To view this message as a file click here

- Reductions in mutual fund management fees in Israel lead to an increase in inflows to mutual funds, while increases in management fees lead to a decrease in inflows to the funds.

- Investors in funds with initially high management fees are less sensitive to further increases in management fees.

- "Wealthy" investors are less sensitive to changes in fees.

- Existing investors in mutual funds are more attentive to changes in fees than potential investors.

- Mutual fund investors are not indifferent or naive but are alert to changes in management fees and recognize their importance to the overall return to the customer. However, the findings regarding the lower sensitivity of some investors to the level of management fees and changes in them may indicate a need for targeted regulation to protect less aware investors.

A new study conducted by Dr. Nadav Steinberg of the Bank of Israel Research Department and Dr. Yevgeny Mugerman Bar-Ilan University sheds light on how investors respond to changes in mutual fund management fees. The study, which analyzed data on changes in mutual fund management fees in Israel from 2011 to 2020, a period during which the average management fees in various mutual funds generally declined (Figure 1), found that investors respond strongly to both increases and decreases in management fees.

Mutual funds are a popular investment tool for households seeking well-diversified exposure to the capital market. The cost of investing in these funds, known as management fees, is paid to fund managers for their services and directly affects the net returns realized by investors. Like other prices, higher management fees may lead to lower demand for the fund, and vice-versa, assuming all other factors remain constant. However, this assumption may not hold due to differences in fund quality and the challenges investors face in measuring this quality and understanding fund costs. Indeed, the research literature on mutual funds has presented mixed results regarding the relationship between management fees and investment flows into mutual funds.

The current study differs from most previous literature in that it focuses on changes in management fees rather than their levels, and uses daily data on mutual funds, allowing for the investigation of the effects of changes in management fees on fund flows at a higher frequency than previous studies. These factors, along with a variety of advanced methodologies, enabled the researchers to address the potential correlation between the level of management fees and the fund's essential characteristics, and to demonstrate a causal relationship between changes in management fees and the responses of investors in the fund.

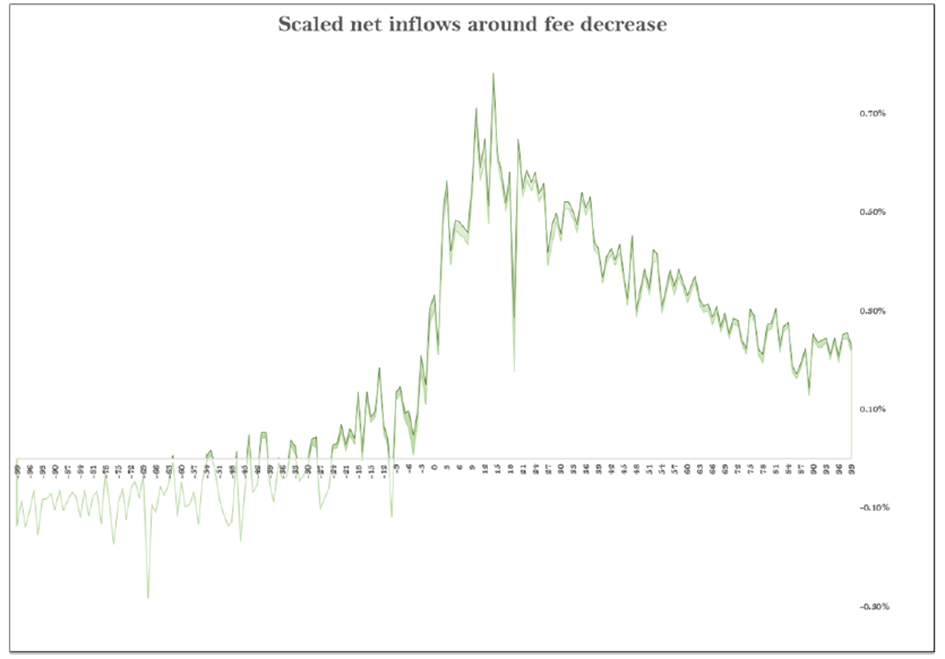

Data analysis shows that reductions in management fees lead, on average, to an increase in fund inflows (Figure 2), while increases in management fees lead, on average, to a decrease in inflows (Figure 3). These findings hold even after controlling for fund size, fund age, past performance, and management fee level. The researchers address econometric challenges related to specific fund characteristics and time-specific events by including fixed effects for the fund and fixed effects for the date in the analysis. This approach accounts for unobserved factors affecting fund flows, and reduces the impact of time-varying macroeconomic events. The analysis reveals that the impact of changes in management fees on net fund flows is consistent across all types of funds, with a particularly notable effect for mutual funds specializing in bonds.

While the main results of the paper show that mutual fund investors tend, on average, to respond strongly to changes in management fees, the researchers also find that investors in funds with initially high management fees exhibit lower sensitivity to further increases in management fees. Additionally, the researchers decompose net fund flows into inflows and outflows. They find that increases in management fees deter both current and potential investors, but the impact is greater on potential investments, including both new investors and additional investments by existing investors. Reductions in management fees attract more inflows but do not appear to prevent outflows from the funds. Finally, the researchers use mutual fund holdings data to examine the investment decisions of specific investors in response to changes in mutual fund fees. Using these data, they find that changes in inflows to funds following a change in management fees are primarily due to changes in holdings by existing investors rather than potential investors, and that "wealthy" investors, based on the total amount of their investments in securities, are less sensitive to changes in fees.

The study's findings are relevant to fund managers and regulators. They indicate that mutual fund investors are not indifferent or naïve, but are alert to changes in management fees and recognize their importance to customer returns. Therefore, fund managers should carefully consider their management fee structure and the rationale behind any changes. The findings also highlight the importance of regulation to ensure sufficient transparency and prominence of changes in management fees, alongside the need for targeted regulation to protect less aware investors from the level of management fees and changes in them.

Figure 1:

Annual Management Fees in Active Mutual Funds by Fund Type: June 2011–December 2020

![]()

Government bond funds Corporate bond funds Equity funds

SOURCE: Based on Israel Securities Authority

Figure 2:

Figure 3: