To view this message as a file click here

- In the first quarter of 2024, the balance of the public’s financial assets portfolio increased by approximately NIS 268.7 billion (4.96 percent), to about NIS 5.68 trillion.

- The increase in the portfolio’s value in the first quarter was mainly due to increases in the balance of investments abroad (8.2 percent), the balance of equities in Israel (6.7 percent), and in the balance of cash and deposits (4 percent).

- The balance of the asset portfolio managed by institutional investors increased in the first quarter by approximately NIS 109 billion (4.3 percent), to NIS 2.62 trillion at the end of the quarter.

- Institutional investors’ rate of exposure to foreign assets and to foreign currency increased by 1.5 percentage points and by 0.4 percentage points, respectively, to approximately 44.7 percent and 22.6 percent, respectively, at the end of the quarter.

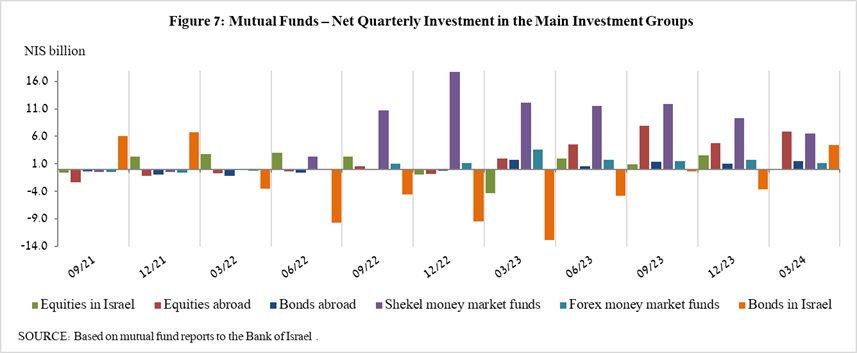

- The value of the portfolio managed by mutual funds in Israel increased by approximately NIS 40 billion (8.8 percent) in the first quarter, to NIS 495.7 billion. There were net new investments, mainly in funds specializing in foreign equities and in shekel money market funds.

1. The public’s total assets portfolio

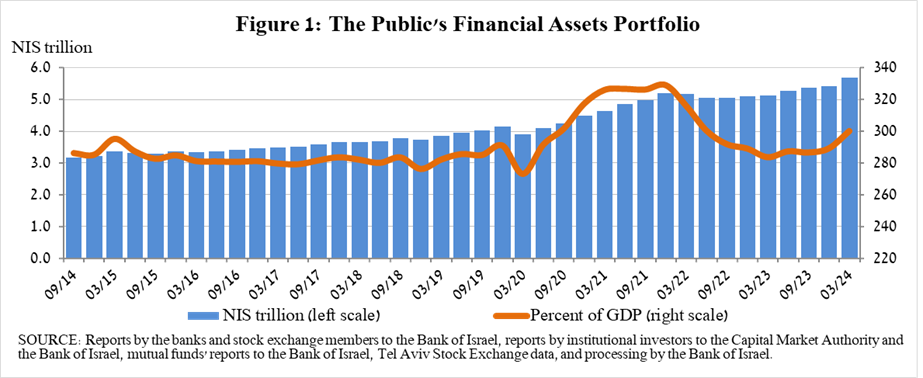

In the first quarter of 2024, the balance of the public’s financial assets portfolio increased by approximately NIS 268.7 billion (4.96 percent), to NIS 5.68 trillion (Figure 1). The weight of the public’s financial assets portfolio relative to GDP increased by approximately 10.7 percentage points, to about 300 percent at the end of the quarter, as a result of an increase in the asset portfolio that was larger than that of the GDP.

