To view this press release click here

- This study introduces a novel and unique method for estimating excess demand using data from Israel's Business Tendency Survey.

- Positive excess demand, as measured by the new index, contributes to an increase in inflation as measured by the Consumer Price Index, the Producers Price Index, and business sector output prices. This effect is beyond the impact of the shekel exchange rate and of global import prices.

- The new index better explains inflation as measured by the Consumer Price Index, the Producers’ Price Index, and business sector output prices relative to the indices common in the literature.

- Since the beginning of the war in October 2023, there has been excess demand—a positive output gap—in the economy, which has grown stronger during the war, however it is more moderate than in 2021–2022, when inflation accelerated in Israel and globally.

The measurement of excess demand, which enables us to measure the output gap, is central to conducting monetary policy. The output gap represents the difference between the actual observed output (actual GDP) and the unobserved potential output (potential GDP) of the economy, and is a key macroeconomic indicator used by central banks to evaluate business cycles and inflationary pressures. Real-time output gap estimation provides monetary policy makers with important information for a more precise real-time determination of monetary policy.

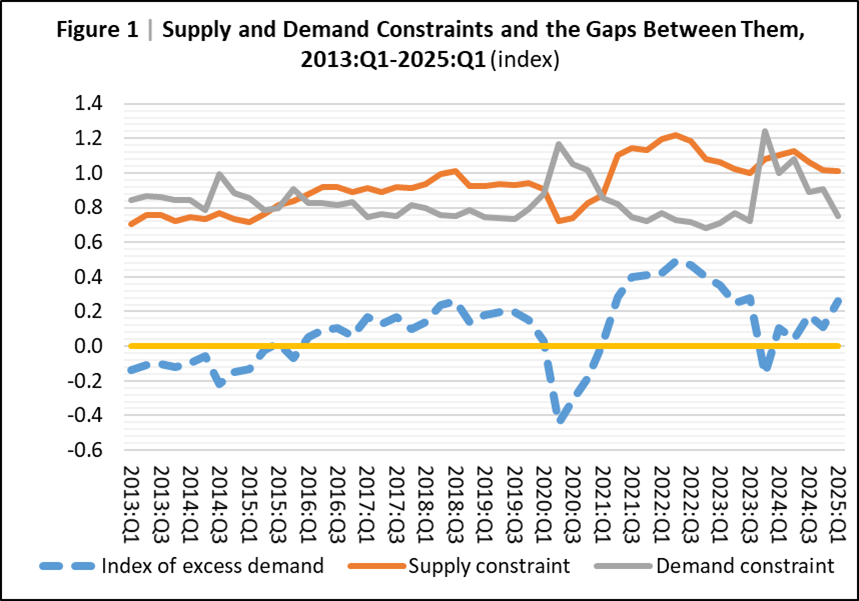

A new study conducted by Dr. Alex Ilek and Dr. Yuval Mazar of the Bank of Israel Research Department introduces a novel and simple method for estimating the real-time output gap in the business sector. The study uses data from Israel's Business Tendency Survey, including reported supply and demand constraints. Excess demand in the business sector is calculated as the difference between the weighted average of constraints (based on 10 industries) expressed as supply difficulties, mainly a shortage of workers, and those expressed as weakness in demand (Figure 1).

The approach proposed in the paper introduces a new method for calculating the output gap, complementing other existing methods in the literature. It provides important insights for economic analysis and policy-making by utilizing real-time Tendency Survey data, incorporating business managers' perceptions of economic constraints in the Israeli economy.

According to the new index, since the beginning of 2024, the Israeli economy has been characterized by excess demand, primarily due to a relatively high supply constraint, mainly because of a worker shortage caused by the war. Additionally, with the outbreak of the war, there was a sharp drop in demand, and the excess demand recorded after the peak of the COVID-19 pandemic disappeared. This excess demand gradually recovered and has now returned to its pre-war level (see Figure 1). As a result, there has been an upward trend in excess demand because the easing of demand constraints was faster than that of supply constraints. Despite the rise in excess demand, even in the second quarter of 2025, it remains moderate compared to the peak excess demand experienced in 2021–2022 when inflation in Israel and globally was higher.

A key advantage of the current index is its ability to break down the sources of excess demand into changes in supply constraints and demand constraints. This breakdown allows for identifying the dominant factor affecting the economy at a given time. Accurate identification is crucial for setting monetary policy: when weak activity is due to demand constraints (weak demand), monetary expansion through interest rate cuts may help boost economic activity. Conversely, if the activity is hindered by supply constraints, lowering interest rates to boost demand is unlikely to help and may create demand pressures that lead to accelerated inflation.

Another advantage of the proposed method is that the Tendency Survey data are available almost in real-time—just a few days after the end of the reference month—and are not revised retroactively, making the index value stable after the initial calculation. The index also allows for examining the contribution of each industry to the development of economic indicators. This precise identification of pressure sources in the economy enables decision-makers to implement more targeted and effective policy measures.

The study indicates that excess demand, as measured by the proposed index (and the derived output gap), has a significant positive impact on the Consumer Price Index, the Producer Price Index, and business output prices in Israel. Furthermore, its contribution to explaining the development of price indices is greater than that of conventional output gap measures derived from statistical calculations or various economic models. It was found that a one percentage point increase in the average output gap (for example, from 0% to 1%) is expected to lead to a 0.1 percentage point increase in annual inflation of the Consumer Price Index over two years, assuming all other variables affecting inflation remain constant