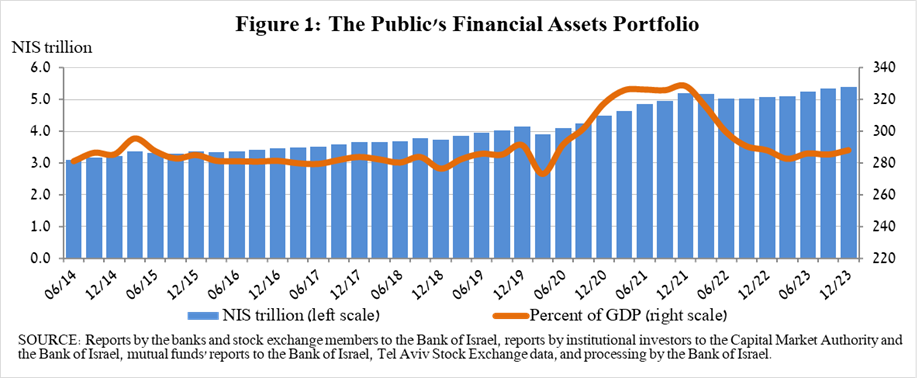

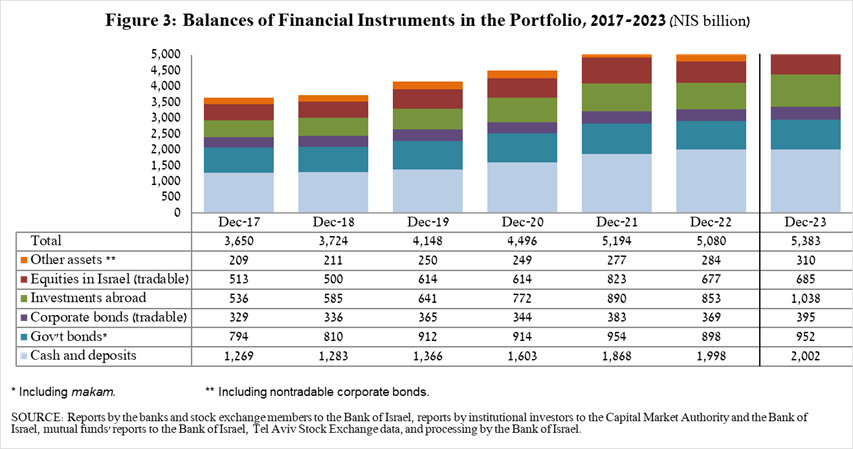

- In the fourth quarter of 2023, the balance of the public’s financial assets portfolio increased by approximately NIS 50 billion (0.9 percent), and for the full year increased by approximately 6 percent, to about NIS 5.4 trillion.

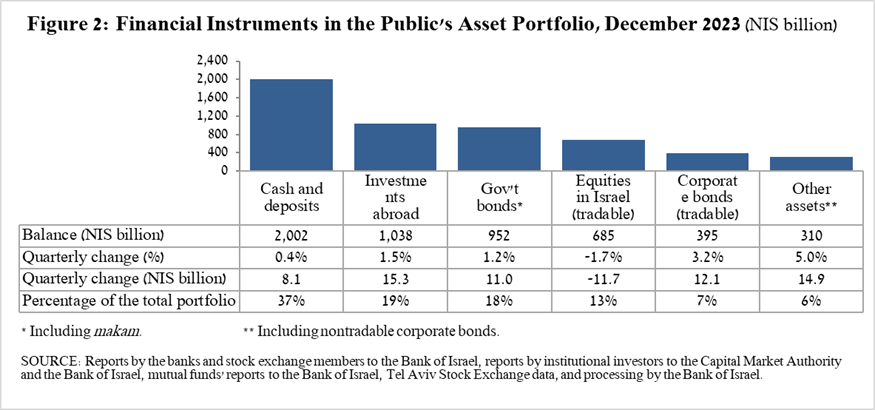

- The increase in the portfolio’s value in the fourth quarter was mainly due to an increase in the balance of corporate bonds (3.2 percent), in the balance of investments abroad (1.5 percent), and in the balance of government bonds and Makam (1.2 percent).

