To view this message as a file click here

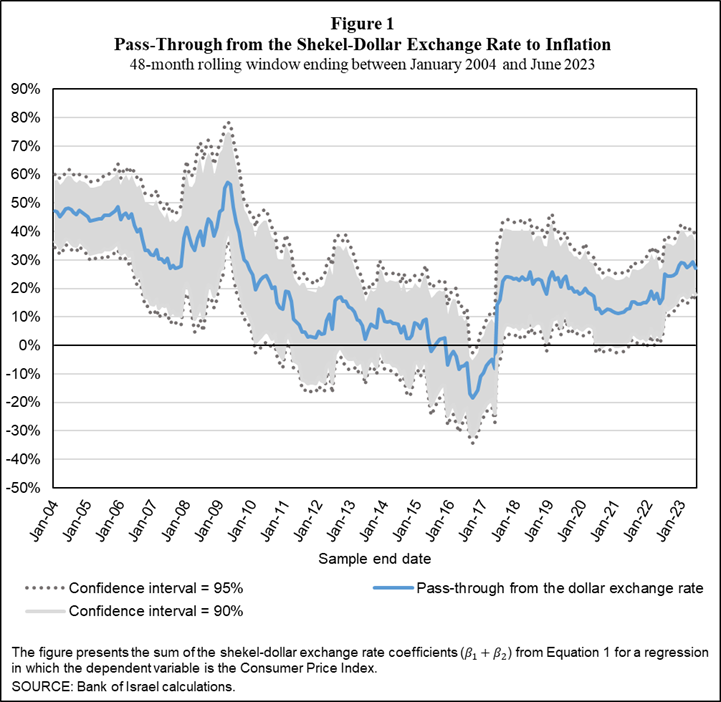

- Since the second half of 2022, it appears that the pass-through from the shekel/dollar exchange rate to overall inflation in Israel has strengthened. While the average pass-through in samples ending between June 2017 and Jun 2022 was slightly less than 20 percent, the pass-through in samples ending between the end of 2022 and mid-2023 was slightly above 25 percent.

- The pass-through in Israel was found to strengthen significantly when inflation exceeds the upper bound of the target range (3 percent). This finding is consistent with the literature, which finds a positive relationship between the level of inflation and the extent of the pass-through from the exchange rate.

- Based on the revised estimate of the pass-through, we can estimate that the weakening of the shekel contributed to an increase of approximately 1 percentage point in inflation during the first half of 2023.

In a small and open economy such as Israel’s, the exchange rate plays an important role in determining the prices of tradable goods, and therefore in determining the inflation rate. The exchange rate pass-through to prices (hereinafter – “the pass-through”) is the extent to which a change (for instance, of one percent) in the exchange rate influences prices. The pass-through reflects the correlation between the exchange rate and prices—a correlation that partly depends on the average composition of shocks prevalent in the economy during the sample period—and does not necessarily reflect a clear causal relation between the two.

In an article included in the Bank of Israel’s forthcoming Selected Research and Policy Analysis Notes, Ari Kutai of the Bank of Israel Research Department, together with Uri Enzel and Eden Anavim, conducted a revised estimate of the short-term pass-through from the exchange rate to inflation in Israel. They analyzed the pass-through using a rolling linear regression in a four-year time window, utilizing monthly data spanning from 2000 to the second half of 2023.

A dynamic analysis of the pass-through from the change in the shekel/dollar exchange rate to the overall CPI (Figure 1) shows that from the end of the first half of 2017, the pass-through was positive and statistically significant, following a period of low estimates since 2011. For samples ending in 2018 and 2019, the estimate was relatively high, at about 20 percent, but in samples ending from the second half of 2020 until the end of the first half of 2022, the pass-through weakened considerably. In samples ending at the beginning of the second half of 2022 and later, the pass-through again strengthened, and at the end of 2022 it reached its highest level in over a decade—more than 25 percent. Since then it has remained at similar levels.

The economic literature indicates a positive relation between the inflation rate and the pass-through rate, derived from agents’ perception that price changes are less persistent in a low-inflation environment, making the pass-through weaker. Given Israel's rising inflation, the researchers investigated whether the pass-through from the exchange rate to prices intensifies with higher inflation in Israel as well. Similar to the findings in the economic literature, their findings indicate that Israel's pass-through has indeed increased alongside the notable rise in inflation since 2022. The researchers also directly assessed the relationship between the pass-through rate and the annual inflation rate (Figure 2). They found evidence that the pass-through increases once the inflation rate exceeds the upper bound of the target range in Israel. When inflation is below 3 percent, the pass-through is lower (approximately 8 percent), and the pass-through strengthens significantly (to 20 percent) when inflation exceeds 3 percent.

The pass-through to tradable goods and services prices is expected to be stronger than the pass-through to nontradable goods prices. The study’s findings support this hypothesis, showing a 37 percent pass-through from the dollar exchange rate to tradable goods and services prices at the end of 2022, and it has since remained high. The pass-through to nontradable goods prices was 23 percent at the end of 2022, and has since remained stable. In the study, the researchers also examined the pass-through from the euro exchange rate, and found it to be negligible or very low throughout most of the reviewed period. This suggests that for the short-term inflation analysis in Israel, tracking the dollar exchange rate is more important than tracking the euro.

Based on the revised estimate of the pass-through, the recent weakening of the shekel (10 percent in 2022 and 6 percent in the first half of 2023) contributed to an approximate1 percentage point rise in inflation during the first half of 2023.

Click to download as PDF Click to download as PDF