To view this message as a file click here

- The Exchange Rate

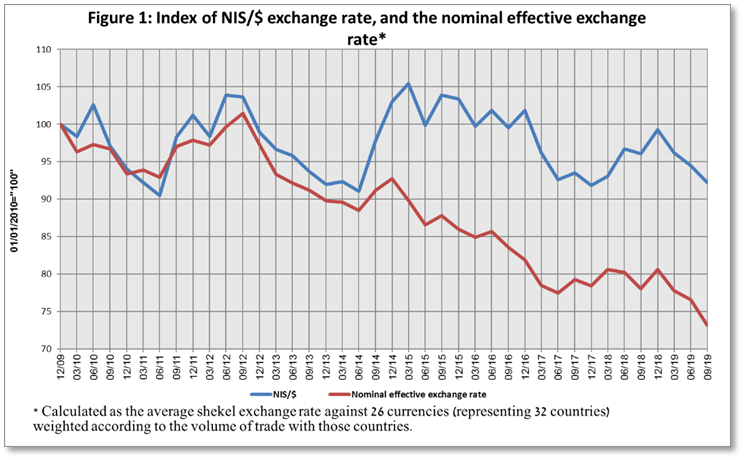

Weakening of the shekel alongside a mixed trend of the dollar worldwide.

During the course of the first quarter, the shekel weakened against the dollar by 2.7 percent and against the euro by 4.8 percent.

In addition, the shekel weakened by 3.3 percent against the currencies of Israel's main trading partners, in terms of the nominal effective exchange rate (i.e., the trade-weighted average shekel exchange rate against those currencies).

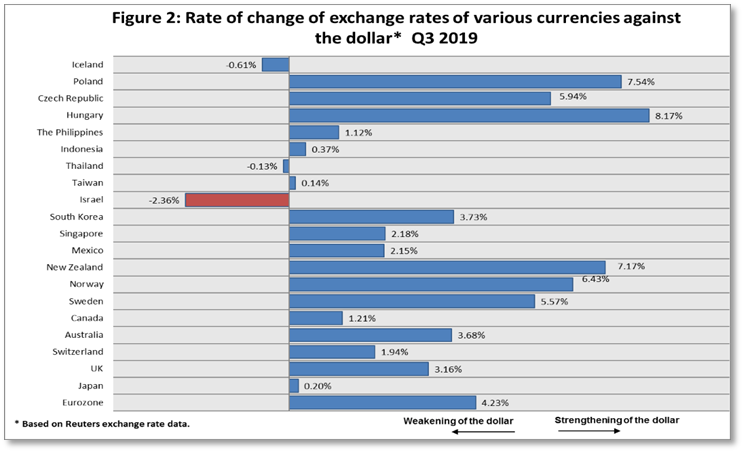

In terms of the dollar vis-à-vis major currencies (Figure 2), there was a mixed trend during the quarter. The dollar weakened by approximately 2 percent against the euro and by 2.6 percent against the pound sterling, and in contrast, the dollar strengthened by 1.2 percent against the Japanese yen, and by about 1.7 percent against the Australian dollar.

- Exchange Rate Volatility

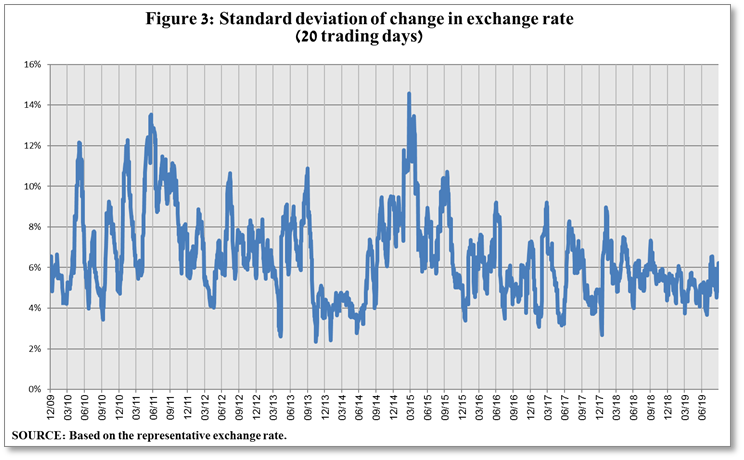

An increase in actual volatility and an increase in implied volatility.

The standard deviation of changes in the shekel/dollar exchange rate, which represents its actual volatility, increased during the quarter, to an average level of 12.5 percent.

The average implied volatility in over-the-counter shekel/dollar options, an indication of expected exchange rate volatility, increased to about 10.3 percent by the end of the quarter.

