To view this message as a file click here

To view the data as a file click here

- In the second quarter of 2023, the balance of assets held abroad by Israeli residents increased by approximately $13.6 billion (2.1 percent), to about $670 billion at the end of June. The increase was mainly due to a rise in the prices of foreign securities held by Israelis, and by net investments abroad by Israeli residents.

- Outstanding liabilities to abroad increased in the second quarter by approximately $1.8 billion (0.4 percent), to about $479 billion at the end of the quarter. The increase was primarily due to net direct investments.

- Israel’s surplus of assets over liabilities vis-à-vis abroad increased in the second quarter by approximately $11.8 billion (6.6 percent), to about $192 billion at the end of the quarter.

- The surplus of assets over liabilities vis-à-vis abroad in debt instruments alone (negative net external debt) increased during the second quarter by about $2.7 billion (1.2 percent), to approximately $223 billion at the end of June.

- The ratio of gross external debt to GDP was essentially unchanged in the second quarter, at about 30.2 percent at the end of June.

Table 1: Asset and liability balances, and changes in them

- The balance of Israel’s assets abroad

In the second quarter of 2023, the value of the assets held abroad by Israeli residents increased by about $13.6 billion (2.1 percent) to approximately $670 billion at the end of June. The increase in the balance was seen in all investment channels, particularly an increase in the balance of investments in the tradable securities portfolio and in the balance of direct investments.

- The value of direct investments increased in the second quarter by about $2 billion (approximately 2 percent), mainly as a result of reinvested earnings.

- The value of the securities portfolio increased during the second quarter by about $10.5 billion (about 5 percent) mainly as a result of price increases on foreign securities held by Israeli residents.

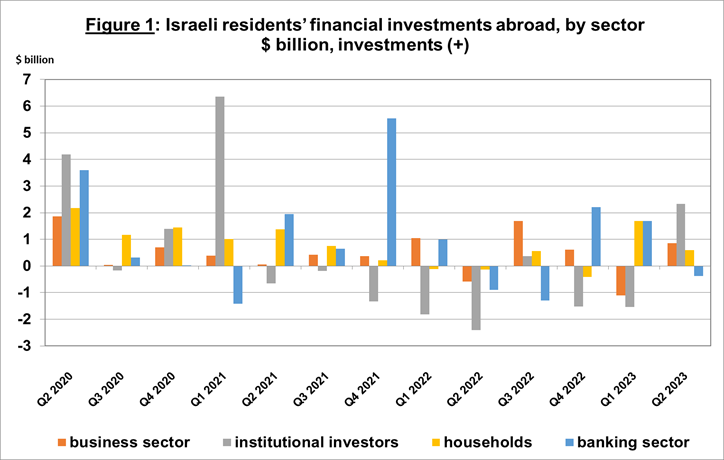

During the second quarter, there were net investments in the securities portfolio abroad totaling about $3.5 billion; investments in bonds totaling about $3 billion and investments of about $0.5 billion in foreign equities.

Most of the investments in the securities held abroad portfolio were by institutional investors (Figure 1).

Source: Bank of Israel data and processing[1].

- The value of other investments abroad increased by about $0.7 billion (0.5 percent) in the second quarter. The increase derived mainly from increases in the prices of nontradable foreign securities held by Israeli residents and from the providing of loans totaling about $1 billion by Israeli residents to residents abroad. These were partly offset by withdrawals from Israeli residents’ (including banks) deposits abroad.

- The value of reserve assets increased during the second quarter by about $1.4 billion (about 0.7 percent), to about $202 billion at the end of June. The increase derived mainly from price increases totaling about $1.7 billion.

- The composition of Israelis’ securities portfolio abroad: During the course of the second quarter, the share of equity instruments in Israeli residents’ portfolio abroad remained unchanged at 44 percent at the end of June. Accordingly, the share of debt instruments remained at 56 percent at the end of June.

- Israel’s liabilities to abroad

The balance of Israel's liabilities to abroad increased by about $1.8 billion (0.4 percent) during the second quarter, to approximately $479 billion at the end of the quarter. The increase was mainly due to net investments, particularly direct investments.

- The value of direct investments in the economy increased during the second quarter by about $3.8 billion (1.7 percent), mainly due to net direct investments in share capital totaling about $3.4 billion, of which about $1.7 billion was in respect of reinvested earnings.

- The value of the securities portfolio decreased by about $1.5 billion (about 0.8 percent) in the second quarter, as a result of a decline in equity prices totaling about $1 billion and from a depreciation of the shekel vis-à-vis the dollar during the quarter, which reduced the dollar value of the investment portfolio by about $1.5 billion. This decline was partly offset by nonresidents’ net investments of about $1.3 billion.

