To view this message as a file click here

The Banking Supervision Department today submitted the Periodic Report on the Prices of Common Household Banking Services for 2022 to the Knesset Economics Committee. The Report is based on reports by the banking corporations and credit card companies regarding the fees that they collected during 2022. In the past decade, there has been a significant decline in the ratio of total fees income to total assets of the banking system, with the ratio stabilizing in recent years.

Supervisor of Banks Daniel Hahiashvili said, “The report to the Knesset Economics Committee is also an opportunity to bring to the public’s attention the importance of proper banking conduct, including with regard to price comparisons. As part of this, I call on the public to make use of the banking tools published on the Bank of Israel website for the public’s benefit[1], and to get to know the tools and guides that make information much more accessible, as well as fee track calculators[2], the Banking ID[3], and more. These tools help in negotiations with the banking system with regard to the terms and prices of banking services.”

The following are the main points of the report:

- In the past 13 years, there has been a cumulative decline of about 46 percent (Figure 1.1) in the ratio between fees income and total banking system assets. The decline is partly attributed to Banking Supervision Department activities related to fees in recent years. Between 2020 and 2022, the ratio of fees income was stable, and lower than previous years. However, in 2022, there was a slight increase in the ratio, which was greatly influenced by an increase in the volume of fees charged to large businesses and fees on payment cards, as a result of an increase in the volume of activity as part of the return to routine following the COVID-19 crisis.

[1] https://www.boi.org.il/information/bank-paymnts/ (in Hebrew)

[3] Video with more information (in Hebrew) found here.

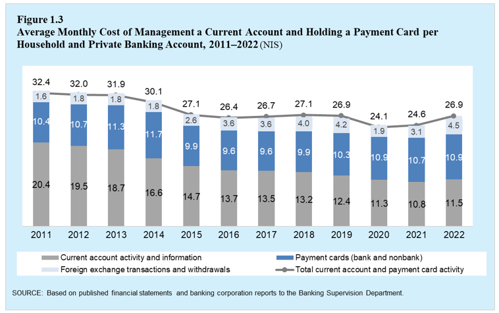

- The average cost of managing a current account and holding a payment card in the account in 2022 was NIS 26.9 per month (an increase of NIS 2.3 per month over 2021). It should be noted that this cost is identical to the cost measured in 2019, and about NIS 5 lower than the cost that was common a decade ago (about NIS 32 in 2012). The increase in 2022 was mainly due to an increase in foreign exchange transactions made by the public through payment cards, as part of the return to routine following the COVID-19 crisis.

- The average mix of household expenditures on banking fees in 2022 was comprised of 42.8 percent from current account transactions and information, 40.5 percent from payment card transactions, and 16.7 percent from foreign exchange transactions (Figure 1.3). In 2022, the cost of maintaining a current account and obtaining information was NIS 0.7 higher than in 2021, at an average of NIS 11.5 per month. This increase was mainly due to an increase in income from fees on direct channel transactions due to the increase in the fee rate for such transactions at Bank Hapoalim from NIS 1.35 to NIS 1.75 per transaction.[4] In the past 12 years, there has been a cumulative decline of about 44 percent in this cost. The cost of holding and using payment cards averaged NIS 15.4 per month per account, an increase of about NIS 1.6 on average relative to 2021.

[4] The first increase by Bank Hapoalim in the price of a “direct channel” transaction since the reform took effect in 2008.

- Two additional suggestions for proper consumer conduct that are raised by the data in the Report, and that help save on costs are: the use of direct channels and digital means that are less expensive than making transactions through a teller, and examining the worthwhileness of the tracks service at a fixed cost.

- As part of the Banking Supervision Department’s philosophy, which emphasizes putting the customer at the center, on September 1, 2022, the Banking Supervision Department put a number of basic current account services under supervision.[5] Imposing supervision on such services fixes the existing price level, such that prices cannot be increased beyond it without approval by the Banking Supervision Department. The aim of this is to enable the public to consume these essential and basic banking services, both at bank branches and through digital channels, at a fair price.

- In 2008, banking rules were enacted that set a uniform fee structure for all banking corporations in Israel. The banking corporations’ fee structures include the benefits that the banks give to various population groups in Appendix A of the bank’s fee schedule. As such, small business owners, senior citizens, and people with disabilities beyond a certain level may be entitled to various benefits. For more details, please click here.

[5] More information (in Hebrew) is available here.

The full report is attached.

Click to download as PDF Click to download as PDF