For comparison, the average level of implied volatility in foreign exchange options in emerging markets was 12.9 percent at the end of the quarter, a decrease of 0.8 percentage points from its level at the end of the previous quarter. The average level of implied volatility in advanced-economy markets was 9.9 percent at during the quarter, a decline of about 1.3 percentage points from the previous quarter (Figure 4).

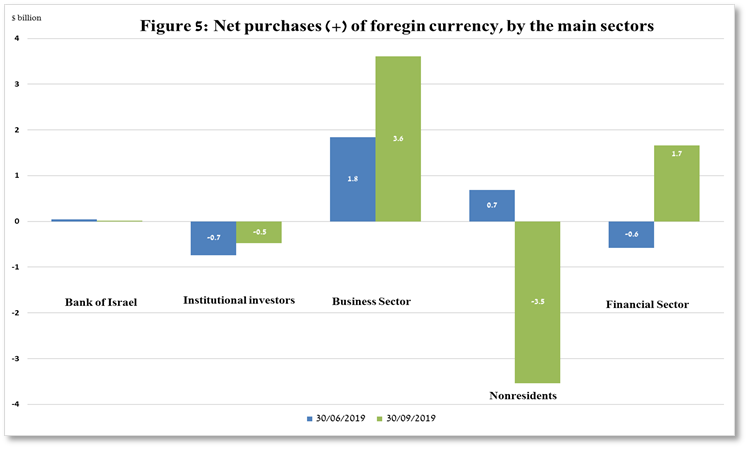

- The Activity of the Main Segments in the Foreign Exchange Market[1]

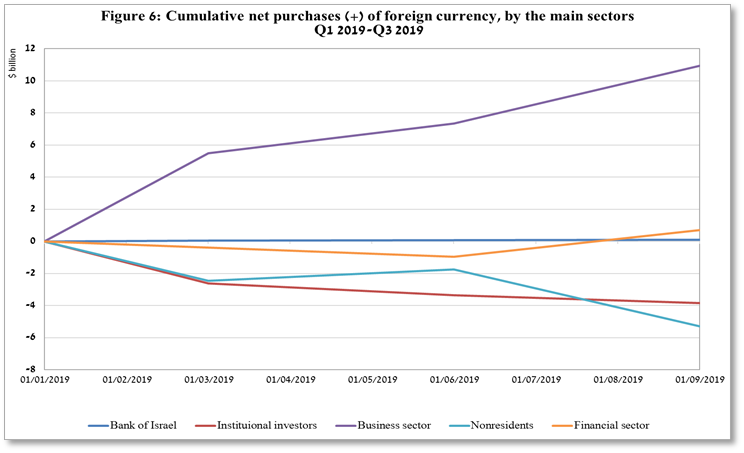

An estimate of the activity of the main segments in the foreign exchange market indicates that during the course of the first quarter, institutional investors (pension funds, provident funds, and insurance companies) purchased foreign currency totaling about a net of $3.3 billion and the business sector purchased about $1.4 billion in foreign currency. Nonresidents sold a net of about $10.1 billion.

- Trading Volume in the Foreign Currency Market—Tables and Figures

Trading volume vis-à-vis the domestic banking system[2]