- Analysis of the changes in the overall portfolio

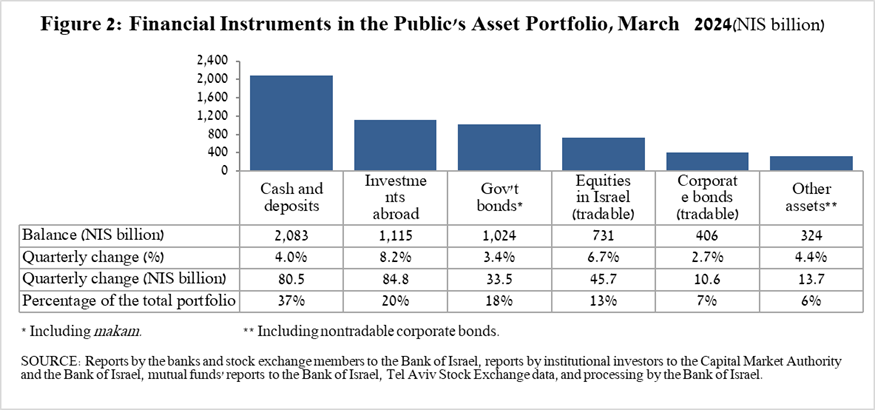

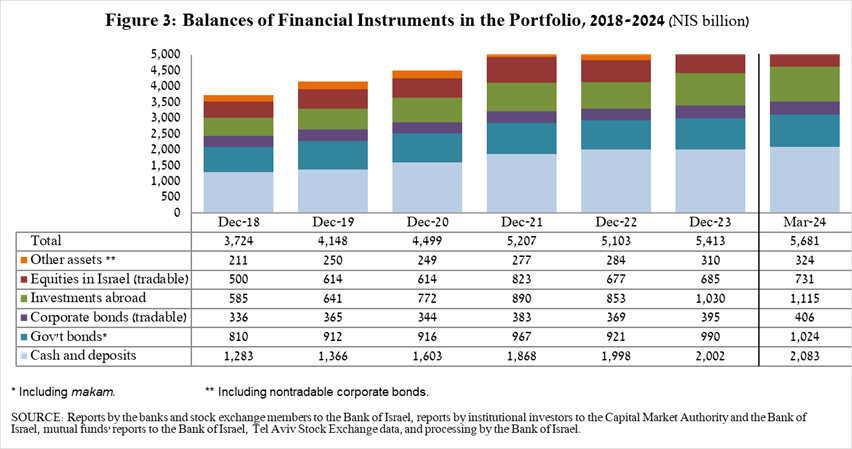

Over the course of the first quarter, there were increases in the balances of the public’s holdings in all components of the portfolio. The increases in the balance of investments abroad (8.2 percent), in the balance of equities in Israel (6.7 percent), and in the balance of cash and deposits (4 percent) were notable.

- The balance of cash and deposits increased during the first quarter by about NIS 80.5 billion (4 percent) to about NIS 2.08 trillion, which is about 37 percent of the total portfolio.

- The balance of equities in Israel increased by about NIS 45.7 billion (6.7 percent), mainly in view of the increase in equity indices and alongside net investments (estimated at about NIS 4.3 billion).

- The balance of government bonds (tradable and nontradable) and Makam increased during the quarter by about NIS 33.5 billion (3.4 percent) to about NIS 1.02 trillion at quarter end. The increase derived mainly from the increase in tradable government bonds (about NIS 30 billion), manly due to net funds raised.

The balance of investments abroad increased by approximately NIS 84.8 billion (8.2 percent) during the quarter, to NIS 1.11 trillion at quarter end, constituting approximately 20 percent of the total asset portfolio. The development in the balance of investments abroad derived from the following components:

- The balance of equities held abroad increased by approximately NIS 58.6 billion (10.3 percent), to NIS 628.9 billion. This was mainly the result of price increases and net investments, (estimated to be NIS 4 billion).

- The balance of tradable (corporate and government) bonds abroad increased by approximately NIS 21.6 billion (10.4 percent) during the quarter, to about NIS 254.5 billion. This increase derived mainly from net investments totaling NIS 15 billion.

As a result of the developments during the quarter, there was an increase of about 1.2 percentage points (from 25.4 percent to 26.6 percent) in the share of foreign currency assets, and an increase of about 0.6 percentage points (from 19 percent to 19.6 percent) in the share of foreign assets.

