Abstract

This document presents the forecast of macroeconomic developments compiled by the Bank of Israel Research Department in March 2016. The forecast was presented to the Monetary Committee on March 27, 2016, during its meeting prior to the decision on the Bank of Israel interest rate for April 2016. According to the staff forecast, gross domestic product (GDP) is projected to increase by 2.8 percent in 2016 and by 3.0 percent in 2017. The rate of inflation over the next year (ending in the first quarter of 2017) is expected to be 0.8 percent. In 2017, the inflation rate is expected to be 1.4 percent. The Bank of Israel interest rate is expected to remain at its current level of 0.1 percent until the first quarter of 2017, and to increase gradually from the second quarter of 2017.

Forecast

The Bank of Israel Research Department compiles a staff forecast of macroeconomic developments on a quarterly basis. The staff forecast is based on several models, various data sources, and assessments based on economists' judgment.[1] The Bank's medium scale DSGE (Dynamic Stochastic General Equilibrium) model developed in the Research Department—a structural model based on microeconomic foundations—plays a primary role in formulating the macroeconomic forecast.[2] The model provides a framework for analyzing the forces which have an effect on the economy, and allows the integration of information from various sources into a macroeconomic forecast for real and nominal variables, with an internally consistent "economic story".

a. The global environment

Our current assessments of expected developments in the global economy in the next two years are based mainly on projections by international institutions (the International Monetary Fund and the OECD) and by foreign investment houses. These forecasts indicate continued weakness in global activity, with considerable uncertainty regarding the real global economic situation. Specifically, the forecasts for the rate of growth in imports by OECD countries in 2017 were reduced to 4.2 percent (compared with 4.7 percent in the previous forecast, in December), and the forecast for 2016 remained unchanged (3.8 percent), so that relative to 2016 only a moderate increase in this growth rate is expected. Global growth forecasts were also revised downward slightly, to 1.9 percent in 2016 and to 2 percent in 2017. In particular, continued weakness in the eurozone is expected. Thus, for example, an ECB report published in March projects a low rate of growth in the eurozone of 1.4 percent in 2016 and 1.7 percent in 2017.

Oil prices (Brent crude) declined in the first two months of the year, to very low levels of about $28 per barrel, though in March the price began to increase, reaching around $40—a level similar to the price in December, when the previous quarterly forecast was compiled. The average price over the first quarter of 2016 is still markedly lower than that in previous quarters. Commodity (excluding energy) prices began to increase in February, after their relative stability from November 2015 and their long trend of decline prior to that.

Following the December 2015 hike, the US Federal Reserve has not changed the federal funds rate. Based on assessments derived from futures contracts traded on the US and global capital markets, the Fed will increase the federal funds rate only once in 2016, and one additional time in 2017. These assessments are more moderate than the assessments in the previous quarter, which reflects cautious optimism regarding the real economic situation in the US. In contrast, the capital market does not expect any interest increase at all in Europe and in Japan.

b. Real activity in Israel

Table 1

Economic Indicators | |||

Research Department Staff Forecast for 2016 to 2017 | |||

(rates of change, percent, unless stated otherwise) | |||

Data for |

Bank of Israel forecast |

Bank of Israel forecast | |

2015 |

2016 |

2017 | |

GDP |

2.5 |

2.8 |

3.0 |

Civilian imports (excluding diamonds, ships, and aircraft) |

2.7 |

5.7 |

6.0 |

Private consumption |

4.9 |

3.3 |

3.0 |

Fixed capital formation (excluding ships and aircraft) |

-1.4 |

5.3 |

4.1 |

Public sector consumption (excluding defense imports) |

3.7 |

3.4 |

1.4 |

Exports (excluding diamonds and start-ups) |

-1.3 |

3.5 |

5.6 |

Unemployment ratea |

5.3 |

5.6 |

5.6 |

Inflation rateb |

-0.9 |

0.2 |

1.4 |

Bank of Israel interest ratec |

0.10 |

0.10 |

0.50 |

a) Annual average. |

|||

b) Average CPI reading in the final quarter of the year compared with the final quarter average in the previous year. | |||

c) End of the year. |

|||

Source: Bank of Israel. | |||

GDP growth is expected to be 2.8 percent in 2016. This rate of GDP growth is similar to that of the past two years. The forecast is unchanged from the previous forecast in December. Although there was a downward revision in projected private consumption and exports, there was an upward revision in the projected growth rate of public consumption.