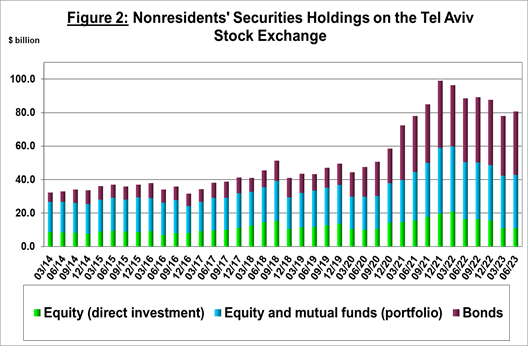

- The value of nonresidents' financial portfolio on the Tel Aviv Stock Exchange, which makes up a part of nonresidents’ investments in Israel, increased by about $2.8 billion in the second quarter, to about $80.8 billion at the end of June. The increase in the portfolio value derived mainly from investments by nonresidents in nominal government bonds, which were partly offset by the depreciation of the shekel vs. the dollar. (Figure 2 and Figure 3).

Source: Israel Securities Authority, and Bank of Israel data and processing[1].

The value of other investments in the economy decreased by about $0.6 billion (about 1 percent) in the second quarter, to about $60.6 billion. The decrease was mainly due to net withdrawals from foreign banks’ deposits in Israel totaling about $1 billion.

The balance of liabilities in debt instruments alone, which makes up Israel's gross external debt, increased by about $0.7 billion (0.5 percent) in the second quarter, to about $156 billion.

The ratio of gross external debt to GDP remained unchanged, at about 30.2 percent at the end of June (Figure 4).

Source: Israel’s Ministry of Finance, Israel’s Central Bureau of Statistics, and Bank of Israel data and processing[1].

- Israel’s surplus assets over liabilities vis-à-vis abroad

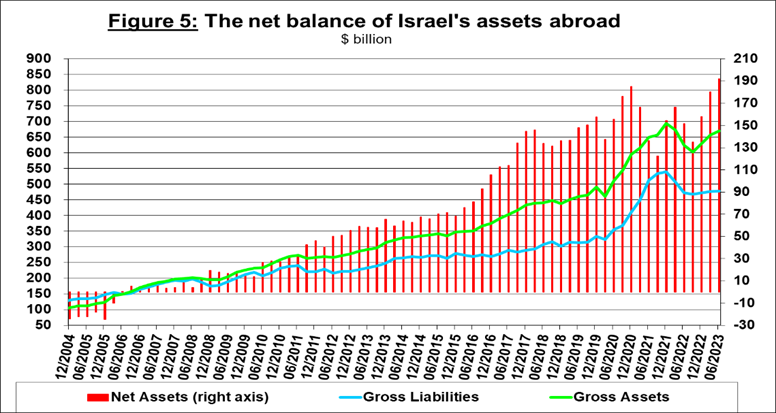

An increase in outstanding assets that was greater than the increase in outstanding liabilities led to an increase of about $12 billion (about 6.6 percent) in surplus assets over liabilities vis-à-vis abroad, which totaled about $192 billion at the end of June (Figure 5).

Source: Bank of Israel data and processing[1].

- Net external debt

The surplus of assets over liabilities vis-à-vis abroad in debt instruments alone (negative net external debt) increased by approximately $2.7 billion (about 1.2 percent) in the second quarter, to $223 billion at the end of June (Figure 6).

The balance of assets in debt instruments increased by about $3.4 billion in the second quarter, to about $380 billion at the end of the quarter, of which about $202 billion is the Bank of Israel's foreign exchange reserves. This balance reflects a coverage ratio of 2.4 times the gross external debt.

Source: Israel’s Ministry of Finance, and Bank of Israel data and processing[1].

For the complete data file, click here.

[1] Bank of Israel data and processing: The Bank of Israel’s Information and Statistics Department collects data from numerous varied sources. Most of the data on the economy’s activity vis-à-vis abroad are received by force of a Bank of Israel Order, from direct reports by corporations and individuals to the Bank of Israel. (See: “Information Regarding Foreign Exchange Market Developments in Israel”, 5770–2010). Additional data used for measuring economic activity vis-à-vis abroad are received by reports from the Bank of Israel’s Accounting Division, the Ministry of Finance, the Central Bureau of Statistics, the Israel Securities Authority, domestic banks and other financial intermediaries, and institutional investors. The Department carries out estimations and processing on data received from the various sources.