This document presents the forecast of macroeconomic developments compiled by the Bank of Israel Research Department in December 2016. The forecast was presented to the Monetary Committee on December 25, 2016, during its meeting prior to the decision on the Bank of Israel interest rate for January 2017. According to the staff forecast, gross domestic product (GDP) is projected to increase by 3.2 percent in 2017 and by 3.1 percent in 2018. The rate of inflation over the next year (ending in the fourth quarter of 2017) is expected to be 1.0 percent. The Bank of Israel interest rate is expected to remain at its current level of 0.1 percent in the first three quarters of 2017, and to increase gradually from the fourth quarter of 2017.

Forecast

The Bank of Israel Research Department compiles a staff forecast of macroeconomic developments on a quarterly basis. The staff forecast is based on several models, various data sources, and assessments based on economists' judgment.[1] The Bank's DSGE (Dynamic Stochastic General Equilibrium) model developed in the Research Department—a structural model based on microeconomic foundations—plays a primary role in formulating the macroeconomic forecast.[2] The model provides a framework for analyzing the forces which have an effect on the economy, and allows the integration of information from various sources into a macroeconomic forecast for real and nominal variables, with an internally consistent "economic story".

a. The global environment

Our assessments of expected developments in the global economy are based mainly on projections by international institutions (the International Monetary Fund and the OECD) and by foreign investment houses. These institutions revised their forecasts for growth in advanced economies and for world trade slightly downward. Our forecasts are for growth in advanced economies of 1.7 percent in 2017 and 1.8 percent in 2018. As for the world trade, in its recent Economic Outlook from November, the OECD reduced the expected growth of trade to 2.9 percent in 2017, and forecast 3.2 percent in 2018. The revised forecasts indicate that the international institutions expect that compared with the past, global growth in coming years will be based less on world trade and more on domestic demand, because, among other things, recent political developments in the US and the UK, reflect a tendency worldwide toward more isolationist economic policy.

Based on assessments derived from the capital market (assessments based on interest rate futures contract prices), the forecast path of the US federal funds rate rose sharply after the US elections. There was a further moderate increase in December, after the Federal Reserve’s decision to increase the federal funds target rate. According to these assessments, the federal funds rate is expected to increase to around 1.2 percent at the end of 2017 and to around 1.6 percent at the end of 2018. (The median assessment of the members of the Federal Open Market Committee is that the interest rate will increase more rapidly—to 1.4 percent at the end of 2017 and 2.1 percent at the end of 2018.) In contrast, the interest rate on deposits in Europe is expected to remain negative at -0.3 percent at the end of 2017 and -0.2 percent at the end of 2018, and this policy will be supported by an asset purchase plan, which according to the most recent ECB announcement was extended until the end of 2017.

At the end of November, OPEC announced an agreement to reduce production quotas, in which Russia was also expected to take part. Following the announcement the price of a barrel of Brent crude oil increased to around $54. The forecast is based on the assumption that the price of oil will remain at this level (compared with $47 per barrel that we assumed in the previous quarter). Nonenergy commodity prices also increased in recent months, and contributed to an upward revision in international institutions’ global inflation forecasts. In accordance with those forecasts, we assess that inflation in advanced economies will be 1.8 percent in 2017 (compared with 1.6 percent that we assumed in the previous forecast) and 2 percent in 2018.

