Abstract

This document presents the forecast of macroeconomic developments compiled by the Bank of Israel Research Department in January 2018[1]. According to the staff forecast, gross domestic product (GDP) is projected to increase by 3.4 percent in 2018 and by 3.5 percent in 2019. The rate of inflation over the next year[2] is expected to be 1.1 percent. The Bank of Israel interest rate is expected to remain at its current level of 0.1 percent over the first three quarters of the year, and to increase to 0.25 percent in the fourth quarter of the year.

Forecast

The Bank of Israel Research Department compiles a staff forecast of macroeconomic developments on a quarterly basis. The staff forecast is based on several models, various data sources, and assessments based on economists’ judgment.[3] The Bank’s DSGE (Dynamic Stochastic General Equilibrium) model developed in the Research Department—a structural model based on microeconomic foundations—plays a primary role in formulating the macroeconomic forecast[4]. The model provides a framework for analyzing the forces that have an effect on the economy, and allows information from various sources to be combined into a macroeconomic forecast of real and nominal variables, with an internally consistent “economic story”.

a. The global environment

Our assessments of expected developments in the global economy are based mainly on projections by international institutions (the International Monetary Fund and the OECD) and by foreign investment houses. These institutions revised their forecasts for growth and inflation in advanced economies and for world trade slightly upward compared to their previous forecasts. Accordingly, our assessments are for growth in advanced economies of about 2.2 percent in 2018 and 2.0 percent 2019, and that imports to the advanced economies will increase by 3.8 percent in 2018 and by 3.9 percent in 2019. Based on the assessments of investment houses, the US federal funds rate is expected to increase to 2.2 percent at the end of 2018 and 2.7 percent at the end of 2019. In contrast, the ECB’s main interest rate is expected to remain at 0.0 percent at the end of 2018 and increase to 0.3 percent at the end of 2019. Additionally, our assessment is that inflation in the advanced economies will reach about 1.9 percent in 2018 and in 2019. Oil prices increased in recent months, with the average price of Brent crude oil reaching about $61 per barrel in the fourth quarter, compared with an average of $52 in the third quarter.

b. Real activity in Israel

GDP is expected to grow by 3.4 percent in 2018 and by 3.5 percent in 2019 (Table 1). Exports are expected to continue increasing in the forecast period due among other things to the expected recovery in world trade. Fixed capital formation is expected to continue increasing, even though a number of large, import-oriented investments that were expected to take place in 2018 will only be made in 2019. Changes in vehicle taxation are expected in January 2019, and our assessment is that they will lead to vehicle purchases being brought forward, which will be reflected in growth figures for 2018 (similar to the development that was observed in previous years) [5]. Our assessment is that, net of vehicles, the growth rate in 2018 will be 3.0 percent.

|

Table 1 |

|

|||

|

Research Department Staff Forecast for 2018 to 2019 |

|

|||

|

(Rates of change, percent, unless stated otherwise; previous forecast in parentheses) |

|

|||

|

|

Bank of Israel forecast |

|

||

|

|

2017a |

2018 |

2019 |

|

|

GDP |

3.0 |

3.4 (3.3) |

3.5 |

|

|

Civilian imports (excluding diamonds, ships, and aircraft) |

5.5 |

4.0 (8.0) |

7.5 |

|

|

Private consumption |

3.0 |

4.0 (3.5) |

3.0 |

|

|

Fixed capital formation (excluding ships and aircraft) |

2.8 |

3.0 (9.0) |

7.0 |

|

|

Public sector consumption (excluding defense imports) |

2.8 |

2.0 (1.5) |

3.0 |

|

|

Exports (excluding diamonds and start-ups) |

3.9 |

3.5 (4.0) |

6.0 |

|

|

Unemployment rateb |

3.7 |

3.6 (3.5) |

3.6 |

|

|

Inflation ratec |

0.3 |

1.1 (1.0) |

1.4 |

|

|

Bank of Israel interest rated |

0.10 |

0.25(0.25) |

0.50 |

|

|

a) According to preliminary estimations. b) Annual average of unemployment in the primary working ages (25–64). c) Average CPI reading in the final quarter of the year compared with the final-quarter average in the previous year. d) End of the year. |

