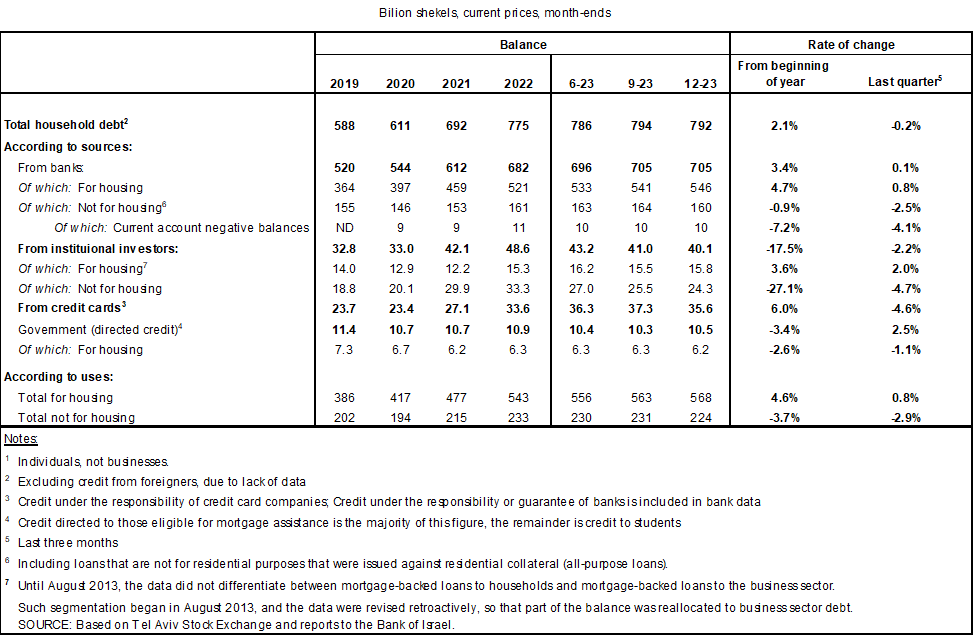

- The balance of households’ outstanding debt shrank by 0.2 percent in the fourth quarter of 2023, to about NIS 792 billion, combining an increase in the balance of housing debt, which was completely offset by a decline in the balance of nonhousing debt. The slowdown in the annual rate of growth of total household debt (housing and nonhousing), which began in the second half of 2022, continued to about 2 percent.

- The balance of housing debt continued to increase, by a moderate rate of about 0.8 percent (about NIS 5 billion) in the fourth quarter, to about NIS 568 billion, mostly to banks. The decline in nonhousing debt that began at the beginning of the year continued (about NIS 7 billion, 2.9 percent) to about NIS 224 billion, as a result of a decrease in the balance of debt to banks, credit card companies, and institutional investors.

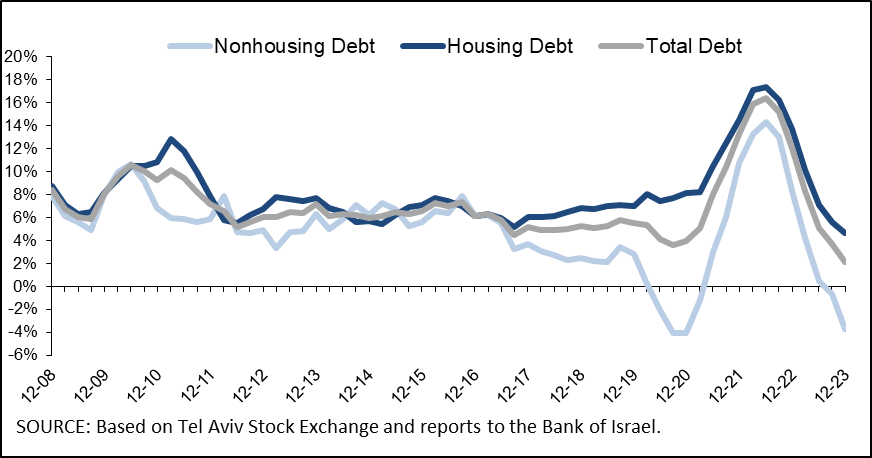

- As a result of these effects, the annual growth rates of outstanding household debt (both housing and nonhousing) continued to slow, such that the annual growth rate of housing debt was about 5 percent, and the annual growth rate of nonhousing debt was negative at about -4 percent (Figure 5).

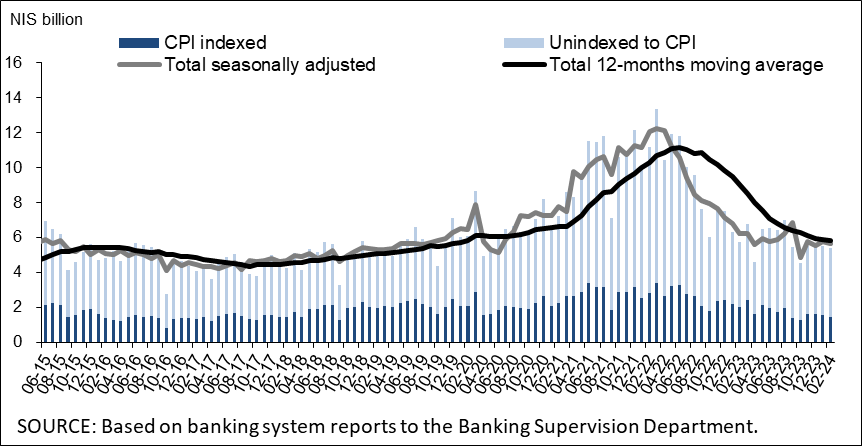

- The moderation of the increase in housing debt is a result of the slowdown in new mortgage borrowing from the banks, which intensified following the outbreak of the war. In the fourth quarter of 2023, new mortgages taken out totaled about NIS 16 billion, significantly lower than in the corresponding quarter of the previous year (about NIS 21 billion). The slowdown in new mortgages continued in January–February 2024, and they totaled about NIS 11 billion, seasonally adjusted (Figure 6).

Table 2: Outstanding Debt Balances of Households1

Figure 5: Rates of Change in Households’ Housing and Nonhousing Debt, Current Quarter vs. Corresponding Quarter of Previous Year

Figure 6 :Amount of New Home Purchase Loans Provided by Banks to the Public (Mortgages)

Links to Data and Statistics on the Bank of Israel website:

[1] Data on debt owed to the banks are based on monthly balance-sheet figures and not on annual financial statements, since as of the date of this notice, the financial statements for 2023 have not yet been published.

[2] Israeli firms, excluding banks, credit card companies, and insurance companies.

[3] The change in the spread from one quarter to the next is calculated as the difference between the average spread in the final month of the reviewed quarter and the average spread in the final month of the previous quarter.