b. Real activity in Israel

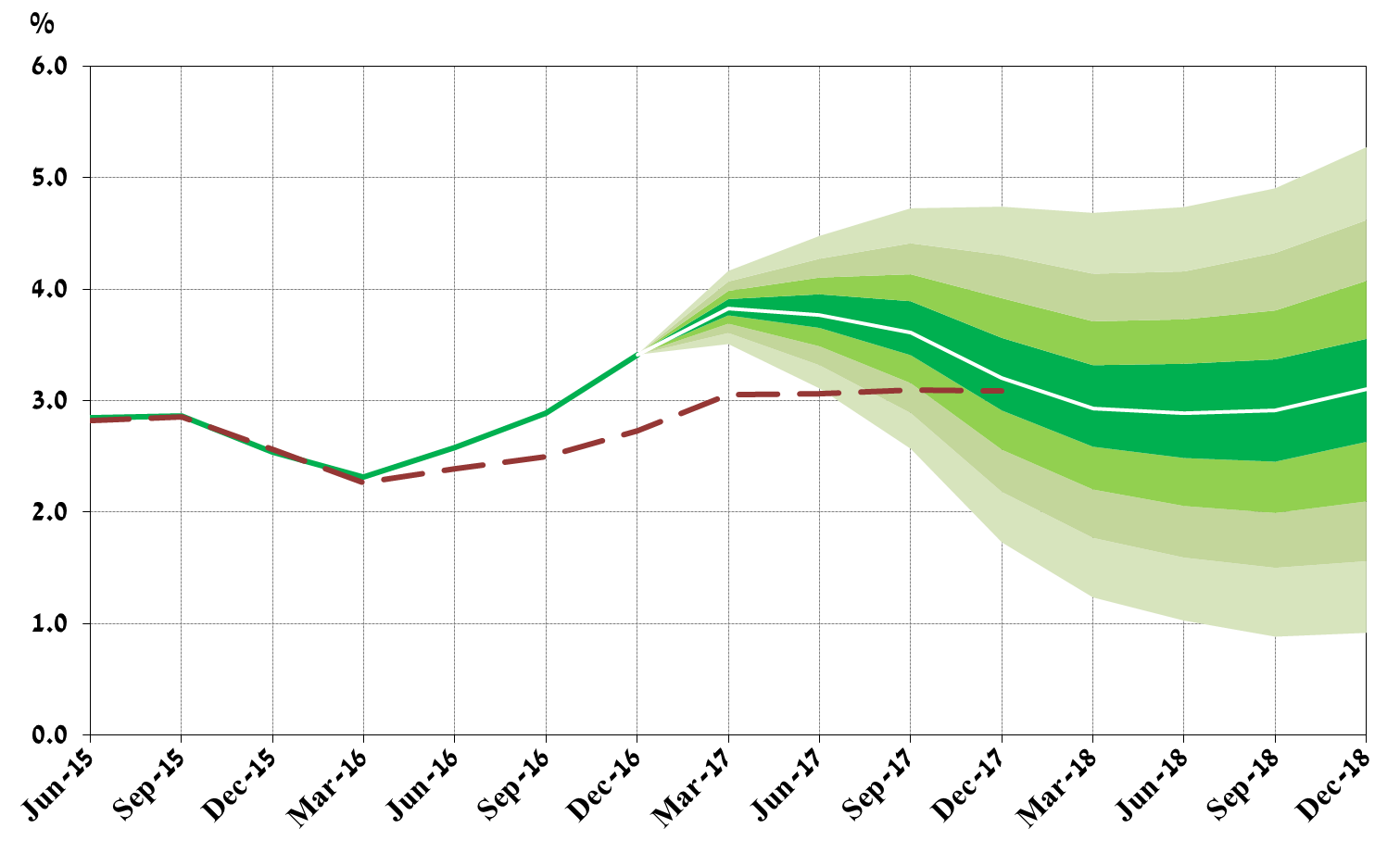

GDP is expected to grow by 3.5 percent in 2016 (Table 1). The increase relative to the previous forecast (2.8 percent) derives from National Accounts data for the first half of 2016 being revised upward, and third quarter growth being higher than we assessed when compiling the previous forecast. Based on the data, the increase in GDP was seen mainly in domestic uses: private consumption and investments, which are supported by the low interest rate and the high rate of employment, as well as public consumption. Part of the growth in GDP reflects an atypical jump in imports of transportation vehicles for personal use and investment.[3],[4] Net of this factor, we assess that GDP growth in 2016 will be about 3 percent.

