To view this message as a file click here

Abstract

This document presents the macroeconomic staff forecast formulated by the Bank of Israel Research Department in July 2023[1] concerning the main macroeconomic variables—GDP, inflation, and the interest rate.

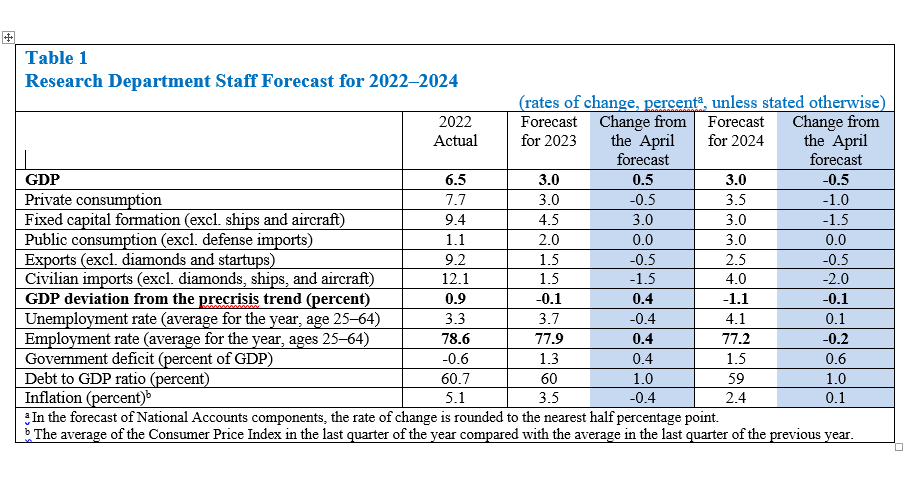

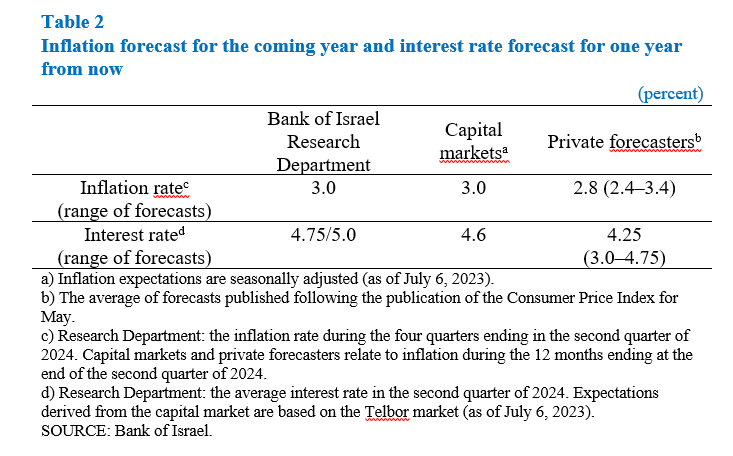

According to the forecast, which is based on a scenario in which the dispute surrounding legislative changes regarding the judicial system is resolved in a way that does not affect economic activity moving forward[2], GDP is expected to grow by 3 percent in each of 2023 and in 2024. Inflation in the coming four quarters[3] is expected to be 3.0 percent, and inflation in 2024 is expected to be 2.4 percent. According to the forecast, in the second quarter of 2024, the interest rate is expected to average 4.75–5 percent.

The forecast

The Bank of Israel Research Department compiles a staff forecast of macroeconomic developments on a quarterly basis. The staff forecast is based on several models, various data sources, and assessments based on economists’ judgment. The Bank’s DSGE (Dynamic Stochastic General Equilibrium) model—a structural model developed in the Research Department and based on microeconomic foundations—plays a prime role in formulating the macroeconomic forecast.[4] The model provides a framework for analyzing the forces that have an effect on the economy, and allows information from various sources to be combined into a macroeconomic forecast of real and nominal variables, with an internally consistent “economic story”.

- The global environment

Our assessments of expected developments in the global economy are based mainly on projections by international financial institutions and foreign investment houses. Their growth forecasts for the advanced economies were revised upward by 0.3 percentage points for 2023 and downward by 0.2 percentage points for 2024 to 0.9 percent for each year. In keeping with the OECD’s revised forecast of world trade, we assume that it is expected to grow by 1.6 percent in 2023 and by 3.8 percent in 2024. The inflation forecasts for the advanced economies for 2023 remained unchanged from our assumption from the April forecast—3.1 percent—and the forecasts for 2024 were revised upward by 0.3 percentage points to 2.4 percent. Investment houses’ forecasts of the average interest rate in the advanced economies increased by 0.3 percentage points relative to our assumptions in April, to 4.7 percent at the end of 2023, and 3.6 percent in 2024. The price of Brent crude oil declined to about $76 per barrel at the beginning of July (compared with $78 when the previous forecast was prepared in April).

