To view this message as a file click here

The Bank of Israel is expanding the comparative information published on the Bank’s website. In addition to information published on the site regarding the interest rates on consumer deposits and loans, divided by the various banks, now there will also be information on the interest rates on loans for housing purposes (“mortgage”), in order to strengthen consumers’ awareness and to enhance the competition among the banks.

Supervisor of Banks Mr. Daniel Hahiashvili said, “The information that we are publishing today on the interest rates granted for loans for housing purposes is another important step in enhancing the transparency and strengthening the customer’s power. This step will enable customers to make an informed decision, after examining the data in a simple, accessible, and convenient manner.”

The Banking Supervision Department today announces the publication of additional information, on the issue of housing loans, in order to make accessible to the public information on the interest rates charged on credit for housing purposes performance and to assist the public to compare prices in the process of taking out a housing loan. We note that the data represent the portfolio average of each bank, and not a specific mortgage extended in actuality. The interest rate offered to a customer is impacted by various characteristics such as the loan to value ratio, the payment to income ratio, the term of the loan, and more.

Following are details on the information that will be published, as of today:

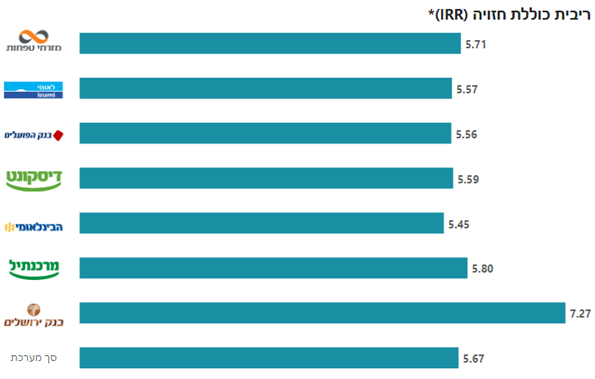

- The “forecast overall interest rate or the Internal Rate of Return (IRR)” calculated on the portfolio

The “Internal Rate of Return (IRR)” (the actual cost of the credit) is calculated according to the equation established in Proper Conduct of Banking Business Directive no. 451 on “Procedures for Extending Housing Loans”.[1],[2]

[1] The actual cost of the credit reflects the internal rate of return, which is the rate at which the present value of the future payments in respect of the credit is equal of the present value of the amount of credit, as of the calculation date. This rate incorporates several parameters: compound interest, timing differentials for dates of payments on the credit account, one-off additions paid when executing the credit, additional payments when making regular payments, as well as expected changes in anchors, interest rates, and inflation, in accordance with capital market forecasts derived from the yield curves.

[2] The calculation of the forecast overall interest rate uses yield curves as of the end of the publication month and nets out bullet, balloon, and foreign currency loans. The calculation assumes that the period of the interest rate changing for a variable-rate, unindexed, loan (that is not prime) and a variable rate CPI-indexed loan is 5 years.

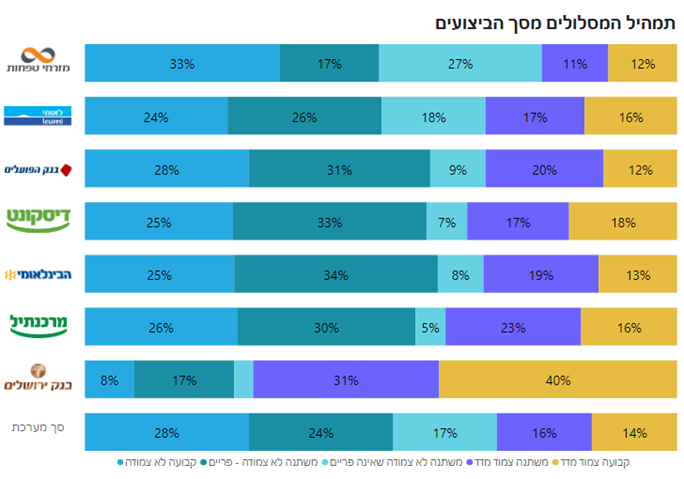

2. The composition of the tracks in total performance

In addition to a simple comparison of the forecast overall interest rate on the total portfolio, a comparison is presented of the composition of the tracks for the bank’s performance in the publication month.

A housing loan is made up, in many cases, of numerous different loans called “tracks”.

The tracks are differentiated from each other by several variables, such as type of interest rate, type of indexation, frequency of the interest rate changing, term of the loan, etc. In Israel there are 5 major housing-loan tracks. These tracks are included in the publication.

The monthly payment over the course of the loan changes in all of the tracks, except the fixed-rate, unindexed track, in which the monthly payment is fixed. The changes in the monthly payment are determined based on the changes in the anchor interest rate and/or the Consumer Price Index (CPI) (in CPI-indexed loans).

[3] All the data presented are as of May, 2023. Additional monthly data is collected, processed, and analyzed on days after the end of a specific month and are expected to be published 10–15 days after the end of the month.

3. Information on the forecast interest rate in each track

In order to improve the ability to compare, we also present the interest rate offered to customers on each of the tracks. Note should be taken that the interest rate on each track is impacted by the loan composition.

In order to improve the ability to compare, there are “filters” to compare interest rates for each of the tracks.

See the example of the “Variable-rate, Unindexed, Prime” track

The information is published on a monthly frequency, via a designated, accessible page on the Bank’s website, which was developed by the Banking Supervision Department at the Bank of Israel.