The forecast for growth is 3.2 percent in 2017 and 3.1 percent in 2018. The expected development of GDP reflects a gradual transition to growth based less on domestic uses and more on exports. Thus, the growth rate of private consumption is expected to moderate gradually, after a long period in which it was relatively rapid compared with the rate of growth of other uses and the GDP growth rate. In contrast, exports are expected to grow by a more rapid pace than in the past, in light of international institutions’ forecasts for gradual recovery of world trade. Compared with the previous forecast, the composition of uses is expected to change more slowly. This is in light of data indicating continued strength of private consumption, while in contrast, international institutions’ forecasts reflect a slower recovery of world trade, compared with the forecast when compiling the previous forecast.

|

Table 1 Economic Indicators |

|||

|

Research Department Staff Forecast for 2016 to 2018 |

|||

|

(rates of change, percent, unless stated otherwise. Previous forecast in parentheses.) |

|||

|

|

Estimate for |

Bank of Israel forecast |

Bank of Israel forecast |

|

|

2016 |

2017 |

2018 |

|

GDP |

3.5(2.8) |

3.2(3.1) |

3.1 |

|

Civilian imports (excluding diamonds, ships, and aircraft) |

10.2(7.5) |

3.8(8.4) |

3.0 |

|

Private consumption |

5.9(5.9) |

4.0(3.7) |

3.2 |

|

Fixed capital formation (excluding ships and aircraft) |

10.0(5.8) |

1.6(6.3) |

3.0 |

|

Public sector consumption (excluding defense imports) |

4.3(3.4) |

4.2(3.6) |

1.5 |

|

Exports (excluding diamonds and start-ups) |

2.2(1.0) |

2.9(3.9) |

4.3 |

|

Unemployment ratea |

4.8(4.9) |

4.6(4.8) |

4.6 |

|

Inflation rateb |

-0.3(-0.2) |

1.0(1.1) |

1.5 |

|

Bank of Israel interest ratec |

0.10(0.10) |

0.25(0.25) |

0.50 |

|

a) Annual average. |

|||

|

b) Average CPI reading in the final quarter of the year compared with the final-quarter average in the previous year. |

|||

|

c) End of the year. |

|||

|

Source: Bank of Israel. |

|||

c. Inflation and interest rate estimates

In our assessment, the inflation rate in 2017 will be 1.0 percent and in 2018 it will be 1.5 percent. The inflation forecast reflects the assessment that prices of domestic products and of imported products will develop differently. Prices of imported products are expected to increase at a higher rate than that of the past two years, as inflation expectations worldwide increased against the background of the US election results and the increase in commodity prices. In contrast, the low inflation in the final quarter of 2016 strengthened the assessment that there are forces acting to moderate domestic inflation—including enhanced competition and government measures to reduce the cost of living—and in our assessment they are likely to continue moderating domestic inflation over the next two years as well; in addition, convergence toward full employment and the wage increases have not, to date, created pressure for increasing domestic inflation. We expect that wages will continue to increase, against the background of labor market resilience, and it is plausible that this will act to increase inflation.

|

Table 2 |

|||

|

Forecasts for inflation rate and interest rate for the coming year |

|||

|

(percent) |

|||

|

|

Bank of Israel Research Department |

Capital marketsa |

Private forecastersb |

|

Inflation ratec |

1.0 |

0.6 |

0.7 |

|

(range of forecasts) |

|

|

(0.3–1.0) |

|

Interest rated |

0.25 |

0.16 |

0.22 |

|

(range of forecasts) |

|

|

(0.1–0.5) |

|

a) Daily average for the month of December (up to the 21st). Seasonally adjusted inflation expectations. |

|||

|

b) Inflation and interest rate forecasts are those published after the publication of the CPI reading for November. |

|||

|

c) Inflation rate over the next year (Research Department: in the four quarters ending in the fourth quarter of 2017). |

|||

|

d) The interest rate in one year (Research Department: the interest rate in the fourth quarter of 2017). Capital markets forecast derived from Telbor rates. |