|

|||

c. Inflation and interest rate estimates

In our assessment, the inflation rate in the four quarters ending in the fourth quarter of 2018 will be 1.1 percent and at the end of 2019 it will be 1.4 percent. This forecast reflects the assessment that inflation will increase moderately toward the center of the target range. Inflation in the prices of domestic goods and services will be spurred by pressure from the labor market, which is in a full employment environment, and will be moderated by the continued increase in competition and measures taken by the government to lower the cost of living. The pace of increase in the prices of imported goods will rise due to the increase in inflation globally, particularly the increase in energy prices, assuming that the shekel’s exchange rate remains relatively stable. However, it will be moderated by long-term trends in the prices of tradable goods, and by structural processes (such as the development of Internet commerce), which are expected to continue receiving support from government measures as well.

According to the Research Department’s assessment, the Bank of Israel interest rate is expected to start increasing in the fourth quarter of 2018, following the increase of the annual inflation rate to within the target range, and as the inflation expectations at that time will also be within the inflation range.

Table 2 indicates that the forecasts compiled by the Research Department regarding inflation and interest rate in the coming year are higher than the projections of private forecasters and expectations derived from the capital markets. However, according to the forecasters and market expectations, an increase in the interest rate during the coming year is likely.

Table 2 |

|||

|

Inflation and interest rate forecasts for the coming year |

|||

|

(percent) |

|||

|

|

Bank of Israel Research Department |

Capital markets |

Private forecasters |

|

Inflation ratea |

1.1 |

0.5 |

0.7 |

|

(range of forecasts) |

(0.2–2.2) |

||

|

Interest rateb |

0.25 |

0.16 |

0.14 |

|

(range of forecasts) |

(-0.10–0.25) |

||

|

a) Research Department: average CPI reading in the fourth quarter compared with the average in the fourth quarter of the previous year. Forecasters: Average forecast of inflation in 2018 published following the publication of the CPI for November 2017. |

|||

|

b) Research Department: in the fourth quarter of 2018. Expectations from the capital market are absed on the monthly average forward Telbor rates for 9–12 months. Forecasters: Average forecast of interest rates at the end of 2018 published following the publication of the CPI for November 2017. |

|||

d. Risks in the forecast

Several factors may lead to the domestic economy developing differently than in the baseline forecast. These include uncertainty concerning the future development of the exchange rate and the extent to which the cumulative appreciation of the shekel will roll over to prices, as well as uncertainty concerning the extent to which government measures to reduce the cost of living will roll over to prices and regarding the possibility that the government may take further measures of this kind. Regarding the global environment, even though the international financial institutions note that downward risks to growth and world trade have decreased, uncertainty remains regarding the pace of recovery of these variables.

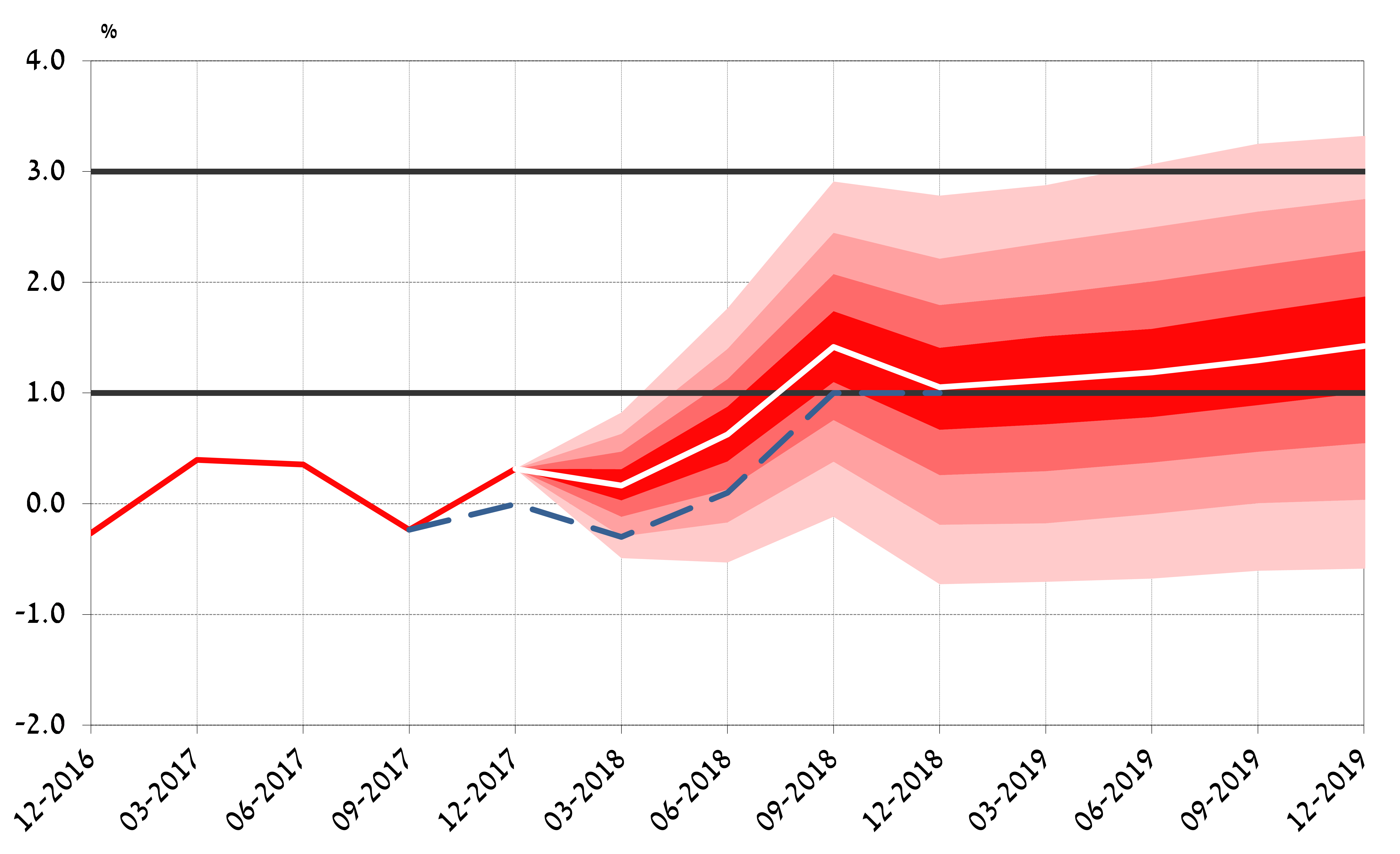

Figures 1 to 3 present fan charts around the inflation rate, interest rate and GDP growth forecasts. The center of the fan (the white line) reflects the Research Department’s staff forecast. The broken line represents the baseline forecast from October. The width of the fan is derived from the estimated distributions of the shocks in the Research Department's DSGE model, and the fan encompasses 66 percent of the expected distribution.

Figure 1

Actual Inflation and Fan Chart of Expected Inflation

(Cumulative increase in prices in the previous four quarters)

Figure 2

Actual Bank of Israel Interest Rate and Fan Chart of Expected Interest Rate

Figure 3

Actual GDP Growth Rate in the Past Four Quarters and Fan Chart of Expected Growth Rate

(Total GDP over the past four quarters relative to GDP in the preceding four quarters)

The center of the fan chart (the white line) is based on the Bank of Israel Research Department assessment. The width of the fan is based on the Department’s medium-scale DSGE (dynamic stochastic general equilibrium) model. The full fan covers 66 percent of the expected distribution. The dotted line corresponds to the previous staff forecast (published in October 2017). In terms of GDP growth (Figure 3), until September 2017, the dotted line reflects the data and estimates that were known at the time when the previous forecast was formulated, while the solid line reflects the updated data and estimates (the difference between them derives from new and data and revisions to the data by the Central Bureau of Statistics).

[1] The forecast was presented to the Monetary Committee on January 9, 2018 during its meeting prior to the decision on the Bank of Israel interest rate reached on January 10, 2018.

[2] The average CPI in the fourth quarter of 2018 compared with the average in the fourth quarter of 2017.

[3] An explanation of the macroeconomic staff forecasts compiled by the Research Department, as well as a review of the models on which they are based, appear in Inflation Report number 31 (for the second quarter of 2010), Section 3c.

[4] A Discussion Paper on the DSGE model is available on the Bank of Israel website, under the title: “MOISE: A DSGE Model for the Israeli Economy,” Discussion Paper No. 2012.06.

[5] According to the National Accounts recording rules, taxation on imported vehicles is included in GDP. These imports also contribute to GDP through their effect on importers’ added value.