- Real activity in Israel

GDP is expected to grow by 3.0 percent in 2023, and by a similar rate in 2024 (Table 1). National Accounts data published since the previous forecast (for the first quarter of 2023) were higher than expected. Therefore, the level of GDP in the first quarter of 2023 remained higher than the precrisis trendline. However, GDP is expected to fall slightly below the trendline in the near future. The expected slowdown in growth is derived from the expectation of moderation in the growth of world trade, and from an increase in the real interest rate in Israel within the forecast period. The assessment regarding expected growth in 2023 was revised slightly upward due to the effect of final first quarter data, and growth in 2024 was revised slightly downward, such that at the end of 2024, the GDP level is expected to be similar to that of our assessment in the April forecast.

At the starting point of the forecast, the labor market is tight, the employment rate among the prime working ages is higher than it was prior to the COVID-19 crisis, and the unemployment rate is slightly higher than it was during the same period. Within the forecast period, our assessment is that the labor market will remain tight, but slightly less so than at the starting point. In view of our assessments of moderating growth in economic activity during the forecast period, we expect that the employment rate among the prime working ages will decline in 2024 to an average of 77.2 percent, while the unemployment rate will increase to an average of 4.1 percent. The government deficit in 2023 will total 1.3 percent of GDP, and in 2024 it will total 1.5 percent of GDP. Government debt is expected to stabilized at 60 percent of GDP in 2023 and decline to 59 percent of GDP in 2024.

- Inflation and interest rates

According to our assessment, inflation in the next four quarters (ending in the second quarter of 2024) is expected to be 3.0 percent (Table 2(. Inflation in 2024 is expected to be 2.4 percent (Table 1). Similar to the previous forecast, the trend of moderation in the annual inflation rate during the forecast period is influenced by developments in the prices of goods and energy, as well as by the moderation in demand for domestic output. This is partly influenced by the restraining monetary policy in Israel and abroad. The lower inflation rate at the starting point (relative to our previous assessments) also contributed the moderation of inflation. In contrast, the depreciation of the shekel since the April forecast, and the high level of economic activity, contributed to the upward revision of the inflation forecast for the coming four quarters.

The interest rate is expected to average 4.75 or 5 percent in the second quarter of 2024 (Table 2). The interest rate level during the forecast period will help expected inflation become entrenched within the target range during forecast period.

Table 2 shows that the Research Department’s staff forecast regarding inflation is similar to expectations derived from the capital market and slightly higher than the average of the private forecasters’ projections. Regarding the interest rate, the staff forecast is similar to expectations derived from the capital market and 0.5/0.75 percentage points higher than the average of the private forecasters’ projections.

- Main risks to the forecast

The revised forecast is based on a scenario presented in the April forecast in which developments in the political arena will not have an impact on economic activity moving forward. A main risk is that legislative and institutional changes are accompanied by one or more of the following developments: an increase in the country’s risk premium accompanied by a depreciation of the shekel, an adverse impact on exports, a decline in domestic investment, or a decline in private consumption. The potential effects of these developments—on growth, inflation, the exchange rate, and the interest rate in the economy—are detailed in Table 3 of the April forecast.

Another risk factor to the forecast is inflation abroad, which is expected to converge to around 2 percent during the forecast period. However, in view of the relatively slow decline in the pace of inflation in the prices of services in the US and in the eurozone, there is a risk that the pace of the convergence will be slower than our assumption in the forecast, which will contribute to higher domestic inflation and more restraining monetary policy.

We have recently seen a decline in the volume of funds raised for investment in Israeli startup companies. This decline is apparently stronger than the declines in investment in startups abroad, which has even recovered to some extent in contrast to investments in startups in Israel. While the various activity indices in the Israeli high-tech industry indicate only a slight moderation following the high growth rate of 2022, continued decline in investments in startups is a risk to the growth forecast.

[1] The forecast was presented to the Bank of Israel Monetary Committee on July 9, 2023, prior to the decision on the interest rate made on July 10, 2023.

[2] The April 2023 forecast presented a detailed analysis based on a scenario that analyzed the potential economic implications should legislative and institutional changes be accompanied by an increase in the State’s risk premium, harm to exports, and declines in domestic investment and in demand for private consumption. This scenario is mentioned later in this document, in the section on risks to the forecast.

[3] The four quarters ending in the second quarter of 2024.

[4] A Discussion Paper on the DSGE model is available on the Bank of Israel website, under the title: “MOISE: A DSGE Model for the Israeli Economy,” Discussion Paper No. 2012.06.