To view the message as a file click here

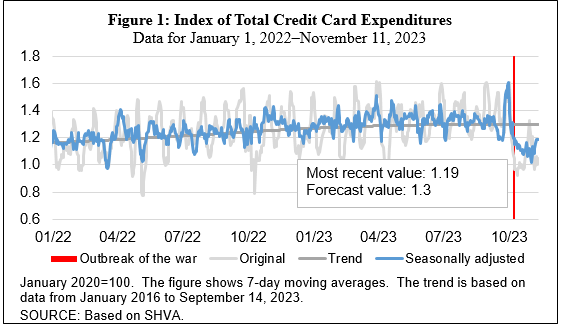

- Five weeks after the outbreak of the Swords of Iron war, total credit card expenditure is 9 percent lower than its forecast level, according to seasonally adjusted data.

- With the outbreak of the war, total credit card expenditure declined for three weeks, according to seasonally adjusted data, reaching a low point of about 20 percent lower than its forecast level. In the following two weeks, expenditures stabilized, and there was even some recovery in total purchases.

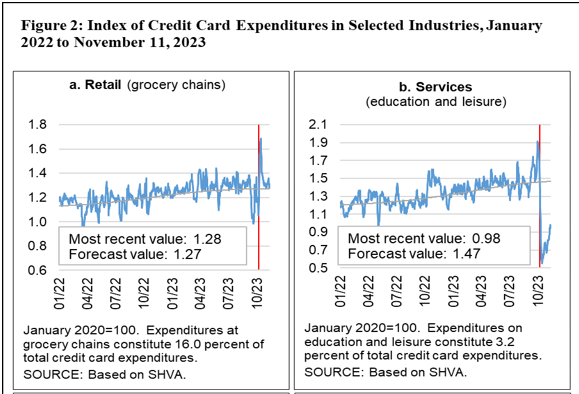

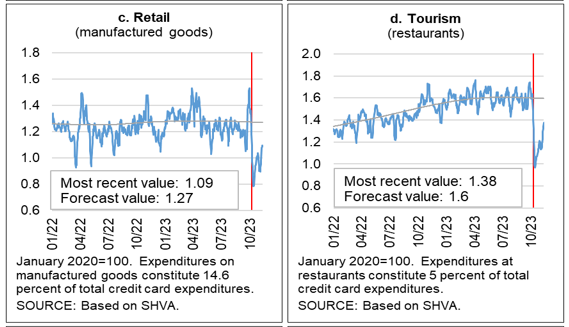

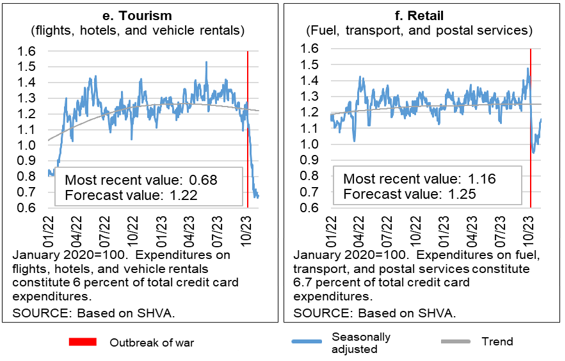

- During the period, credit card expenditures were particularly lower than expected in the following industries: education and leisure services, tourism (flights, hotels, and vehicle rentals), retail (manufactured goods), retail (fuel, transportation and postal services), and tourism (restaurants). Expenditures at grocery stores were exceptionally higher than the forecast level during the first week of the war, and then declined to normal levels.

- In most industries where credit card expenditures dropped sharply with the outbreak of the war, that decline has been partly corrected so far—five weeks since the outbreak of the war—with the exception of expenditures in the tourism industry (flights, hotels, and vehicle rentals).

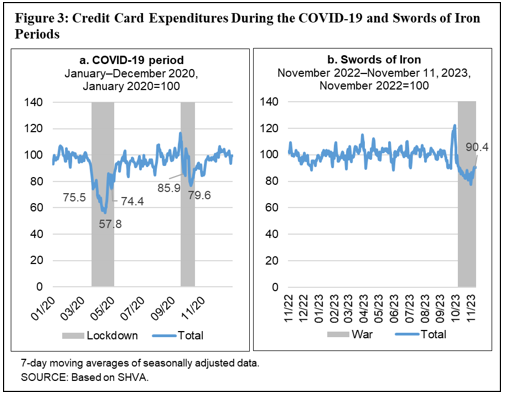

- The decline in expenditures during the five weeks since the outbreak of the war is less than during the first COVID-19 lockdown, and similar to the decline during the second lockdown.

