To view the message as a file click here

The credit data sharing system began its operation in April 2019, by force of the Credit Data Law, 5776-2016, with the goal of promoting competition and the public’s access to credit, while reducing discrimination in extending credit and economic gaps. The Law mandated the Bank of Israel to establish the national database of credit data and to oversee all the entities acting within the framework of the arrangement to share credit data established by law.

After four years of activity for the credit data sharing system, we are pleased to publish primary data on the system’s activity that indicate its importance to increasing the sophistication of the retail credit market in Israel and its contribution to the State of Israel’s citizens:

- The number of adult customers about whom there is information in the credit data system is approximately 6.5 million customers, who make up the majority of the adult population with credit data.

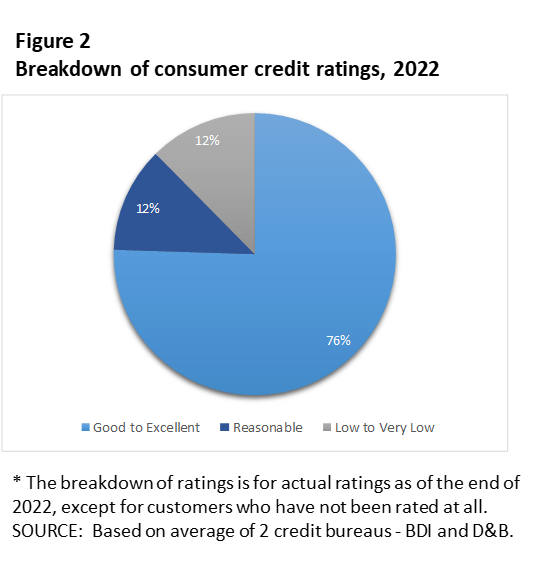

- More than three quarters of the database’s population (about 76 percent) are rated excellent or good. It may very well be that these customers can improve the interest rate they are given for the loans they take out, if they will contact various credit providers in order to receive additional offers. Of the other rated people: 12 percent have a reasonable rating and 12 percent have a low rating.

- There are 44 credit providers using data from the database, compared to 28 entities in April 2019, an increase of 57 percent. The increase derives from bank and nonbank entities that make use of the database’s data in order to reach decisions on extending credit or renewing credit. As the use of the system grows, the information asymmetry between large credit providers, which are the banks, and the smaller credit providers decreases, as they can make attractive credit proposals to new customers and thus enhance the competition in the retail credit market. In addition, due to the access granted the credit providers to reliable information regarding the public’s compliance with its undertakings, there is reduced use of nonfinancial information that is liable to cause prohibited discrimination (such as demographic or personal data of the customer).

- The information in the database is provided via credit bureaus to all users in the system. The credit bureaus, operating with a license from the Bank of Israel and under its supervision, are: D&B Credit Data Company Ltd. and BDI-Coface Ltd. The credit bureaus issue credit ratings to the credit providers and to customers, credit reports and creditworthiness assessments.

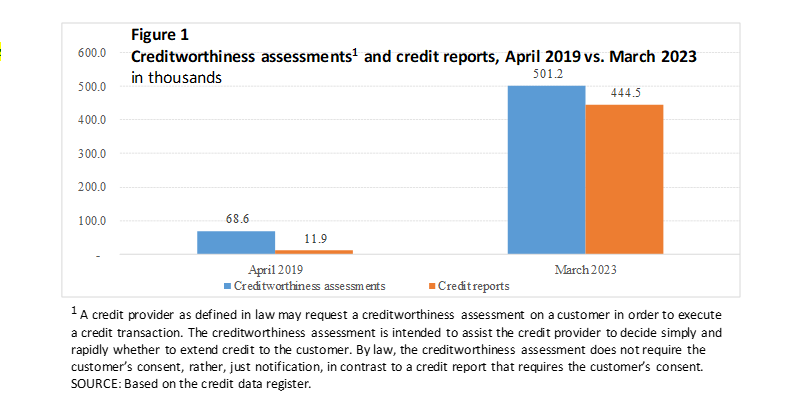

- The quantity of credit reports provided by the credit bureaus based on the data in `the databases increased 6-fold from the first month it was established through the end of March this year: From April 2019 through the end of the first quarter of this yeas, about 14 million credit reports have been issued and about 27 million creditworthiness assessments.