GDP in 2017 is expected to grow by 3.0 percent, 0.1 percentage points lower than the December forecast, mainly a result of reduced forecasts for imports by OECD countries. The growth rate in 2017 is expected to increase relative to the growth rate in 2016, mainly due to an improvement in exports (excluding diamonds and start-up companies). In contrast, the growth rates of public consumption and investment (excluding extraordinary investments that are sourced only in imports) are expected to be moderate and to act to moderate growth in 2017.

Compared with the December forecast, the forecasts for the growth rate of public consumption in 2016 were revised upward, in light of the budget performance at the end of 2015 and in the first two months of 2016. The growth forecast for public consumption in 2017 remained unchanged and is at a relatively moderate rate of 1.4 percent. This, assuming that in the same year public consumption will increase in line with the fiscal expenditure rule.

Investment in 2016 and 2017 is expected to increase rapidly, mainly due to investment by a large company. As this investment will mostly be comprised of the import of machines and equipment, the growth rate of imports is also expected to be substantial in the next two years.

We assess that exports will recover in 2016, due to some correction to their weakness in 2015, which partly derived from transitory factors (such as a strike at Israel Chemicals Ltd.). Exports are expected to continue to strengthen in 2017 as well, due to an increase in the rate of growth of imports by OECD countries.

In contrast, we assess that the growth rate of private consumption will moderate in 2016 and 2017 relative to its rate in the past two years. Among the reasons for this are the negative effect of the security situation in 2016[3] and the exhaustion, to an extent, of the effect of the low interest rate, against the background of a high level of consumption and stabilization of the unemployment rate after a long period of declines. The growth rate of private consumption is still expected to be greater than the rate of growth of GDP.

c. Inflation and interest rate estimates

Inflation in the four quarters ending in the first quarter of 2017 is expected to be 0.8 percent. We assess that inflation in the first half of 2016 will be low due to price declines worldwide (particularly energy prices) and due to one-off price reductions by the government.[4] In the second half of the year, inflation is still expected to be low, primarily due to low import prices and the moderating effects of the inflation rate in the first half of the year. In coming quarters, inflation will increase gradually, due to the fading of the moderating effect of recent energy price declines, a gradual increase in inflation worldwide, labor market strength, and some improvement in real activity. The increase in minimum wage and the public sector wage agreements are also expected to act to increase wages and prices. In 2017, the inflation rate is expected to be 1.4 percent, within the inflation target range. As indicated in Figure 1, in view of the developments noted above, the path of inflation expected for the coming two years is lower than the path presented in the forecast from December.

According to the Research Department’s assessment, the Bank of Israel interest rate is expected to be 0.1 percent during the coming year and to increase gradually beginning from the second quarter of 2017. In our assessment, this path reflects a balance between the need to bring inflation to its target and to support real activity, vis-a-vis the need to maintain financial stability, for example in view of the risks in the housing market. This path of the interest rate also takes into account the expected interest rates in the US and in other economies. According to the forecast, at the end of 2017 the interest rate in Israel will be 0.5 percent, lower than the US rate but higher than the rate in Europe (assessments of global interest rates are derived from interest rate futures contracts in capital markets).

According to the forecast, the Bank of Israel interest rate is expected to begin increasing in the second quarter of 2017, as opposed to the forecast from December in which the assessment was that the interest rate would begin increasing in the final quarter of 2016. This is the result of a decline in the inflation environment and due to the more moderate interest rate increases expected worldwide, compared with the increases expected in December.

Table 2 compares the Research Department’s forecasts with expectations derived from the capital markets and projections of professional forecasters. The table indicates that the forecast compiled by the Research Department regarding inflation in the next year is similar to that of the projections of professional forecasters, on average, (and is within the range of their projections) and is higher than expectations derived from the capital market. The Research Department's interest rate forecast for one year from now is similar to the projections of the professional forecasters and to expectations derived from the capital market.