With the outbreak of the Swords of Iron war, consumer’s credit card expenditures in Israel declined sharply (Figure 1).[1] In the first week of the war, total credit card purchases were about 11 percent lower than the level forecast according to the trend. This decline reflected higher-than-normal expenditures at grocery stores, and declines in expenditure on other goods and services (Figure 2). Expenditures at grocery stores jumped to about 130 percent of the forecast rate according to the trend—due to the public’s initial concerns of a shortage of products, and calls by the Home Front Command (which were later clarified) to stock food for 72 hours. In contrast, the closure of the education system and of shopping centers led to a decline in demand for consumption in other components. This was reflected in a drop of about 60 percent in expenditures on education and leisure services. As well, expenditure on manufactured goods (clothes, sports equipment and toys, interior furniture, electric appliances, and more) and restaurants was almost 40 percent lower than the forecast level, expenditure on fuel, transportation, and postal services dropped by about 20 percent, and expenditure on tourism services (flights, hotels, and vehicle rentals) was about 15 percent lower. Three weeks after the outbreak of the war, the high expenditure in grocery stores declined back to its normal level for the season, but in other industries, expenditure remained low, so that total expenditure reached a low point of about 20 percent lower than the normal level. In the fourth and fifth weeks, there was some recovery in most areas that were hit hard (other than expenditures on flights, hotels, and vehicle rentals), such that there was some recovery in total expenditure as well, to a level that was about 9 percent lower than during normal times.

Credit card expenditures is a real-time indicator of the level of business and consumer activity. The expansion of credit card use as a means of payment over the years increases the connection between credit card expenditures and total private consumption.[2] This comes in addition to the fact that credit card expenditure data are high-quality administrative data at a daily frequency. These data make it possible to lower the extent of uncertainty with which economic policy decisions are made, and their use is very important during a crisis—when uncertainty is exceptionally high. Many of the data necessary in order to make economic policy decisions are not available in real time, and the lag in such data is sometimes a matter of weeks or even a few months. The Bank of Israel receives credit card expenditure data from SHVA. The Bank of Israel’s preparation of the data for use in making policy decisions includes arranging the data, special adjustment to the daily, intra-monthly, and monthly seasonality components, calculation of trends, and weekly averaging. These processes were developed at the Bank of Israel, and are intended to reduce excess volatility that exists in the raw expenditure data, in order to reach the optimal estimation of the actual level relative to expectations according to previous data.[3] As Figure 1 shows, the seasonally adjusted series features lower volatility than the original series.

The use of credit card expenditures also makes it possible to assess the level of activity during the Swords of Iron war compared to the past, for instance during the COVID-19 period. Figures 3a and 3b show total credit card expenditure during the COVID-19 period and the current period. The two figures present a period of 12 months, and are calibrated such that the first month in each period sows the base level (100%). The relative credit card expenditure level during the first month of the Swords of Iron war is similar to the level during the second COVID-19 lockdown (September-October 2020), and much higher than the level during the first COVID-19 lockdown. This comparison improves the estimate of the economic impact resulting from the war, and the ability to set policy based on those estimates.

[1] Daily data on credit card purchases are reported on a daily basis to the Bank of Israel by SHVA. These data reflect the sum of settlements of credit card purchases by Israelis and nonresidents in Israel, including business credit cards. All seasonally adjusted data in this document are presented as 7-day moving averages.

[2] In this context, see: Bank of Israel (2021): “Survey of the Main Developments in the Payment and Settlement Systems in 2018–2020”. According to our assessment, credit card expenditure accounts for about 60–70 percent of total expenditure on private consumption in Israel. Private consumption data are obtained from the National Accounts, with a lag of one quarter.

[3] Figure 1 shows that in the week prior to the war, credit card expenditures were particularly high, despite the adjustment for the holiday period (seasonality). This shows that even seasonally adjusted data may be highly volatile at the daily and weekly levels, and there is not always an economic explanation for this. As such, the analysis compares the expenditure level to the trend or the average of the previous month (and not the previous day), and avoids drawing conclusions regarding jumps on individual days.