Supervisor of Banks Dr. Hedva Ber said, “We continue to act to enhance the competition in the payment and settlement market and the results can already be seen in the field, with a marked decline in the acquiring fees paid by businesses. Today we granted a second license to a new acquirer, Cardcom, following the license we granted a year ago to Tranzila Ltd. This comes after the regulatory leniencies we carried out led a sizable number of interested parties to examine the possibility of establishing an acquiring company. Alongside the lowering of barriers to entry to the market, and the entry in actuality of new acquirers, the competition in the payment and settlement market is also markedly affected by the preparation of the credit card companies for the separation of two of the companies from the banks. All the changes in the market lead to considerable saving, of hundreds of millions of shekels a year, for companies.”

In 2015, the Bank of Israel markedly eased the regulatory requirements for establishing new acquirers. Within this framework, the capital requirements from a new acquirer were reduced (particularly the minimum capital requirements, to a level of only NIS 1 million), and leniencies were established in the risk management area and in other areas. In addition, a simple and supportive process was established for receiving the license, which enables a license applicant to ascertain its chances of being granted the license before making significant investments in the company. Due to these changes, in April 2017 the Bank of Israel granted an acquirer license to Tranzila Ltd., and today an acquirer license was granted to Cardcom Acquiring Ltd.

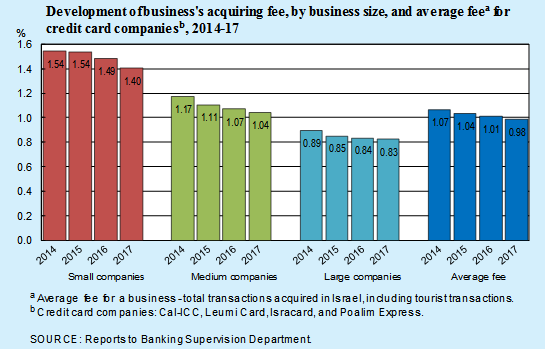

In recent years, there has been a prolonged and consistent decline in acquiring fees for businesses in Israel, reflected in savings of hundreds of millions of shekels for businesses. This trend is expected to continue in the coming years due to numerous steps being taken in addition to the entry of new participants in the market, such as:

- The new framework for reducing the interchange fee over the coming years, which was published recently by the Bank of Israel

- The agreement between the Ministry of Finance and the American Express and Diners companies to reduce acquirer fees in the coming years

- Agreements between credit card companies and aggregators or small-business organizations

- Leniency on remote contracting with an acquirer and on switching between acquirers

Questions and answers:

What is the scope of activity in the payment card acquiring market in Israel, and what is the fee paid by businesses to merchant acquirers?

In 2017, the scope of payment card transactions acquired at businesses in Israel was NIS 294 billion. The average fee paid by businesses in 2017 for payment card acquiring was 0.98 percent. Of this fee, card issuers are paid an interchange fee of 0.7 percent of total transactions, and the balance, an average of 0.28 percent, is transferred to the acquirer. With that, there is some variance in the fee paid by various businesses.

In 2017, small businesses (with annual turnover of up to NIS 500,000) paid an average fee of 1.4 percent of turnover; medium sized businesses (with annual turnover of up to NIS 5 million) paid an average of 1.04 percent of turnover, and large businesses paid, on average, 0.83 percent of turnover.

Who is Cardcom?

Car

dcom Ltd., owned by Eyal, Yael, and Yaniv Abo has been active for more than 10 years in the gateway market for companies. The company makes secure acquiring possible for customers via websites, and offers additional acquiring solutions such as virtual terminals. For the new activity, a subsidiary was established—Cardcom Acquiring Ltd.—that will deal only with merchant acquiring. An additional company owned by Eyal and Yael Abo, “Eyal Software Solutions Ltd.”, specializes in developing systems, primarily ERP systems and business management systems. The business experience accumulated in gateway activity and the experience as a software firm will contribute to the company’s ability to deal with the challenges of the new activity.

When will Cardcom be able to begin acquiring and operating?

From a regulatory perspective, the company can begin operating immediately. However, the company needs some operational and managerial preparation, which is expected to take approximately 18 months.

Is the new acquirer permitted to carry out all the activities that the existing acquirers do?

The license granted at this stage is narrow, as the leniencies in the license granting process do not require the company to complete all the technical preparations in order to receive the license. As such, there are certain limitations on the scope of the company’s activities. After the company completes the preparations and meets all the requirements, the narrow license will be converted into a full license.

From the merchant’s perspective, is the risk in contracting with the new acquirer higher than contracting with existing acquirers?

No. The Banking Supervision Department directives require that all a business’s acquiring funds that pass through the new acquirer are to be deposited in a trust account, and the acquirer does not have the possibility of using those funds. Like with every acquiring company, there are operating risks in the new company as well, and these will be monitored by the acquirer in accordance with the guidelines of the Bank of Israel and its Banking Supervision Department.