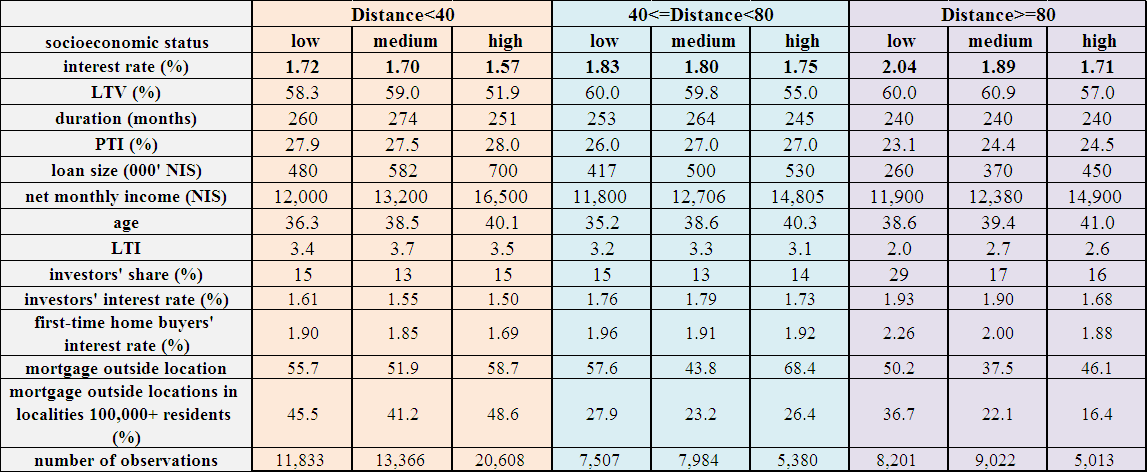

While in the US and in other countries the existence of discrimination between various mortgage borrowers was checked, this research is the first in the relevant literature to examine the impact of the location of the asset on the mortgage pricing: in order to examine the impact of the location of the asset being purchased on the mortgage interest rate, the statistical regions (neighborhoods) were divided into 9 groups, defined by the distance from central Tel Aviv and the socioeconomic level of that statistical region. For each distance group (up to 40 kilometers, 40–80 kilometers, and more than 80 kilometers from central Tel Aviv), three socioeconomic levels are defined (low, medium, and high) in accordance with Central Bureau of Statistics characteristics. Table 1 presents median values for some of the variables used in the research. The dependent variable in the research—the weighted real interest rate on the mortgage for every borrower—is calculated as the weighted average of the inflation-adjusted interest rates for all the mortgage tracks utilized by the borrower.

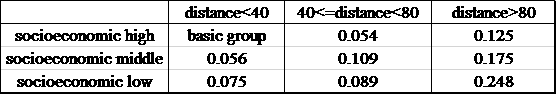

The empirical analysis indicates statistically significant differences in the interest rates on mortgages extended to finance the purchase of homes in various geographical regions and in statistical districts at various socioeconomic levels. While the interest rate that homebuyers in economically prosperous neighborhoods in the center of the country pay is the lowest, on average, the interest rate paid by buyers of homes in economically weak neighborhoods in peripheral areas is the highest, on average. As can be seen in Table 2, the interest rate differentials range from 0.054 percentage points, on average, between mortgages extended to buyers of assets located 40–80 kilometers from central Tel Aviv in neighborhoods at a high socioeconomic level compared with mortgages given to purchase assets located up to 40 kilometers from central Tel Aviv in neighborhoods with a high socioeconomic level, to 0.248 percentage points, on average, between mortgages given to buyers of assets located more than 80 kilometers from central Tel Aviv in neighborhoods at a lower socioeconomic level compared with mortgages extended to purchase assets located up to 40 kilometers from central Tel Aviv in neighborhoods with a high socioeconomic level, other factors being held equal. This range is similar to findings abroad in other types of research, which examined the interest rate differential between different groups—in which the range varies from 0.04 to 0.3 percentage points.

Among the other findings of the estimation of the econometric model:

- High-income households pay lower interest rates on mortgages: an increase of 10 percent in household income, all else being equal, is identified with a decline of 0.02 percentage points in the annual interest rate;

- Borrowers who take out a mortgage in the bank in which they hold a current account pay, on average, an interest rate that is 0.13 percentage points lower than customers who take a mortgage at a bank that does not recognize them as customers, all else being equal;

- Homebuyers upgrading their homes pay, on average, an interest rate that is 0.03 percentage points lower than first home buyers with similar characteristics who buy a home in a similar location; the gap between investors and first home buyers is even greater—0.07 percentage points in favor of the investors;

- Buyers who take a mortgage with a loan to value (LTV) ratio greater than 60 percent pay an interest rate that is 0.06 percentage points higher, on average, all else being equal;

- Borrowers who take out a mortgage for a period of more than 20 years pay an interest rate that, on average, is 0.22 percentage points higher, all else being equal;

- An increase of 10 percent in liquidity in the housing market in the locality (measured, as noted, as a ratio of the number of transactions in a year to the stock of homes in the locality) is identified with an interest rate that is 0.08 percentage points lower, on average, all else being equal;

- Borrowers that take out a mortgage outside the locality in which the purchased asset is located pay, on average, an interest rate that is 0.04–0.08 percentage points lower (depending on the specification of the estimated model) than borrowers who take out a mortgage in the locality in which they purchased the asset, all else being equal;

- A high level of competition between banks in the mortgage market reduces the interest rate: the addition of 1 banking corporation in the locality in which the asset was purchased is identified with a decline of 0.016 percentage points in the interest rate, on average, all else being equal, while the addition of 1 banking corporation in the locality in which the mortgage was taken is identified with a decline of 0.009 percentage points in the interest rate.

The observed characteristics of the borrower, the mortgage, and the asset being financed, as well as the extent of competition between the banks, can explain up to approximately two-thirds, at the most, of the inter-regional gaps in the interest rate on mortgages observed in the raw data. Additional factors that can explain the gaps include borrowers’ unobservable characteristics, such as financial literacy and negotiating ability, employment characteristics for which we did not have data, as well as some degree of statistical discrimination of groups of borrowers among whom there are above-average rates of mortgages in arrears.

Table 1

Median Values of Main Mortgage and Borrower Characteristics, Broken out by Combinations of Distance and Socioeconomic Status of Neighborhood

Table 2

Estimated Coefficients of Interregional Interest Differentials

Full research

Full research