After receiving comments from the public, the Bank of Israel publishes the final path for reducing interchange fees. The fee will be reduced each year, and the path of reduction will be brought forward. The interchange fee on debit transactions will also be reduced.

1. Background

On January 16, 2018, the Bank of Israel published a notice of the Governor’s intention to use her authority pursuant to Section 9k and 9l of the Banking (Service to the Customer) Law, 5741–1981, and to declare the service provided by a merchant acquirer to a merchant in connection with the settlement of payment card transactions as a supervised service in regard to the rate of the fee collected from the merchant by the acquirer and transferred to the issuer (the issuer’s fee or the interchange fee).

In that notice, the intention was stated to reduce the interchange fee for deferred debit transactions in a gradual path, and to leave the fee for debit transactions at the level set in 2015. In addition, the final decision regarding the level of the fee would be published after examining comments from the public, should any be received.

In the period allocated for receiving comments from the public, comments were received from various entities: credit card companies and banks (hereinafter: the companies) and various organizations (hereinafter: the organizations). The comments were examined with due consideration by the professional team at the Bank of Israel that is entrusted with formulating recommendations on the matter of interchange fees.

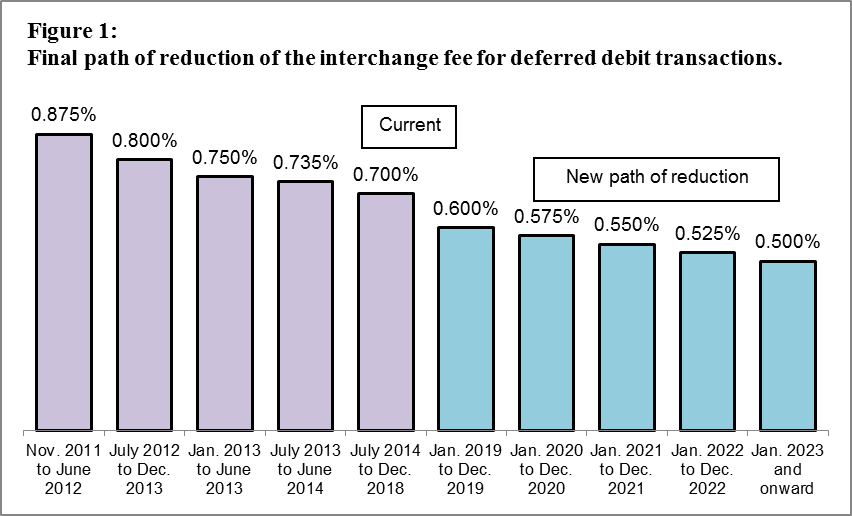

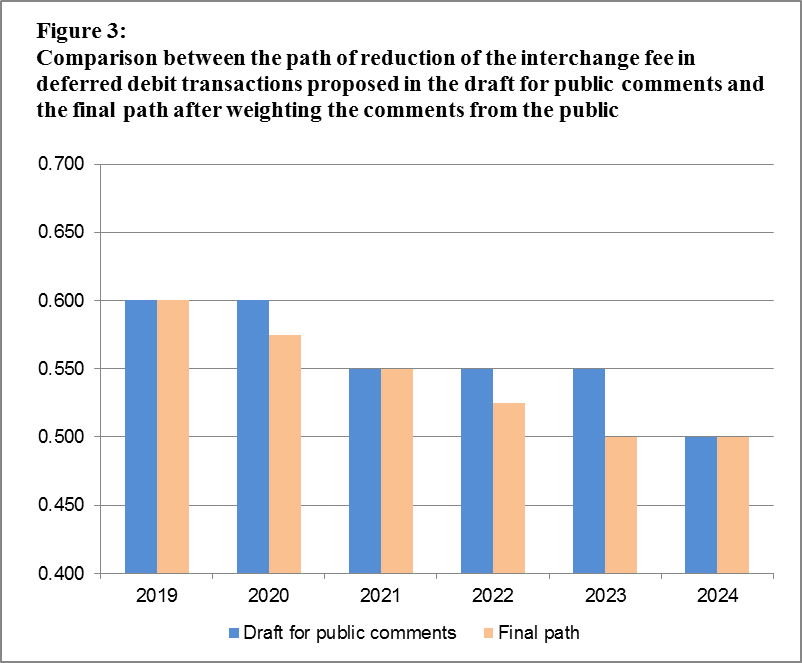

Following the examination of the comments, the Governor of the Bank of Israel decided to adopt the recommendations of the professional team and to make two changes to the path published on January 16, 2018. First, the pace of the reduction of the fee on deferred debit transactions will be accelerated, and the date for completing the path, meaning the date on which the interchange fee of 0.5 percent will be set, will be brought forward. The change will require the companies to implement streamlining procedures at a more rapid pace, and will enable merchants to benefit from the lower settlement fees at an earlier stage.