|||

|

Source: Bank of Israel. |

|||

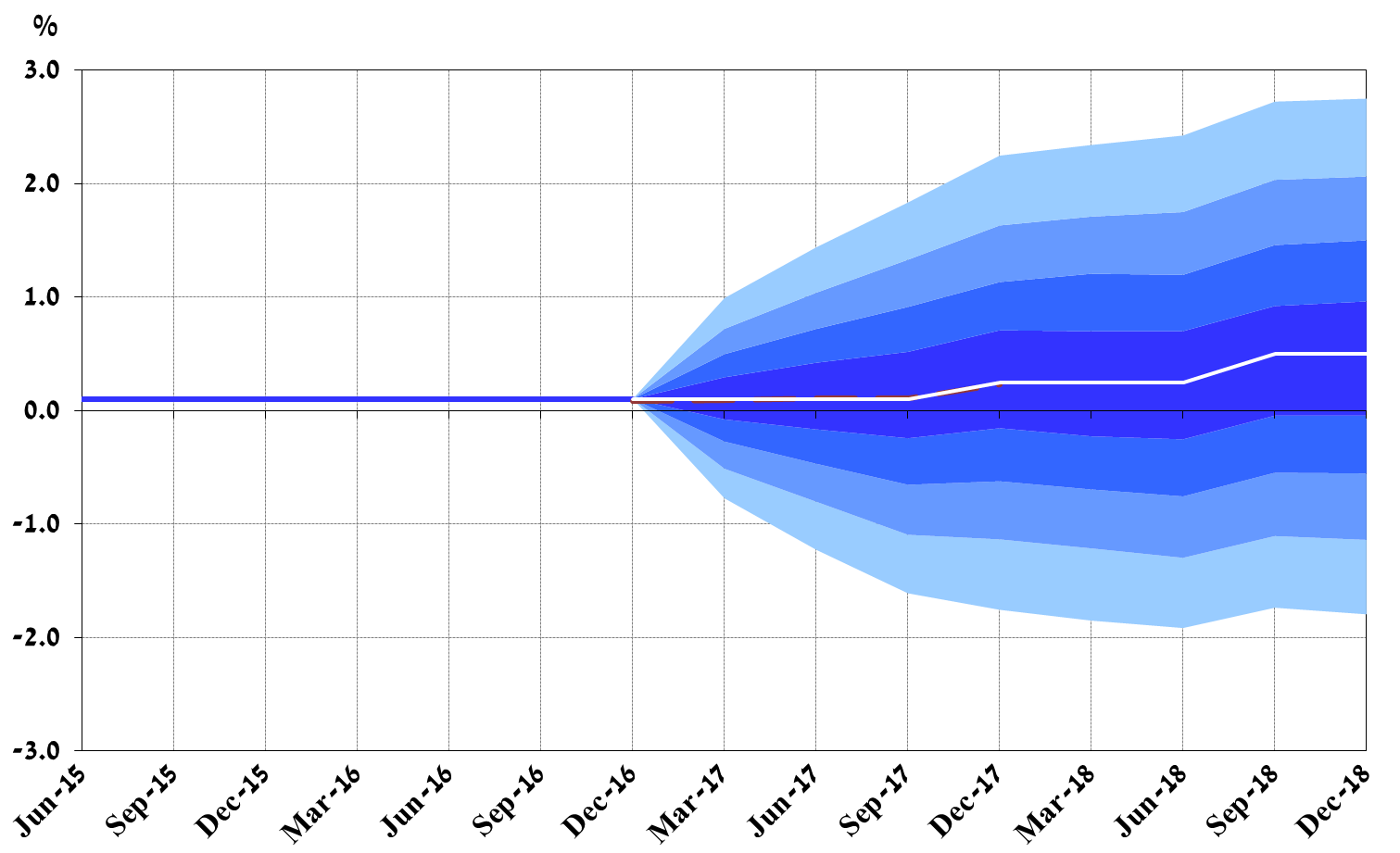

According to the Research Department’s assessment, the Bank of Israel interest rate is expected to be 0.1 percent until the third quarter of 2017, and to start increasing thereafter. The interest rate is expected to remain at its current level in the coming months, in order to support the return of inflation to within the target range and economic growth. The interest rate is expected to begin to rise in the final quarter of the year, to 0.25 percent, against the background of a gradual increase in the inflation rate and continued growth of GDP at a rate of around 3 percent. We expect an additional increase in 2018, so that the rate will be 0.5 percent at the end of that year. As such, according to our assessment, the interest rate in Israel will increase more slowly than in the US, while monetary policy in Europe is expected to remain very accommodative for a considerable time.