Table 2 | |||

Forecasts for inflation rate and interest rate for the coming year | |||

(percent) | |||

Bank of Israel Research Department |

Capital marketsa |

Private forecastersb | |

Inflation ratec |

0.8 |

0.2 |

0.6 |

(range of forecasts) |

(-0.2–0.9) | ||

Interest rated |

0.1 |

0.1 |

0.20 |

(range of forecasts) |

(0.1–0.5) | ||

a) Daily average for the month of March after publication of the CPI reading for February. Seasonally adjusted inflation expectations. | |||

b) Inflation and interest rate forecasts are those published after the publication of the CPI reading for February. | |||

c) Inflation rate over the next year (Research Department: in the next four quarters). | |||

d) The interest rate in 1 year (Research Department: the interest rate in the first quarter of 2017). Capital markets forecast derived from Telbor rates. | |||

Source: Bank of Israel. | |||

d. Balance of risks in the forecast

This forecast is contingent on assumptions related to the global environment and to domestic background conditions. Developments different from those assumptions may lead to developments in the domestic economy that are different than those in the baseline forecast (Table 1). There are several especially notable factors leading to uncertainty at this time. First is the real economic situation worldwide, especially in the US and China. Recently, we have seen marked and very frequent changes in the expected path of the US federal funds rate, which reflects, among other things, high uncertainty regarding the real economic situation there. Oil prices are also characterized by considerable uncertainty. In the first two months of the year, the price of oil declined, but in March the price increased to its level of December. At this point it is difficult to say whether this increase reflects a turning point or a transitory event. Another source of uncertainty is the development of the effective exchange rate. Its development may be impacted by unexpected changes in Israel, such as changes in the security situation, changes in real activity and various global developments. Additional sources of uncertainty come from the housing market situation in Israel—home prices continue to increase and it is not clear when, and to what extent, government measures will have an effect on them. We note that changes in home prices, among other things, impact on rents, an item with a high weight in the CPI.

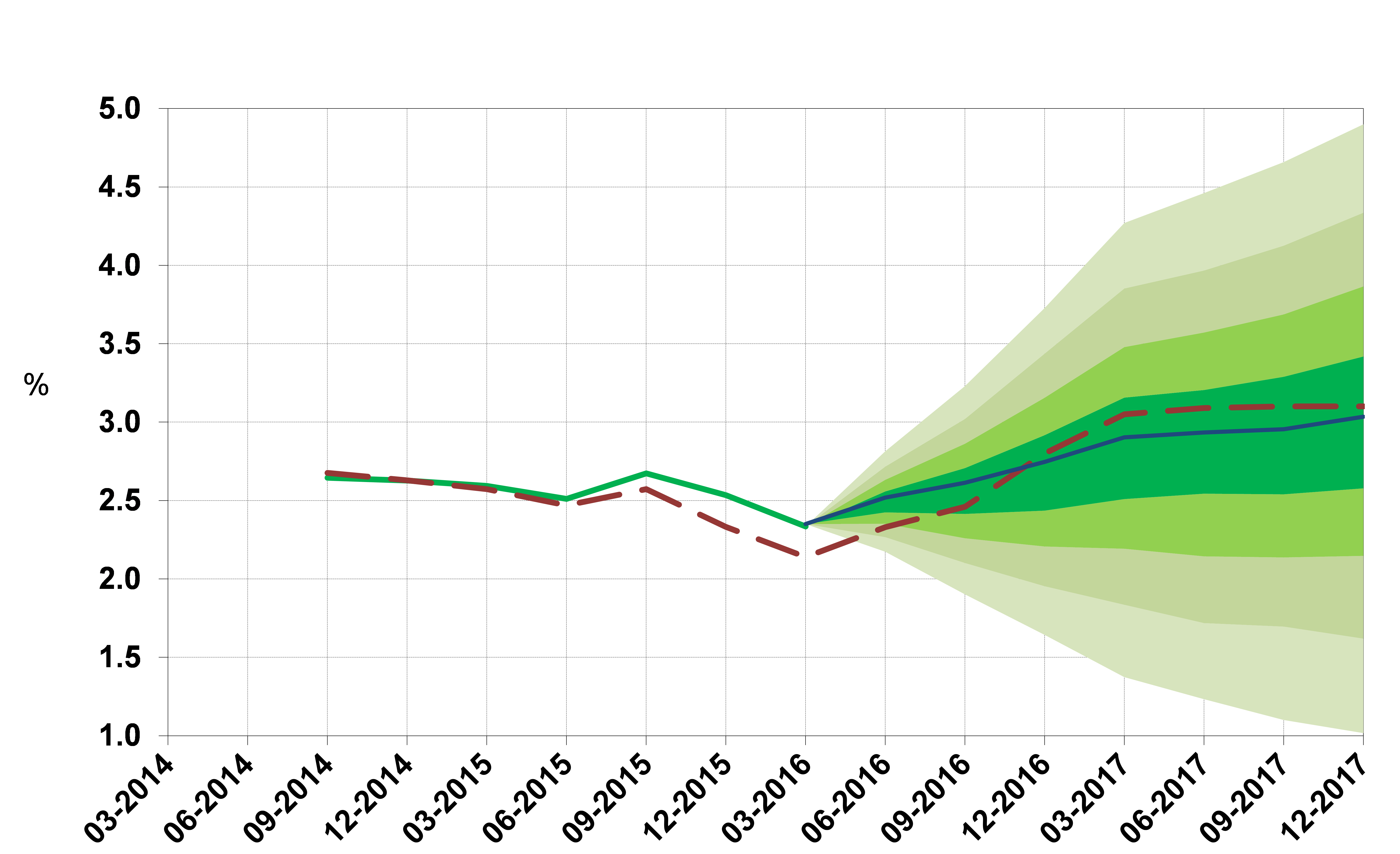

Figures 1 to 3 present fan charts around the inflation rate, interest rate and GDP growth forecasts. (The broken line represents the baseline forecast from December 2015.) The width of the fan is derived from the estimated distributions of the shocks in the Research Department's DSGE model.

Figure 1

Actual Inflation and Fan Chart of Expected Inflation

Actual Inflation and Fan Chart of Expected Inflation

(cumulative increase in prices in previous four quarters)

Figure 2

Actual Bank of Israel Interest Rate and Fan Chart of Expected Interest Rate

Actual Bank of Israel Interest Rate and Fan Chart of Expected Interest Rate

The center of the fan charts (the white line) is based on the Bank of Israel Research Department assessment. The width of the fan is based on the Department’s medium-scale DSGE (dynamic stochastic general equilibrium) model. The full fan covers 66 percent of the expected distribution. The dotted line corresponds to the previous staff forecast (published in December 2015).

Source: Bank of Israel.

Figure 3

Actual GDP Growth Rate in the Past Four Quarters and Fan Chart of Expected Growth Rate

The annual growth rate is calculated as total GDP over the past four quarters relative to GDP in the preceding four quarters. The center of the fan chart (the blue line) is based on the Bank of Israel Research Department assessment. The width of the fan is based on the Department’s medium-scale DSGE (dynamic stochastic general equilibrium) model. The full fan covers 66 percent of the expected distribution. The dotted line corresponds to the pervious staff forecast (published in December 2015).

SOURCE: Bank of Israel.

[1] An explanation of the staff macroeconomic forecast, and an overview of the models on which it is based, can be found in Inflation Report 31 for the second quarter of 2010, section 3-C.

[2] A Discussion Paper on the model is available on the Bank of Israel website, under the title: “MOISE: A DSGE Model for the Israeli Economy,” Discussion Paper No. 2012.06.

[3] Support for this can be found in, for example, the fourth quarter of 2015: In this quarter, current consumption increased only moderately, after it had increased markedly before that.

[4] Including the reductions of public transport and water prices announced by the Ministry of Finance on December 27, and the declines in prices of compulsory vehicle insurance.