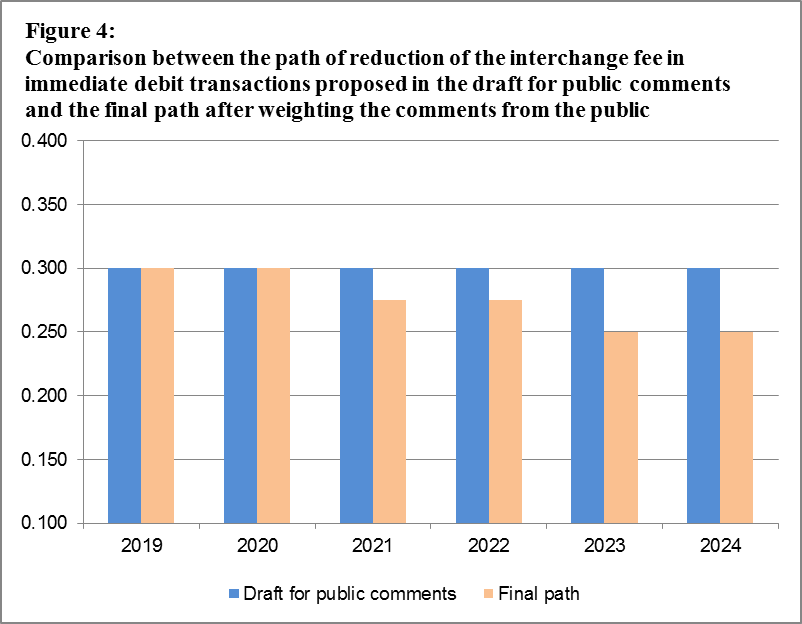

In addition, the Governor has decided to adopt a path for reducing the interchange fee in respect of debit transactions, at the end of which the fee will be 0.25 percent. This path of reduction reflects the forecast of the Bank of Israel’s professional team concerning the expected decline in the ratio between the relevant costs for setting the fee in respect of the issuer’s activity in debit card transactions and the volume of transactions carried out on such cards. This ratio is expected to decline both in view of the expected streamlining in the companies’ work methods, and as a result of the increase expected in turnover of debit transactions in the coming years.

The path set out provides the required level of certainty to players in the market in the coming years. It thereby enables the advancement of the separation of the credit card companies from the banks, which is a significant element in the implementation of the reform to increase competition in the credit market. Moreover, the path encourages the companies to continue streamlining.

The reduction of the interchange fee on deferred debit cards and on debit cards is expected to be reflected in savings of hundreds of millions of shekels per year for merchants in the economy in the coming years.

Figures 1 and 2 show the final path of reduction of the interchange fee in respect of deferred debit and debit transactions, respectively. Figures 3 and 4 show a comparison between the reduction path of the interchange fee for deferred debit and debit transactions (respectively) published in the draft for public comments on January 16, 2018 and the final paths after examining the comments from the public. –

2. Comments from the public

The comments received mainly deal with four main issues: the level of the fee for debit card transactions; the level of the fee for deferred debit card transactions and the path for its reduction; the streamlining coefficient; and arguments regarding the lack of transparency of the data used in calculating the fee.

a. The level of the fee for debit card transactions:

Comments received: On this topic, the organizations made two main arguments. First, the fee set for debit transactions is too high, and second, a path should be set for reducing the fee on transactions using debit cards that will be calculated on the basis of the companies’ expected streamlining in the coming years and the smaller ratio between the entitling costs in these transactions and the business turnover, similar to the path of reduction adopted for the fee charged in respect of deferred debit transactions.

Discussion and decision: The fee for debit card transactions was set based on the methodology that was used in determining the fee for transactions with a deferred payment card, with necessary changes that were mostly due to the low volume of transactions in debit cards and the difficulty in estimating the future path of streamlining in respect of the costs inherent in those transactions.

After looking into it again, it was decided that it would be correct to assume that the ratio between the entitling costs in debit transactions and the volume of those transactions will decline in the coming years for two reasons: a decline in the volume of the companies’ entitling costs in view of streamlining their work methods, and the expected increase in the transaction turnover on debit cards in the coming years. As such, the Governor decided to adopt the recommendations of the professional team developing the path of reduction of the fee in debit card transactions, which will in the end by 0.25 percent.

b. The level of the fee for deferred debit card transactions and the path for its reduction:

Comments received: The credit card companies noted that in their opinion, the fee was set too low. They also claimed that the path of reduction is extreme and rapid. In their opinion, the adoption of the proposed path may lead to a negative impact on the companies’ competitive abilities after their separation from the banks.

In contrast, the organizations argued that the fee was set too high; that the companies’ other sources of income, beyond the interchange fee, that they can use to cover the costs of insuring the payment and approving the transaction, should be taken into account; and that the proposed path of reduction is too slow. According to them, a more rapid adoption of the path may accelerate the pace of the companies’ streamlining.

Discussion and decision: In terms of the level of the interchange fee, the calculation was made based on a methodology that was approved by the anti-trust court, and which has previously been used in regulating the interchange fee. In terms of the path of reduction, after a re-examination and weighting of the various arguments, it was decided to adopt a more rapid path of reduction. The new path will require the companies to take more rapid streamlining steps, and will allow merchants to benefit from reduced settlement fees at an earlier stage.

c. The streamlining coefficient:

Comments received: The companies argued that the methodology through which the interchange fees are calculated does not allow for the inclusion of a streamlining coefficient.

Discussion and decision: The inclusion of a streamlining coefficient is accepted in price supervision methodologies based on recognition of costs. The streamlining coefficient has a double function. It allows for a more reliable reflection of the companies’ future costs, and it contains a normative component that encourages companies to streamline even when they are entitled to compensation for the costs they incur. In view of this, the principle of lowering the level of the fee, which is based on the expected fulfillment of streamlining, remains in place.

d. Transparency of the data used in calculating the fee:

Comments received: The organizations argued that the data used in calculating the fee were not revealed to the public, and that the formulae of the methodology were not provided.

Discussion and decision: The cost data that were used in the calculation of the fee are trade secrets belonging to the companies, and revealing them may have a negative impact on their operations. We note that neither the raw nor the aggregate data were published when the previous interchange fee regulations were set either. In any case, the reasonability of the data was examined in depth by the professional team, inter alia through a comparison of the data over time and between the various companies, and obtaining point by point clarifications and documentation as required.

Graphs and data

Graphs and data