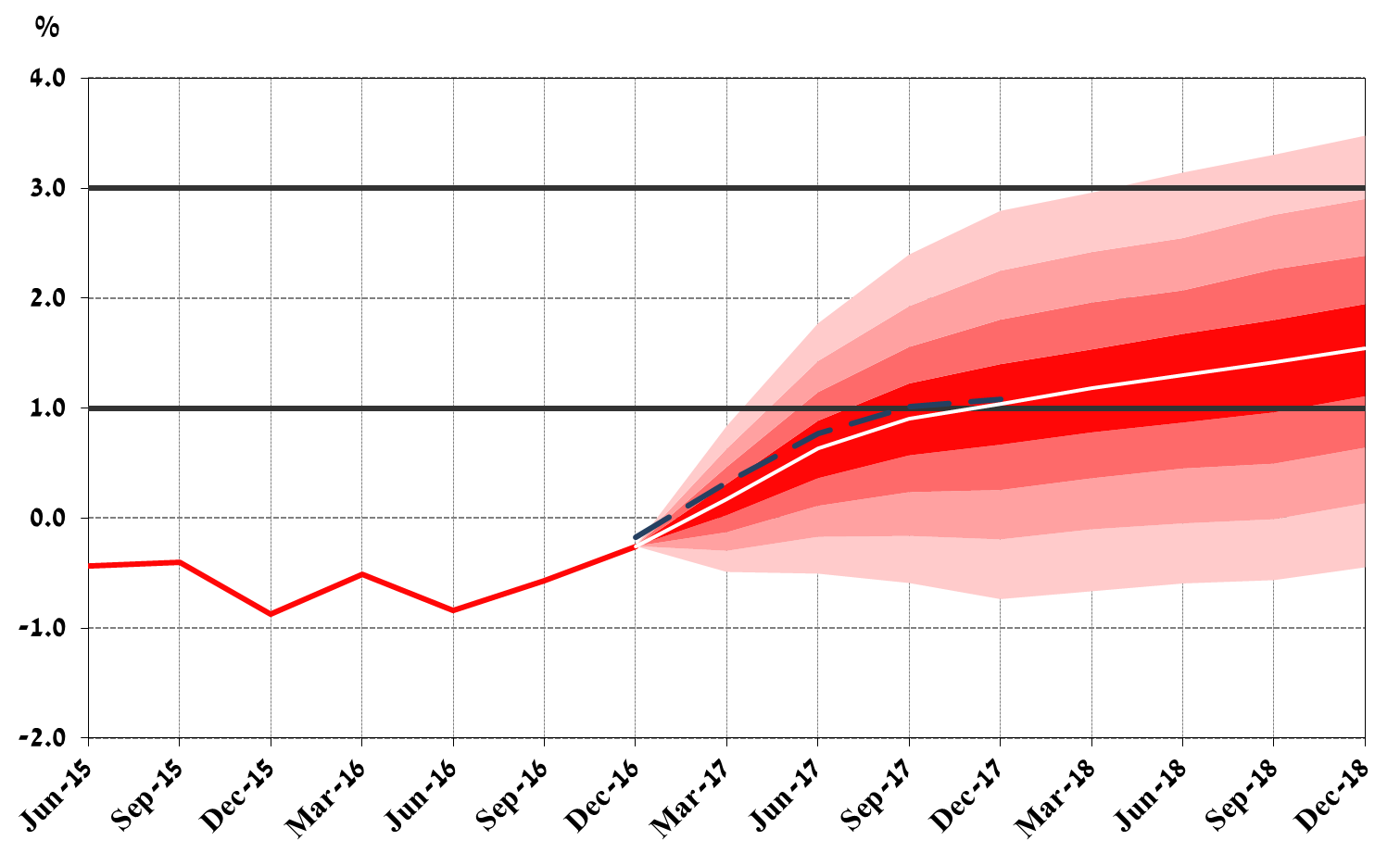

As indicated in Figure 2, the expected path of the Bank of Israel interest rate in 2017 remains unchanged compared with the previous forecast.

Table 2 indicates that the forecast compiled by the Research Department regarding the interest rate in the coming year is similar to projections of private forecasters and slightly higher than expectations derived from the capital markets. However, with regard to inflation, the Research Department’s forecast is higher than that of the professional forecasters and expectations derived from the capital market.

d. Balance of risks in the forecast

Several factors may lead to the domestic economy developing differently than in the baseline forecast. Regarding the global environment, in the recent period the forecasts of international institutions and those derived from the capital market for US inflation and interest rates were revised upward. In contrast, monetary policy in Europe is expected to remain very accommodative, as reflected in the extension of the ECB’s asset purchase plan. This divergence is accompanied by marked uncertainty, and in addition, there is considerable uncertainty regarding its impact on capital markets and on the domestic economy. In particular, there is uncertainty about the development of the exchange rate due to the opening of yield gaps between the US, Israel and Europe. The uncertainty regarding nominal developments is also accompanied by uncertainty regarding the strengthening of global growth and world trade, among other things against the background of the strengthening of the voices calling for pulling out of trade agreements and for implementing isolationist economic policy, which was seen in recent political developments in the UK and the US.

Figures 1 to 3 present fan charts around the inflation rate, interest rate and GDP growth forecasts. (The broken line represents the baseline forecast from September.) The width of the fan is derived from the estimated distributions of the shocks in the Research Department's DSGE model.

