![]() To view this message as Word doc

To view this message as Word doc![]() To graphs & data

To graphs & data

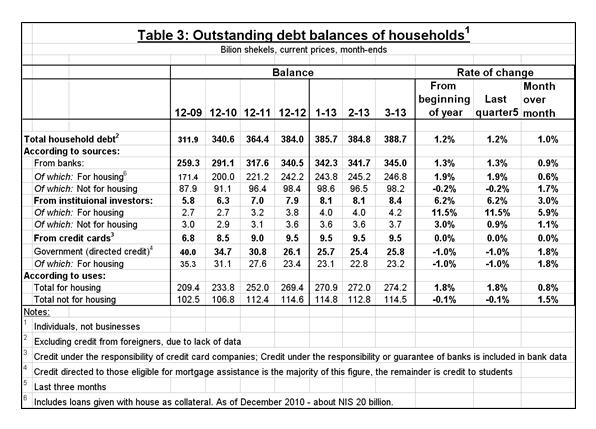

Business sector debt declined by about 0.9 percent mainly due to the strengthening of the shekel to around NIS 778 billion in March. Households' housing debt increased by about NIS 2 billion (0.8 percent), to about NIS 274 billion at the end of the month.

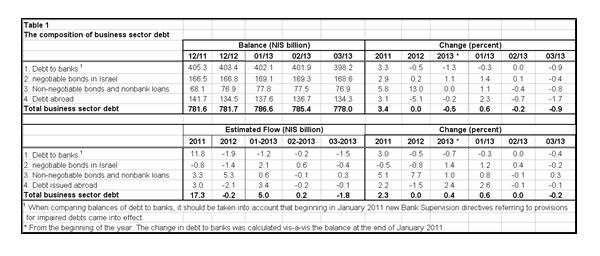

The business sector's outstanding debt

- The total outstanding debt of the business sector declined in March by about NIS 7.4 billion (-0.9 percent), to about NIS 778 billion. The decline derived primarily from the appreciation of the shekel against the dollar, which reduced the shekel value of foreign currency debt, and partially from net repayments of about NIS 1.8 billion.

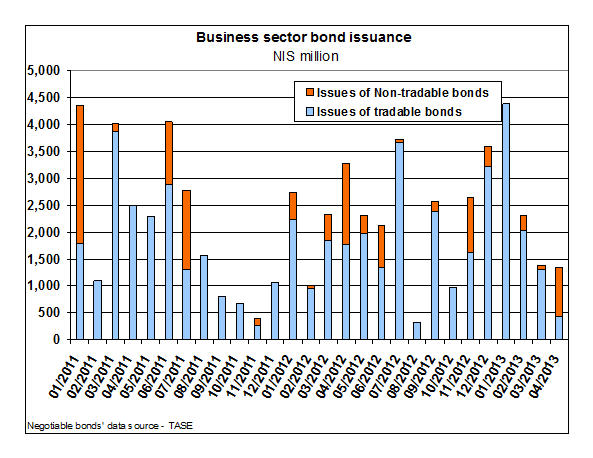

- In April, the business sector (excluding banks and insurance companies) issued about NIS 1.4 billion of bonds, most of which were non-tradable bonds. This was lower than the monthly average of bond issuances since the beginning of the year, which is about NIS 2.4 billion.

Households' debt

Households' debt

The cost of the debt

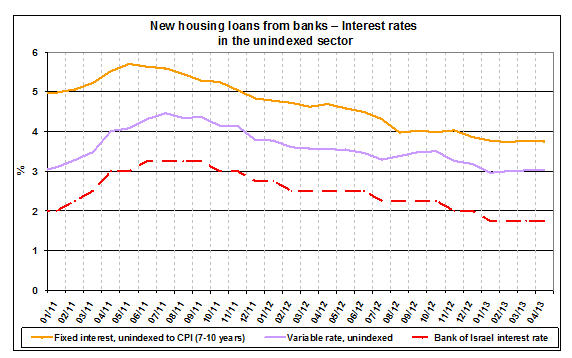

- In March, the interest rate spread in the unindexed track was essentially unchanged, as a result of stability in the interest rate on the balance of unindexed credit and the average interest rate on total deposit balances.

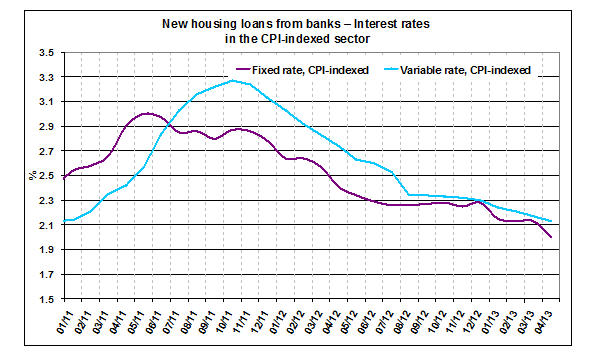

- In the CPI-indexed track, the spread between interest on new bank credit and interest on deposits increased by 0.4 percentage points, due to an increase in the interest rate on credit.

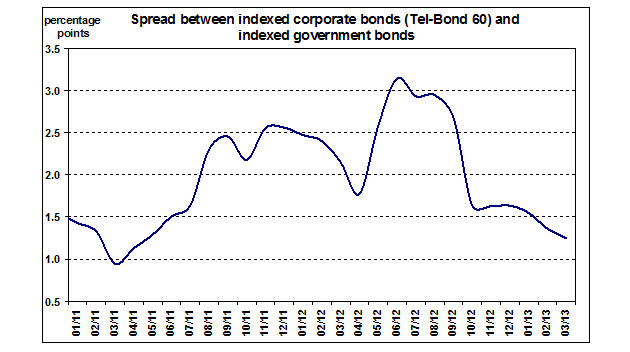

- There was a decline of 0.1 percentage points from the previous month in the spread between the yield on indexed corporate bonds—measured by the Tel-Bond 60 Index—and average yields on indexed government bonds, to 1.25 percentage points at the end of March. Since June 2012, the spread has declined by about 1.9 percentage points.

- In April, the average interest rate on new unindexed mortgages was unchanged, and the average interest rate on new CPI-indexed mortgages declined by 0.1 percentage points.

For links to Information and Data on the Bank of Israel website:

For links to Information and Data on the Bank of Israel website: