To view this message as a file click here

To view the full article click here

The study employs a difference-in-differences approach to examine bid-ask spreads across various markets. It leverages a unique characteristic of the Israeli government bond market, which trades in an exchange, to analyze whether having an exchange affects market liquidity during a crisis.

The research suggests that:

- Trading on an exchange significantly enhances liquidity during times of crisis.

- The results suggest that efficient netting and all-to-all trading in an exchange can reconcile these findings.

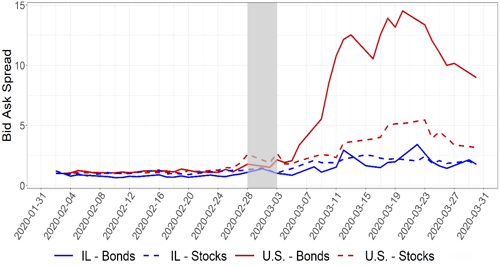

The government bond markets in most developed countries, particularly the US, are typically viewed as liquid and secure safe havens for investment. However, this perception shifted temporarily in March 2020, when these markets experienced severe illiquidity (Figure 1). In response, central banks globally enacted measures to enhance liquidity and ensure the markets' efficient operation. This liquidity crisis sparked an active debate among researchers, regulators, and policymakers worldwide about reforming the government bond trading system.

Figure 1: Time series of Israeli and US spreads of government bonds and stock indices

Notes: Authors' own calculations and Bloomberg.

One proposal suggests that transactions be conducted through a central clearinghouse on an exchange, enabling various investors to trade directly with one another, akin to the global stock trading model (refer to Figure 2). However, it's challenging to gather evidence supporting or opposing this suggested reform due to the nature of government bond trading. Unlike stocks, government bonds are traded over the counter (OTC) rather than on an exchange. This distinction makes it difficult to speculate on the outcomes had these markets operated through an exchange.

Figure 2: Proposed change in the market structure

In a study by Daniel Nathan and Ari Kutai from the Bank of Israel's Research Division, along with Milena Wittwer from Boston College, the researchers leverage the unique characteristic of the Israeli government bond market, where trading occurs on an exchange, to explore whether and why trading on an exchange influences market liquidity during times of crisis. The study employs a difference-in-differences approach to examine bid-ask spreads across various markets. These include markets traded on exchanges—such as global stock markets, the bond market in Israel, and the Treasury futures market in the US—and markets traded OTC, like the government bond markets in the US, Germany, Japan, and England. This comparison sheds light on the impact of the trading platform on market liquidity, especially in a crisis.

Their research suggests that trading on an exchange significantly enhances liquidity during times of crisis. Initially, the researchers analyzed the differences in the bid-ask spreads between bonds and stocks across Israel and other countries (the US, Germany, Japan, and England) while accounting for country and trading-day fixed effects. They find that the spreads on Israeli bonds were 20%-50% lower than those in the mentioned countries. Additionally, when comparing the spreads in the US Treasury futures market, which trade on an exchange, with those in the US Treasury bond market (traded over the counter), they observe that the spreads in the futures market were 63%-66% lower.

In Israel, the study also takes advantage of large transactions being executed over the counter to minimize price impact. They find that the spreads in the Israeli bond market, when traded on the exchange, increased by 53%-63% less than those traded off the exchange. This analysis underscores the potential benefits of exchange trading in maintaining or enhancing market liquidity, especially during financial crises. Although there may be alternative explanations for each of the results obtained separately, the consistency in the results across a series of different analyses strengthens the assessment that differences in the trading mechanism indeed explain the differences.

In the final part of the study, the researchers look at two critical characteristics of an exchange that may promote liquidity. First, on an exchange, everyone can trade with everyone (an all-to-all trading mechanism). Therefore, investors can provide liquidity to each other if dealers cannot or do not wish to provide liquidity. Second, trading is done on a central clearing platform. Therefore, immediate netting of liabilities is possible, leading to more efficient trading with a lower clearing risk, which frees resources from the dealers' financial balance. These two aspects played a central role in Israel. Without these characteristics, the authors calculate that Israeli banks (which act as dealers) would have been forced to absorb liabilities of 2.8 billion shekels instead of 0.6 billion, as occurred. The result indicates that in the alternative situation (i.e., no exchange), Israeli banks would have encountered a difficulty like that experienced by the US banks, who could not absorb the entire massive flow of sales that occurred.