Figure 1

Actual Inflation and Fan Chart of Expected Inflation

(Cumulative increase in prices in previous four quarters)

Figure 2

Actual Bank of Israel Interest Rate and Fan Chart of Expected Interest Rate

Figure 3

Actual GDP Growth Rate in the Past Four Quarters and Fan Chart of Expected Growth Rate

(Total GDP over the past four quarters relative to GDP in the preceding four quarters)

The center of the fan chart (the white line) is based on the Bank of Israel Research Department assessment. The width of the fan is based on the Department’s medium-scale DSGE (dynamic stochastic general equilibrium) model. The full fan covers 66 percent of the expected distribution. The dotted line corresponds to the previous staff forecast (published in September 2016). In terms of GDP growth (Figure 3), until September 2016, the dotted line reflects the data and estimates that were known at the time when the previous forecast was formulated, while the solid line reflects the updated data and estimates (the difference between them derives from new and data and revisions by the Central Bureau of Statistics to the data).

SOURCE: Bank of Israel Research Department.

[1] An explanation of the staff macroeconomic forecast, and an overview of the models on which it is based, can be found in Inflation Report 31 for the second quarter of 2010, section 3-C.

[2] A Discussion Paper on the model is available on the Bank of Israel website, under the title: “MOISE: A DSGE Model for the Israeli Economy,” Discussion Paper No. 2012.06.

[3] Taxes on transportation vehicles and domestic activity of importers contribute to GDP growth.

[4] In January 2017, new tax regulations are expected to come into force, regarding vehicles that pollute. It is likely that some of the atypical consumption of vehicles derives from purchases being brought forward against the background of these regulations. A similar development characterized the investments item (there was a very atypical increase in the passenger vehicle investment item) and imports.