To view this message as a file, click here

In the third quarter of 2024, the Bank of Israel initiated a Credit Officers Survey in the banking system in Israel. The purpose of this survey is to obtain direct and current qualitative information from banking corporations about developments in the credit market in Israel. This information will contribute to a deeper understanding of credit market trends, aiding the decision-making processes at the Bank of Israel, including interest rate discussions, risk assessments in the financial system, credit accessibility, and more.

Survey Format

The format of the Credit Officers Survey is based on similar surveys conducted by leading central banks worldwide, including the Federal Reserve, the European Central Bank, the Bank of England, and others. The survey is conducted quarterly and contains 22 questions addressing various aspects of household credit for housing and consumer purposes, as well as business credit categorized by business size, with special attention to credit in the construction and real estate industries. The questions in the survey pertain to actual developments in the last quarter and the banks’ expectations for the upcoming quarter, covering areas such as credit provision policies, credit terms and conditions offered, and the demand for credit from the banking system. Additionally, it addresses factors influencing the supply and demand for credit.

The survey was sent to all the banking corporations in Israel (10 banks), and it was filled out by the banks' credit departments.

Key Findings

The findings published here are aggregated and pertain to the banking corporations as a whole. They are presented using weighted net balances[1], summarizing the change that occurred in the surveyed quarter compared to the previous quarter, or the expected change in the upcoming quarter compared to the surveyed quarter. The data in the survey were collected from banking corporations during the second half of March 2025.

- In the first quarter of the year, the growth of demand for credit among micro and small businesses moderated, with an expectation of increased demand in the next quarter.

- The expectation is that demand for credit in the real estate industry will decline and demand in the construction industry will increase in the second quarter.

- Demand for consumer credit and housing credit increased in the first quarter. The expectation is for continued growth in demand for consumer credit and stabilization in demand for housing credit in the second quarter.

- In the first quarter of the year, there was an increase in the hardening of margins (increase in margins) in high-risk housing credit.

- There was continued easing in credit terms and conditions across most segments, mainly reflected in the margins in non-risky credit.

- Competition in the credit market and high capital ratios were the main factors contributing to the easing of margins.

- Demand for Credit

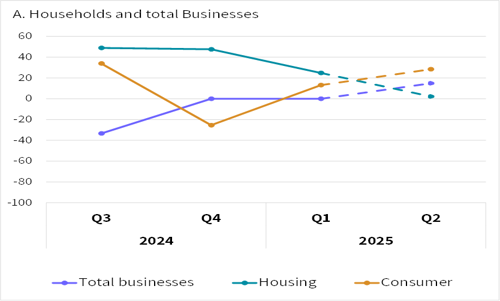

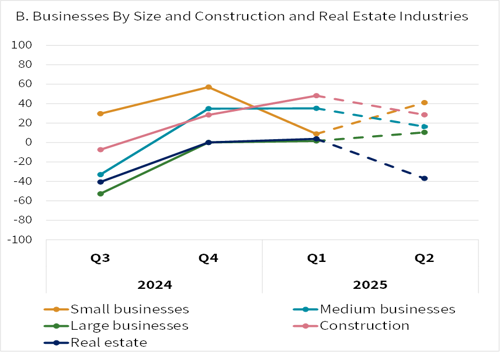

The demand for consumer credit and housing credit increased in the first quarter of 2025, with expectations for continued growth in demand for consumer credit and stabilization in demand for housing credit in the next quarter. In the business segment, the growth in demand for credit among small and micro businesses moderated, with banks expecting a return to growth in the next quarter. Banks anticipate continued growth in demand for credit in the construction industry and a decline in the real estate industry[2] in the second quarter (Figure 1).

Figure 1. Net balances* of the change in demand for credit (dashed lines denote expectations)

*A positive value denotes growth in demand for credit, and vice-versa.

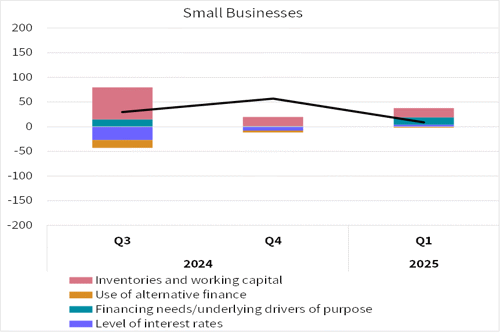

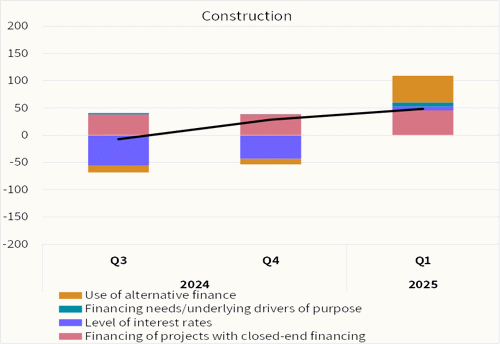

In terms of the impact of different factors on demand for credit, it appears that the increase in inventory and working capital, indicating cash flow issues for businesses, continues to be the primary driver of increased demand for credit among small and micro businesses. In the construction industry, the main factor driving the increase in demand for credit was the financing of projects with closed-end financing (Figure 2).

Figure 2. Net balances* of the change in impact of various factors on demand for credit

*A positive value denotes growth in demand for credit, and vice-versa.

- Credit Supply

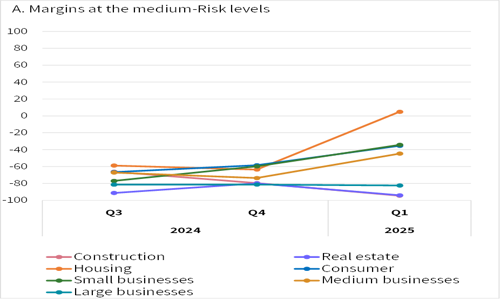

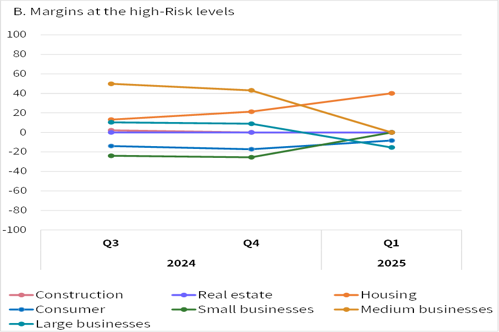

The easing of credit terms and conditions continued in the first quarter of the year across most credit segments, primarily reflected in the credit margins for medium-risk levels. However, there was a noticeable tightening in the credit margins for high-risk housing credit (Figure 3).

Figure 3. Net balances* of changes in credit terms and conditions for new requests for credit

*A positive value denotes growth in demand for credit, and vice-versa.

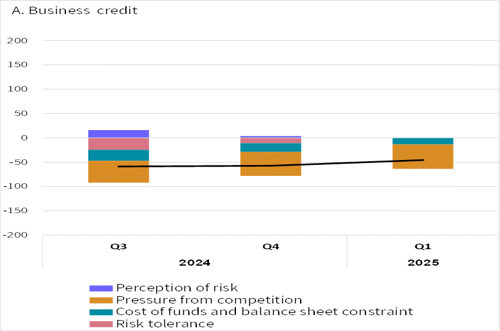

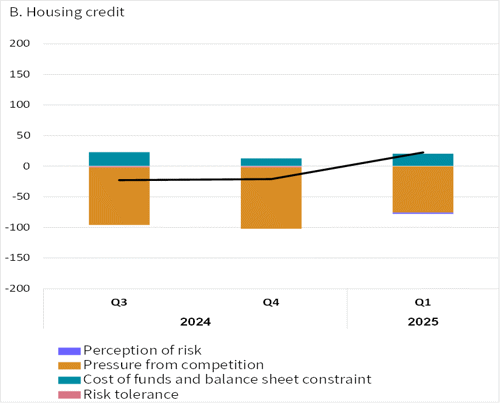

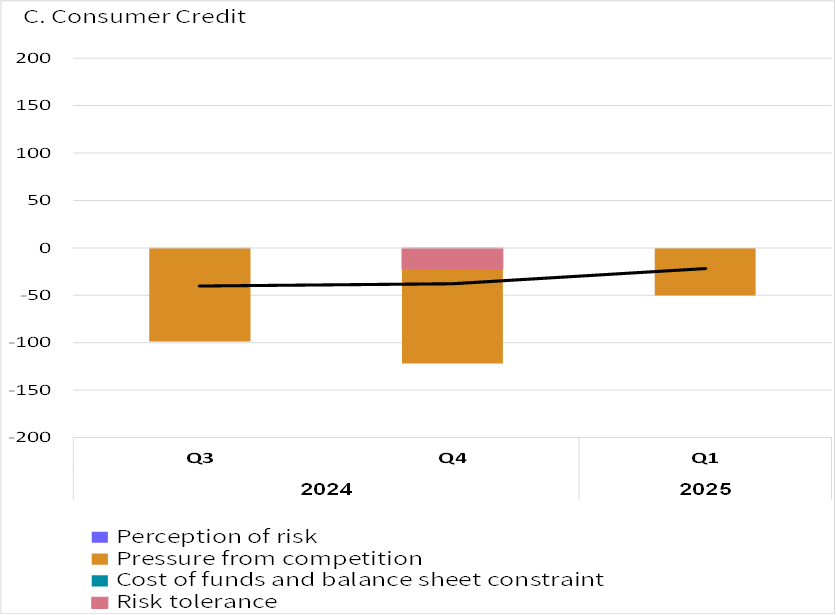

The main factors contributing to the easing of credit margins continued to be competitive pressures and high capital ratios (Figure 4).

Figure 4. Net balances* of changes in the effect of various factors on the change in credit margins

*A positive value denotes growth in demand for credit, and vice-versa.

[1] The net balance is calculated as the difference between the percentage of positive responses and the percentage of negative responses. For questions regarding demand for credit, the responses “increased/increased significantly” are defined as positive, and the responses “decreased/decreased significantly” are defined as negative, so a positive net balance reflects an increase in demand for credit, and vice-versa. For questions regarding credit supply, i.e., credit provision policies and credit terms and conditions, the responses “significant tightening/some tightening” are defined as positive, and the responses “some easing/significant easing” are defined as negative, so a positive net balance reflects tightening in policy or credit terms and conditions, and vice-versa. The responses were weighted according to each bank’s share in each credit segment.

[2] The definitions of the construction and real estate industries are according to the Central Bureau of Statistics Standard Industrial Classification. The construction industry (Section F) mainly includes the construction of buildings and infrastructure, while the real estate industry (Section L) includes real estate activities, mainly buying, selling, renting, and operating real estate. It does not include the development of construction projects for sale.