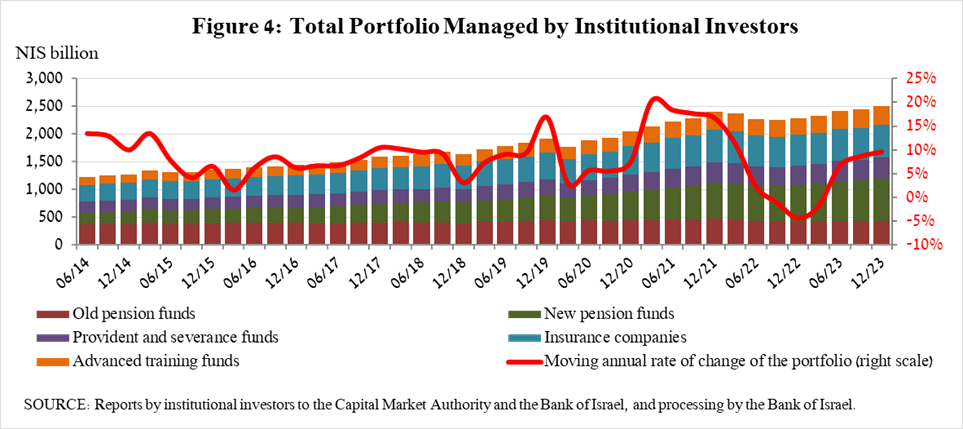

- The balance of the asset portfolio managed by institutional investors increased in the fourth quarter by approximately NIS 67 billion (2.7 percent), to NIS 2.51 trillion at the end of the quarter. For the year overall, the balance increased by NIS 218 billion (9.5 percent).

- Institutional investors’ rate of exposure to foreign currency increased by 2.3 percentage points to approximately 22.2 percent at the end of the quarter , and their exposure to foreign assets increased by about 1.7 percentage points during the quarter, to about 43.2 percent at quarter end.

- The value of the portfolio managed by mutual funds in Israel increased by approximately NIS 26.9 billion (6.3 percent) in the fourth quarter, to NIS 456 billion. Net new investments continued, mainly in shekel money market funds and in funds specializing in foreign equities.

1. The public’s total assets portfolio

In the fourth quarter of 2023, the balance of the public’s financial assets portfolio increased by approximately NIS 50 billion (0.9 percent), to NIS 5.45 trillion (Figure 1), so that for the year overall it increased by approximately 6 percent. The weight of the public’s financial assets portfolio relative to GDP increased by approximately 3 percentage points, to about 288 percent at the end of the quarter, as a result of an increase in the asset portfolio.

2. Analysis of the changes in the overall portfolio

Over the course of the fourth quarter, there were increases in the balances of the public’s holdings in most components of the portfolio, excluding equities in Israel (-1.7 percent). The increases in the balance of corporate bonds (3.2 percent), investments abroad (1.5 percent), and in the balance of government bonds and Makam (1.2 percent) were notable.

- The balance of tradable corporate bonds in Israel increased by about NIS 12 billion, to about NIS 395 billion at the end of the quarter, as a result of price increases and net investments (estimated to be NIS 5 billion).

- The balance of government bonds (tradable and nontradable) and Makam increased during the quarter by about NIS 11 billion (1.2 percent) to about NIS 952 billion at quarter end.

- The balance of cash and deposits increased during the fourth quarter by about NIS 8 billion (0.4 percent) to about NIS 2 trillion.

- The balance of equities in Israel declined by about NIS 12 billion (-1.7 percent), in view of the volatility in equity indices and despite net investments.

The balance of investments abroad increased by approximately NIS 15 billion (1.5 percent) during the quarter, to NIS 1.04 trillion, constituting approximately 19 percent of the total asset portfolio. The increase derived from the following components:

- The balance of equities held abroad increased by approximately NIS 13 billion (2.3 percent), to NIS 575 billion. This was mainly the result of a combination of price increases and net investments, which were partly offset by the appreciation of the shekel against the US dollar (-5.2 percent).

- The balance of tradable (corporate and government) bonds abroad increased by approximately NIS 4 billion (2 percent) during the quarter, to about NIS 232.5 billion. This increase derived mainly from net investments totaling NIS 10 billion alongside price increases, which were partly offset by appreciation of the shekel against the US dollar (-5.2 percent).

As a result of the developments during the quarter, there was an increase of about 0.1 percentage points (from 19.2 percent to 19.3 percent) in the share of foreign assets, and a decline of about 0.8 percentage points (from 26.5 percent to 25.7 percent) in the share of foreign currency assets.

3. The portfolio managed by institutional investors[1]

- The balance of assets managed by all institutional investors increased in the fourth quarter by about NIS 67 billion (2.7 percent), to NIS 2.51 trillion (approximately 47 percent of the public’s total financial assets portfolio). The development in the balance of the managed portfolio during the quarter was mainly due to changes in the following investment components: cash in Israel—an increase of NIS 18.4 billion (17.1 percent); tradable government bonds—an increase of NIS 19.6 billion (8.8 percent); futures contracts abroad (balance sheet amount)—an increase of NIS 22 billion; equities abroad—a decline of NIS 13.7 billion (-8.9 percent).