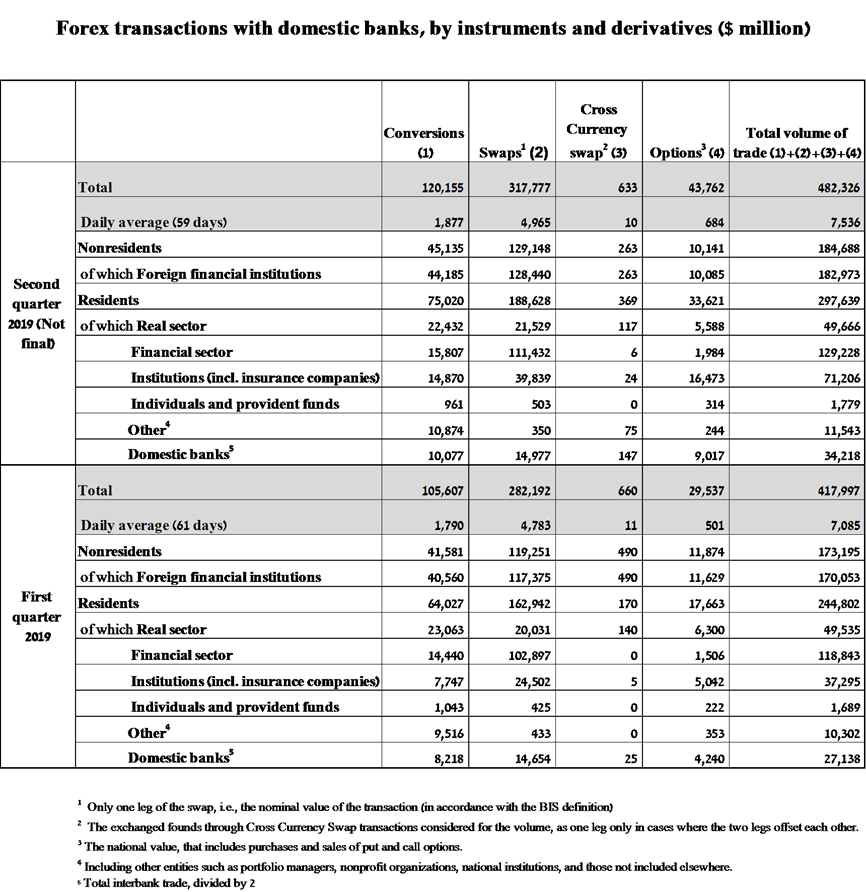

The average daily trading volume increased by about 8.5 percent during the quarter to a level of $10.9 billion, with most of the increase due to an increase in the daily trading volume of spot and forward transactions.

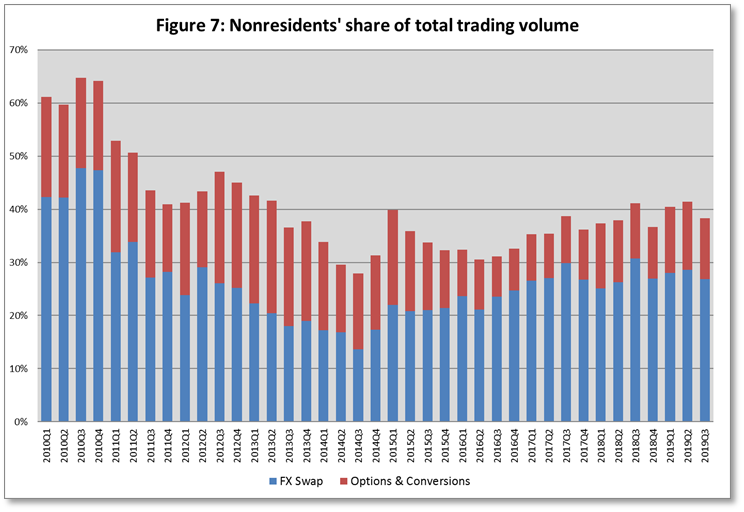

Nonresidents' share of total trading volume vis-à-vis the domestic banking system (spot and forward transactions, options, and swaps) increased by about 1.9 percent to about 43.3 percent at the end of the first quarter.

Estimated total trading volume[3]—domestic banking system and foreign reporting entities

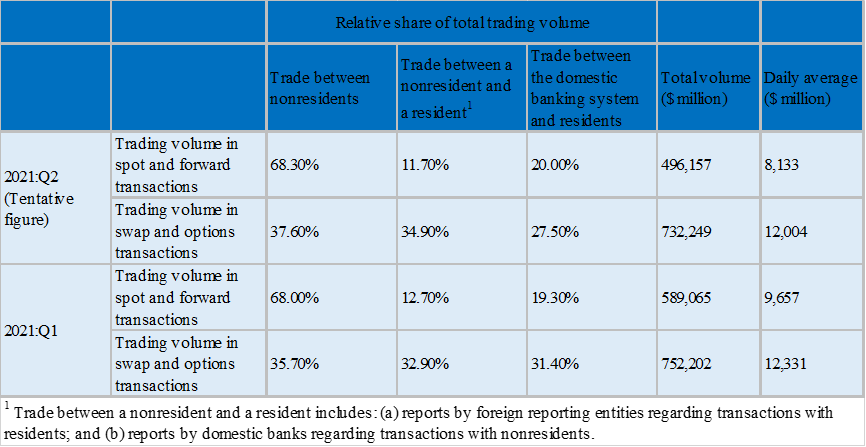

The estimated total activity in transactions against the shekel reflected in reports from the domestic banking system and foreign reporting entities indicates that nonresidents’ relative share of trading volume in spot and forward transactions (excluding swaps and options) was 82.1 percent in the first quarter, and that trade between nonresidents constituted 69.6 percent of the volume, which had a daily average of $12.6 billion.

[1] The main segments presented do not make up the entire market—for additional information, see the section on “The Database of Foreign Exchange Market Activity” in the Bank of Israel's "Statistical Bulletin" for 2018 (in Hebrew):

https://www.boi.org.il/he/NewsAndPublications/RegularPublications/Documents/MabatStat2018/shekel.pdf

[2] Volumes of trade only vis-à-vis the domestic banking system. From the beginning of 2020, the data do not include branches of foreign banks in Israel.

[3] Total trading volume is an estimate of total activity in transactions against the shekel, based on reports by the domestic banking system and by foreign reporting entities.