- Since the establishment of the system, about 330,000 customers requested their credit data reports from the system, which is about 560,000 reports in 4 years. In addition, 1.3 million reports were provided to customers via the credit bureaus. This figure indicates the growing awareness of Israeli citizens about the importance of the database and its ramifications.

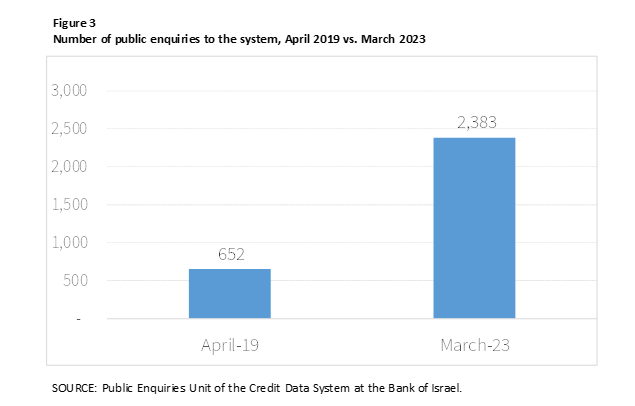

- In view of the impact that the credit data that are reported to the Bank of Israel have on a customer’s ability to receive credit and on terms of the credit, the Bank of Israel dedicates considerable resources to responding to the public’s questions and to clarifying its complaints. In the past 4 years, the Public Enquiries Unit of the Credit Data System dealt with about 90,000 enquiries in writing and responded to 500,000 phone enquiries. For comparison, and in view of the increasing familiarity of the public with the system, in the first year of the system’s operation, there was a total of a few hundred enquiries per month, compared with the first quarter of 2023, when about 5,300 enquiries were received in writing (of which 2,383 were in last March).

- Research published today examines the impact of a credit data system on a bank’s relationship with its customers, and in particular on its pricing of consume credit. It was found that before the system was established, customers that maintained a current account at an individual bank (exclusive customers) paid 0.4 percent more for consumer credit compared to customers that maintained several current accounts at various banks. In addition, after establishing a credit database, this gap in interest rates contracted markedly.

- Data from the statistical database enable the Bank of Israel to carry out its functions optimally, in order to make decisions and policy recommendations. These data serve the Bank of Israel in formulating policy recommendations for the government and also assist in making policy decisions by the Monetary Committee.

Bank of Israel Director General Shulamit Geri said, “The credit data sharing system was established by law to promote the competition in the credit market in Israel and to ensure that financial entities will have information that is relevant to making informed credit decisions. The expanded use of the database by financial entities leads to the promotion of the retail credit market and to its becoming more competitive. The system also has great importance in promoting responsible credit conduct by the public and to the prevention of over leverage by households. In addition, the database data support the Bank of Israel in making the monetary policy decisions and in the processes of making decisions within the framework of fulfilling its other functions including in the areas of advising the government and financial stability. We continue to act to increase the efficiency and to improve the credit data system for the benefit of the public and on the basis of the same approach, we are also advancing the establishment of the business credit data database.”

The Supervisor of Credit Data Sharing, Eyal Hadad, said, “Since the establishment of the system we have acted and will continue to act to improve and strengthen its benefits for the citizens of the State of Israel. The credit data sharing system provides financial entities with information, on the basis of which they can offer the optimal offers to their customers. For customers, the system provides a tool for leveraging their financial conduct in order to improve and maximize the consumer credit offers received from the credit providers. We are constantly working to ensure the data security, the protection of customers’ privacy, and the protection of customers’ interests, whether via regulatory directives or via supervision and control of processes of monitoring and examination in order to check the appropriateness and effectiveness of the reporting processes and use of the data. I am proud of the system’s development and its positive effect on the economy and am happy to accompany the process of its development.”