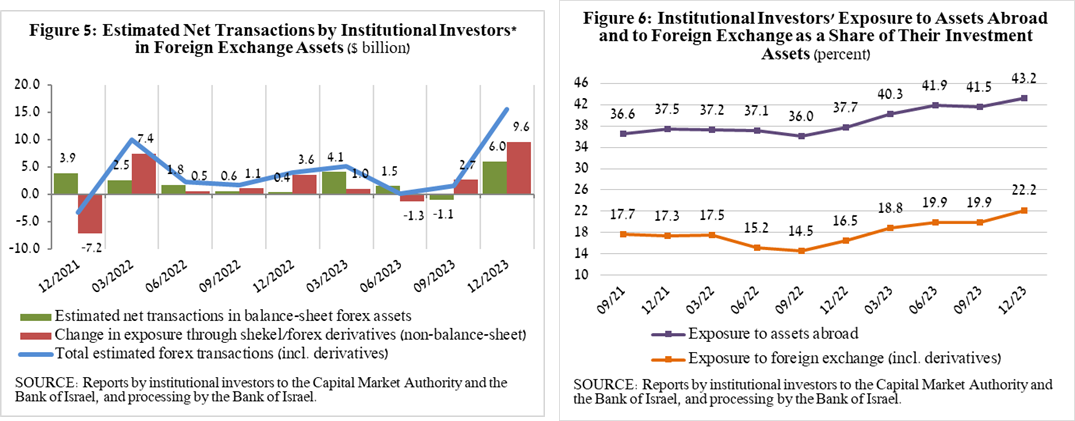

- Exposure of the portfolio managed by institutional investors[1] to foreign assets and to foreign currency

In the fourth quarter of 2023, the share of institutional investors’ exposure to assets abroad increased by about 1.7 percentage points, to approximately 43.2 percent of total assets. This was a result of an increase in the balance of exposure to foreign assets (12.7 percent) that was greater than the increase in the balance of institutional investors’ total assets (8.4 percent) in dollar terms.

The increase in the balance of exposure to foreign assets (about $32 billion) derived mainly from a decline in exposure through futures contracts and options on foreign equity indices (about $16.7 billion), and in the balance sheet level of the contracts (about $6.3 billion).

Exposure to foreign currency— During the fourth quarter of 2023, institutional investors’ rate of exposure to foreign exchange (including shekel/forex derivatives) increased by 2.3 percentage points, to 22.2 percent.

During the quarter, institutional investors made net purchases of foreign currency assets, totaling about $15.6 billion; purchases of about $6 billion in assets denominated in and linked to foreign currency (mainly in futures contracts and options, investment funds abroad, and foreign equities issued in Israel) and net foreign exchange purchases via derivative financial instruments totaling about $9.6 billion, meaning a decline in futures transactions for the sale of foreign exchange.

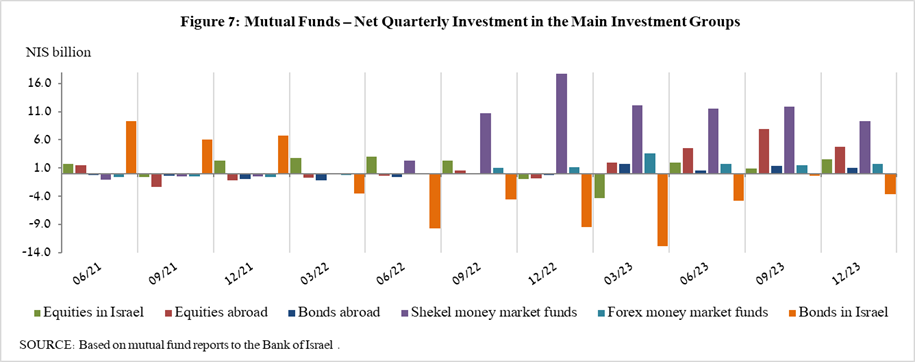

4. The portfolio managed by mutual funds

The value of the portfolio managed by Israeli mutual funds increased in the fourth quarter by approximately NIS 26.9 billion (6.3 percent), to about NIS 456 billion, constituting about 8.5 percent of the public’s asset portfolio.

The increase in the fourth quarter derived from net investment in the funds totaling about NIS 15.7 billion and from price increases. Most of the new investment was in shekel money market funds, totaling approximately NIS 9.3 billion, further to the trend since the beginning of 2022, and in funds specializing in equities abroad totaling about NIS 4.8 billion. In contrast, there were net withdrawals of about NIS 2.3 billion from funds specializing in general bonds in Israel, and of about NIS 1.2 billion from funds specializing in government bonds in Israel.

Further information and details:

Long-term tables on the asset portfolio are available here.

Long-term tables on institutional investors’ exposure to foreign exchange and to foreign assets are available here.

Long-term tables on mutual funds are available here.

[1] Estimates of members’ exposure (rather than exposure of the institutional investors themselves) to various risks in the portfolio managed for them by the institutional investors (excluding insurance policies with a guaranteed yield, where the risk is taken on by the institutional investors). For additional details on definitions, terms, and explanations, see “Measuring the Exposures of Institutional Investors to Foreign Currency and to Foreign Assets” in the Bank of Israel’s Statistical Bulletin for 2016.

[1] Excluding mutual funds.