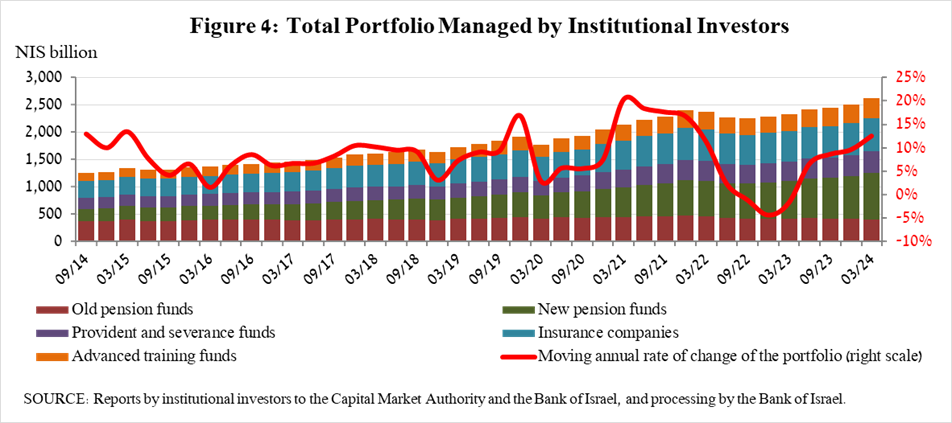

3. The portfolio managed by institutional investors[1]

- The balance of assets managed by all institutional investors increased in the first quarter by about NIS 109 billion (4.3 percent), to NIS 2.62 trillion (approximately 46 percent of the public’s total financial assets portfolio). The increase in the balance was reflected in all institutional investors, except for the veteran pension funds. The increase in the balance of the managed portfolio during the quarter derived mainly from price increases in the global and domestic equity markets, and was reflected in the following components: ETFs abroad that track equity indices—an increase of about NIS 19 billion (10.3 percent), mainly in view of price increases; equities abroad – an increase of NIS 17.8 billion (12.7 percent), mainly in view of price increases; equities in Israel – an increase of NIS 16.6 billion (7.4 percent), mainly in view of price increases; government bonds and Makam – an increase of NIS 15 billion (1.9 percent); cash and deposits in Israel – an increase of NIS 12.7 billion (5.1 percent).

- Exposure of the portfolio managed by institutional investors[2] to foreign assets and to foreign currency

In the first quarter of 2024, the share of institutional investors’ exposure to assets abroad increased by about 1.5 percentage points, to approximately 44.7 percent of total assets. This was a result of an increase in the balance of exposure to foreign assets (6.3 percent) that was greater than the increase in the balance of institutional investors’ total assets (2.7 percent) in dollar terms.

The increase in the balance of exposure to foreign assets (about $18 billion) derived mainly from an increase in exposure through futures contracts and options on foreign equity indices (about $8.7 billion), and in the balance of equities abroad (about $5.7 billion).

Exposure to foreign currency -

During the first quarter of 2024, institutional investors sold net foreign currency assets totaling about $3.5 billion—sales of about $3.7 billion in assets denominated in and indexed to foreign currency (mainly futures contracts and options, equites, and bonds, and in contrast purchases of ETFs and foreign equities traded in Israel), and in parallel net purchases of foreign currency via derivative financial instruments at a scope of $0.2 billion, meaning a reduction of futures transactions to sell foreign currency.

In this quarter, there was an increase in the share of exposure to foreign currency (including NIS/forex derivatives) of institutional investors by about 0.4 percentage points to a level of 22.6 percent.

4. The portfolio managed by mutual funds

The value of the portfolio managed by Israeli mutual funds increased in the first quarter by approximately NIS 40 billion (8.8 percent), to about NIS 495.7 billion at the end of the quarter, constituting about 8.7 percent of the public’s asset portfolio.

The increase in the first quarter derived from net investment in the funds totaling about NIS 20 billion and from price increases. Most of the new investment was in funds specializing in equities abroad, at a scope of NIS 6.9 billion, and in shekel money market funds, totaling approximately NIS 6.6 billion, further to the trend since 2023.

Further information and details:

Long-term tables on the asset portfolio are available here.

Long-term tables on institutional investors’ exposure to foreign exchange and to foreign assets are available here.

Long-term tables on mutual funds are available here.

[1] Excluding mutual funds.

[2] Estimates of members’ exposure (rather than exposure of the institutional investors themselves) to various risks in the portfolio managed for them by the institutional investors (excluding insurance policies with a guaranteed yield, where the risk is taken on by the institutional investors). For additional details on definitions, terms, and explanations, see “Measuring the Exposures of Institutional Investors to Foreign Currency and to Foreign Assets” in the Bank of Israel’s Statistical Bulletin for 2016.